Running payroll accurately is arguably one of your most critical employer responsibilities. But even if you use a reliable payroll processing system, there’s room for user error. You might input numbers incorrectly, forget to add an employee’s pay raise, or fail to remove a terminated employee from your payroll. To combat these potential problems, conduct a payroll audit.

Regularly performing a payroll audit can alert you to mishaps early on. Learn about payroll audit procedures to catch mistakes and avoid IRS penalties, payroll fraud, tax filing corrections, and disgruntled employees.

What’s a payroll audit?

A payroll audit is an analysis of a company’s payroll processes to ensure accuracy. Payroll audits examine things like the business’s active employees, pay rates, wages, and tax withholdings. You should conduct a payroll audit at least once per year to verify your process is up-to-date and legally compliant.

Generally, payroll audits are internal, meaning you or someone in your business conducts them. Performing internal audits can help you catch errors and prevent possible external audits later on.

After conducting the review, examine your payroll audit report. If necessary, make changes for future payroll processing. You may also need to retroactively make changes. For example, you might provide retroactive pay to an employee or remit more in taxes to the IRS.

Benefits of conducting a payroll audit

So, why should you conduct a payroll audit? The better question is, why shouldn’t you?

Conducting a payroll audit regularly can help you:

- Prevent payroll fraud by weeding out ghost employees or mismarked time cards

- Catch manual errors made when entering numbers into a system

- Spot calculation mistakes if doing payroll by hand

- Realize you need to factor in a raise

- Remove terminated employees from your payroll

- Verify your tax withholdings are accurate

- Accurately account for paid or unpaid time off

- Compare hours paid to when employees clocked in

- Ensure you are compliant with employment laws (e.g., overtime pay)

If you fail to audit your payroll process, your small business can end up doling out excess money, breaking employment laws, and remitting incorrect tax amounts.

Let’s take a look at a made-up employer, Amy. Amy terminated an employee, Jenn, in March but forgot to remove Jenn from payroll. In December, Amy decides to conduct a payroll audit. She realizes that she never removed Jenn. Amy gave Jenn wages for nine additional months, totaling $19,000.

Payroll audit procedures

Use the following steps to get started on your payroll audit process.

1. Look at the employees listed on your payroll

Review your employees listed on your payroll. Verify that all of these employees worked for you during the time period. If more workers are listed on your payroll than you had working for you, you may have a problem.

Some employees commit payroll fraud by adding fake employees to payroll. Or, you may have forgotten to remove a terminated employee from your payroll.

Make sure that the list of employees on your payroll matches your employment records. Remove any employees who no longer work for you. You may need to dig deeper to find out why those employees are on your payroll.

2. Analyze your numbers

When conducting a payroll audit, you can’t avoid analyzing numbers. Running payroll is mostly numbers—pay rate, hours worked, total pay for the period, and withheld taxes are some essential payroll numbers.

Examine each employee’s pay rate to ensure you paid the worker the correct amount. Make sure the pay rate is up-to-date and matches the employee’s record. If you gave the employee a raise or salary reduction, verify that you changed the pay rate on the applicable date.

Look into the hours the employee worked. Did they really work those hours during the pay period? Does your payroll system match what’s recorded in your time and attendance software? Did you provide overtime pay to nonexempt employees who worked over 40 hours in a workweek?

3. Verify time is correctly labeled

Most employers give employees time off from work, with many providing paid time off (PTO). Do you provide time off? If so, make sure you or your employees properly labeled time when running payroll. That way, you can identify when an employee worked and when they didn’t.

If you provide a set number of paid time off, subtract it from the employee’s available time off. Be sure to label time off as vacation, personal, sick, bereavement leave, or whatever labels you use.

4. Reconcile your payroll

Next, look at your payroll. Compare your findings to other records to verify your totals match. If there is a discrepancy, closely examine your records to find out the problem.

Compare your payroll records to your business’s general ledger. The payroll expenses in your general ledger should match your payroll audit findings.

Next, you need to reconcile your payroll records with your bank statements. Compare the amounts listed in your payroll records to what was withdrawn from your account. Consider having a separate payroll account to make bank reconciliation easier.

5. Confirm tax withholdings, remittance, and reports are accurate

Another critical payroll audit procedures step is verifying the accuracy of your employment taxes.

Make sure you withheld the correct amount of taxes from each employee’s wages. You must withhold federal income, Social Security, and Medicare taxes. You may also need to withhold state and local income tax. And, verify that remitted tax amounts are correct.

Compare the values on your payroll reports (e.g., Form 941) to your payroll records. Wages and tax withholding amounts listed on your payroll reports should match your payroll records.

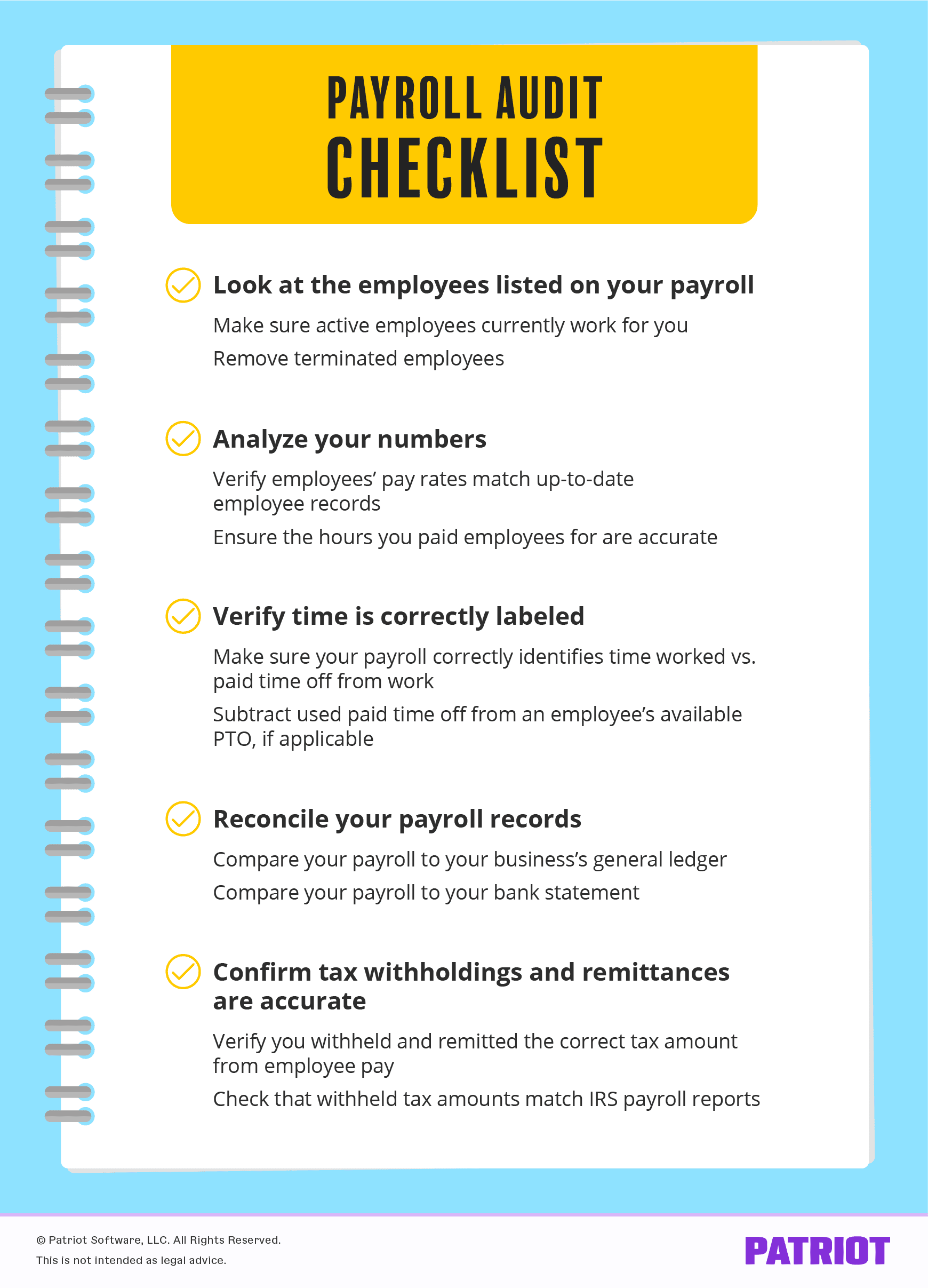

Payroll audit checklist

Take a look at our payroll audit checklist to make sure your process is thorough.

Looking for an easy way to run payroll and conduct a payroll audit? With Patriot’s online payroll software, you can run payroll in three easy steps. Plus, access numerous payroll reports like time off balances, payroll details, and payroll tax liabilities. Streamline your payroll process with a free trial!

This article has been updated from its original publication date of April 15, 2019.

This is not intended as legal advice; for more information, please click here.