Notice something fishy about an unemployment claim that you receive? If so, one of your employees might have fallen victim to unemployment fraud … which means you could, too.

Between 35% – 40% of unemployment claims are fraudulent. Because employers are often the first to see unemployment fraud warning signs, you must take action. Read on to learn how to prevent fraud from hurting your business and its team members.

How fraudulent unemployment claims can affect you

So, how does unemployment affect an employer? Employers are responsible for paying federal and state unemployment taxes for each employee. These taxes fund your state’s unemployment insurance (UI) program, which is what doles out unemployment benefits to eligible individuals.

Your state unemployment tax, or SUTA, rate depends on a number of factors, such as your:

- Industry

- Experience

- Number of former employees who have received UI benefits

The more successful claims your former employees file, the higher your state unemployment tax rate. Fraudulent claims that result in benefit payments can also contribute to a rising SUTA tax rate.

Not to mention, an employee who falls victim to fraudulent unemployment claims may raise concerns about identity theft with you.

The big red flag for employers that unemployment fraud is afoot

Now that you know how damaging false claims can be for your business and employees, you might be wondering how you can tell if there’s fraud going on.

Unemployment fraud doesn’t mean you’ll receive sketchy emails or mail from a scammer. In this case, it means a scammer filed for unemployment benefits with the state using a worker’s personally identifiable information (PII). Employers then receive a legitimate notice from the state.

The one glaring red flag that alerts you to fraud is:

- You receive a state notice about an individual filing for unemployment benefits who is still employed by your business

Employees, on the other hand, may learn about the problem by receiving:

- Notice from employer about an unemployment claim

- Mail from a government agency about claims or payments

- IRS Form 1099-G, Certain Government Payments, indicating “received” unemployment benefits

If an employee receives mail from the state about unemployment payments or IRS Form 1099-G about reporting payments, the fraud has already been successful. But, employers promptly notifying employees of fraudulent unemployment claims can help nip problems in the bud early on.

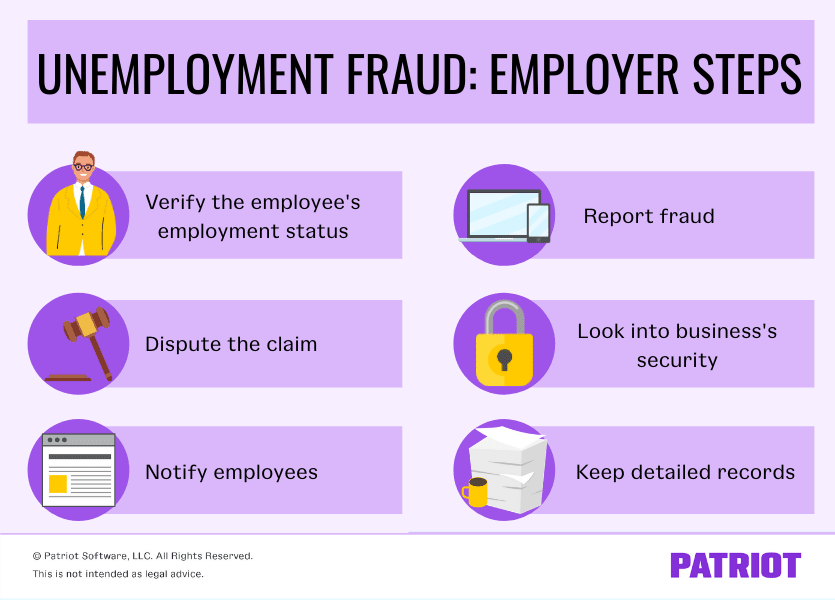

6 Steps you can take to fight fraudulent unemployment claims

Because fraudulent activity, like filing for unemployment, is on the rise during COVID-19, you must be alert. Also, discuss the rise in false claims with employees and encourage them to be on the lookout. And, let employees know to come to you if they suspect they are victims of UI fraud.

When you receive a state unemployment claim in the mail, don’t ignore it. Here are six steps to take if an employee falls victim to unemployment identity theft.

1. Verify the employee’s employment status

Whenever you receive an unemployment claim from your state, you need to verify the employee’s status. Check your payroll and employee records to find out for sure.

Does the employee still work for you? If so, there’s a chance that they didn’t file for unemployment benefits. Talk with the employee to find out if they filed or not.

If the employee does not work for you, the unemployment claim may be legitimate. Check your records to determine whether they have a qualifying case for filing for UI benefits or not.

2. Dispute the claim

When you receive a state notice about an unemployment claim, you have the opportunity to dispute the claim.

There are a number of reasons you can dispute a UI claim, including if you fired the employee for misconduct, they voluntarily quit for another job, and—that’s right—if they still work for you and it’s a fraudulent claim.

When disputing a claim, provide proof to back up your decision. In this case, you could gather documents showing that the employee is still employed and on your payroll.

3. Notify employees

If a scammer files for unemployment under one of your employee’s names, the scammer has that individual’s PII. You must notify the employee of their next steps of dealing with identity theft.

When notifying employees about a fraudulent claim, be sure to:

- Alert the employee as soon as you can

- Give employees the resources they need to protect themselves and secure their identities

- Filing an identity theft report

- Contacting the credit bureaus (Experian, Equifax, and TransUnion) to review their credit report and/or freeze their report

- Encourage employees against using any unemployment benefit funds that wind up in their accounts

4. Report fraud (employer + employee)

Both you and your affected employee must report the fraud to your state. There should be contact information for your state’s unemployment benefits agency on the notice.

You can also use the Department of Labor’s state directory to find out where to report identity theft with your state.

State+unemployment fraud processes for reporting fraud differ. So, contact your state to find out what you need to do to submit a claim.

5. Look into your business’s security system

Has there been a breach? Unemployment fraud doesn’t mean scammers accessed your business’s security systems and gained access to an employee’s information. Scammers can gain this information …. anywhere.

However, you should look into your business’s systems to make sure scammers didn’t access an employee’s PII. This is especially important if you have fraudulent unemployment claims for multiple employees.

6. Keep detailed records

Whenever you’re dealing with theft and fraud, keep a copy of your communications with each party for your records.

Make copies of the state notice and any correspondence you have with the state unemployment benefits agency (e.g., fraud claims). Take down notes throughout the process, too, so you know who you’ve communicated with.

Resources

Here are some quick-access links to help you and your employees deal with unemployment identity theft and fraud:

- Department of Labor: Unemployment identity theft state directory

- IRS: Identity Theft and Unemployment Benefits

- Federal Trade Commission: Steps for employees

Make sure your employee records are organized and up-to-date so you can verify employment status. With Patriot’s HR software add-on*, you can store employee files online to access critical info anytime, anywhere. Try it free, along with our payroll software, today! (*Must have payroll to use HR add-on).