Shuttered businesses. Major updates for compliance with COVID-19 regulations. Quarantine fatigue.

The upside?

Maybe you’ve had a chance to notice the benefits of a remote workforce, like an expanded talent pool. And if you have, you might decide to hire out-of-state remote workers. So, what do you need to do if your employees work out of state?

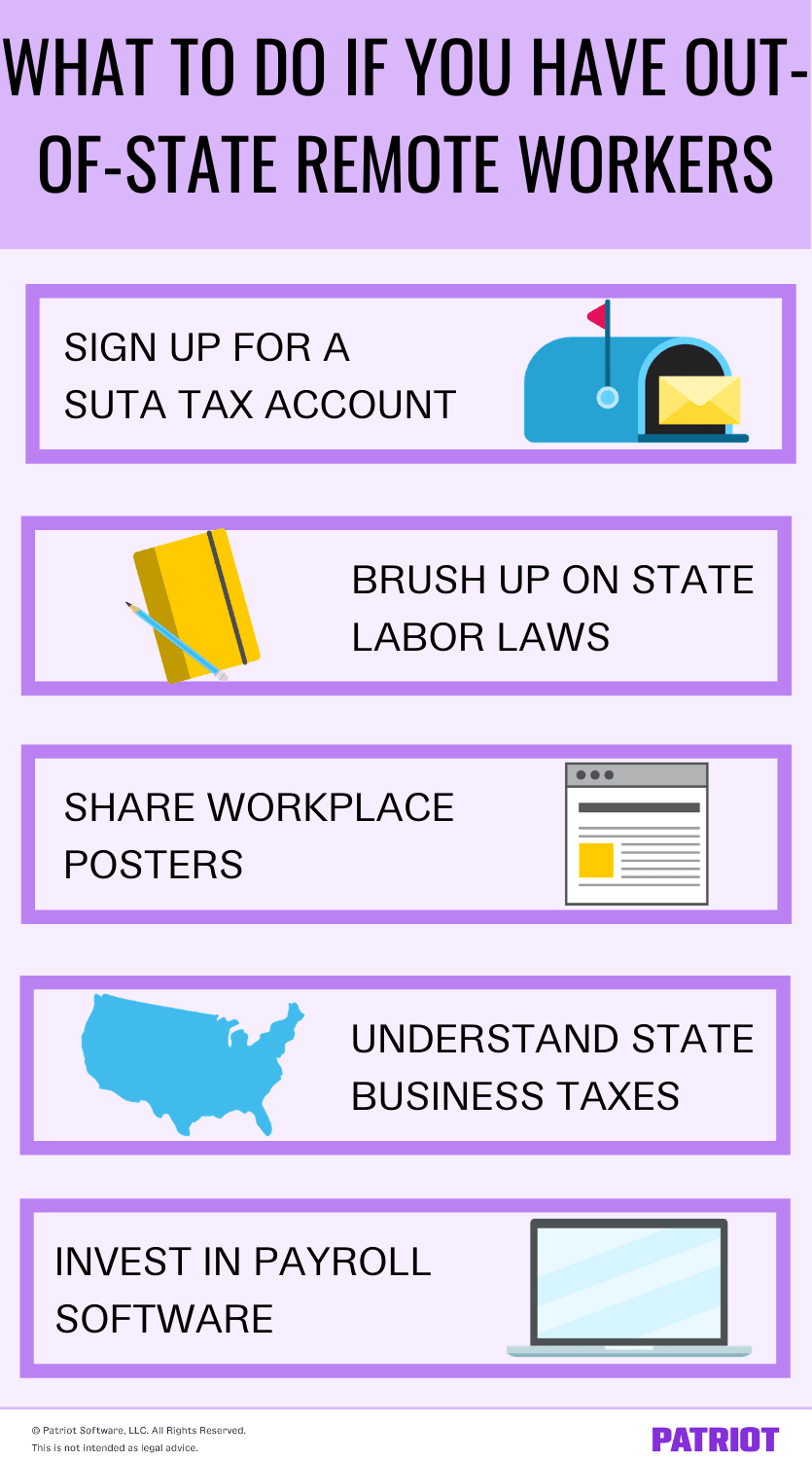

What to do if you have out-of-state remote workers

The joy of lower overhead and an expanded talent pool might be at the forefront of your mind. But before you get too excited, remember that there are a few things you need to do to stay compliant with taxes and labor laws.

Take a look at what you need to do if you have at least one employee working in another state.

1. Sign up for a SUTA tax account in the other state

You’re probably familiar with your state unemployment, or SUTA, tax obligations. As an employer, you must pay state unemployment tax for each of your employees. In Alaska, New Jersey, and Pennsylvania, you also need to withhold SUTA tax from employees.

Each state has a different SUTA tax rate for new employers, range for non-new employers, and wage base. So, which state unemployment tax rate do you pay for out-of-state employees?

Generally, you must pay SUTA tax for the state your employees work in. But before paying the tax, you need to sign up for a SUTA tax account. For example, if you have one employee working in California and another in Ohio, you must sign up for a SUTA tax account with both states.

If you have an out-of-state remote worker who performs work in multiple states, you might have questions. Unemployment tax rules for multi-state employees can get confusing. There are four Department of Labor “tests” that can help you determine SUTA tax for these employees. Go in order, and if the answer to each question is “No,” move on to the next number:

- Location of service: Is the employee’s service localized in one state?

- Base of operations: Does the employee perform some service in the state where their base of operations is located?

- Direction and control: Does the employee perform work in the state where an employer or manager directs and controls their work?

- Residence: Does the employee perform any service in the state where they live?

As soon as you answer “Yes,” that is the state to send SUTA tax for the multi-state remote employee.

2. Brush up on state labor laws

Following federal and state labor laws is key to staying compliant and avoiding penalties. There’s always one set of federal laws to follow. But when you have someone working in another state, you may have an additional set of state labor laws to comply with.

Some employment laws that may vary by state include:

- Paid sick leave

- Paid family leave

- Minimum wage

- Overtime

And if you’re thinking that federal law trumps state law, think again. You must follow whichever law is most generous to the employee. For example, pay an out-of-state employee according to their state’s minimum wage law if it’s higher than the federal minimum wage.

3. Hang up workplace posters—virtually

As an employer, you have to follow both federal and state labor law posting requirements. These posters detail your employees’ employment rights relating to things like minimum wage, safety, time off, and equal opportunities.

Common federal workplace posters include:

- Fair Labor Standards Act (FLSA)

- Family and Medical Leave Act (FMLA)

- Occupational Safety and Health Act (OSHA)

- Equal Employment Opportunity (EEO)

- Families First Coronavirus Response Act (FFCRA)

Each poster has different rules on who must post it, the poster size, and location requirements. Generally, you must hang up federal posters in a conspicuous place so all employees have access to seeing it.

In addition to federal labor laws, you must post specific state labor law posters that apply to your business and employees.

But when you have out-of-state remote workers, which state posters do you need to hang up? And … where do you hang them up?

If you have a business building where some employees work, hang up the posters there. Also make sure virtual employees have easy access to readable posters. You can:

- Mail them

- Email them

- Post them on an employee information website

You are only responsible for hanging up the posters that apply to you and your employees. If you are unsure what posters you need to post, use the Department of Labor’s eLaws Poster Advisor.

Contact the state labor offices in the states remote employees work to determine additional posting requirements.

4. Understand how it impacts state business taxes

How much do you know about state tax laws? If you know a fair bit, you probably know where this is heading…

An employee working in another state might trigger a tax obligation in that state due to nexus. This obligation may include state income, gross receipts, and sales taxes.

If you don’t know a ton about state tax obligations, here’s a brief recap. Most states require businesses to pay several types of taxes to their state if they have a “business presence” there. Often, having an employee working in the state is enough to establish nexus.

For example, most states have sales tax laws that say a business has nexus in a state if an employee works there.

So, if an employee works out of state, check with that state to determine whether you have new tax obligations.

If your employees are working out of state due to COVID-19, you may get some relief. A number of states established guidelines exempting businesses from state tax obligations if their employees work from home due to the pandemic.

5. Invest in reliable payroll software

There are a lot of intricacies involved in paying remote employees. Handling them by yourself can be difficult. To simplify your responsibilities for out-of-state remote workers, consider investing in reliable payroll software.

With software, you know that state tax withholding (e.g., income) is accurate. And, you can use direct deposit to pay out-of-state workers.

If you opt for a full-service payroll, the provider deposits and files in the employee’s state on your behalf. That’s right—you can stop stressing about juggling SUTA and state income tax deposits for multiple states.

Keep in mind that there might be an additional fee for each state you need to file in.

If you have out-of-state remote workers, don’t panic about your added filing requirements. Patriot’s Full Service payroll files in all 50 states and can file in more than one state for customers with out-of-state employees. Start your free trial today!

This is not intended as legal advice; for more information, please click here.