Online Payroll Is Easy With Patriot Payroll®

User-friendly payroll that simplifies payday and compliance

See a Demo Create AccountA Trusted Payroll Provider

That goes the extra mile

USA-based support that is unmatched

Fast, simple, & affordable online payroll

Over 60,000 customers across the USA

Up to 500 employees company size supported

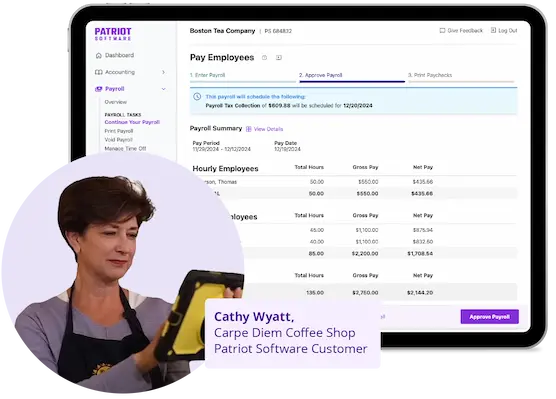

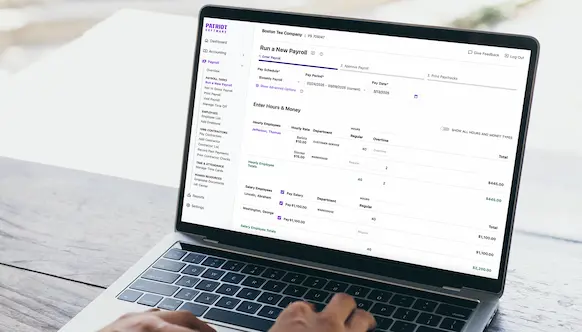

Payroll in 3 Easy Steps

Patriot Payroll customers average less than 3 minutes to run a payroll.

“I do my entire payroll in about a minute each week…Patriot has made payroll the fastest, easiest part of running my business. I wish the rest of it was this easy.” —Roger Goff

Run Unlimited Payrolls

Pay employees and contractors as often as you want.

- Supports all pay frequencies

- Off-cycle payroll options

- Customizable to meet your needs

Tax Filings & Deposits With Full Service Payroll

Ditch the stress with our payroll services.

- Federal, state, and local payroll tax filing and deposits

- Year-end payroll tax filings (e.g., W-2) at no additional cost

- Tax filing reliability guarantee

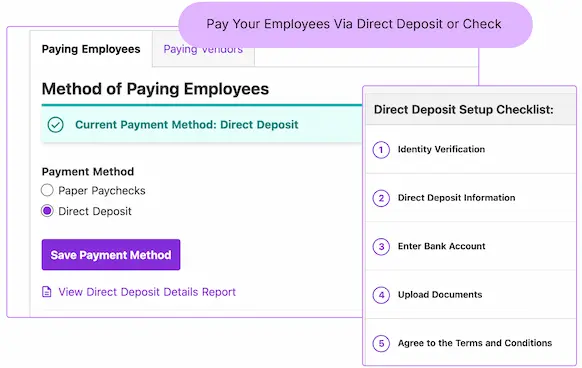

Pay With Free Direct Deposit or Check

Pay employees and contractors with our direct deposit services.

- 4-day and 2-day (for qualifying customers) direct deposit

- Easy direct deposit application process

- Handwrite or print checks right from the software

Free USA-based Support

- Thousands of 5-star reviews

- No robots—just a friendly team of humans!

- Call, email, or chat

- Short wait times

This is why we’re known as ☆America’s Payroll™.

Our customers have described our unparalleled, free USA-based support as:

- “Exceeds expectations”

- “Unmatched”

- “HUMANS!”

- “The absolute best”

- “Short queue time”

- “Knowledgeable”

- “TOP RATED”

Easily Switch to Patriot’s Online Payroll Processing

Setting up your payroll software is easy when you sign up for Patriot Software.

Do it yourself

Our payroll setup wizard will walk you through onboarding.

or

Let us help you

Contact our dedicated USA-based onboarding team.

Give Your Team the Power

Our free employee and contractor portals lets your team:

- Print pay stubs and reports

- View paychecks, tax forms (W-2s, 1099s), and more

- Manage personal info, direct deposit, and more

Online Payroll Reports

Filter and export the data you need with Patriot Payroll.

- Payroll Details Report

- Payroll Tax Liabilities Report

- Payroll Tax Deposit Report (With Full Service Payroll)

Two Payroll Options

Federal, state, and local tax calculations; free direct deposit; unlimited payrolls; and more.

Chosen by 84% of customers

Everything in Basic Payroll, plus federal, state, and local tax filings and deposits.

Simplify Your Work With One Unified Platform

Our integrated platform is available under one seamless login.

- Income and expense tracking

- Create and send invoices

- Accept credit cards

- Employees enter their hours

- Clock-in and out via web or app

- Custom overtime rules

Free Payroll Integrations

We offer integrations with Vestwell, NEXT Insurance, and QuickBooks to streamline every aspect of payroll.

401(k) Plans

- Free 401(k) integration with Vestwell

- Customized, streamlined, and affordable retirement plans

- Exclusive pricing and plan options

Workers’ Compensation

- Free pay-as-you-go workers’ comp integration with NEXT

- Multiple carrier choices

- Automatically pay your premium each payroll

Accounting Software

- Free accounting integration with QuickBooks

- Integrate your payroll entries into QuickBooks Online

- Export payroll entries to QuickBooks Desktop

Online Payroll FAQs

Asked ... and Answered

No, we offer free direct deposit! There’s no additional software charge for providing standard or expedited direct deposit to your employees.

New customers can switch to Patriot at any time. When to switch is entirely up to you! We will help you get started whether you start fresh in the new year or switch mid-year or at the end of a quarter.

Patriot offers a few direct deposit options to meet our customers' needs: expedited 2-day direct deposit for qualifying customers, standard 4-day direct deposit payroll prefunding, or customer initiated funding through bank wires or Instant payments.

Our Full Service Payroll will collect, file and deposit federal, state, and most local taxes, in the USA. Learn more here.

Yes, we file in all 50 states with our Full Service Payroll. However, there is a $12 fee for each additional state that we file in.

After you have completed your tax filing setup, Patriot Software will collect payroll taxes on approved payrolls usually the first banking day before the pay date. If payroll is run on the same day as the pay date, payroll taxes will be collected on the next available banking day. We will deposit your payroll taxes based on your business's tax deposit frequency.

Payroll FAQs

New customers can switch to Patriot at any time. When to switch is entirely up to you! We will help you get started whether you start fresh in the new year or switch mid-year or at the end of a quarter.

Patriot offers a few direct deposit options to meet our customers' needs: expedited 2-day direct deposit for qualifying customers, standard 4-day direct deposit payroll prefunding, or customer initiated funding through bank wires or Instant payments.

Our Full Service Payroll will collect, file and deposit federal, state, and most local taxes, in the USA. Learn more here.

Yes, we file in all 50 states with our Full Service Payroll. However, there is a $12 fee for each additional state that we file in.

After you have completed your tax filing setup, Patriot Software will collect payroll taxes on approved payrolls usually the first banking day before the pay date.

We offer a convenient setup checklist to help you gather this information ahead of time and ensure a quick and efficient setup. Learn what information you need to set up payroll here.

Our software is designed to guide you through the setup process with our easy payroll wizards. We offer free payroll setup for customers who would like assistance. We will enter your employee data and year-to-date payroll information. If you’d like to take advantage of this option, first sign up for a free trial. Then, call 877-968-7147 option 2, email our team at success@patriotsoftware.com, or chat us to request free setup assistance.

No. You are charged the base monthly price and a per worker fee on the first of each month. If a worker does not have a payroll during certain months, you are not charged for them.

Our payroll software is online. You can access it anytime or anywhere you have data or internet access. There’s no software to download.

The software is designed for small to large businesses, from 1–500 employees, in all industries. Whether you are a seasoned business or just starting out, our software will help you keep your time and money.

Yes. You may run a payroll whenever you need to in the payroll software.

No–our software is only available to companies with employees working in the USA. It’s our passion to help American businesses by providing streamlined, easy, and affordable payroll management solutions.

In the months you don’t run payroll, you will only be charged the base price for the payroll.

Patriot Software accepts credit or debit cards from Visa, Mastercard, American Express, and Discover for your software and service fees.

You’ll need a commercial or business bank account to utilize our direct deposit or Full Service payroll.

We are SOC2 Type II compliant to ensure the industry gold-standards in keeping your data safe. We will also require you to set up multiple authentication methods to ensure your log in credentials are not compromised.

Patriot collects and files Workers’ Compensation Insurance for Washington and Wyoming. For other states, we do offer free integration with NEXT Insurance, who offers Pay-As-You-Go Workers’ Compensation Insurance.

Unfortunately, we don’t handle the IRS Form 943 with our Full Service Payroll at this time. However, you can use our Basic Payroll and file outside of the software if your business is required to file Form 943.

Patriot offers free integrations through our partners: Vestwell for 401(k) and Next Insurance for pay-as-you-go workers’ comp. We don’t handle payments for garnishments, health insurance, child support, or other retirement plans.