Calculating your business profits shows you how much money your company brings in. And, you can compare profits from previous accounting periods to determine growth. There are two types of profit that businesses must deal with and calculate: gross profit and net profit.

Understand gross profit vs. net profit to make business decisions, create accurate financial statements, and monitor your financial health.

Gross profit vs. net profit

Profit is the amount of money your business gains. The difference between gross profit and net profit is when you subtract expenses.

Gross profit is your business’s revenue minus the cost of goods sold. Your cost of goods sold (COGS) is how much money you spend directly making your products. But, your business’s other expenses are not included in your COGS. Gross profit is your company’s profit before subtracting expenses.

Net profit is your business’s revenue after subtracting all operating, interest, and tax expenses, in addition to deducting your COGS. To calculate net profit, you must know your company’s gross profit. Your business’s net profit is known as a net loss if the number is negative.

Your business might have a high gross profit and a significantly lower net profit, depending on how many expenses you have.

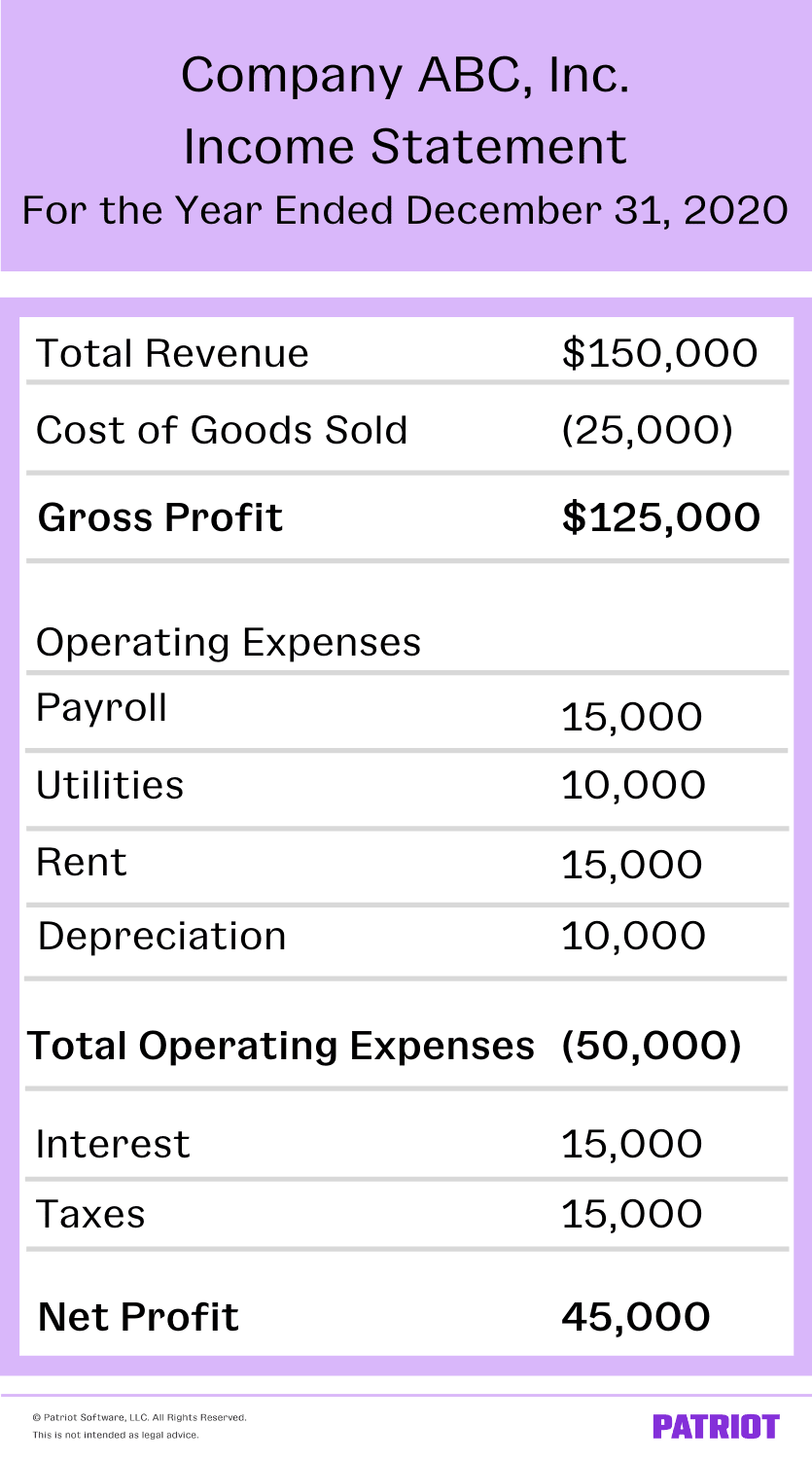

Gross and net profit on the income statement

Record both gross and net profit on your small business income statement. Your income statement shows your revenue, followed by your cost of goods sold, and your gross profit. The next section shows your operating, interest, and tax expenses. The bottom line of the income statement is your net profit.

Here is a sample income statement, showing both your gross and net profits:

How to calculate gross vs. net profit

To find your gross profit, calculate your earnings before subtracting expenses. To find your net profit, deduct all expenses from your incoming revenue.

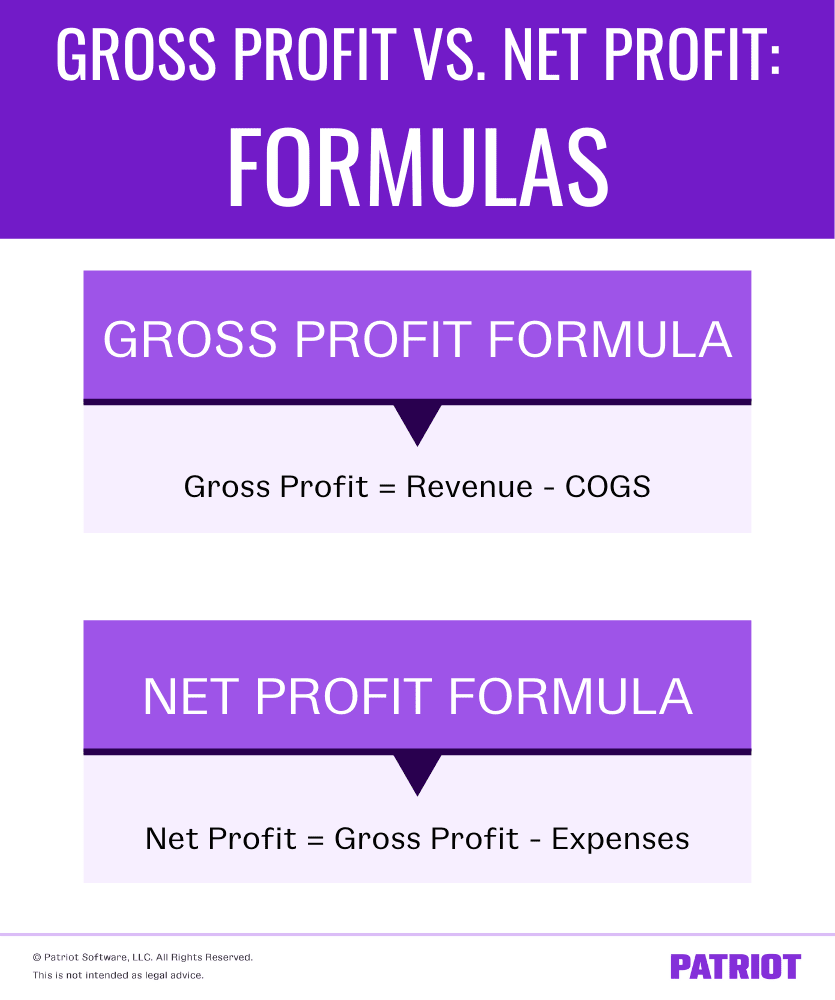

Gross profit formula

Here is the formula for gross profit:

Gross Profit = Revenue – Cost of Goods Sold

Your revenue is the total amount you bring in from sales. Again, your COGS is how much it costs to make your products.

Example

Let’s say your business brought in $12,000 in sales during one accounting period and had a total cost of goods sold of $4,000. Subtract $4,000 from $12,000 to get your gross profit of $8,000.

Remember that your gross profit is not your business’s bottom line. Your gross profit does not represent how much you have to dip into for your business owner wages or to reinvest in your business. But, you can use your gross profits to calculate your net profits.

Net profit formula

Here is the formula for net profit:

Net Profit = Gross Profit – Expenses

Operating expenses, interest, and taxes make up your business’s total expenses. Examples of operating expenses include costs like rent, depreciation, and employee salaries.

Example

Using the above example for gross profits, let’s say your business has a gross profit of $8,000 during an accounting period. You also have expenses of $1,000 for rent, $250 for utilities, $2,000 for employee wages, $300 for supplies, $500 in depreciation, $1,000 in taxes, and $250 in interest.

First, total your business’s expenses. Your total expenses are $5,300 ($1,000 + $250 + $2,000 + $300 + $500 + $1,000 + $250).

Now, you can subtract your total expenses of $5,300 from your gross profit of $8,000. Your business has a net profit of $2,700.

Why knowing the difference between gross and net profit matters

When you own a small business, you need to know your business’s gross and net profits.

Investors and lenders want to know about the financial health of your business, and showing them your gross profits just won’t cut it. You must know your company’s net profits when seeking outside lenders. That way, investors and lenders can determine how much money you have after paying all your expenses.

To create your income statement, you need to be able to calculate both gross and net profit. Confusing the two will only lead to muddled and inaccurate documents.

You also need to know the difference between gross profit vs. net profit to make educated business decisions. Knowing your business’s gross profit can help you come up with ways to reduce your cost of goods sold or increase product prices. And if your net profit is significantly lower than your gross profit, you can determine expense cuts.

To calculate your business’s gross and net profits, you need organized and accurate books. With Patriot’s online accounting software, you can track income and expenses, allowing you to monitor your business’s financial health and prepare financial statements. Start your free trial today!

This is not intended as legal advice; for more information, please click here.