Keeping your books in order throughout the year is important. So, you track every item, line by line. And, you record every transaction. But, what is transaction in accounting? What, specifically, do you need to track and record?

What is transaction in accounting?

So, what exactly is the transaction definition in accounting? In accounting, a transaction is any monetary business event that impacts a business’s financial statements.

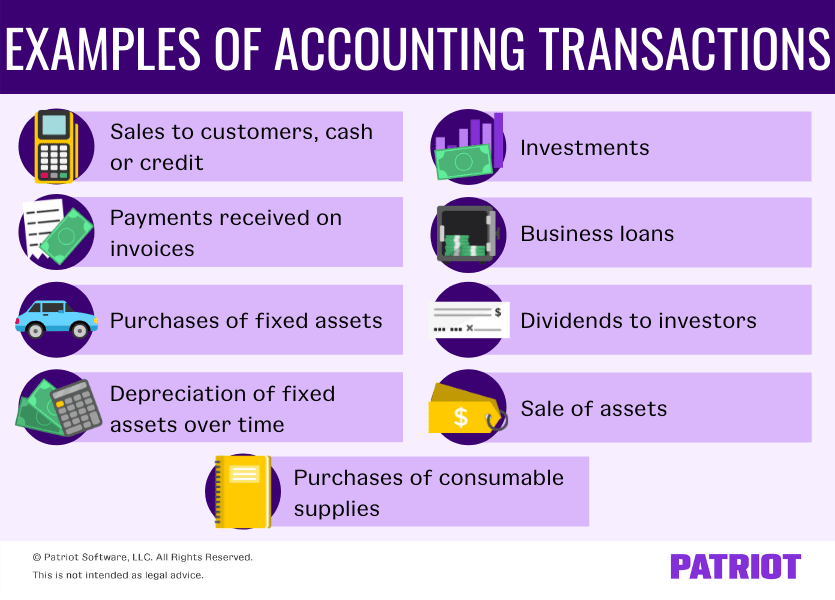

Because transactions include any event that has a monetary impact on your financial records, there are a lot of items that are transactions. Accounting transactions examples in your account ledger include:

- Sales to customers, cash or credit

- Payments received on invoices

- Purchases of fixed assets

- Depreciation of fixed assets over time

- Investments

- Business loans

- Dividends to investors

- Sale of assets

- Purchases of consumable supplies

…And more. You need to record transactions regardless of the type of accounting method you use.

If your business uses accrual accounting, record the transactions when you accrue the revenue or expense.

Businesses that use cash-basis accounting must record income or expenses when the payment is received or made.

Modified cash-basis accounting blends cash basis and accrual accounting. With this method, you record transactions at the time payment is received or made (like in cash-basis).

All three types use transactions, but when you record the transactions differs.

Cash-basis transactions

Again, only record a transaction in accounting when there is an actual exchange of cash in cash-basis accounting. Transactions in cash-basis accounting are immediate and do not cover long-term transactions. What does this mean?

Cash-basis transactions are all short-term transactions. And, the transactions only include monetary exchanges in the following accounts:

- Assets

- Liabilities

- Equity

So, cash-basis accounting typically sees fewer accounting transactions because the method uses fewer accounts. And, cash-basis accounting uses single-entry accounting. So, you only record each transaction once (i.e., when the transaction actually occurs) to the specific account the transaction impacts (e.g., the cash account).

Accrual-basis transactions

Accrual accounting uses double-entry bookkeeping. So, you record a single transaction, but it affects at least two accounts. The accrual method also typically sees more transactions in the account ledger because it uses more accounts. And, you use journal entries to record the funds.

When you record a financial transaction in your books, use debits and credits to show the equal and opposite effects on two or more accounts.

For example, you send an invoice to a customer for a product. Record the income at the time the customer receives the invoice by debiting the asset account for income. Then, credit the asset account for inventory to decrease the amount of inventory.

In the example, one transaction (selling inventory) results in two journal entries in accrual-basis accounting. However, the journal entries are not the transactions. Instead, the transaction is the sale of the product for income.

With accrual accounting, every transaction results in a balanced accounting equation.

Modified cash-basis transactions

Again, modified cash-basis accounting combines parts of both cash basis and accrual methods. But, modified cash basis uses double-entry accounting and includes more accounts than cash basis. So, each transaction can have two or more journal entries to more accounts.

With modified cash basis, you can have more types of transactions than you would with cash basis. The big difference is when you record the transactions.

Examples of transactions in accounting

Remember that a single transaction results in at least two journal entries in double-entry accounting but only one entry in single-entry accounting.

Take a look at some examples of transactions in recording an accounting transaction in a double-entry system

1. Example 1

You decide to open up a small business selling a wide variety of handmade items. To open the business, you save up $10,000. After you save up the money, you deposit the cash into a new business bank account.

The $10,000 is your owner’s equity and is the first transaction in your books.

To record the deposit in your books, debit the cash account $1,000 and credit the owner’s equity account the same amount.

2. Example 2

Your first customer comes in and buys multiple items with cash. The first customer represents one transaction even though they purchased multiple items. The total cost of the sale was $100.

To record the sale in your books, debit the cash account $100 and credit the sales account for the same amount.

3. Example 3

Your second customer purchases $50 worth of products using a credit card. Again, the sale is one transaction even though the customer purchases multiple items.

Record the sale by debiting the accounts receivable $50 and crediting the sales account by the same amount.

4. Example 4

After a few months in business, you decide to take out a business loan to expand. When you receive the loan, you record one transaction. Then, each loan payment will be individual transactions until you pay off the loan. Remember that most loans have interest rates, so you will have to create an interest expense account in your books.

To record receipt of the loan, debit the cash account by the amount of the loan. If you haven’t already done so, create a loans payable account in your books under liabilities. Then, credit the loans payable account by the amount of the loan.

When you make your first payment, the payment transaction impacts three accounts:

- Debit the loans payable account

- Debit the interest expense account

- Credit the cash account

Why are transactions in accounting important?

Transactions in accounting allow you to see where you spend and receive money and how much. And, the individual transactions create the foundation of all of your financial statements, including:

- Income statement

- Balance sheet

- Cash flow statement

Keep in mind that your financial statements are only as accurate as the data you enter. So, remember to record every transaction carefully and promptly. Not to mention, doing so is key to help you prepare for tax time.

You can use accounting software to streamline the process of recording transactions. How? Accounting software can:

- Record invoices in your books when you send the invoice

- Connect to your bank account and import transactions

- Integrate with your payroll software and record payroll transactions in your books automatically

- Create automatic journal entries for sales and bill payments

…And more! For transactions that the software cannot automatically create, record the journal entries as soon as possible.

Consider finding a software option that allows you to attach receipts and documents to each transaction. And, look for an option that lets you reconcile your books, too.

This is not intended as legal advice; for more information, please click here.