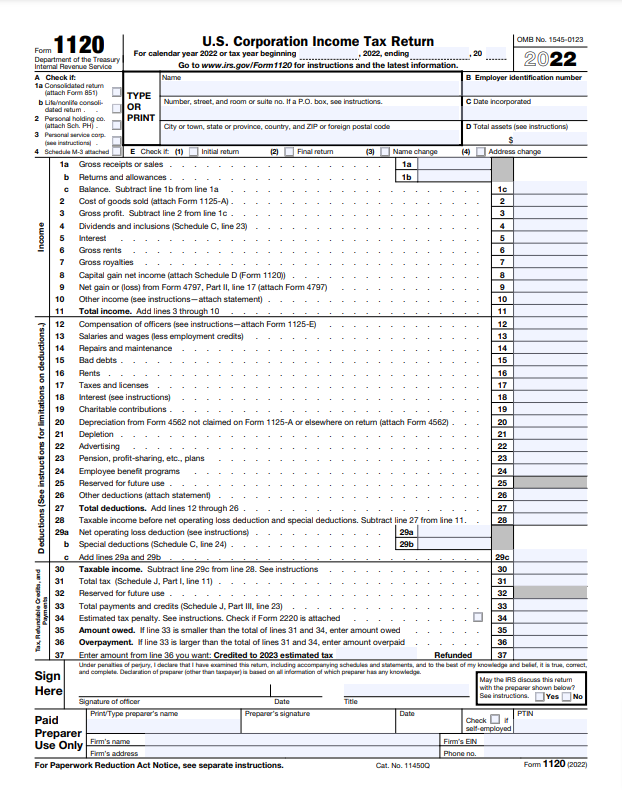

Structuring your business as a corporation comes with benefits like limited liability and increased access to capital. It also comes with its own unique small business tax return—Form 1120. Do you know how to fill out Form 1120?

Read on to learn:

- What is Form 1120?

- How to fill out Form 1120

- Tips to simplify your responsibilities

What is Form 1120?

Corporations use Form 1120, U.S. Corporate Income Tax Return, to report income, gains, losses, deductions, and credits and determine income tax liability. All domestic corporations, regardless of if they have taxable income or not, must file Form 1120 (unless you have tax-exempt status).

If your business isn’t structured as a corporation or as an LLC filing as a corporation, do not use Form 1120. Instead, you must use the tax return for your business structure. For example, S corporations use Form 1120-S, sole proprietors use Schedule C, and partnerships use Form 1065.

How to fill out Form 1120

Ready to learn how to fill out 1120 tax form? Take a look at the following steps to get started learning how to fill out 1120s.

1. Gather Form 1120 information

Before you can fill out the six-page-long form, you need to gather some information about your corporation.

Gather your business and financial information beforehand so you’re ready to fill out Form 1120, including:

- Employer Identification Number (EIN)

- Date you incorporated

- Total assets

- Gross receipts and sales

- Cost of goods sold (COGS)

- Tax deductions

- Tax credits

- Capital gains

- Dividend, interest, and royalties earned

- Liabilities

- Shareholder equity

You can find Form 1120 information on your financial statements and in your records. If you can’t find your EIN, look through past tax returns.

2. Fill out business information

To kick off Form 1120, you need to enter some information about your corporation, including your:

- Name

- Address

- Employer Identification Number

- Data incorporated

- Total assets

You must also notify the IRS if it’s your first or final return or if you’ve had a name or address change.

3. Fill out the rest of page 1

Form 1120—excluding Schedules C, J, K, L, M-1, and M-2—is relatively short. The first part of the form is one page and ends with your signature. But to fill it out, you must use some of the schedules.

Let’s dive into the different sections on page 1.

Income

The first part of Form 1120 asks for all income-related information. Keep in mind that gross income does not include income from certain shipping activities if your corporation elected to be taxed on its notional shipping income.

Line 1a

Here, you record your corporation’s gross receipts or sales. Include gross receipts or sales from all business operations.

However, do not include dividends and inclusions, interest, gross rents, gross royalties, capital gain, net gain, and other income. These go on separate lines (below).

Line 1b

On Line 1b, record returns and allowances. This includes cash and credit refunds your business made to customers for:

- Returned merchandise

- Rebates

- Other allowances made on gross receipts or sales

Line 1c

Subtract line 1b from line 1a to find what you need to record for line 1c. This is the balance between your gross receipts or sales and returns and allowances.

Line 2

Record your cost of goods sold (COGS). Your cost of goods sold is how much it costs to produce your corporation’s products or services.

Also, attach Form 1125-A, Cost of Goods Sold. Line 2 of Form 1120 should be the same as Form 1125-A, line 8.

Line 3

To find line 3, subtract line 2 from line 1c. This is your corporation’s gross profit. Gross profit is the difference between revenue and cost of goods sold.

Line 4

Line 4 asks for your corporation’s dividends and inclusions. To fill out line 4, you must complete Schedule C (Dividends, Inclusions, and Special Deductions) which begins on page 2 of 1120.

Record the total dividends and inclusions from line 23 column a of Schedule C here.

Line 5

Did you accrue taxable interest? Enter your total interest here. Include taxable interest from:

- Loans

- Notes

- Mortgages

- Bonds

- Bank

- Deposits

- Corporate bonds

- Tax refunds

Report any tax-exempt interest received or accrued on Schedule K, line 9.

Line 6

Did you rent any property? Enter your gross rents here. You can deduct costs for repairs, interest, taxes, and depreciation on the appropriate lines.

Line 7

Record any gross royalties on line 7.

Line 8

Here, record your capital gain net income. Also, attach Schedule D (Form 1120).

Line 9

Record your corporation’s net gain or loss. You can find this on Form 4797, Sales of Business Property, Part II, line 17. Also, attach Form 4797.

Line 10

Enter your corporation’s other income here. This includes any other taxable income you do not report on lines 1 through 9, such as recoveries of bad debt deducted in prior years under the specific charge-off method.

Attach a statement listing the type and amount of income.

Line 11

Add together lines 3 through 10 and record your total income on line 11.

Deductions

The next section of Form 1120 is where you record your corporation’s deductions. Keep in mind that there are deduction limitations, such as:

- Limitations on business interest expense

- Passive activity limitations

- Limitations on deductions related to property leased to tax-exempt entities

Consult IRS Form 1120 Instructions for more information on deduction limitations.

Line 12

Record the compensation of officers on line 12. Do not include their compensation deductible on other parts of the return.

You may also need to give a detailed report of the deduction for compensation of officers. Complete and attach Form 1125-E, Compensation of Officers, if your total receipts are $500,000 or more.

Line 13

Here, record the total salaries and wages you paid during the year, minus employment credits.

Do not include salaries and wages you can deduct on other areas of the return (e.g., officers’ compensation, cost of goods sold, etc.).

If you provide taxable fringe benefits to your employees, don’t deduct the amount allocated for depreciation and other expenses you claim on lines 20 and 26.

Line 14

Record deductible repairs and maintenance you didn’t claim anywhere else on Form 1120 here.

Line 15

Enter your corporation’s total bad debts (aka debts that became worthless) here.

Line 16

Did you rent or lease a vehicle? Enter the total annual rent or lease expense paid or incurred here.

Line 17

Enter the total amount of taxes you paid or accrued during the year, excluding certain taxes like federal income taxes and taxes not imposed on your corporation.

Line 18

Record interest on line 18. Do not deduct certain interest, like prepaid interest allocable to later years if you use cash-basis accounting.

See IRS instructions for special rules, non-deductible interest, and deduction limitations.

Line 19

Did you make charitable contributions during the tax year? Record qualifying contributions or gifts paid on line 19.

Line 20

On line 20, record depreciation and the cost of certain property you elected to expense under section 179 from Form 4562, Depreciation and Amortization. Only record depreciation not claimed on Form 1125-A or anywhere else on Form 1120.

Attach Form 4562.

Line 21

Record depletion on line 21, if applicable.

Line 22

Record any deductible advertising expenses on line 22.

Line 23

Enter the deduction amount for contributions you made to qualified pension, profit-sharing, or other funded deferred compensation plans.

Keep in mind that you must also file an additional return to report employee benefit plans (e.g., Form 5500, Annual Return/Report of Employee Benefit Plan).

Line 24

Report your contributions to employee benefit programs that are not an incidental part of a pension, profit-sharing, or similar plan. Only enter the amount that you don’t claim anywhere else on Form 1120.

Line 25

This line is currently reserved for future use.

Line 26

Enter any other deductions you did not deduct elsewhere on line 26. Examples include amortization, certain business startup and organizational costs, and legal and professional fees.

Attach a statement listing the type and amount of allowable deduction.

Line 27

Add together lines 12 through 26 and enter your total deductions here.

Line 28

Subtract line 27 from line 11 to get your taxable income before net operating loss deduction and special deductions.

Line 29a

Record your total net operating loss carryovers from other tax years on line 29a. You can use your net operating loss incurred in one tax year to reduce your taxable income in another tax year.

You must also attach a statement showing your net operating loss deduction computation. And, complete Schedule K, line 12.

Line 29b

Enter any special deductions from Schedule C, line 24 here.

Line 29c

And last but not least, add together lines 29a and 29b to get 29c.

Tax, refundable credits, and payments

This section of Form 1120 is where you record total taxes, credits, and the amount you owe or are owed from the IRS.

Line 30

Here, record your corporation’s total taxable income. To find this, subtract line 29c from line 28.

Line 31

Enter your corporation’s total tax. You can find this on Schedule J, part I, line 11.

Line 32

This line is currently reserved for future use.

Line 33

Here, record your total payments and credits. You can find this on Schedule J, part III, line 23.

Line 34

Enter your estimated tax penalty.

Check the box if you are also attaching Form 2220, Underpayment of Estimated Tax By Corporations.

You must attach Form 2220 if one of the following is true:

- You use the annualized income or adjusted method

- Your corporation is a large corporation computing its first required installment based on the previous year’s tax

Line 35

Add together lines 31 and 34. Is line 33 smaller than that sum? If so, enter the total amount you owe here.

Line 36

Add together lines 31 and 34. Is line 33 larger than that sum? If so, enter the total amount you overpaid here.

Line 37

If you did overpay, enter the amount that you want to be refunded or applied to next year’s estimated tax here.

Signature

One of the last parts of filling out Form 1120 is the signature. But, only qualifying people can sign the form.

The following people can sign and date Form 1120:

- President

- Vice president

- Treasurer

- Assistant treasurer

- Chief accounting officer

- Any other corporate officer (e.g., tax officer) authorized to sign

Authorized signers must sign in the box next to “Sign Here,” add a date, and print their job titles. Also, check “Yes” or “No” in the box asking if the IRS may discuss the return with the preparer shown below. Checking “Yes” authorizes the IRS to call the paid preparer to answer questions about the return.

Paid preparer

The paid preparer section of Form 1120 is only for individuals you pay to prepare the return. This does not include employees or anyone else who prepares the return and doesn’t charge.

If you hire a paid preparer, they need to fill out the “Paid Preparer Use Only” section and include like their:

- Name

- Signature

- Date

- Preparer Tax Identification Number (PTIN)

- Firm’s name, address, and EIN

- Phone number

4. Fill out Form 1120 schedules

There are several schedules that make up the rest of Form 1120:

- C, Dividends, Inclusions, and Special Deductions

- J, Tax Computation and Payment

- K, Other Information

- L, Balance Sheets per Books

- M-1, Reconciliation of Income (Loss) per Books With Income per Return

- M-2, Analysis of Unappropriated Retained Earnings per Books (Schedule L, Line 25)

For more information on filling out these schedules, see the IRS Instructions for Form 1120.

5. Submit the form

Form 1120’s due date is based on your corporation’s year-end date.

In most cases, Form 1120 is due on the 15th day of the fourth month after the end of your business financial year. So if you had a year-end date of December 31, your Form 1120 due date would be April 15.

But if your fiscal year ends on June 30, Form 1120 is due by the 15th day of the third month (i.e., September 15).

Mail or e-file Form 1120 to the IRS. You can view mailing addresses on the IRS website. You must e-file Form 1120 if you have $10 million or more in assets and file at least 250 returns per year.

Before you submit Form 1120, be sure to attach any additional schedules, such as Schedule D, Capital Gains and Losses.

Tips to simplify your responsibilities

Filling out Form 1120 can become an all-day or all-week event (at least!). But it doesn’t have to be.

One of the most time-consuming parts of filling out the tax form is gathering documents, including your financial statements and receipts. The other is interpreting what your documents are telling you.

Now that you know how to fill out Form 1120, simplify the process by:

- Using accounting software: Track income and expenses with online accounting software, not spreadsheets and shoeboxes. Keep your records in one accessible location. And, generate key financial statements, like your balance sheet, to make filling out Form 1120 a breeze.

- Working with an accountant: Confused by what exactly your records are telling you? An accounting professional can help. Accountants can notify you of filing deadlines, find tax credits and deductions, and help you understand your records.

Make tax time a breeze with Patriot’s accounting software for small business. Record and track the money going in and out of your business and generate key accounting reports in just a few clicks. Get started with a free trial today!