As a business owner, you’re going to run into a few accounting mistakes from time to time. Some of the biggest blunders you can make involve your business balance sheet. If you want to avoid balance sheet problems, learn about the most common errors you can make on your balance sheet and how to avoid them.

What is a balance sheet?

Before we can dive into balance sheet mistakes, let’s briefly review what a balance sheet is.

A balance sheet is a financial statement that tracks your company’s progress. Your balance sheet is broken down into three parts:

- Assets (what you own)

- Liabilities (what you owe)

- Equity (money left over after expenses)

On your business balance sheet, your assets should equal your total liabilities and total equity. If they don’t, your balance sheet is unbalanced. If your balance sheet doesn’t balance it likely means that there is some kind of mistake.

Keep this formula in mind for your balance sheet:

Assets = Liabilities + Equity

Your balance sheet is the best indicator of your business’s current and future health. If your balance sheet is chock-full of mistakes, you won’t have an accurate snapshot of your business’s financial health.

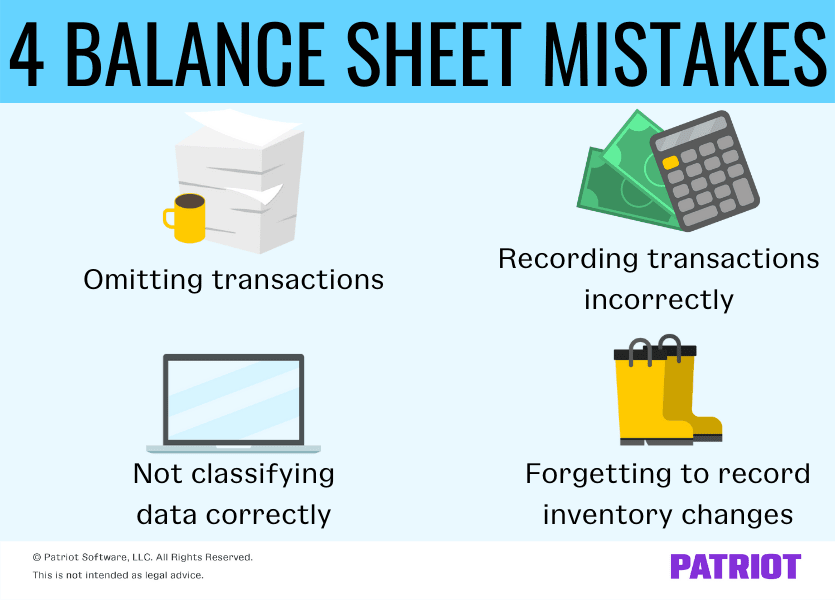

4 Balance sheet problems

All balance sheet problems are avoidable—you just have to know what to watch out for. Here are four balance sheet boo-boos you should be on the lookout for in your business.

1. Omitting transactions

At some point, recording a transaction on your balance sheet might slip your mind. Omitting accounting transactions is a fairly common (and very fixable) mistake.

Forgetting to record a transaction throws off the rest of your balance sheet. You might forget to record things like:

- Petty cash

- Inventory

- Supplies

- Other expenses

Omitting transactions can cause your balance sheet to present an inaccurate financial future. To prevent this balance sheet issue, set reminders to record transactions regularly (e.g., monthly) to avoid missing information.

2. Recording transactions incorrectly

One major mistake business owners make with their books is incorrectly recording transactions and inverting numbers, known as transposition errors.

An accounting transposition error is when you reverse the order of two numbers when recording a transaction. For example, you might flip-flop two numbers (e.g., 52 vs. 25).

You can make a transposition error while writing down two numbers or a sequence of numbers on your balance sheet. This balance sheet error is super easy to make, and it can even happen to a seasoned business owner or bookkeeper.

Luckily, this error is just as easy to catch as it is to make. To avoid this balance sheet mistake, make sure you double-check any numbers you input on your balance sheet. Consider having another employee cross-check your transactions, too.

3. Forgetting to record inventory changes

Another common mistake that can plague your business balance sheet is forgetting to record inventory changes.

Sure, counting and changing inventory in your system is pretty straightforward. But some businesses tend to forget to tally up and update their inventory levels at the end of each period.

To remedy this, keep your inventory as up-to-date as possible. That way, you can avoid messing up your balance sheet and ensure your inventory is accurate in your records.

4. Not classifying data correctly

When you’re recording transactions on your balance sheet, you must correctly classify each transaction as an asset or liability. If you don’t accurately classify your transactions, you can wind up with a major balance sheet blunder.

As a brief recap, assets are physical or non-physical property that adds value to your business. Some examples of assets include your business’s computer, car, and trademarks. Here are a few types of asset accounts:

- Petty cash

- Inventory

- Accounts receivable

Liabilities are current debts your business owes to other companies, organizations, employees, vendors, or government agencies. If you have more debts, you’ll have higher liabilities.

Your liabilities can be current (short-term) or noncurrent (long-term). Examples of liabilities include supplies, invoices, loans, and mortgages.

Types of liability accounts you may have include:

- Accrued expenses

- Unearned revenue

- Accounts payable

Clearly, assets and liabilities are not something you want to confuse on your business balance sheet.

Before recording a transaction on your balance sheet, make sure you’re classifying it correctly and recording it under the right liability or asset account. Double-check with an accountant or another professional if you’re unsure about how to classify a transaction.

How to prevent balance sheet mistakes

If you want to prevent common balance sheet errors, be on the lookout for red flags on your balance sheet. That way, you can catch errors before they snowball out of control.

Here are a few ways you can prevent balance sheet mistakes:

- Conduct a trial balance before creating your balance sheet

- Review balance sheet transactions regularly

- Pinpoint any problems ASAP

- Keep financial documents organized

When it comes to your balance sheet, the more organized you are, the better. The best thing your business can do is be as proactive as possible and keep detailed financial records for reference.

Mistakes are inevitable. But if you have a plan in place to track them down, you can avoid bigger balance sheet issues in the future.

Looking to avoid balance sheet mistakes? Patriot’s accounting software lets you streamline the way you record income and expenses. Say goodbye to accounting problems and try it out for yourself with a free trial!

Have questions, comments, or concerns about this post? Like us on Facebook, and let’s get talking!

This is not intended as legal advice; for more information, please click here.