The end of the year is a busy time for businesses. If you’re like most business owners, you’re probably juggling end-of-year accounting procedures in addition to heavier traffic and sales and payroll tasks.

Instead of scrambling (or forgetting) to get your year-end processes complete, use a year-end accounting checklist to organize the way you wrap up the year.

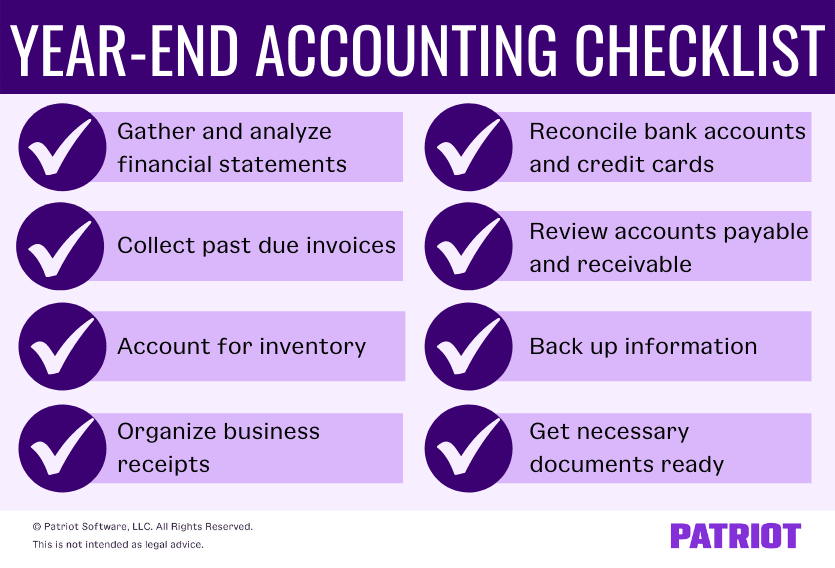

Year-end accounting checklist

Before the clock strikes midnight on December 31, you need to square away several accounting tasks. Your accounting books should be organized, up-to-date, and ready for the transition into a new year.

Make sure you check these eight procedures off your year-end accounting closing checklist before the year officially comes to a close.

1. Gather and analyze financial statements

Your financial statements are a lifeline for your small business. They give you a glimpse of where your business stands financially. And, statements let you see past and current finances so you can forecast your business’s financial future and plan for the new year.

Financial statements help you understand your business’s financial standing and (hopefully) make tax season less of a burden on your company. You can access your financial records in your accounting books.

Use your accounting records to compile and analyze year-end statements. There are a few financial statements that you should have handy, including:

- Income statement

- Cash flow statement

- Balance sheet

Income statement

Your income statement, or profit and loss (P&L) statement, summarizes your revenue and expenses. Your income statement lists all of the money you gained and lost throughout the year.

Here are some things you might see on your P&L statement:

- Revenue

- Tax expenses

- Operating expenses

- Cost of goods sold

- Depreciation

- EBIT/EBITDA

- Other financial costs and gains

You can find your business bottom line by looking at the difference between money gained and lost on your statement. Compare this year’s income statement to last year to analyze the differences in revenue and expenses from year to year.

Cash flow statement

Your cash flow statement lists your business’s incoming and outgoing cash. Cash flow statements only record the actual cash you have, not credit.

Cash flow can be positive, meaning that your business has more incoming money than expenses. Negative cash flow occurs when you spend more money than what you’re bringing in.

Your cash flow statement can show you the timing in which money comes in or goes out of your business. For example, you can see which months have a higher cash flow and the months where your business’s cash flow is struggling.

Tracking your cash flow throughout the year and at year-end can also help you create a cash flow forecast and predict your future cash flow.

Balance sheet

Your business balance sheet shows your assets, liabilities, and equity and tracks your company’s financial progress.

Here’s a snapshot of the different aspects of your balance sheet:

- Assets: What you own

- Liabilities: What you owe

- Equity: Money left over after you pay expenses

Your liabilities and equity should always be the same amount as your assets.

Use your balance sheet at year-end to ensure your accounts balance and everything is in order for the new year. If you find a discrepancy, make sure you find the accounting mistake and fix it.

2. Collect past due invoices

If you want to wrap up your books for year-end, try to collect the money that customers owe to your business. This means putting in a little legwork and trying to collect past due invoices before the new year.

Some customers may just need a gentle nudge with a simple invoice reminder. Others may need some additional nudging. So, what do you do if a customer won’t pay? You can:

- Set up invoice payment terms (e.g., due dates)

- Document the payment process

- Contact customers with past due invoices

- Establish a payment plan with customers

When reaching out to customers about past due invoices, be professional. Be understanding, patient, and positive when you reach out to late-paying customers.

If collecting payments from customers is difficult, consider offering them a payment plan. The customer might not be able to pay their invoice off all at once. Negotiating an installment plan can help you get paid faster. Plus, it shows customers that you understand their situation and care about their needs.

If you really can’t collect the money yourself, consider hiring outside help. Collection agencies can help you collect past due invoices for a price. Generally, the collection agency keeps a portion of the total amount due.

3. Account for inventory

You must get an accurate count of the materials and supplies you have on hand if your business has inventory. Otherwise, you could wind up with empty shelves or inventory shrinkage (e.g., expired goods).

If your business has inventory, complete an inventory check before year-end. Match your inventory totals to your balance sheet. If you find discrepancies between your count and balance sheet, make adjustments.

Accounting for inventory at year-end can also help you know how much you spent on inventory during the year and its value. And, it can help you better plan next year’s inventory, especially for busier seasons.

4. Organize business receipts

Are you still storing your business receipts in a shoebox? If so, you might want to rethink the way you organize business receipts to tidy up for the new year.

Disorganized receipts can put your small business at risk of sloppy and inaccurate books. Not to mention, messy records can increase your chances of making errors on your business tax return and cause more issues in the future.

To get your business receipts organized prior to year-end, you can:

- Sort receipts by type of expense

- Use folders and labels

- Organize receipts chronologically

- Store receipts digitally on your computer or device

To keep your receipts in shipshape year-round, make sure you organize from the get-go. As soon as you get a receipt, organize it using your filing or storage system. That way, you don’t have to worry about misplacing the receipt or forgetting to account for it.

If you use accounting software, you may even be able to attach receipts and documents to transactions to better track them.

5. Reconcile bank accounts and credit cards

A major aspect of your accounting year-end procedures checklist is reconciling your bank accounts and credit cards. That way, you verify that your accounting records match your bank accounts.

To reconcile your accounts, compare your bank and credit card statements to your accounting records. Your statements should match the balance listed in your books. If they don’t match, do a little digging to find the discrepancy. You may need to adjust one of your records for the balances to be equal (e.g., interest amounts).

6. Review accounts payable and receivable

Prior to year-end, review both your accounts receivable and accounts payable to ensure you settle all collections and debts.

In accounts receivable, check for past due invoices. If a customer has any late or unpaid invoices, contact them as soon as possible (e.g., email, phone call, etc.).

Look at your accounts receivable aging report to see if you have any late or unpaid bills before year-end. Follow up with vendors and pay off bills to start off the new year with a clean slate.

7. Back up information

To ensure you securely save your accounting data for the new year, add backing up information to your year-end closing checklist.

The last thing you want to do is lose important accounting information from this year and previous years. To ensure your data is safe, have a reliable backup system in place.

You could back up accounting information on your computer or smartphone or print off documents (e.g., financial statements) and store them in a secure spot. If you use online accounting, you can rest easy knowing that your information is secure in the cloud.

Whatever you decide to do, make sure you have a plan in place to back up those precious accounting records for your business.

8. Get necessary documents ready for your accountant, if applicable

If you use an accountant in some shape or form for your business (e.g., accounting software in conjunction with a tax professional), you need to get documents ready to go for your accountant before year-end.

Although it depends on what your accountant is handling for you, here is some information you may need to gather:

- Financial statements

- Bank and credit card statements

- Petty cash records

- Invoices and receipts

- Sales records

- Payroll records

- Loan information

If you use software, you should be able to easily grab the necessary documents for your accountant.

Check with your accountant to see what information they need from you to close your books at year-end and prepare for the upcoming year and tax season.

This article has been updated from its original publication date of December 6, 2016.

This is not intended as legal advice; for more information, please click here.