Accounting and Payroll Software

Affordable, powerful, and ridiculously easy to use

See a Demo Create Account 30 Days Free!

Fun Fact

Patriot’s internal mantra is “leave no customer behind.”

Our Accounting and Payroll Software Is Known for...

- Fabulous customer support—all USA based.

- Lower prices than nearly every competitor.

- Highest reviews & awards in Accounting and Payroll industries.

- Month-to-Month subscription.

- Quality—everywhere.

- Being trustworthy.

Tens of Thousands Trust Patriot Accounting And Payroll Software!

Businesses rely on Patriot to streamline their Accounting & Payroll

Our Accounting and Payroll Products Are Offered Á La Carte ...

And are integrated with one seamless login

Accounting

Powerful accounting software designed to be easy to use so you can get back to running your business faster.

- Invoice customers

- Track your money

- Toggle between cash basis and accrual

- Automatically import bank transactions

- Pay your bills

- Get financial reports

Payroll

Payroll Software that takes the pain out of payroll. Stay compliant with automatic tax rate updates.

- Accurate tax calculations

- Free payroll setup

- Free direct deposit or print checks

- Customizable payroll

- Unlimited payrolls for your employees

- Pay W-2 employees or 1099 contractors

Optional Add-Ons

Time & Attendance

Keeping track of employee time is easy when you add on our employee time tracking software to your payroll.

Select manual or time punch entry for salaried or hourly employees.

HR Software

Add HR Software to payroll to keep your employee data organized and your desk decluttered.

Top 3 Reasons We're Chosen ...

Ease of use, stellar customer service, and price

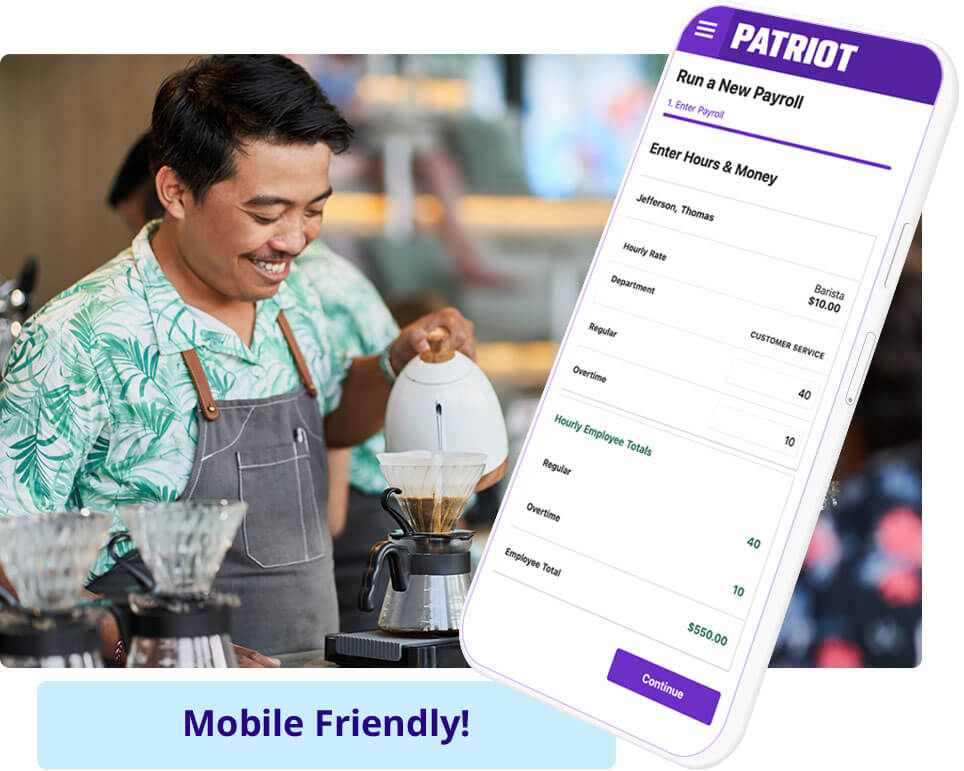

Do It From Your Cell Phone

Run your business from anywhere

Mobile Friendly

Access your accounting and payroll software from any phone, tablet, or desktop computer, without needing a mobile app.

100% Online

Securely access your software from any device connected to the internet. All updates are automatic. No downloads are needed.

Featured In: