Letting employees go is never easy. But if you’re dealing with staggering profits, unproductive workers, or the effects of COVID-19, you might not have a choice. When your employees become unemployed, they may be eligible for unemployment benefits. But, how does unemployment work for employers? What are your responsibilities?

How do unemployment benefits work?

If an employee loses their job through no fault of their own (e.g., downsizing), they may be eligible for unemployment benefits. Employees may also apply for partial unemployment benefits if their employer reduces their work hours. Unemployment is a portion of the former employee’s compensation they receive while they look for new work.

Unemployed individuals can apply to receive unemployment insurance benefits through their state unemployment office. If approved, states distribute benefits.

In most cases, unemployed individuals must meet a few state-specific requirements before receiving their benefits, such as:

- Actively looking for work

- Going through a waiting period

However, a number of states have made temporary changes to how unemployment benefits work due to the coronavirus pandemic. Examples include extended benefits to self-employed individuals and waived waiting period and active work search requirements.

So, if unemployed individuals are the ones applying for benefits and states are the distributors, where do employers come into play?

Employer responsibility for unemployment benefits: Taxes

As an employer, how does unemployment work? And how much do employers pay for unemployment? Your responsibility for unemployment benefits begins when you hire an employee, not when you terminate employment.

When you hire new employees, report them to your state. You must pay federal and state unemployment taxes for each employee you have. These taxes fund your state’s unemployment insurance program.

Federal Unemployment Tax Act (FUTA) tax is an employer-only tax. It is 6% on the first $7,000 each employee earns in a year, meaning you will pay a maximum of $420 per employee per year. Most employers receive a tax credit of up to 5.4%, meaning your FUTA tax rate would be 0.6%. With the maximum tax credit, your FUTA tax liability would be $42 per employee per year.

State Unemployment Tax Act (SUTA) tax is generally an employer-only tax, but some states require employee contributions, too. Tax rates vary by state, and each state also sets its own wage base. If you have employees working out of a different state, follow the unemployment tax rules for multi-state employees. Generally, the state determines your SUTA tax rate based on factors like your experience, industry, and how many former employees claimed unemployment benefits.

Independent contractors are not eligible to receive unemployment benefits because you do not pay unemployment taxes on their pay. Only employees whom you’ve paid FUTA and SUTA taxes for are eligible to receive these benefits.

How does unemployment work for employers?

Now that you know your employer responsibility for unemployment benefits, you might wonder what happens when someone files a claim. How does unemployment affect the employer?

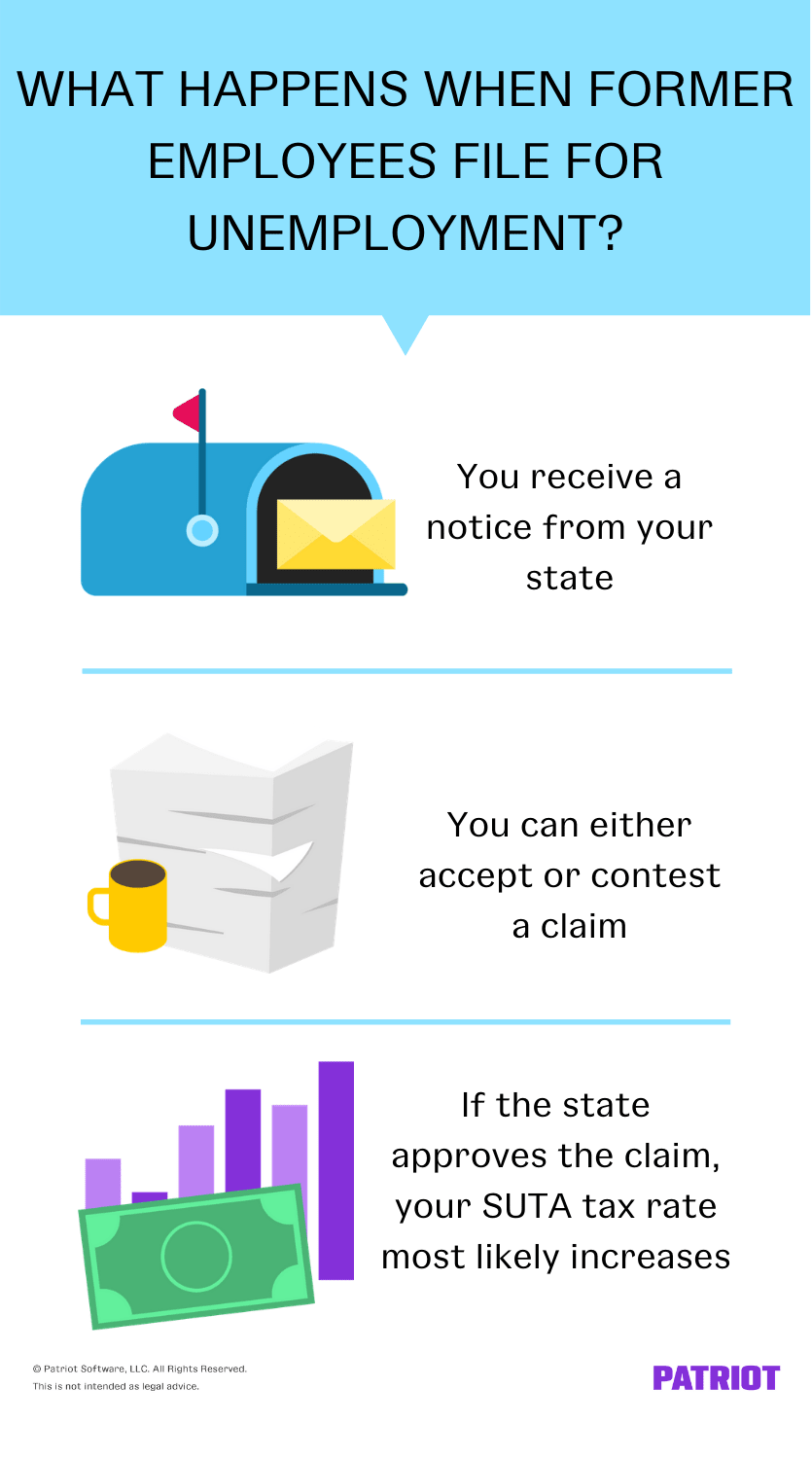

When a former employee files a claim for unemployment benefits, you receive a notice. The state sends this “Notice of Unemployment Insurance Claim Filed” to the employee’s most recent employer.

Now, onto the part you really want to know. Who pays for unemployment—do employers pay unemployment? Yes … and no.

Again, you are responsible for paying FUTA and SUTA tax for your employees. And when former employees file for unemployment benefits, you are (indirectly) the one footing the bill.

Benefit payments are charged to your employer tax account, which results in increased state tax rates. The more unemployment claims the state approves, the more you contribute for unemployment taxes.

Keep in mind that there may be exceptions. For example, mass layoffs due to the coronavirus do not affect employer SUTA tax accounts in some states (e.g., Ohio). Consult your state for more information to receive a special coronavirus mass-layoff number.

Employer response to unemployment claim

When you receive an unemployment claim notice, you need to take action. The action you take depends on whether you want to contest the claim or not.

Take a look at your responsibilities for accepting or contesting claims, as well as reasons why you might accept or contest claims.

1. Employer says they will not contest unemployment

When a former employee files their unemployment claim, they provide information about their situation.

If the information is factual and the individual a legitimate unemployment claim, you probably don’t want to contest it. Deciding to accept unemployment claims generally means you do not need to take further action.

Here are some reasons for legitimate unemployment claims:

- You laid off the employee due to a lack of work

- You laid off the employee because of financial constraints

- The employee was terminated or quit because of something you did wrong

Accepting an unemployment claim doesn’t guarantee the former employee receives benefits. The decision is ultimately the state’s. If there are issues with the worker’s application, the state may deny the application.

Employers and claimants receive a determination letter from the state. This letter details why the decision was made and any charges to your account. Claimants have the right to appeal the decision if the state denies them unemployment insurance.

2. Employer contesting unemployment claim

In some cases, you may want to contest unemployment claims. Although this takes more time and effort on your end, it prevents your tax rate from rising (if you win).

Here are some reasons a worker is ineligible for unemployment benefits:

- You fired the employee for misconduct

- The employee quit to take another job that fell through

- There is false information on the employee’s claim form

- The worker was an independent contractor, not your employee

- You’re dealing with a case of unemployment fraud

If you contest a claim, respond to the state unemployment department. Failing to respond within the timeframe listed on the notice (generally 10 days) could forfeit your ability to contest.

Gather and provide your state with as much proof as possible to back your decision. Detail why you terminated the employee; their compensation, job title, and dates of employment; and information about your business. This is one reason you must maintain employment and payroll records, even after an employee leaves.

Let’s say you’re contesting the claim because the employee was fired for misconduct. Among other documents, you could show copies of HR meetings with the employee to back up your claim.

When you contest unemployment claims, you may have an unemployment benefits hearing. The state may contact you by phone or letter to ask for additional information.

After the state makes a decision, you receive a determination letter. If you previously contested the claim and disagree with the determination letter, you have a period of time to appeal it. Your former employee also has the right to appeal the decision.

Keep in mind that contesting an unemployment claim could result in the former employee filing a wrongful termination lawsuit. So before contesting, spend some time mulling over whether you have a case. And, contact your state to determine how the claim could impact your SUTA tax rate if accepted. Depending on the situation and the likelihood that you’ll win, contesting a claim might not be worth it.

Unemployment claims and worker misclassification

Bigger issues could come to light during unemployment claim processes. Again, independent contractors are not eligible for unemployment benefits…

…But, what if you misclassified the worker as an independent contractor when they really should have been an employee?

When you misclassify an employee as an independent contractor, you deny them the option of enrolling in benefits programs, like health insurance and retirement plans. And, you fail to provide overtime wages and withhold and contribute necessary payroll taxes.

Misclassifying workers results in penalties, interest, and back taxes. States require you to pay back payments for unemployment insurance and workers’ compensation premiums.

Avoid misclassifying workers by understanding the difference between an independent contractor and employee.

Make sure you contribute federal and state unemployment taxes for each employee. Patriot’s payroll software will accurately calculate your tax liability. And if you opt for our Full Service payroll services, we will deposit and file taxes on your behalf. Get your free trial today!

This article has been updated from its original publication date of June 4, 2018.

This is not intended as legal advice; for more information, please click here.