Thanks to COVID-19, 2020 and 2021 were jam-packed with big changes and new legislation for many employers. Some states, like Massachusetts, began making adjustments to provide employers with temporary relief options.

In 2021, Massachusetts created the COVID-19 Employer Relief Account. And in turn, the COVID-19 Recovery Assessment was born. Read on to learn all about the Recovery Assessment’s purpose, what it means for employers, and how much it may cost you.

What is the COVID-19 Recovery Assessment?

To understand the COVID-19 Recovery Assessment, you need to know a little more background information.

On May 28, 2021, Massachusetts passed legislation that created a new account, the COVID-19 Employer Relief Account. The Department of Unemployment Assistance (DUA) removed COVID-related charges from the solvency fund to the new employer relief account, resulting in a solvency rate decrease (9.23% to 1.12%) and giving UI rate relief to employers. To account for the rate decrease, some employers were charged a solvency assessment and were credited back some of the assessment, resulting in an adjusted 2021 UI rate.

Legislation also created a new COVID-related employer charge, the COVID-19 Recovery Assessment. This was enacted to:

- Recover the charges from the COVID Employer Relief Account

- Reduce the impact of COVID-related charges to employers’ UI rates by recovering costs over time

Who has to pay the assessment?

All private-contributory, experience-rated Massachusetts employers are subject to the COVID-19 Recovery Assessment.

If an employer is not experience-rated yet, they are not subject to the assessment (i.e., new employers). And if an employer is subject to the assessment, they are responsible for MA unemployment insurance (UI).

Employees are not responsible for the Massachusetts COVID-19 Recovery Assessment.

Who is exempt?

The following employers do not have to pay the recovery assessment:

- Reimbursable employers

- Governmental employers

- New non-construction and construction employers that received new employer UI rates

- Employers with zero Three Year Average Wages on their 2021 rate notice that received assigned UI rates

- Nonprofit employers that have changed their method of payment to contributory within the last three years

How are rates determined?

Depending on if they meet the requirements, Massachusetts employers need to pay additional assessments equal to 10.5% of their unemployment insurance rate. For example, if your UI rate is 4.98%, your COVID-19 assessment will be 0.523 (4.98% X 10.5%).

Each employer’s Recovery Assessment rate can vary. The state assigns a rate based on the employer’s adjusted 2021 UI rate. To find your rate, check out the Department of Unemployment Assistance’s chart.

Employers cannot change or appeal their rate because it is assigned based on their calculated UI rate.

Where can employers view their COVID-19 Recovery Assessment rate?

Not sure what your rate is? Employers can view their adjusted UI rate and Recovery assessment rate in the “View Rate Notice Screen” under “Account Maintenance” in their account.

If you cannot find your rates in your employer account, consult the state or the rate chart.

How are contributions calculated for employers?

For the Recovery Assessment, the taxable wage base is $15,000 per employee. This is the same wage base as Massachusetts SUTA tax (state unemployment).

Contributions are calculated by multiplying the COVID-19 Assessment rate by the employer’s quarterly taxable wages:

Recovery Assessment Contributions = Assessment Rate X Employer’s Quarterly Taxable Wages

What are the filing requirements for employers?

So, how does filing work for the new Recovery Assessment? According to the state, “There is no added reporting requirement or change to the reporting process for Employment and Wage Detail reports.”

And, what about payments? Employers should not send their Recovery Assessment payments to the DUA separately.

Bills for Quarters 1 and 2 are due by August 31, 2021. And, COVID-19 Recovery Assessments will be retroactive to January 1, 2021 to help spread the cost of benefits paid by the UI Trust Fund over time.

Do employers need to make adjustments for Quarters 1 and 2 of 2021?

The DUA will recalculate reports for Quarters 1 and 2 to reflect the 2021 UI rate and Recovery Assessment adjustments for employers that previously filed Q1 and Q2 Employment and Wage Detail reports.

Employers that scheduled a future payment online before receiving their adjustment can cancel the payment and review their recalculated contribution amount.

Where can I find more information on the MA Recovery Assessment?

To learn more about the COVID-19 Recovery Assessment for Massachusetts employers, check out:

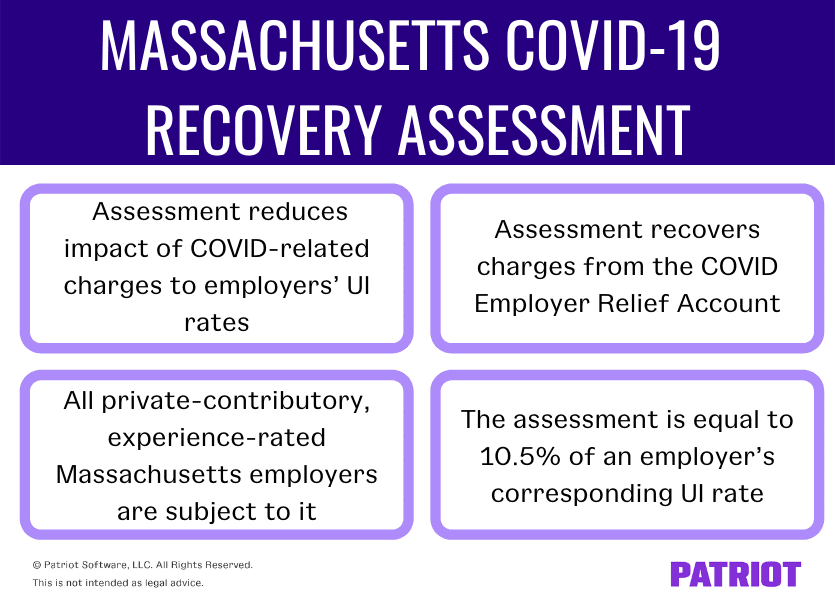

Massachusetts COVID-19 Recovery Assessment fast facts

Wow, that was a lot of information. To ensure you don’t miss a beat with the new assessment, check out a brief recap:

- The COVID-19 Recovery Assessment was created to recover charges from the Employer Relief Account and reduce the impact of COVID-related charges to employers’ UI rates

- All private-contributory, experience-rated Massachusetts employers are subject to the assessment

- The assessment is equal to 10.5% of an employer’s corresponding UI rate

- Taxable wage base is $15,000 per employee for the Recovery Assessment

- The COVID-19 Recovery Assessment is retroactive to January 1, 2021

- Bills for Quarters 1 and 2 of 2021 are due by August 31, 2021

- There is no added reporting requirement or change to the reporting process for the assessment

| Need help with the Massachusetts COVID-19 Recovery Assessment and payroll taxes? Patriot’s online payroll software has your back with guaranteed accurate calculations. And if you opt for our full-service payroll software, we’ll take care of the deposits and filings for you. Get started with a free 30-day trial today! |

This is not intended as legal advice; for more information, please click here.