Thinking about providing petty cash to employees? Before establishing a petty cash fund at your small business, be prepared to create a petty cash accounting system.

You must record petty cash transactions, even if you think they’re too low to matter. Without a petty cash system, using small cash amounts periodically can add up to a major discrepancy in your books. And when you maintain records of all your business’s expenses, you can claim tax deductions.

Read on to learn about establishing a petty cash fund, handling petty cash accounting, reconciling your petty cash account, and claiming a tax deduction.

What is petty cash?

Petty cash, or petty cash fund, is a small amount of cash your business keeps on hand to pay for smaller business expenses. These small amounts of cash can pay for low-cost expenses, like postage stamps or donuts for a meeting. Petty cash is a convenient alternative to writing checks for smaller transactions.

For example, you might send an employee to pick up office supplies, like staples or printer paper. You would use your petty cash fund to reimburse your employee for the purchase of the supplies.

How large are petty cash funds?

The amount kept in a petty cash fund varies for each business. For some, $50 may be sufficient. Others might have $200 in their petty cash fund. Petty cash funds typically depend on how frequently your business makes small purchases.

Most businesses will reserve enough cash in their fund to meet their monthly needs. However, keeping too much cash could result in unused funds sitting in an account.

As your business grows, you may need to re-evaluate the amount you keep in your petty cash fund. Increase and decrease your funds as needed.

Petty cash accountability

A designated employee, the petty cash custodian, accounts for your business’s use of petty cash. When an employee takes money from the petty cash fund, the petty cash custodian must record who took the money, the amount taken, what the money is for, and the date.

An employee using petty cash should provide a receipt for the purchase to the petty cash custodian. Give the receipt to your finance department or the person who handles your small business books.

You typically evaluate your petty cash fund at the end of each month for more accurate balances. Remember to record petty cash expenses in your accounts as journal entries.

Petty cash do’s and don’ts

Review petty cash do’s and don’ts to ensure you correctly handle your fund.

You must specify what the petty cash can be spent on. Make sure your employees understand what the petty cash fund can or can’t be used for by creating a petty cash policy.

Designate a reasonable amount for your petty cash fund. Establishing a dollar amount to meets your business’s petty cash needs is essential. When your petty cash fund gets low, you must refill it. You don’t want to replenish the balance too often. And, you don’t want the amount to be too high in case of theft.

Don’t give petty cash access to every employee. Your petty cash custodian should be the only employee distributing petty cash. Your petty cash custodian determines if the expense is appropriate according to your business’s petty cash policy.

Petty cash is considered a highly liquid asset. Employees or customers can easily steal your cash. Don’t leave your petty cash fund unsupervised. Consider keeping your petty cash locked in a drawer, safe, or filing cabinet.

Establishing a petty cash fund

Petty cash funds are useful alternatives to writing checks or using your business credit card to cover small expenses. Petty cash funds are used to purchase items for your business, reimburse employees who purchased business items, or to make change.

If you decide to establish a petty cash fund, doing the following can help simplify your petty cash accounting responsibilities:

- Select a petty cash custodian and petty cash cashier

- Determine the amount for the petty cash fund

- Decide what petty cash funds can be used for

- Choose a maximum amount for petty cash requests

The petty cash custodian is an employee responsible for petty cash management and distribution to employees. The petty cash cashier is someone (e.g., you or an employee) who puts money in the petty cash fund when it gets too low and handles petty cash accounting. You should ask separate employees to take on these roles to discourage employee theft.

You need to determine how much the petty cash fund is set at. Some businesses put $50 into their petty cash fund while others put $250—the amount of your fund depends on your business needs.

What can employees purchase with petty cash funds? You should set boundaries before distributing petty cash. For example, employees cannot use petty cash to buy themselves coffee.

Lastly, you should choose a maximum amount that employees can request for petty cash transactions. If the employee needs to spend more than the petty cash request limit, they can use the business credit card.

Petty cash accounting

Like any other type of transaction, you must record petty cash transactions in your small business accounting books.

To improve the way you handle petty cash accounting, require a petty cash receipt for each transaction. And, create a petty cash slip indicating the amount, employee’s name, and date when you give employees petty cash. When you or employees pay with petty cash, retain the receipt and attach the petty cash slip to the receipt for your records.

For petty cash accounting, you must create a log detailing your transactions. And, you must record a petty cash journal entry when you put money into the petty cash fund and when money leaves the fund. Consider recording petty cash transactions in your books at least once per month.

So, how does petty cash bookkeeping work?

Petty cash log

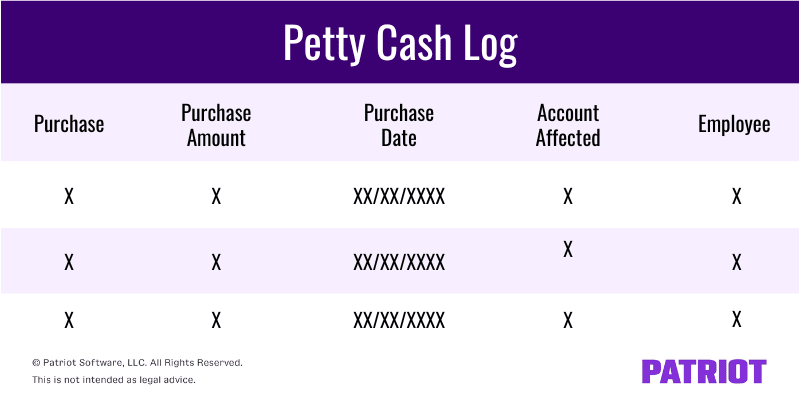

Create a petty cash log that details what was purchased, the amount of the purchase, the date it was purchased, the account affected (e.g., Office Supplies account), and which employee received the funds.

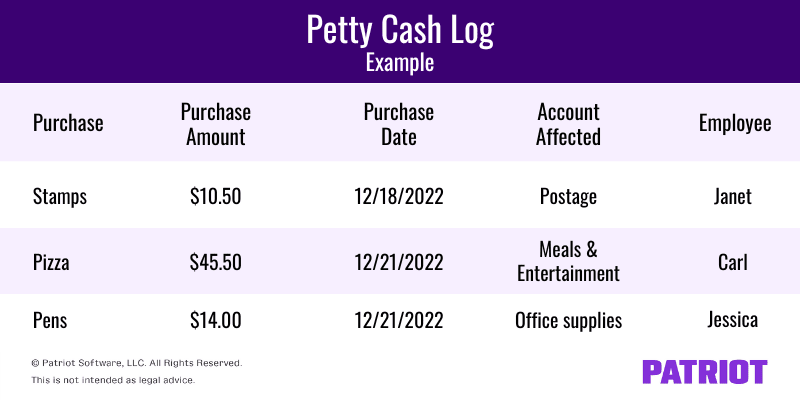

Here’s an example petty cash log:

Journal entry for putting money into the petty cash fund

When your petty cash cashier puts money into the petty cash fund, they must create a journal entry in your books. The entry must show an increase in your Petty Cash account and a decrease in your Cash account. To show this, debit your Petty Cash account and credit your Cash account.

Your petty cash book format should be similar to the following entry:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Petty Cash | Adding to petty cash account | X | |

| Cash | X |

When the petty cash fund gets too low, you must refill it to its set amount. Then, create another journal entry debiting the Petty Cash account and crediting the Cash account.

Journal entry for removing money from the petty cash fund

You (or your petty cash cashier) must also create journal entries showing what petty cash funds go toward.

To create journal entries that show petty fund purchases, you must debit the corresponding accounts (e.g., Office Supplies account if you purchase supplies) and credit your Petty Cash account.

You might debit multiple accounts, depending on how often you update your books for petty cash accounting.

Your petty cash accounting format should be similar to this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Account ABC | Petty cash used for business expenses during period | X | |

| Account XYZ | X | |||

| Petty Cash | X |

Petty cash accounting examples

Let’s say you designate $75 to your petty cash fund. When you put money into the fund, you must create a journal entry debiting your Petty Cash account and crediting your Cash account.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Petty Cash | Adding to petty cash account | 75 | |

| Cash | 75 |

Now, let’s say that you distribute petty cash for the following expenses:

- $10.50 for postage

- $45.50 for pizza for a team meeting

- $14.00 for office supplies

You must update your petty cash log to detail the above expenses. Your petty cash log would look like this:

After collecting receipts from your employees, update your books to show the used petty cash. You must debit your Postage, Meals and Entertainment, and Office Supplies accounts and credit your Petty Cash account.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Postage | Petty cash used for business expenses during period | 10.50 | |

| Meals and Entertainment | 45.50 | |||

| Office Supplies | 14.00 | |||

| Petty Cash | 70.00 |

Petty cash reconciliation

Your petty cash records might be inaccurate due to employee theft or accounting errors. To fix discrepancies, reconcile your petty cash.

For petty cash reconciliation, subtract the amount in your petty cash fund from the amount stated in your books. This shows you how much cash you have withdrawn from the fund. Compare this amount to the total amount listed on your receipts to determine if your accounts are equal.

Petty cash and taxes

Since most petty cash purchases are for business expenses, you will likely be able to deduct them from your business’s taxes at year-end.

Keep and record every receipt for petty cash purchases. You must document each expense if you want to deduct it from your business taxes. If you don’t document your petty cash purchases, you will not be able to deduct the expenses when you pay business taxes.

Review IRS Publication 583 for more petty cash requirements and recommendations for recordkeeping.

Petty cash tax deduction

Many of your business expenses are tax deductible, including purchases made with your petty cash fund.

You can deduct some petty cash purchases from your business taxes if you have the proper records to support your claims.

Want a simple way to record petty cash records in your books? Patriot’s online accounting software is easy-to-use and made for the non-accountant. Plus, we offer free, USA-based support. Get your free trial today!

This article is updated from its original publication date of December 27, 2018.

This is not intended as legal advice; for more information, please click here.