Business owners need to have a pulse on their organization’s financial performance and cash flow for decision making and obtaining business financing. You can learn how your business is doing holistically by preparing different financial statements. So, what is a financial statement?

Skip Ahead

What is a financial statement?

A financial statement is a collection of your business’s financial information. You can form conclusions about your company’s financial health through financial statement analysis and organization.

Statements include line-by-line items as well as total amounts of what you’re looking at. There are three main financial statements:

- Income statement, or profit and loss (P&L) statement

- Balance sheet

- Cash flow statement

Each type of financial statement reports varying information during a period (e.g., month, quarter, etc.). Using statements gives you insight into several areas of your business’s financial health.

Here’s the breakdown of what each major financial summary reveals:

| Financial Statement | What It Tells You | Sections |

|---|---|---|

| Profit and Loss (Income) Statement | How much your business made or lost | Revenue, cost of goods sold, gross profit, and expenses |

| Balance Sheet | What your business owns, owes, and what’s left over | Current assets, noncurrent assets, current liabilities, noncurrent liabilities, equity |

| Cash Flow Statement | How much cash flowed into and out of your business | Cash flow from operations, investing, and financing |

Read on to learn more about income statements, balance sheets, and cash flow statements. Find out each statement’s purpose, financial statement parts, and formulas.

1. P&L (income) statement

An income statement, or profit and loss (P&L) statement, is a summary of your business’s profits and losses during a period. You can prepare the statement monthly, quarterly, or annually. Once you decide on your time frame, break down your business’s revenue and expenses on the statement.

An income statement shows how well your company is doing over time. It measures the profitability of your business.

Look for the bottom line on an income statement to see whether you have a net profit or net loss. This represents whether your business’s net earnings were positive or negative during the period.

Use the following formula to find your business’s net profit (or net loss) and help you know where to pull information from for your income statement:

Net Profit = (Revenue – COGS) – Expenses

Keep in mind that the income statement doesn’t show overall financial health, money you owe or owed to you, or assets and liabilities.

Parts of the income statement

If you want to know how to write a financial statement, take a look at the parts of the income statement:

- Revenue

- Cost of goods sold (COGS)

- Gross profit

- Operating expenses

- Total expenses

- Net income before taxes

- Income taxes

- Interest

- Net profit or net loss

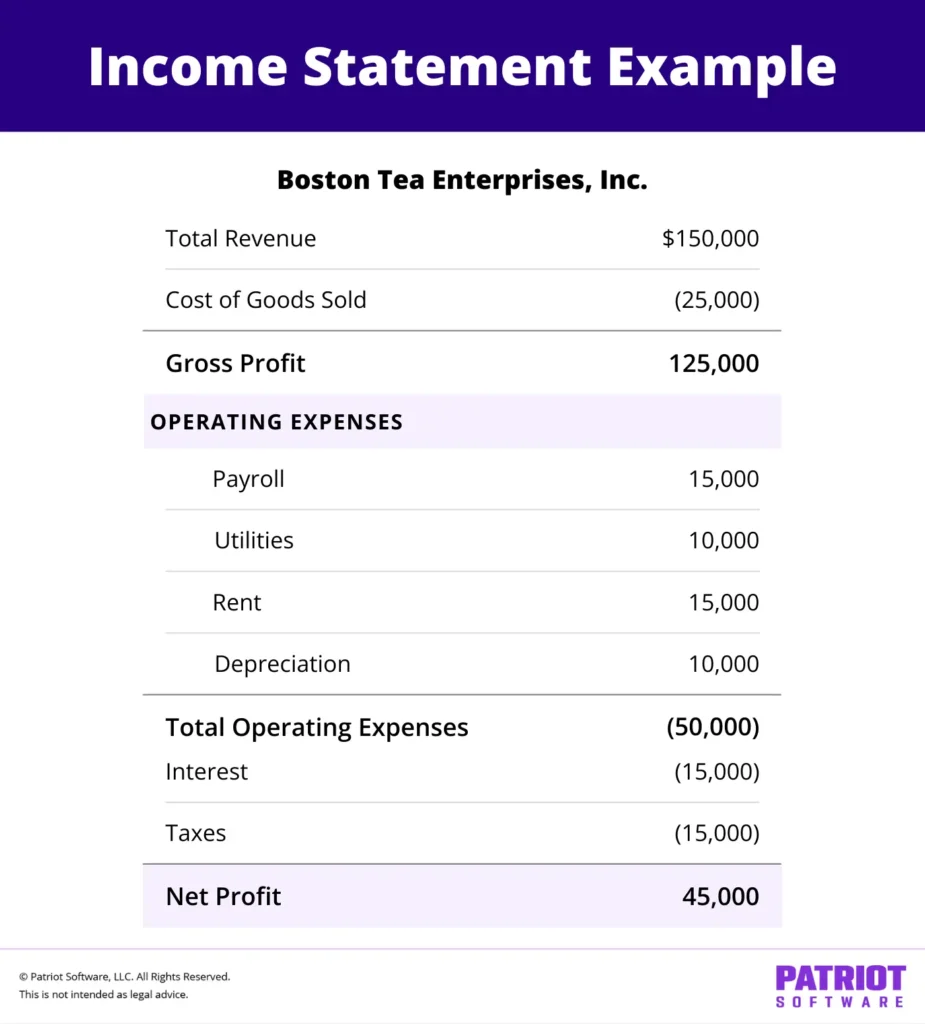

Income statement: Financial statement example

Although they can differ, here’s an example of an income statement:

How to use the income statement

There are several ways to use your income statement to make business decisions, including:

Products: You can see which sales items are the most and least profitable. Also, look for any expenses you could reduce or eliminate.

Budget: Use the income statement to find out if you are over or under your business budget. The statement shows how much cash you have left over after expenses. You can use the leftover cash to expand your business, pay yourself from your business, and pay debt. If you do not have leftover cash, look for ways to adjust your budget.

Financing: Investors, lenders, and vendors often want to look at your business’s income statement. Financial reporting helps these individuals assess the level of risk involved in working with your company.

2. Balance sheet

The balance sheet shows you what you own and owe by breaking down your assets, liabilities, and equity. You can create a balance sheet at the end of a period, such as monthly or quarterly.

Balance sheets use the following formula:

Equity = Assets – Liabilities

Parts of the balance sheet

So, what’s the breakdown of this type of financial statement? Here are the parts of the balance sheet:

- Assets

- Current assets

- Noncurrent assets

- Liabilities

- Current liabilities

- Noncurrent liabilities

- Equity

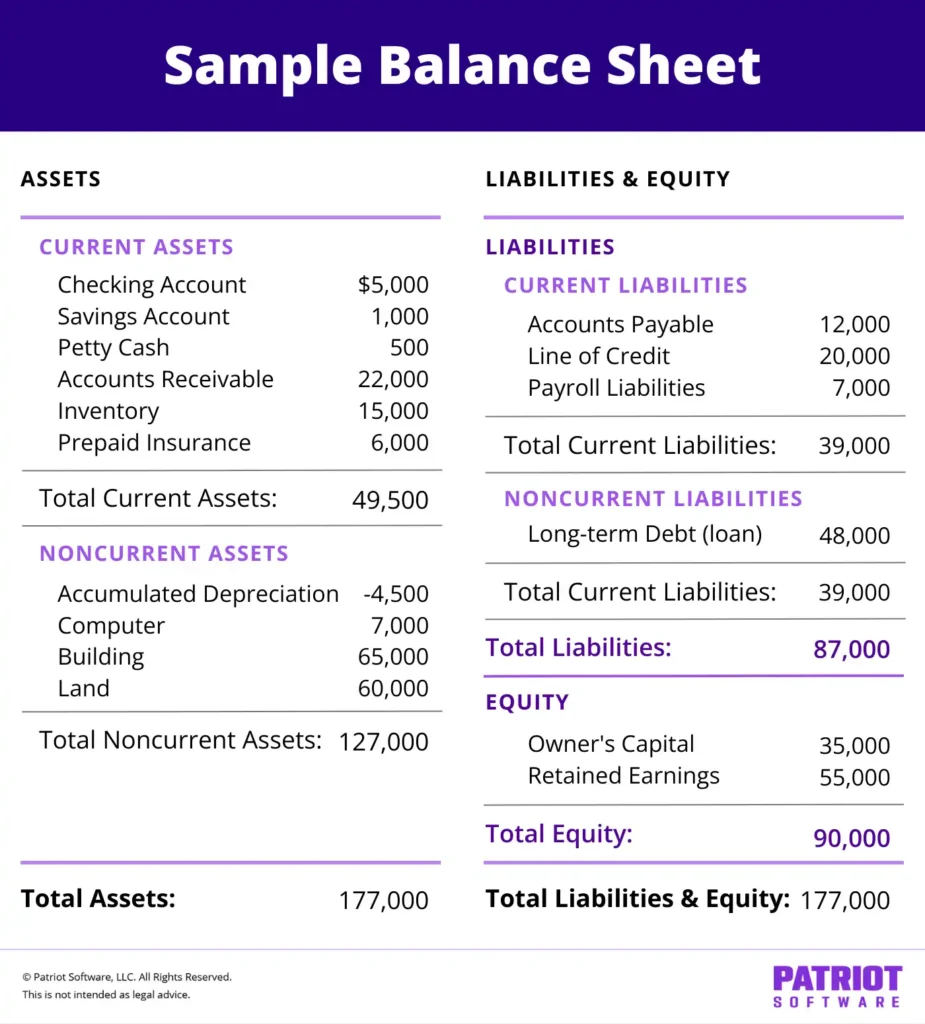

Balance sheet: Financial statement example

Take a look at the following balance sheet example:

How to use the balance sheet

Use your balance sheet to make business decisions such as:

Spending: You can make decisions about spending and managing your business’s debt by looking at the balance sheet.

Liquidity: How liquid is your business? Because the balance sheet gives you an idea of how quickly you can turn assets into cash, you can see your business’s stability and liquidity. This information helps you determine your ability to finance growth without outside funding.

Net value: Use the balance sheet to find your business’s net value, which is important if you want to incorporate or sell your business. Often, lenders and investors want to see your balance sheet. They use the statement to assess the level of risk involved in working with your business.

3. Cash flow statement

The cash flow statement measures money flowing into and out of your business during a period. You can use the cash flow statement to see how much cash you have on hand. Update the cash flow statement daily, weekly, or monthly.

The cash flow statement begins with your starting cash balance. Then, include cash inflows and outflows.

Use the following formula to help you set up your cash flow statement:

End Cash Balance = Operations + Investments + Financing

Parts of the cash flow statement

There are three categories of a cash flow statement:

- Operating activities

- Investing activities

- Financing activities

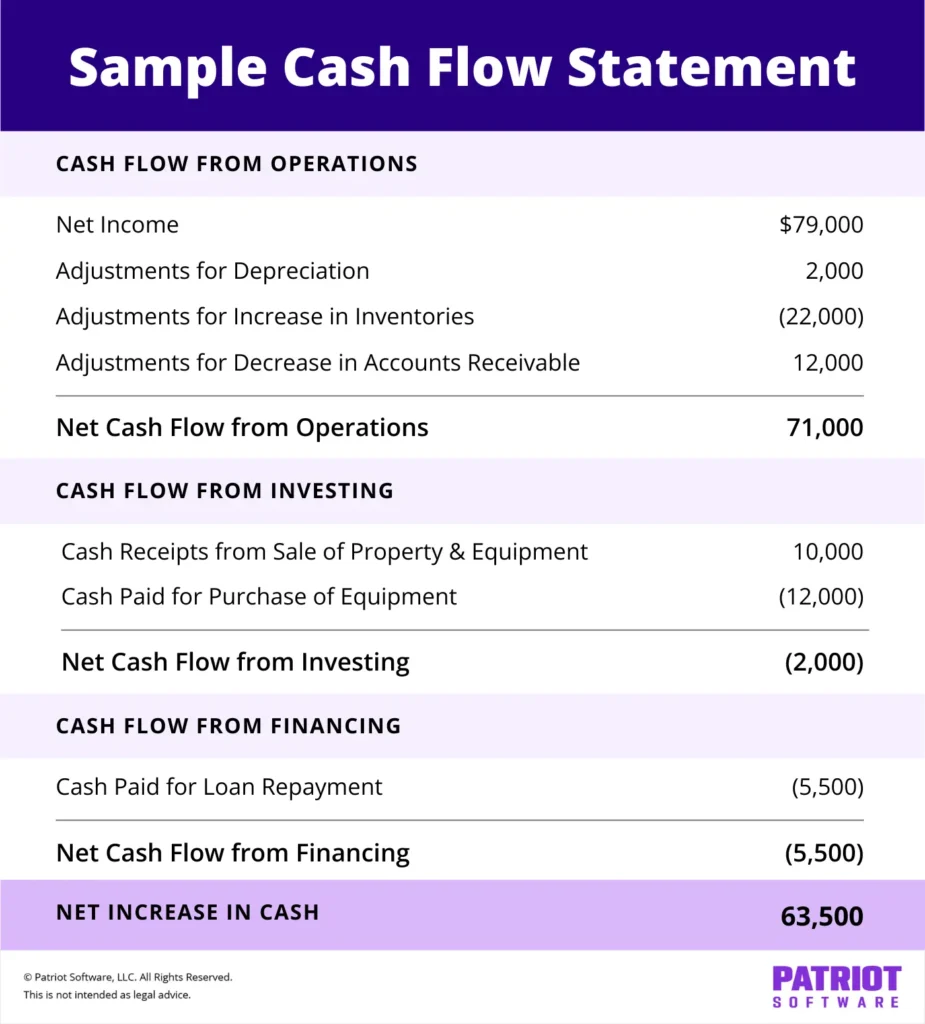

Cash flow statement: Financial statement example

Here’s an example of a cash flow statement:

How to use the cash flow statement

You can use the cash flow statement in a couple of ways, including:

Cash management: The cash flow statement helps you manage incoming and outgoing funds. The statement can also tell you if you need to secure more financing or manage expenses better.

Accounts receivable: Making sure you receive cash from customers in time to pay expenses is crucial to financial health. If your incoming cash is stalled, you might need to adjust your payment terms and conditions to speed up accounts receivable.

How to apply financial statements to your business

At first glance, creating and reviewing financial statements can be a little scary. But, as a business owner, it’s your job to keep track of your company’s financial health. Statements give you a clear view of the direction your business is headed and help you plan your next moves to push your company forward. Gather your financial records to put together your statements.

Keep in mind that income statements, balance sheets, and cash flow statements aren’t the only types of financial statements you can use. Many create and analyze four basic financial statements, which includes the statement of retained earnings.

You can make smart decisions by looking at your financial statements. For example, you can use statements to check that you price products or services effectively.

Financial statements help you keep information organized. You don’t want to report incorrect information to the government when you file a small business tax return. Errors on government forms can lead to fines, fees, and other penalties.

The more you check your books, the more likely you will report accurate information and avoid IRS audit triggers. If the IRS audits you, your statements help prove you reported accurate information.

Generate financial statements with accounting software

Creating financial statements by hand can be time-consuming. Consider using accounting software to streamline the process of generating financial statements.

Patriot’s accounting software makes it easy to record transactions and generate key financial statements, like your profit and loss statement and balance sheet.

You can generate financial statements in just a few clicks. Our software uses your transactions to automatically put together each accounting report. You can filter the data you need by date and view the financial statement in your preferred accounting basis (e.g., accrual accounting).

Simply download any report to a PDF or spreadsheet to pass it on to your accountant, bank, or potential investors.

This article has been updated from its original publication date of January 13, 2017.

This is not intended as legal advice; for more information, please click here.