Failing to pay eligible employees overtime is a wage violation that lands a number of employers in hot water each year. But if you thought federal overtime laws were the end of it, you’re in for a surprise. There are also overtime laws by state you may need to follow.

Should you follow federal or state law? What are the overtime regulations by state? Read on for the scoop.

What is the federal overtime law?

The Fair Labor Standards Act (FLSA) requires most employers to give nonexempt employees overtime pay when they work extra hours.

Overtime wages are 1.5 times an employee’s regular pay rate for each hour worked over 40 in a workweek. Under federal law, you must give overtime pay to your employees unless they have exempt status.

Employees are only exempt from overtime pay if they meet all three of the following requirements:

- Earning Level: The employee earns at least $35,568 annually ($684 per week)

- Salaried: The employee is paid on a salary basis

- Job Duties: The employee has job duties that are considered exempt (e.g., executive, administrative, or professional)

Keep in mind that there are other requirements for employees in certain fields, like outside sales or computers, that may have different exemption requirements. Consult the FLSA Fact Sheet for more information.

Overtime rules by state vs. federal overtime law

Although most employers are subject to the FLSA, there are some rare exceptions. The following are covered by the Fair Labor Standards Act:

- Businesses with $500,000 or more in gross annual sales

- Health- or education-oriented businesses

- Businesses formed as an activity of the government

- Enterprises engaged in interstate commerce in any way

Even if you don’t meet any of the first three FLSA provisions, you likely fall under the fourth: Enterprises engaged in interstate commerce. This covers businesses that make phone calls to other states or handle products that are moving between states. For example, if you receive products from out-of-state or produce products heading out-of-state, you’re probably subject to the FLSA.

Some state laws cover employees who aren’t covered under federal law. And, some state laws are stricter, triggering overtime pay if an employee works beyond a certain number of hours in a day.

So, which do you follow? Federal or state law? That answer depends on which law benefits your employees more. Always follow the law that is most beneficial to the employee, not the one most beneficial to your business’s budget.

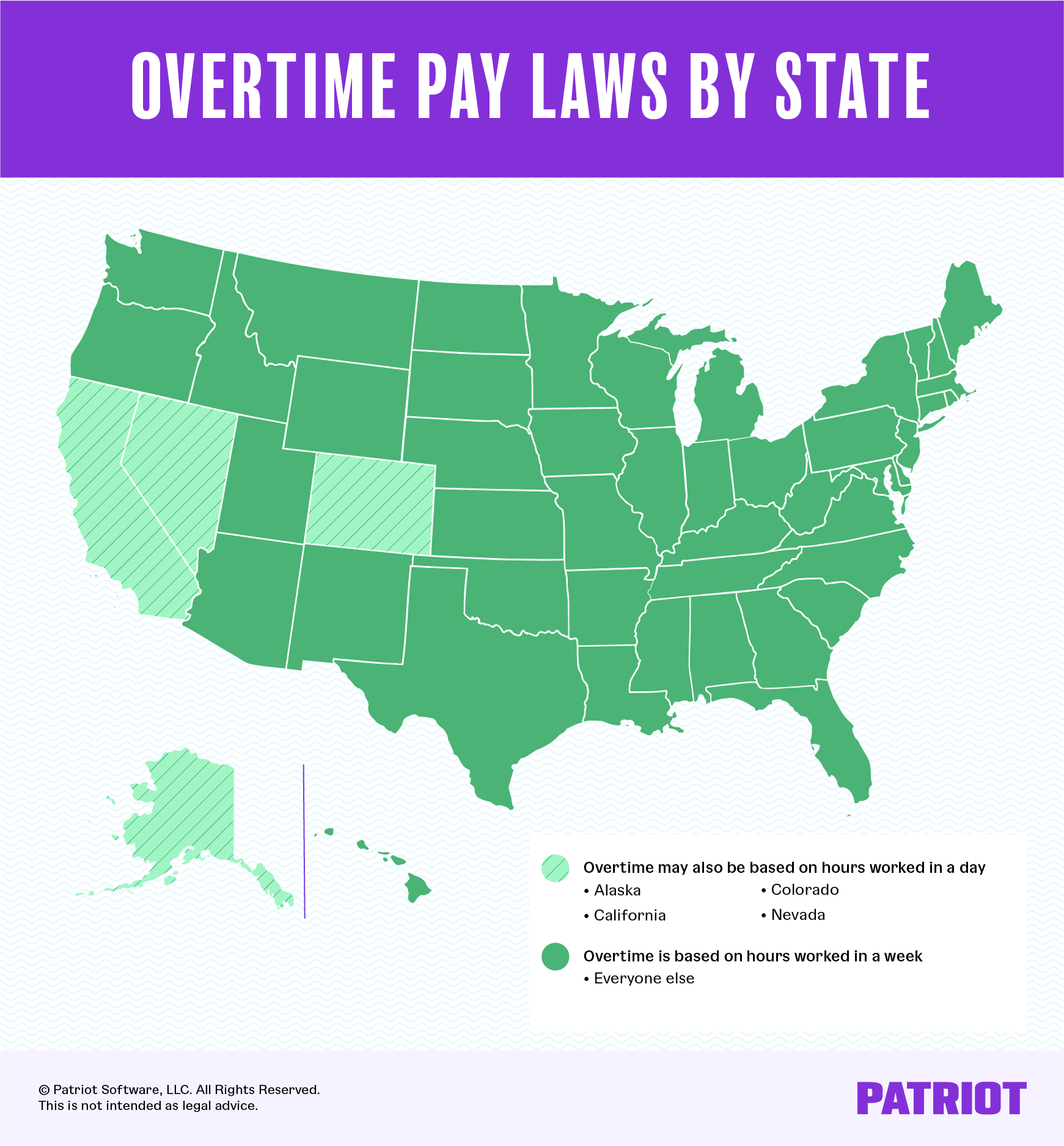

Overtime pay laws by state: Map

The vast majority of states configure overtime pay using a workweek. However, some require overtime pay for hours worked beyond a certain number in a workday.

Use our map to determine which states set strict overtime laws for workdays:

Overtime laws by state

State laws can get intricate. And, not all states have a state-mandated overtime pay law—many states follow the federal law.

Take a look at a brief description of each state’s overtime rules (or lack thereof).

Alabama

Alabama does not have a state law for overtime pay. Instead, follow federal overtime rules.

Alaska

Alaska has a state overtime law.

Under Alaska’s state law, nonexempt employees receive overtime pay if they meet one of the following requirements:

- Work more than 40 hours in a workweek

- Work more than eight hours in a day

However, the state law does not apply to employers who typically employ fewer than four employees. And, there are a number of other exemptions, such as agricultural employees.

Arizona

Arizona does not specify a state overtime pay. Follow federal overtime rules.

Arkansas

Arkansas follows the federal overtime rules that require overtime pay for over 40 hours worked in a workweek.

California

California has a state overtime law.

California’s overtime law requires employers to provide overtime to nonexempt employees for any time worked beyond:

- 40 hours in workweek

- Eight hours in a workday

- Six days in a workweek

Additionally, California has a double-time law. Employers must give employees double their regular pay for any hours worked beyond:

- 12 hours on a workday

- Eight hours on the seventh consecutive day of work in a workweek

Colorado

Colorado has a state overtime law.

Colorado’s overtime law requires employers to provide overtime to nonexempt employees for any time worked beyond:

- 40 hours in a workweek

- 12 hours in a workday

- 12 consecutive hours without regard to the starting and ending time of the workday

Connecticut

Connecticut follows the federal overtime rules that require overtime pay for over 40 hours worked in a workweek.

Delaware

Delaware does not specify a state overtime pay. Follow federal overtime rules.

D.C.

Washington D.C.’s overtime law follows federal requirements.

Florida

Florida does not specify a state overtime pay. Follow the federal overtime law.

Georgia

Georgia follows federal overtime rules.

Hawaii

Hawaii follows federal overtime rules. However, the state does consider hours worked beyond eight in a workday overtime if the work is performed on a State or county public works construction project.

Idaho

Idaho follows federal overtime rules.

Illinois

Illinois follows federal overtime rules.

Indiana

Indiana’s state overtime law aligns with the federal law.

Iowa

Iowa does not specify a state overtime pay. Follow the federal overtime law.

Kansas

Kansas law requires employers to provide overtime to employees for hours worked beyond 46 hours in a workweek. Because the FLSA requires overtime for hours worked beyond 40 hours, follow the federal law.

However, if you are not covered by the FLSA, you must follow Kansas’s overtime rules for nonexempt employees.

Kentucky

Kentucky follows federal overtime rules.

Louisiana

Louisiana does not specify a state overtime policy. Follow federal overtime rules.

Maine

Maine follows the federal law in that it requires overtime for hours worked beyond 40. However, Maine has a different salary threshold than the FLSA’s $35,568. In Maine, employees must be paid beyond $41,401 per year to qualify for the exempt salary threshold.

Maryland

Maryland follows the same overtime rules as federal law. However, some occupations in Maryland calculate overtime using a different period of time than a 7-day workweek.

Massachusetts

The state overtime law in Massachusetts follows federal overtime laws in that it requires overtime for hours worked beyond 40 in a workweek. If you pay employees 1.5 times their pay for work on a Sunday or certain holidays, exclude those hours from the calculation of overtime.

Michigan

Michigan overtime laws are the same as federal regarding the number of hours worked. However, Michigan’s overtime law applies to employers with two or more employees.

Again, between federal and state law, you must follow the one that’s most beneficial to your employees.

Minnesota

Minnesota’s state overtime law requires overtime pay for hours worked beyond 48 in a workweek. Because the federal law is 40 hours, follow the FLSA if you’re covered under it. If the FLSA doesn’t apply to you, follow Minnesota’s overtime law.

Mississippi

Mississippi does not specify a state overtime policy. Follow federal overtime laws.

Missouri

Missouri follows the federal overtime law.

Montana

Montana follows federal overtime rules.

Nebraska

Nebraska follows federal overtime rules.

Nevada

Nevada has an overtime law employers must follow. Nevada’s state overtime law requires that employers pay employees the overtime rate for any hours worked beyond:

- 40 in a workweek

- Eight hours in a 24-hour period if the employee makes less than one and one-half times the minimum wage per hour (unless the employee agreed to work four, 10-hour shifts)

New Hampshire

New Hampshire employers must follow the FLSA.

New Jersey

New Jersey’s state overtime law aligns with federal rules.

New Mexico

New Mexico does not specify a state overtime policy. Follow federal overtime laws.

New York

New York has a state overtime law that lines up with the FLSA’s requirement of offering employees overtime pay for hours worked beyond 40 in a workweek.

However, New York law has an additional requirement. Employees who are exempt from overtime under the FLSA might be covered by the state law.

New York’s state overtime law requires overtime pay at a rate of 1.5 times the state minimum wage for hours worked beyond 40 for these FLSA-exempt individuals.

You can learn more about New York’s overtime law on their state website.

North Carolina

North Carolina’s Wage and Hour Act aligns with the FLSA and requires overtime pay for nonexempt employees who work beyond 40 in a workweek.

North Dakota

North Dakota follows the federal overtime law.

Ohio

Ohio follows federal overtime laws and requires overtime for hours worked beyond 40.

Oklahoma

Oklahoma does not specify a state overtime policy. Follow federal overtime laws.

Oregon

Like federal law, Oregon’s state overtime law requires time and a half for hours worked beyond 40 in a workweek. There are special overtime rules in certain situations, like government agencies and public works projects.

Pennsylvania

Pennsylvania’s state law aligns with the federal law by requiring overtime pay to nonexempt employees who work beyond 40 hours in a workweek.

Rhode Island

Like federal overtime rules, Rhode Island requires overtime for hours worked beyond 40 in a workweek.

South Carolina

South Carolina does not specify a state overtime policy. Follow federal overtime rules.

South Dakota

South Dakota does not have a state overtime law. Follow the FLSA.

Tennessee

Tennessee does not specify a state overtime policy, so follow the FLSA.

Texas

Texas’s state overtime law aligns with federal overtime rules.

Utah

Utah does not specify a state overtime policy. Follow the Fair Labor Standards Act.

Vermont

Vermont’s state overtime law requires overtime pay for employers with two or more employees. However, there are some exceptions to Vermont’s law.

Again, use whichever law (federal or state) is more beneficial to your employees.

Virginia

As of July 1, 2021, the Virginia Overtime Wage Act (VOWA) is in effect. So, how does Virginia’s state overtime law differ from the FLSA?

The law expands the definition of a covered employee, uses a different regular rate of pay calculation, extends the statute of limitations to three years, and may result in more severe damages for employers who fail to pay overtime.

Washington

Washington’s state law aligns with federal overtime rules in that employees are eligible when they work over 40 hours.

Washington law may require double-time pay for “certain public works projects.” And, employers cannot mandate overtime work to registered or licensed practical nurses.

West Virginia

Most employers in West Virginia are subject to the Fair Labor Standards Act.

However, employers must follow West Virginia’s state overtime law if all three of the following are met:

- The business does not qualify for federal “enterprise” coverage

- Eighty percent of the company’s employees do not qualify individually for federal overtime coverage based on work duties considered as interstate commerce activity

- The business has the required six nonexempt employees working in a permanent business location

West Virginia’s state overtime law requires overtime wages to nonexempt employees for any hours worked beyond 40.

Wisconsin

Wisconsin’s state overtime law applies to most employers. Like federal overtime rules, Wisconsin’s state law requires employers to pay nonexempt employees overtime pay for any hours worked beyond 40 in a workweek.

Wyoming

Wyoming enforces the federal overtime law.

With Patriot’s online payroll, it’s easy to record, calculate, and pay your employees’ regular hours and overtime hours. And, use our Time & Attendance software add-on to customize overtime rules to stay compliant with your state overtime laws. Start your free trial of both today!

This article has been updated from its original publication date of July 20, 2020.

This is not intended as legal advice; for more information, please click here.