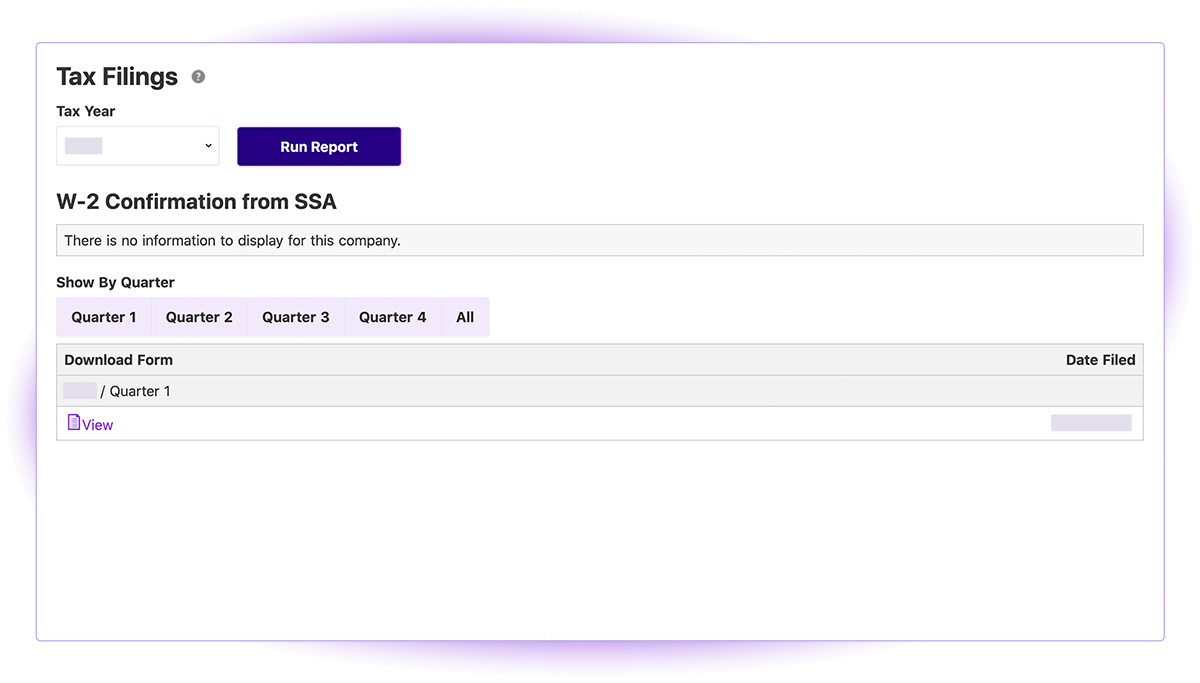

Payroll Tax Filing Report

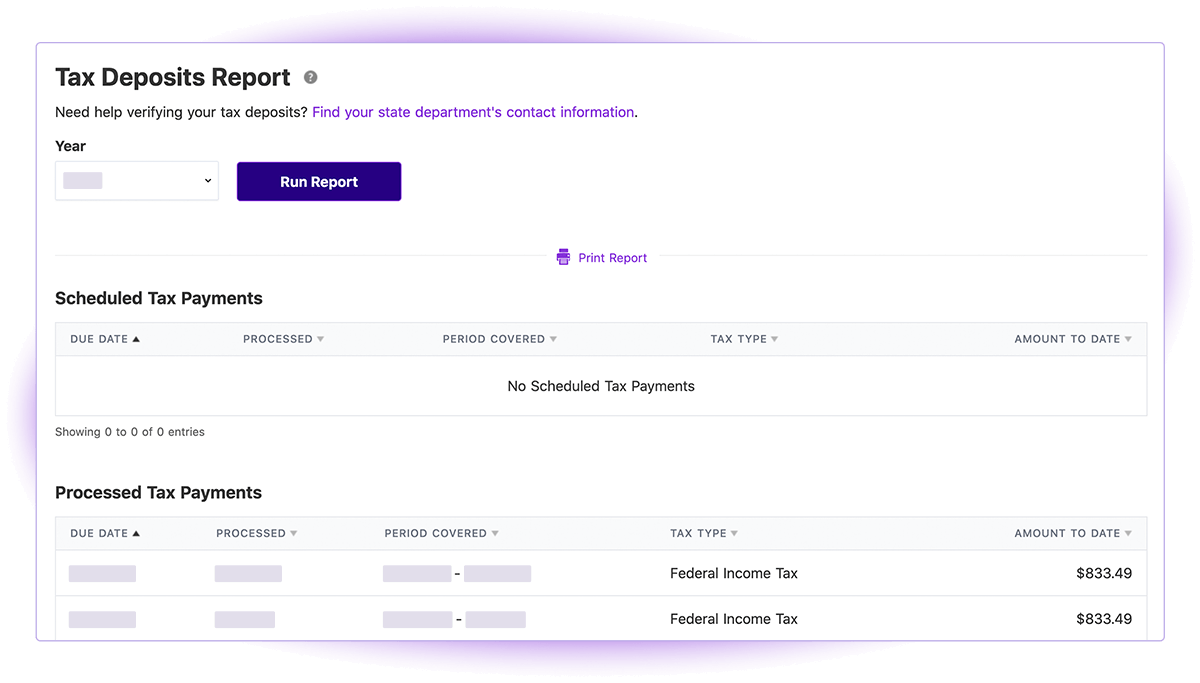

Payroll Tax Deposit Report

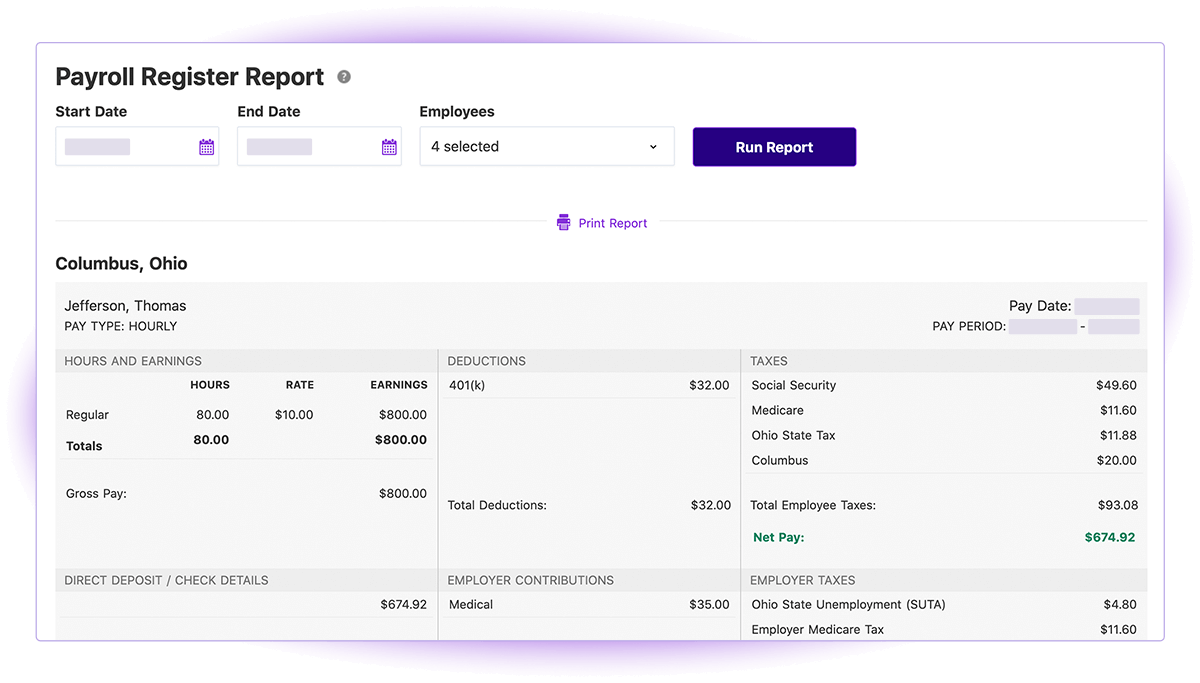

Payroll Register

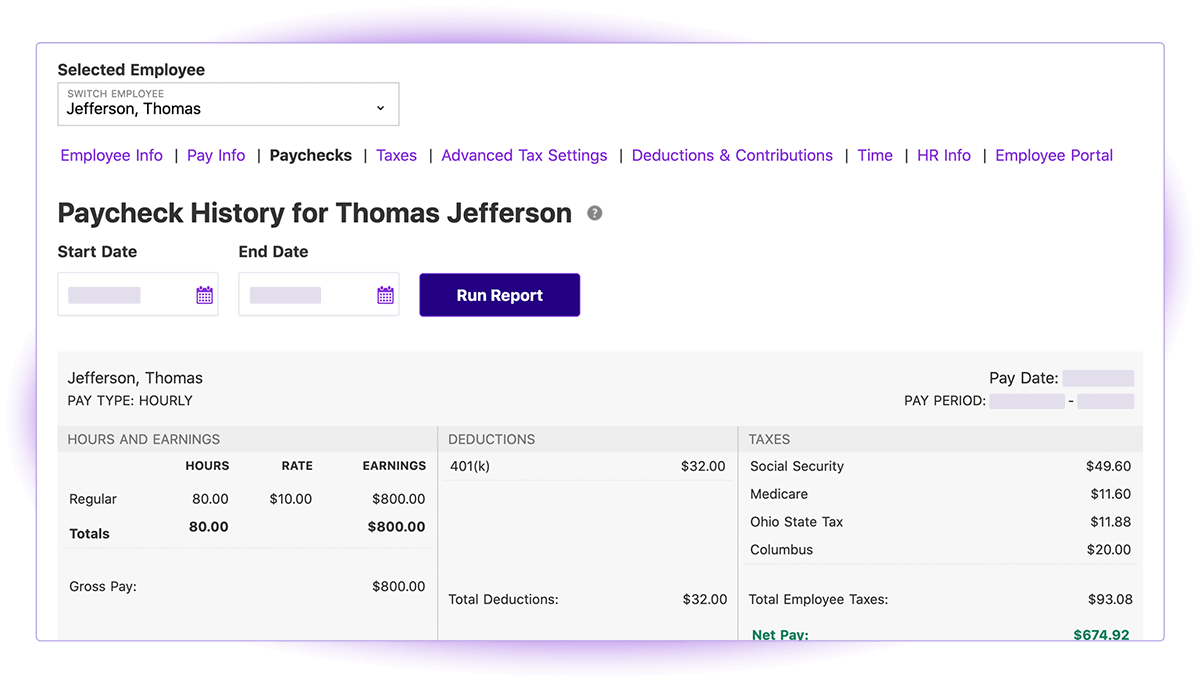

Individual Paycheck History

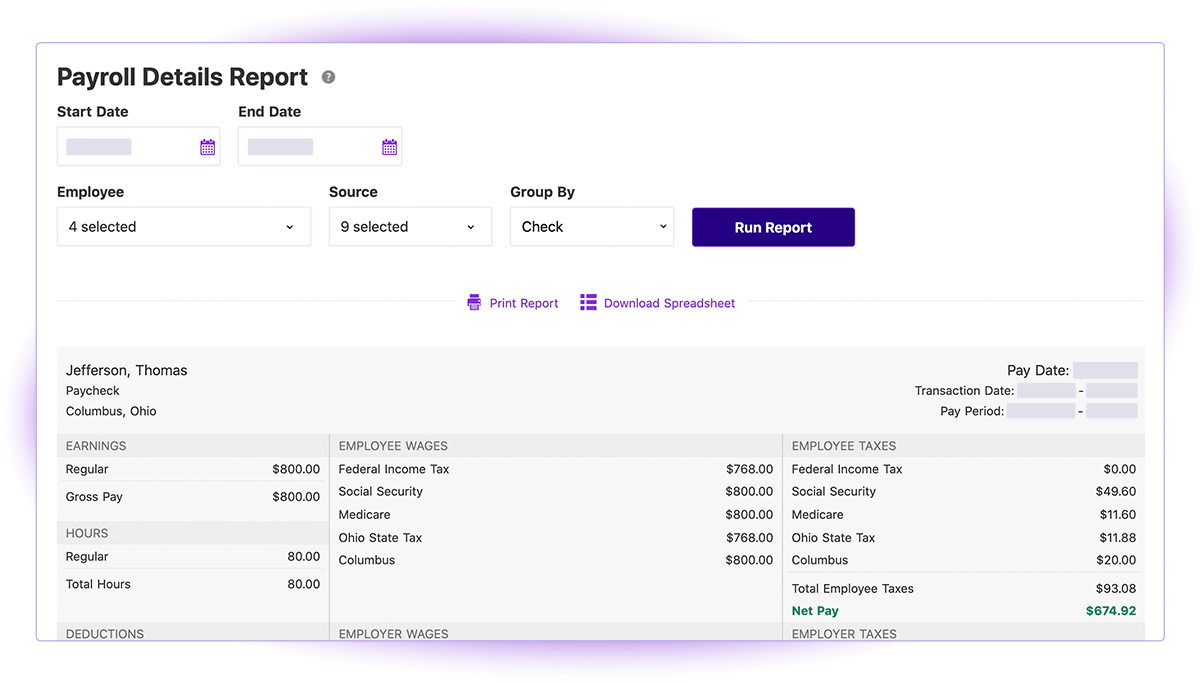

Payroll Details

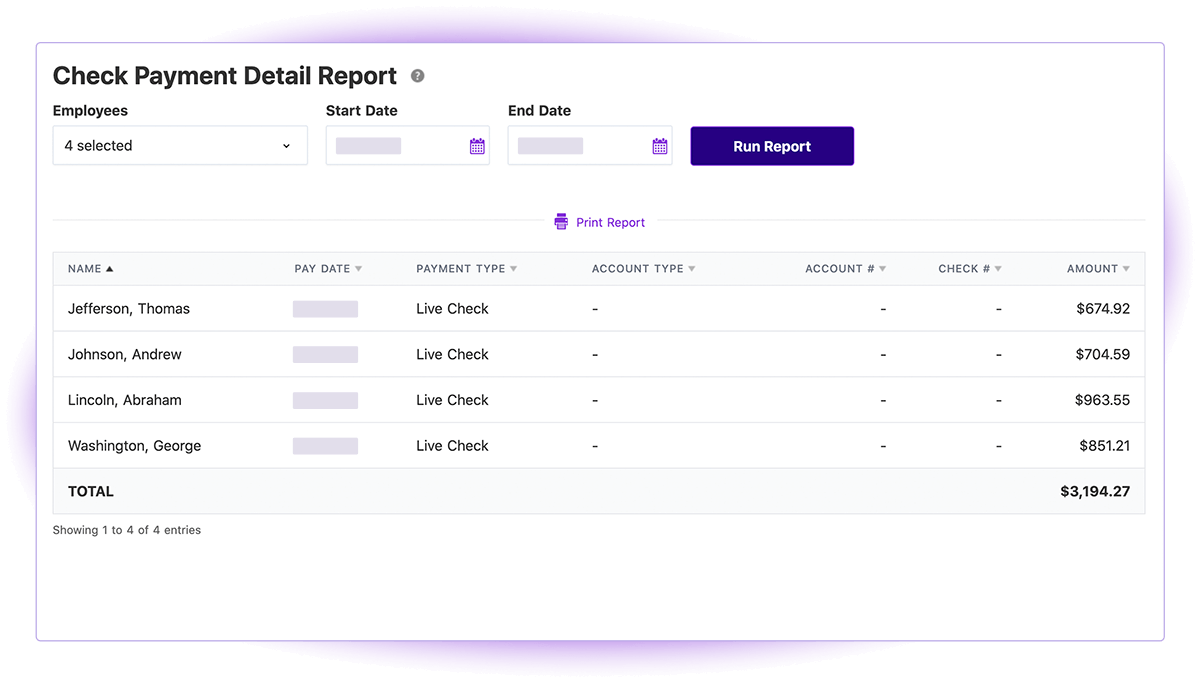

Check/Deposit Payment Detail

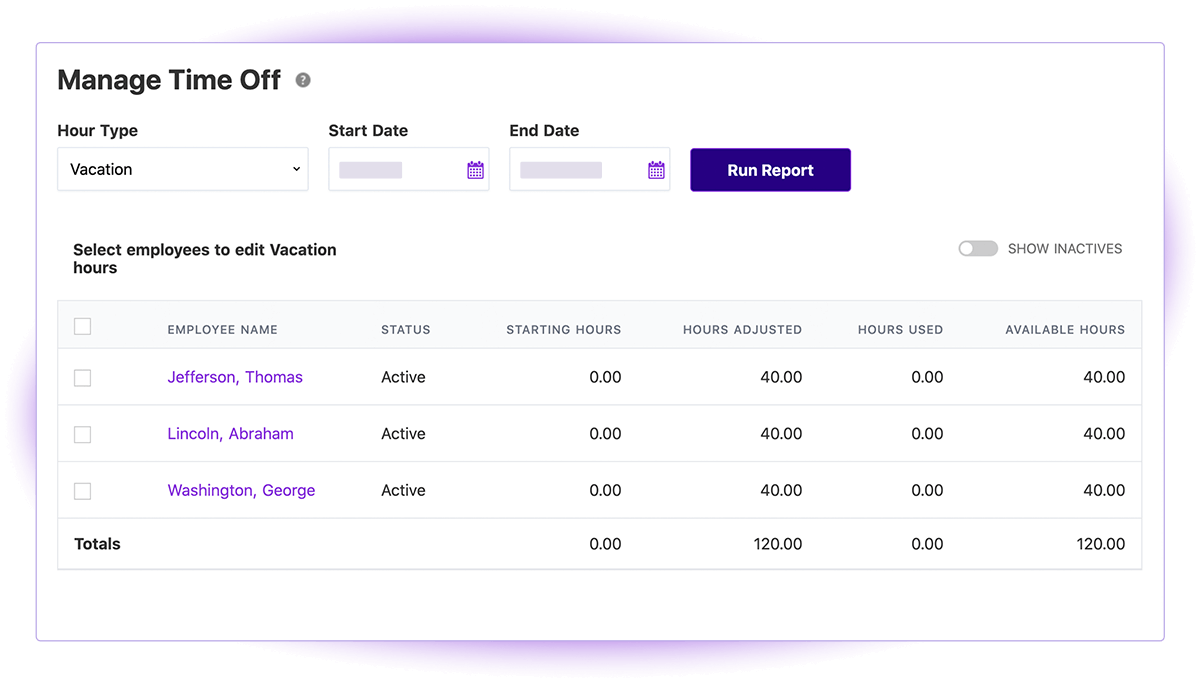

Manage Time Off

W-2 Summary Report

W-2 Preview Report

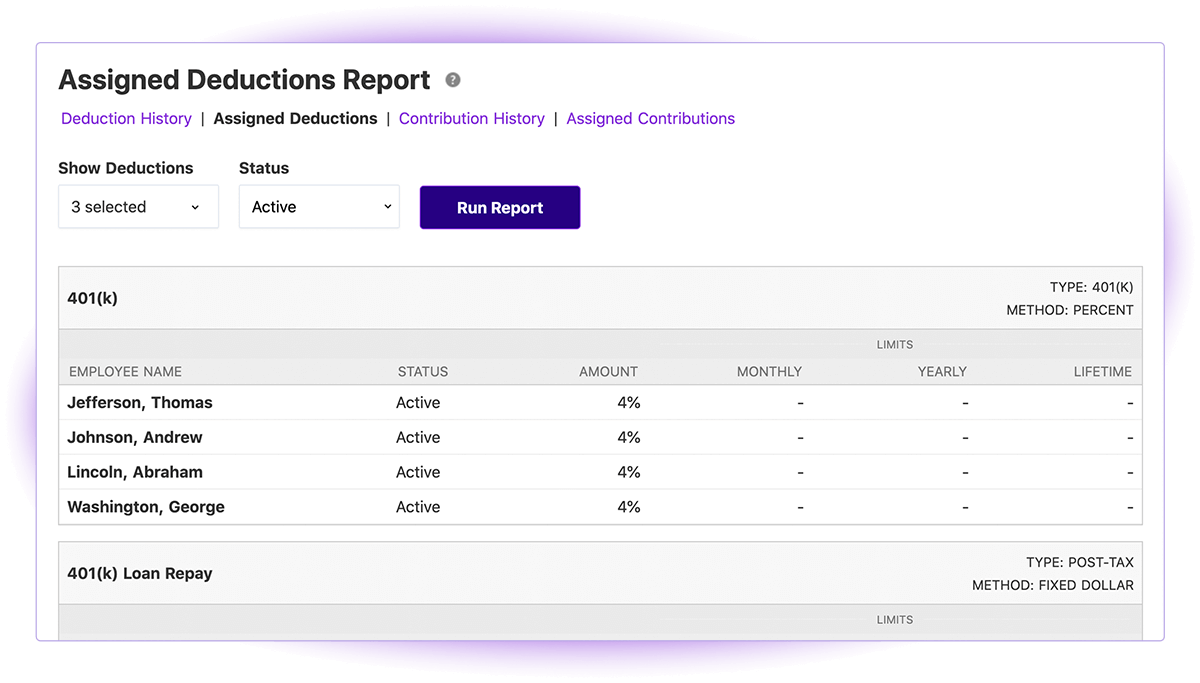

Assigned Deductions

Deduction History

Assigned Contributions

Contribution History

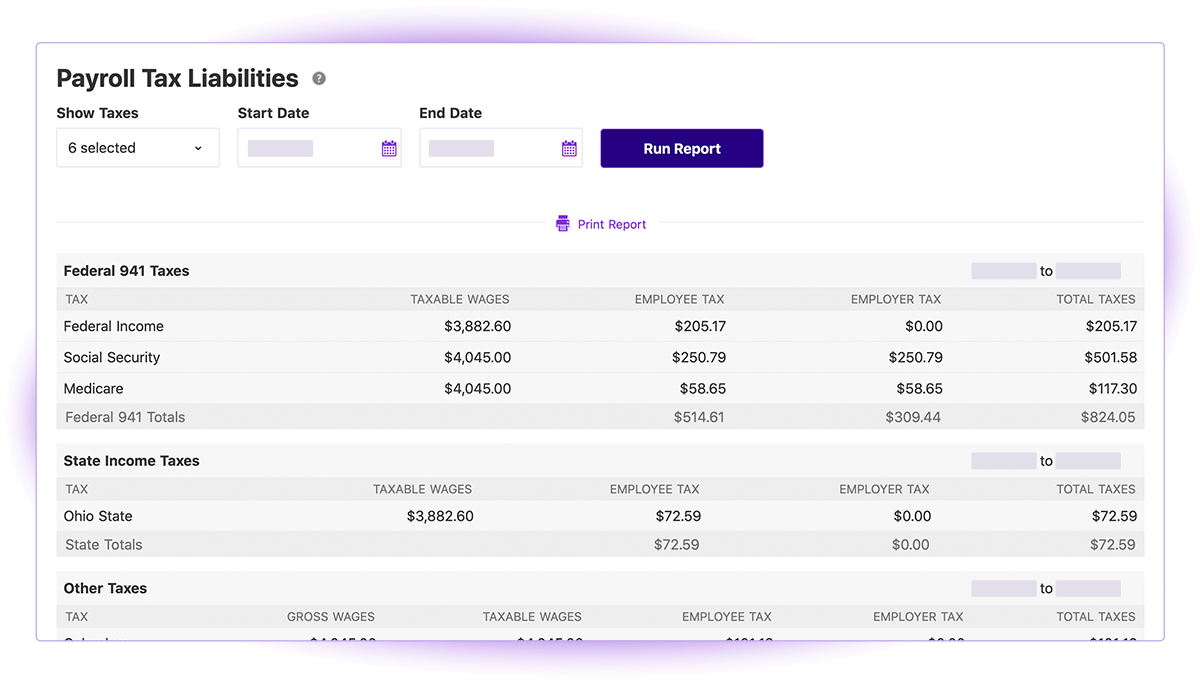

Payroll Tax Liabilities

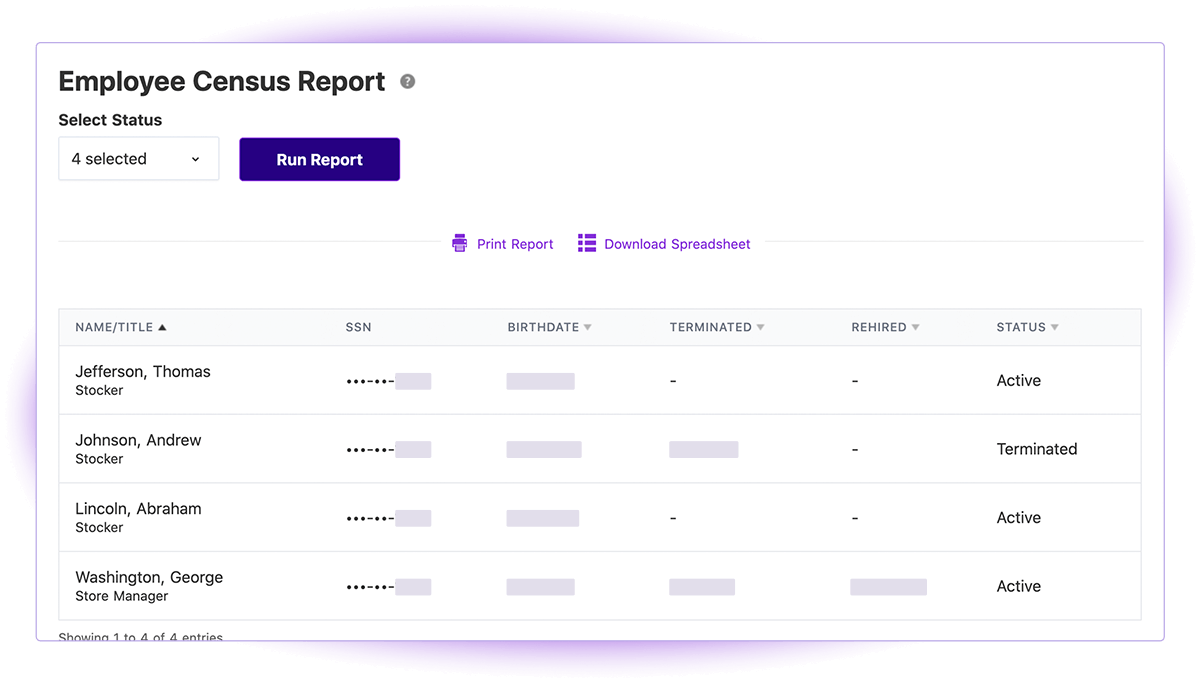

Employee Census