Do you have employees who live in a different state than where they work? Then you might be wondering where to send your state unemployment (SUTA) tax payments. The answer lies in the unemployment tax rules for multi-state employees.

Multi-state unemployment tax compliance

Paying federal and state unemployment taxes for each employee comes with the employer job description. It’s the only way a laid-off or furloughed (in some situations) employee has access to unemployment benefits. But sometimes, you might not know which state to send SUTA tax to for an employee.

Unemployment tax rules for multi-state employees determine which state unemployment tax fund employers pay into for an employee.

But, some employee work situations might cause confusion, such as an employee who:

- Lives in one state but works in another

- Works temporarily in one state and regularly in another

- Splits their work time between two or more states

The state you pay unemployment taxes to, for an employee, is the state that funds the employee’s unemployment benefits. You do not pay SUTA tax to more than one state for a multi-state employee.

Unemployment tax rules for multi-state employees

Unemployment tax rules for multi-state employees depend on the employee’s work scenario.

To make the state unemployment determination, follow the Department of Labor’s Localization of Work Provisions. Use these provisions to find out which state the employee has “employment” in, and is therefore covered by.

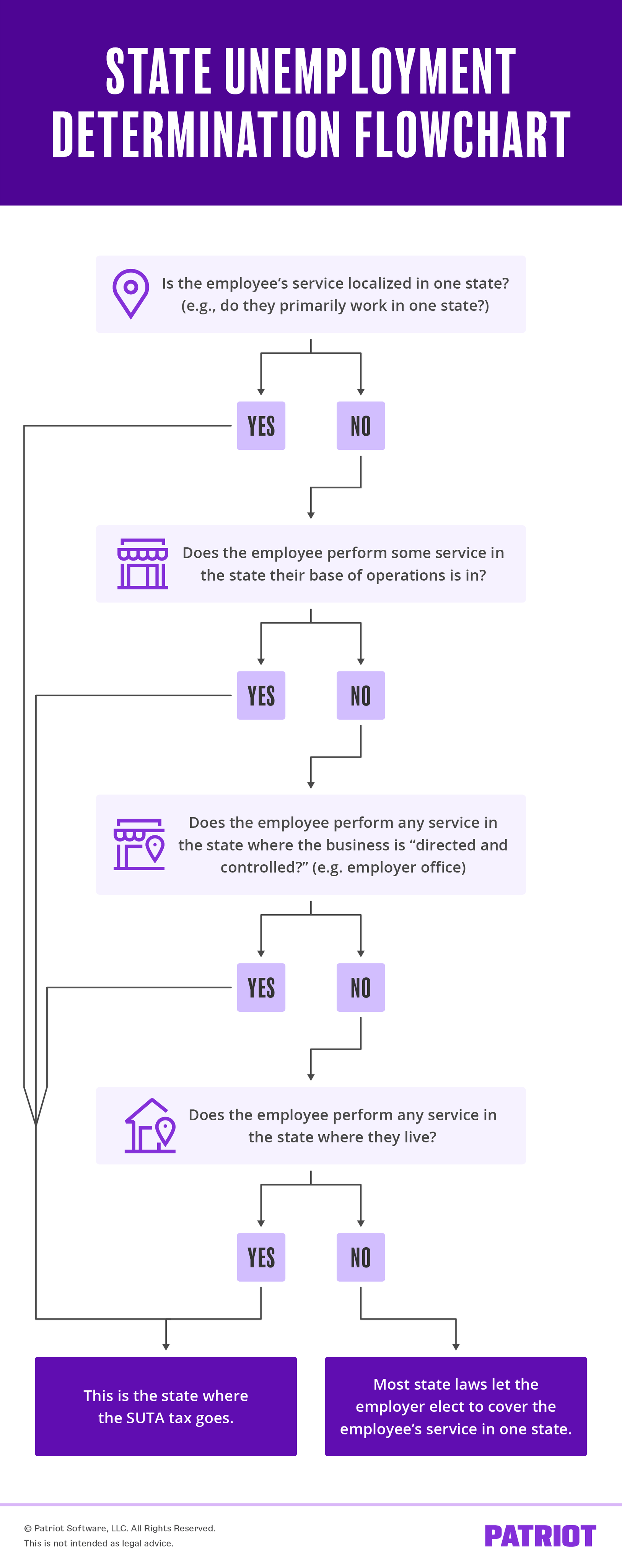

There are four “tests” employers can use to determine which state an employee is covered by for unemployment purposes (aka, the state SUTA tax goes to):

- Localization of service

- Base of operations

- Direction and control

- Residence

Only move onto the next test if an employee’s situation doesn’t fit the test. For example, if an employee’s service is localized, don’t use the base of operations test.

Localization of service

The first question you must ask is whether the employee’s service is localized in the state. An employee’s work is localized if they work entirely from that state. It is also localized if the employee works primarily in that state and temporarily—in isolated situations—in other states.

So, is the employee’s service localized in one state?

If YES, this is the state you send the SUTA tax to. If NO, move on to the base of operations test.

Base of operations

If your employee’s service is not localized in one state, you need to ask whether they perform some work in the state where their base of operations is located. “Base of operations” means the place where an employee begins work. It may also be where an employee:

- Receives instructions or communications

- Replenishes inventory

- Repairs equipment

- Performs any tasks relevant to their job

So, does the employee perform some service in the state where their base of operations is located?

If YES, this is the employee’s covered state. If NO, move on to the directions and control test.

Direction and control

If there isn’t a base of operations, ask if the employee performs any work in the state where the service is directed and controlled. This means the place where you, as the employer, or a manager supervises the employee’s work.

Does the employee perform work in the state where the work is directed and controlled?

If YES, this is the employee’s covered state. If NO, move on to the residence test.

Residence

Use the fourth part of the test if the employee does not work in the state where their work is directed and controlled. This residence test requires you to ask whether the employee conducts some work in the state where they live.

So, does the employee perform any service in the state where they live?

If YES, this is the employee’s covered state.

Still a no?

Rarely, an employee might not meet any of the four tests. If this is the case, you may be able to elect to cover the employee’s service in one state.

Most states allow employers to do this under an “election of coverage” provision or under the “Interstate Reciprocal Coverage Arrangement.”

Consult your state for more information on their election of coverage or reciprocal coverage rules.

State unemployment determination flowchart

If you still have questions about determining where to pay SUTA tax for an employee, use the following flowchart.

Live in one state, work in another: Unemployment claims

An employee may ask you, If I live in one state and work in another, where do I file unemployment?

According to the Department of Labor, the individuals seeking unemployment must either:

- File a claim with the state where they worked (if they worked and lived in the same state)

- Contact the state unemployment insurance agency where they now live to learn how to file a claim with another state (if they worked in one state and lived in another)

Provide your employee with as much information as you can about how to file unemployment claims if you have to lay them off. And, be sure to consult your state for more information.

Need help with handling your SUTA tax liability? Patriot’s online payroll will accurately calculate your tax liability. And if you opt for our Full Service payroll services, we will deposit and file taxes on your behalf. Get your free trial today!

This is not intended as legal advice; for more information, please click here.