As your small business begins to make transactions, you need to record them in your books. If you want an easy way to track business finances, consider using the single-entry method. Single-entry bookkeeping lets you record transactions quickly so you can get back to running your business.

What is single-entry bookkeeping?

Single-entry bookkeeping is a method for recording your business’s finances. You record one entry for every transaction. The single-entry method is the foundation of cash-basis accounting.

With the single-entry system of bookkeeping, you mostly record cash disbursements and cash receipts. You will record incoming and outgoing money in the cash book. Usually, you track assets and liabilities separately.

Cash book

Record transactions with the single-entry system in a cash book. A cash book is a larger version of a check register. It uses columns to organize different uses of cash for your business.

Cash book columns track key information about your finances. Each transaction gets a line in the cash book. Record the following items with the single-entry bookkeeping system:

- Date: The day the transaction takes place

- Description: A brief explanation of the transaction

- Income/expenses: The value of the transaction

- Balance: The running total of how much cash you have on hand

The first entry in the cash book should be the cash balance at the beginning of the accounting period. During the period, record transactions as individual line items. The last line in the cash book should be the cash balance at the end of the accounting period.

The items in your cash book will vary, depending on your business. Here is a single-entry bookkeeping example for using a cash book:

| Description | Date | Notes | Expense (Debit) | Income (Credit) | Account Balance |

|---|---|---|---|---|---|

| Starting Balance | 6/1 | 2,000 | |||

| Rent | 6/3 | 800 | 1,200 | ||

| Sales | 6/8 | 500 | 1,700 | ||

| Supplies | 6/20 | 200 | 1,500 | ||

| Ending Balance | 6/30 | 1,500 |

Income statement for single-entry bookkeeping

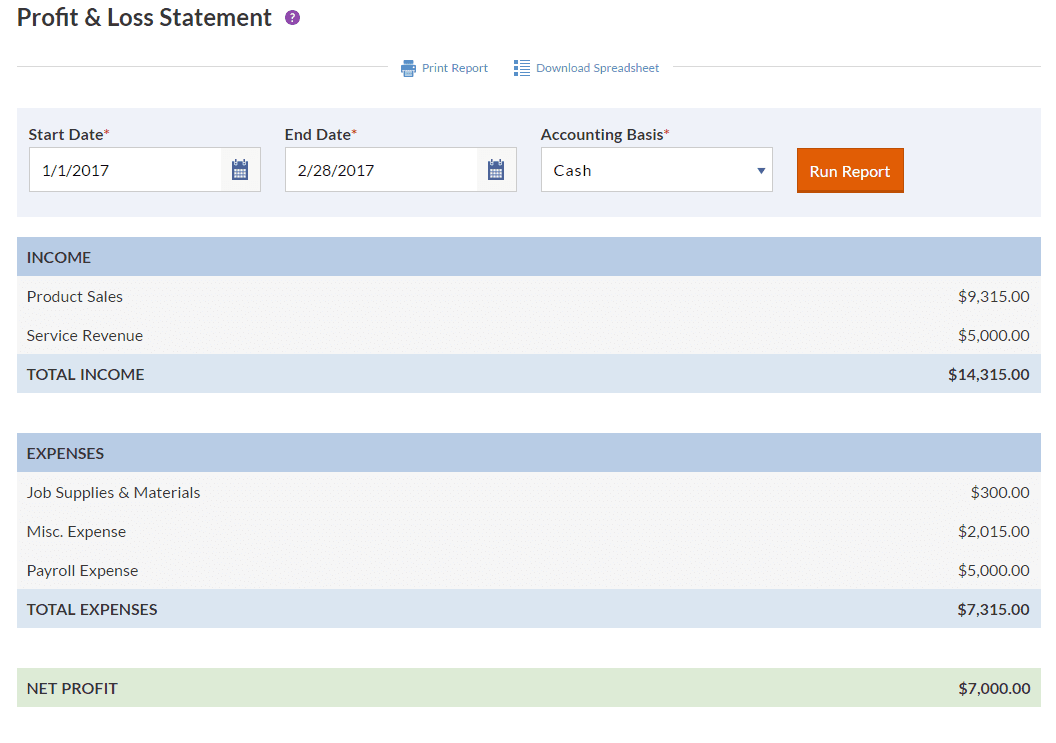

The single-entry bookkeeping system is centered on the results in your company’s income statement. The income statement shows information about a specific accounting period. It is also called a profit and loss statement for small business.

The income statement shows profitability during a time frame. It begins with sales and itemizes financial details down to the net income. Sales and gains are at the top of the income statement. Business expenses and losses are listed next. The bottom figure is the net income, or the take-home earnings after expenses and debts are paid.

To create an income statement, compile information from your cash book. Take a look at the following profit and loss statement example:

Difference between single-entry and double-entry system of bookkeeping

If you don’t use the single-entry method, record transactions with double-entry bookkeeping. The double-entry method is more complicated than single-entry, and it is the basis of accrual accounting.

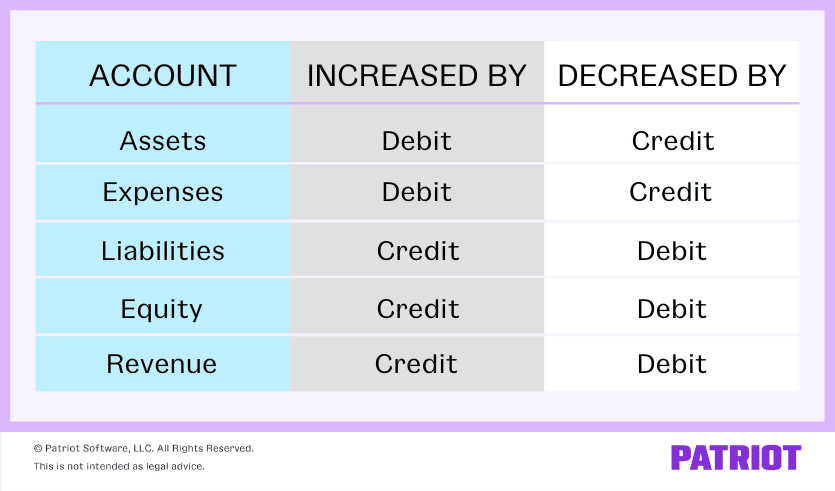

With double-entry bookkeeping, you record two entries for every business transaction. Each entry is either a debit or credit. The entries are equal but opposite. Your debit and credit entries must be the same values.

Some accounts are increased by debits and decreased by credits. Other accounts are increased by credits and decreased by debits. The following chart shows how each account is affected by debits and credits:

Though double-entry is more difficult than the single-entry system of bookkeeping, the method offers benefits to small business owners. It reduces the chance of making an error because you must balance the entries. Some businesses are required to use double-entry bookkeeping.

Who uses single-entry bookkeeping?

Single-entry bookkeeping is the simplest way to organize your accounting records. But, the method is not the best fit for some businesses. Think about your business’s size, industry, and specific needs before choosing a method.

Consider the single-entry method if you:

- Make less than $5 million in annual gross sales or have less than $1 million in gross receipts for inventory sales, according to the IRS

- Are a small business that operates as a sole proprietorship, partnership, S Corp, or LLC

- Collect customer payments at the point of sale

- Operate a service business

Consider the double-entry method if you:

- Make more than $5 million in annual gross sales or have more than $1 million in gross receipts for inventory sales

- Operate as a corporation or a partnership with a C Corp partner

- Send invoices or let customers buy on credit

- Have inventory

Single-entry bookkeeping is great for new businesses. Companies with a low number of transactions and uncomplicated financial tracking needs also benefit from single-entry. And, using the single-entry method is a good way to start learning how to manage your books.

Keep in mind that assets and liabilities are harder to track with single-entry bookkeeping. It’s also easier to make common accounting errors because there is no matching system, like with double-entry. Single-entry bookkeeping shows less information about your business’s financial health.

Need a simple way to keep your small business books? Patriot’s online accounting software is easy-to-use and made for small business owners and their accountants. We offer free, USA-based support. Try it for free today.

This article is updated from its original publication date of June 2, 2017.

This is not intended as legal advice; for more information, please click here.