Running a business means juggling a variety of financial reports, like your company’s trial balance and general ledger. With so many reports to look through, you may be asking yourself, What do these reports mean, and how do I use them? Take a look at the difference between general ledger vs. trial balance and how to use the reports to your advantage.

Double-entry accounting overview

Before we discuss general ledger vs. trial balance, you need to know about double-entry accounting. Your trial balance and general ledger both use double-entry accounting.

Double-entry accounting is exactly what it sounds like—equally recording transactions in two or more accounts. In double-entry accounting, a credit is made in at least one account, and a debit is made in at least one other account.

Debits and credits are equal but opposite entries in your books. With double-entry accounting, your credit and debit totals should balance because each transaction has equal but opposite effects on at least two accounts.

General ledger vs. trial balance

Ready to dive in and learn the difference between general ledger vs. trial balance? Check out how the two reports differ below.

General ledger

Now that you know a bit about double-entry accounting, it’s time to learn all about the general ledger. So, what is it?

The general ledger is the foundation of your books. Use the ledger to sort and summarize all of your business transactions to get a clear picture of your finances. Your general ledger gives detailed information on all the transactions in your chart of accounts.

Think of your general ledger as a filing cabinet and all of the accounts as the folders in the cabinet. Your general ledger typically includes the following main accounts:

In your general ledger, assets and expenses are on the left side. Liabilities, equity, and revenue are on the right side. Both sides of the ledger must have equal values for it to balance.

Trial balance

Your trial balance is an accounting report that contains your general ledger account balances in debit and credit columns. Use your trial balance to make sure that credits and debits are equal in each account.

Remember how your general ledger is like a filing cabinet? Well, your trial balance is like the memo that summarizes the data in your filing cabinet. You primarily use your trial balance as an overview and summary of your general ledger.

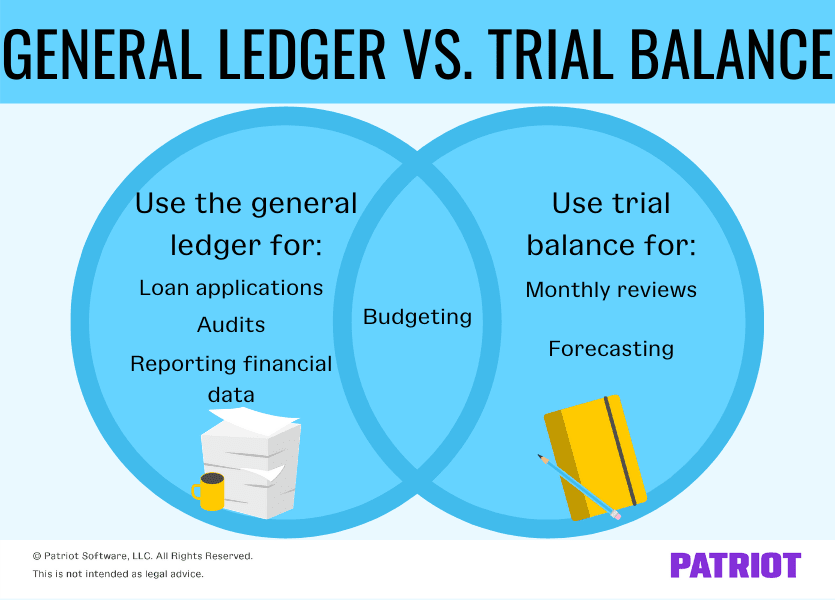

General ledger vs. trial balance: Use this, not that

You may be thinking, How do I know when to use the general ledger vs. trial balance? Great question! The answer? It depends on what information you need to gather.

You may use your trial balance for:

- Reviewing your books monthly

- Forecasting

General ledgers are best for:

- Auditing

- Applying for loans

- Reporting financial information

You can use both your trial balance and general ledger for:

- Budgeting

So, how can you use both of these reports effectively? Take a look-see.

Reviewing your books monthly

When reviewing your books at the end of the month, use your trial balance. The trial balance sheet details the basic information necessary to perform a wellness check on your books.

Rather than get bogged down by the little details of the general ledger, you can use your trial balance to get an idea of where you see money coming in and going out during the month.

Forecasting

Not all businesses use forecasting. But if you do, your trial balance is a good place to look to determine if your business is on the right path financially.

Forecasting lets you look at the general direction of your finances. From there, you can determine if you’re on the right track and make necessary adjustments (e.g., tweak your budget).

Your trial balance is a good report to pull for forecasting because you only need a general idea of where your finances stand.

Auditing

Audits can be a nerve-racking process. During an audit, you have to produce a lot of information to make sure your books are in order. Typically, you pull your general ledger during a routine audit.

Your accountant or financial advisor uses the general ledger to investigate each of your accounts during an audit. Your general ledger shows all of your transactions, including all of your debits and credits.

Applying for loans

Loan applications can be extensive. Not to mention, loan providers want as much detail as possible. For that reason, the general ledger is your best bet when it comes to applying for business loans. A financial institution (e.g., bank) will want to know how much money you are spending and earning in order to minimize their own risk.

Your general ledger tells the bank the financial information they need to move forward with a loan application.

Reporting financial information

Financial reports rely on real financial data—not just guesstimates or forecasts. While the trial balance shows a baseline of where money is coming and going, the general ledger gives the whole picture.

To generate reports that are complete and accurate, use the general ledger. The trial balance may not indicate that something is wrong with an account. The general ledger lets you see a complete financial snapshot and that nothing is out of balance in your books.

Budgeting

Planning your budget for the year is an oh-so-important process for your business. When you plan your business budget, it’s best to look at both your trial balance and general ledger. Why both?

Your trial balance gives you a quick rundown of the different accounts so you can easily see which ones need more attention. Maybe your revenue account is looking great but your expense account is not showing a lot of movement. Your trial balance indicates where you have some wiggle room and gives you an idea of how your budget might look.

Use the general ledger to dive deeper into your business’s transactions. With your general ledger, you can see your overall income and expenses. And, you can pinpoint any changes you need to make (e.g., cut down on unnecessary expenses). The general ledger gives you the total picture of your business’s finances before you proceed with your budget.

Don’t drown in your financial reports. Patriot’s online accounting software lets you easily and securely keep track of all your business transactions. Carry your trial balance and general ledger with you no matter where your business takes you. Try it free for 30 days!

This is not intended as legal advice; for more information, please click here.