If you’re an employer in Oregon (specifically in Multnomah County), listen up. There’s a new personal income tax that went into effect in 2021, and it may impact both you and your employees. What is this new tax in town, you ask? The Multnomah County Preschool for All tax.

Read More Oregon’s Multnomah County Preschool for All Tax: The ScoopPayroll Taxes Articles

Payroll Taxes - Tips, Training, and News

The Employer Guide to Oregon Metro Supportive Housing Services Tax

Oregon employers have a new tax to add to their payroll radar: the Metro Supportive Housing Services (SHS) tax. So, what is the Metro Supportive Housing Services tax? Who must pay the tax? And, what does it fund?

Read More The Employer Guide to Oregon Metro Supportive Housing Services Tax

How Often Does Social Security Tax Increase?

As an employer, you’re responsible for keeping up with the latest tax news and withholding the correct amount of taxes from employee wages. One tax that you constantly need to keep up with is Social Security tax. So, how often does Social Security tax increase? Read on to learn how frequently the Social security tax […]

Read More How Often Does Social Security Tax Increase?

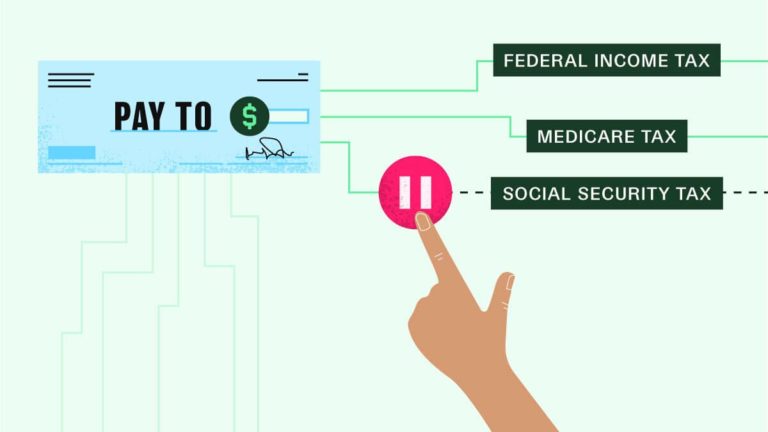

Your Employee Social Security Tax Deferral & Repayment Questions, Answered

Like most employers, you likely had a lot of questions about the executive order payroll tax deferral. And now that you’re in the collection and repayment phase of the employee Social Security tax deferral, you probably have some more.

Read More Your Employee Social Security Tax Deferral & Repayment Questions, Answered

Top 5 Common Payroll Mistakes (and How to Avoid Them)

Payroll responsibilities are a crucial part of having employees. Of those payroll responsibilities, the most important is accurate payroll. After all, inaccurate payroll may lead to fines or other penalties. So, take care to avoid common payroll mistakes.

Read More Top 5 Common Payroll Mistakes (and How to Avoid Them)

Failure-to-file Penalty: You May Delay, but the IRS Will Not

Procrastination can be costly. If you put off submitting your employer tax returns too long, you could wind up with a failure-to-file penalty. And no employer wants that.

Read More Failure-to-file Penalty: You May Delay, but the IRS Will Not

When Are Federal Payroll Taxes Due? Federal Due Dates to Know

Withholding, remitting, and reporting payroll taxes are all a necessary part of being an employer. A big part of the responsibility of remitting these taxes is knowing when to pay them. After all, you don’t want to receive a letter from the IRS saying you missed a deadline.

Read More When Are Federal Payroll Taxes Due? Federal Due Dates to Know

Employee Retention Credit Owner Wages: Do They Count for the Credit?

Heads up: Congress recently passed the Infrastructure Investment and Jobs Act, which President Biden signed on November 15, 2021. The new expiration date of the ERTC is September 30, 2021 for most businesses. Along with other COVID-19 relief measures, the Employee Retention Credit (ERC) took the world by storm in 2020 and 2021. Eligible employers […]

Read More Employee Retention Credit Owner Wages: Do They Count for the Credit?

Personal Allowances: What Employers Should Know Inside and Out

If you’ve seen a recent Form W-4 (i.e., 2020 and after), you know the IRS removed personal allowances. But, some states still use personal allowances on the state W-4 forms.

Read More Personal Allowances: What Employers Should Know Inside and Out

What’s the Deal With the Massachusetts COVID-19 Recovery Assessment?

Thanks to COVID-19, 2020 and 2021 were jam-packed with big changes and new legislation for many employers. Some states, like Massachusetts, began making adjustments to provide employers with temporary relief options.

Read More What’s the Deal With the Massachusetts COVID-19 Recovery Assessment?