As a business owner, accounting records must be at the top of your to-do list. Accounting records track transactions and help you understand the health of your business. What accounting records should you know about, and how long should you keep them? Read on for the scoop.

What are accounting records?

Accounting records is a broad term that covers all types of documents generated in your accounting process. You create them when making or keeping track of transactions.

Accounting records can include:

- Cash receipts

- Bank statements

- Financial statements

- General ledgers

- Invoices

- Journals

- Transactions

- Trial balances

Generally, accounting records help you understand how your business is doing and can help you chart a path for the future. In some unique cases, your accounting records can help prove that you’re on the right side of the law. But before getting into retention requirements for accounting records, let’s do a more detailed overview of accounting records.

Accounting records from sale to trial balance

Your business starts the accounting process from scratch whenever you make a sale. The accounting process generates several accounting records you need to keep track of. Here are some of the records you should know about, from transaction to trial balance.

Transaction

A transaction includes any monetary event that impacts your business’s financial statement. Transactions can include a customer purchase at your store, your company purchasing goods from a vendor, or borrowing money from the bank.

Journal

A journal is a tool used to record business transactions. Journals can include physical records or digital documents (e.g., spreadsheets or information stored in accounting software).

Whenever a transaction occurs, you should make a journal entry to keep track of transactions.

Journals can include:

- Purchase journal

- Purchase returns journal

- Cash receipts journal

- Cash disbursements journal

- Sales journal

- Sales return journal

- General journal

General ledger

The general ledger organizes journal entries across different accounts. You’ll find the following types of accounts in the general ledger:

- Assets

- Equity

- Expenses

- Liabilities

- Revenue

Trial balance

The trial balance is a report that displays your general ledger account balances in debit and credit columns. Use your trial balance to make sure that the debits and credits add up in each account.

Financial statement

Financial statements include income statements, balance sheets, cash flow statements, and your company’s statement of retained earnings. Financial statements help you understand unique aspects of your business’s financial health.

How long should you keep accounting records?

Accounting records cover large and small transactions, from daily sales to building loan payments. With so many different accounting records out there, you may be wondering what records you should keep and how long you should keep them.

While you may not have to keep everything, the IRS has specific guidelines you should follow.

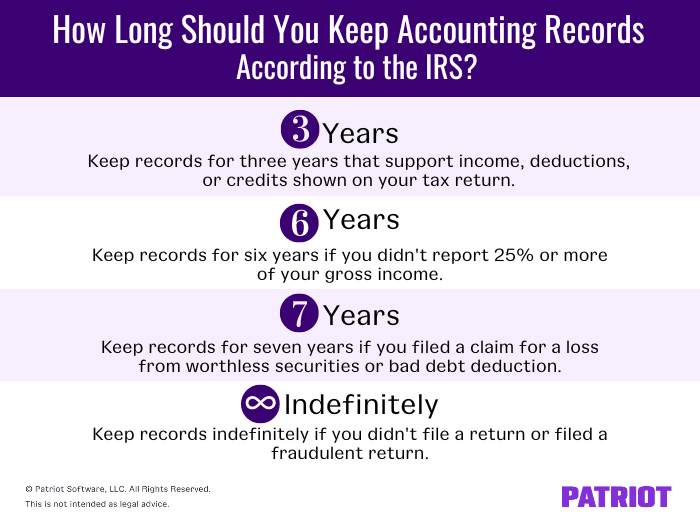

According to the IRS, you should retain records that support income, deductions, or credits shown on your tax return until the period of limitations for the tax return expires. Generally, the period of limitations is three years. During this time, you can amend your tax return, claim a credit or refund, or the IRS can assess additional tax.

Keep records for longer than three years if you:

- Didn’t report 25% or more of your gross income. In this case, keep records for six years.

- Filed a claim for a loss from worthless securities or bad debt deduction. In this case, keep records for seven years.

- Didn’t file a return or filed a fraudulent return. In this case, keep records indefinitely.

Records that support income, deductions, or credits on your tax return include:

- Gross receipts

- Purchases

- Expenses

- Proof of payment (e.g., canceled checks, cash register receipts, and invoices)

- Assets

- Employment taxes

A final thought on accounting records

There are some accounting records you may need to keep longer than the IRS guidelines, like:

- General ledger

- Purchase journal

- Deeds

- Mortgages

- Bills of sale

- Chart of accounts

- Cash receipts journal

Consult your accountant, attorney, or insurance provider before committing to an indefinite storage plan. And no matter what you do, a record retention policy can help you stay organized.

Your state or local government may have further requirements for document retention. Check in with state treasury departments and local governments for more detailed information.

Record retention policy

Before you start storing your accounting records, make sure to develop a record retention policy. A record retention policy can help your company identify and organize appropriate records. And when the files are no longer needed, a record retention policy can detail how to dispose of accounting records properly.

A retention policy may include:

- Types of records

- Length of time to hold on to records

- Organizational and disposal methods

- Security protocol for sensitive documents

- Access permissions

When creating your record retention policy, find out if you can store your records electronically or if they have to be in hardcopy formats. Digital copies can save physical space and may be easier to keep track of over time.

Have you ever wondered if there’s an easier way to keep track of your accounting records? With Patriot Software, there is. Patriot’s online accounting software is so powerful and easy to use it will help you keep your time and money as soon as you join. Try it for FREE today!

This is not intended as legal advice; for more information, please click here.