A profit and loss statement is one of the most important tools you have in your business to determine profitability. Do you know how to create a profit and loss statement?

If not, read on to learn everything you need to know to create a profit and loss statement for your business. And, find out how to save precious time by using accounting software to generate the statement in just a few clicks.

Skip Ahead

- What is a profit and loss statement?

- What information do I need to generate a P&L?

- How do businesses use P&L statements?

- How to create a profit and loss statement

- Tips on how to generate profit and loss statement

- How to generate profit and loss statement with accounting software

- Generate P&L statements with Patriot’s accounting software

- FAQs

- What’s the best way to create a P&L statement?

What is a profit and loss statement?

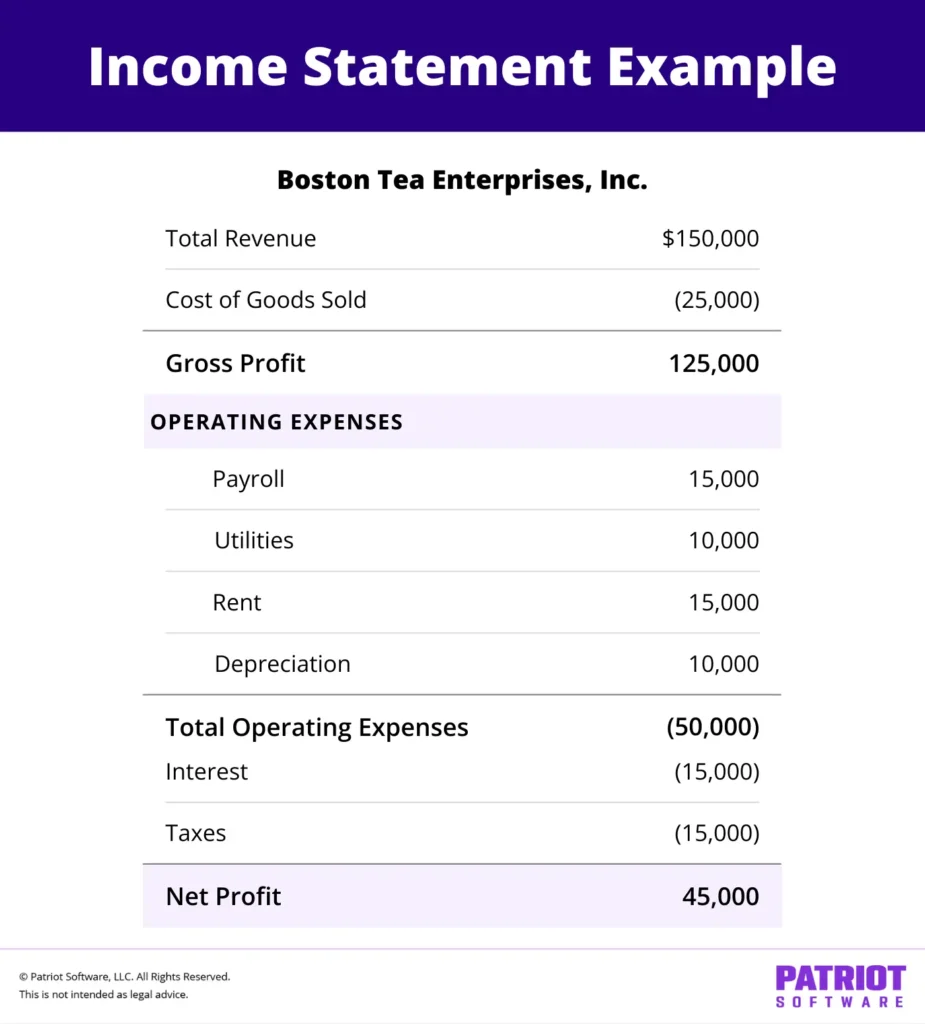

A profit and loss (P&L), or income, statement summarizes your revenue and expenses over a specific timeframe. The P&L statement shows how much your business made or lost during a month, quarter, or year.

The bottom line of your profit and loss statement shows whether you have a net profit (gaining money) or net loss (losing money).

A P&L is one of the three main financial statements businesses use to measure profitability, make decisions, and obtain financing. The other two financial statements are the balance sheet and cash flow statement.

What information do I need to generate a P&L?

There are three main pieces of financial information you need during a period to generate your profit and loss statement:

- Revenue

- Cost of goods sold (COGS)

- Expenses

Revenue: Gather your total revenue during the period, including sales from products or services and other income (e.g., royalties).

COGS: Your cost of goods sold is the cost of producing your products or services. It includes direct costs like raw materials and direct labor costs.

Expenses: Gather your operating expenses, taxes, interest, and other expenses for your P&L statement. These will be separated. Operating expenses include rent, utilities, and insurance premiums.

| Information to Generate P&L | Examples |

|---|---|

| Revenue | Product or service sales |

| COGS | Raw materials, direct labor |

| Operating Expenses | Rent, utilities, insurance premiums |

| Taxes | Income taxes |

| Other Income and Expenses | Interest expenses, investment income |

How do businesses use P&L statements?

Business owners use income statements for decision-making, obtaining small business financing, and more. Your P&L statement might just become your best friend.

Not sure if creating a P&L is worth your time? (Trust us, it is!). Here are some ways to use your statement:

- Evaluate financial performance: Use your statement to determine if your business is making or losing money. You can also see how it’s doing over time.

- Make informed decisions: You need to know your company’s expense and revenue information for better budgeting so you avoid overspending.

- Prepare for tax time: Use your income statement to prepare your small business tax return.

- Obtain loans or investments: Banks and investors want to see profit and loss statements before giving money.

How to create a profit and loss statement

The following steps are for you if you’re wondering How do I create a profit and loss statement?

How to create a profit and loss statement

- Gather financial information

Look through your invoices, credit card statements, and bank account transactions to find your revenue and expense information for the period (e.g., month).

- Calculate revenue

Add your total revenue (i.e., product sales, subscription income, etc.) during the period and list it at the top of your statement.

- Calculate your COGS

Identify all the direct costs (e.g., raw materials, direct labor) of producing your products or providing services and list them below your revenue.

- Calculate your gross profit

Find your gross profit by subtracting your COGS from your total revenue.

The gross profit formula is Gross Profit = Revenue – COGS. - Calculate your operating expenses

Calculate your operating expenses (e.g., rent, utilities) during the period and list the total amount below your gross profit.

- Calculate your taxes

Calculate and list your taxes on net income under your operating expenses.

- Determine any other income and expenses

Include any other income (e.g., investment gains) and expenses (e.g., loan interest) on your P&L statement.

- Find your net income

Determine your profit or loss by subtracting expenses, taxes, and other expenses from your gross profit and adding other income.

The net profit formula is Net Profit = Total Revenue – Total Expenses.

Tips on how to generate profit and loss statement

A profit and loss statement is essential no matter what size your business. You want your statement to be up-to-date and accurate. You don’t want it to take your hours, days, or weeks to generate.

Here are some tips to help you create an accurate and useful P&L statement:

- Keep accurate records: Your income statement is only as accurate as the information (e.g., revenue, expenses) you gather to create it.

- Use accounting software: Streamline data entry and optimize efficiency by using software to generate your statement.

- Reconcile bank statements: Bank statement reconciliation compares your accounting records and bank records to ensure accuracy. Do this before creating your statement.

- Review with your accountant: Review your records and finalized statements with your accountant. They can help spot errors and interpret what your statement shows.

How to generate profit and loss statement with accounting software

You can streamline creating a profit and loss statement with templates, spreadsheets, or accounting software. Accounting software is the fastest and most automated method.

When you use accounting software, the system automatically creates your P&L statement for the period using the transaction information you’ve entered.

Use the following steps to generate P&L statements with accounting software:

- Choose your accounting software

- Enter all transactions into your accounting software

- Run the profit and loss statement

- Download as a PDF or spreadsheet

1. Choose your accounting software

Major accounting software providers, like Patriot Software, have a built-in profit and loss report.

If you’re not already using accounting software, shop for a reliable system with P&L statements and other key financial reports (e.g., balance sheet).

Compare features, pricing, customer support, and usability to help you find the best system for your business.

2. Enter all transactions into your accounting software

Once you have your account set up, you can start recording all your transactions in the system. This includes your revenue and expenses.

Features like automatic bank imports and account reconciliation help streamline the recordkeeping process and ensure your books are accurate and up-to-date.

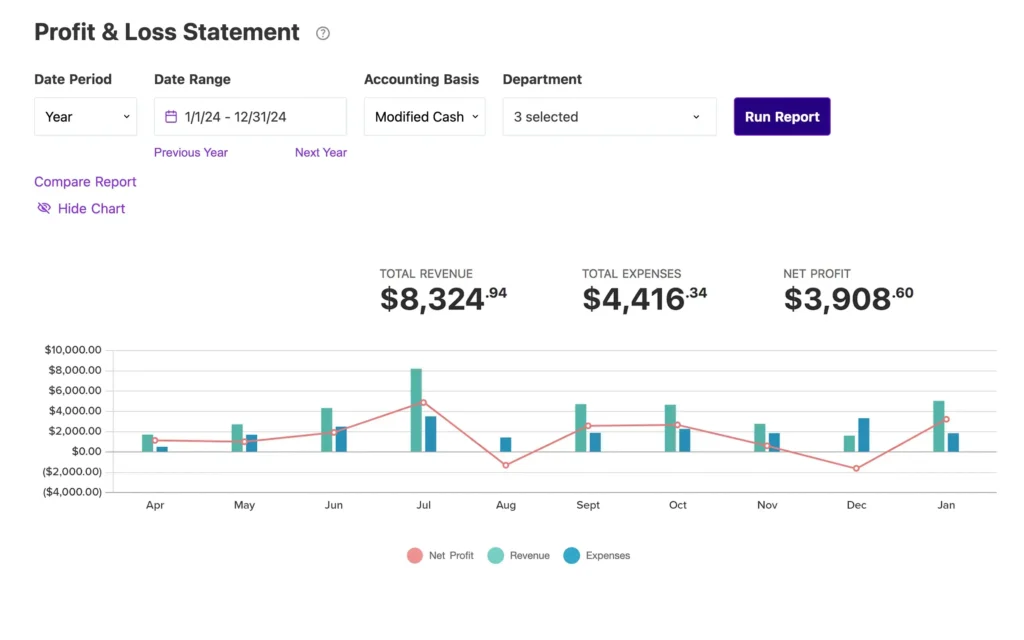

3. Run the profit and loss statement

Before running your report, verify that your accounting records are up-to-date. Typically, you can find your profit and loss (income) statement in your software’s “reports” section.

You can customize your P&L statement. You may be able to:

- Select your date period (e.g., quarter)

- Select your date range (e.g., 1/1/24 – 12/31/2024)

- Choose your accounting basis (e.g., cash basis, modified cash, or accrual accounting)

- Filter by department(s)

When you’re ready, run the report by clicking a button on the page (e.g., “Run Report”).

4. Download as a PDF or spreadsheet

After the system generates the report, you can analyze the results in your software.

You should also be able to download a PDF or spreadsheet to share with your accountant, bank, or potential investor.

Generate P&L statements with Patriot’s accounting software

Patriot’s online accounting for small business streamlines the process of creating the all-important profit and loss statement.

With Patriot’s accounting software, you can:

- Track your income and expenses

- Take advantage of automatic bank imports

- Reconcile your accounts

- Automatically generate P&L statements and other financial reports

- Give your accountant access to your account

Example of a P&L statement in Patriot’s accounting software.

FAQs

Yes! Create your P&L statement using your business records. You can use accounting software to automatically generate a P&L statement. Or, you can use templates or spreadsheets.

You can create a P&L statement if you know your company’s revenue, COGS, operating expenses, taxes, and other income and expenses during a time frame (e.g., quarter).

The fastest and most organized way to track profit and loss is to use accounting software.

Revenue, expenses, and net income or loss are the three main categories of the P&L statement.

Yes, you can create financial statements using accounting software, templates, or spreadsheets.

A P&L statement template is a fillable document that’s already formatted. Gather and enter your revenue and expense information to use it.

You can find the P&L statement by going to Reports > Accounting > Financial Reports > Profit & Loss Statement.

Patriot’s accounting software will generate the statement by pulling all of the income and expense information you’ve entered into your account.

What’s the best way to create a P&L statement?

How to create a P&L depends on your preference. You can use a template, spreadsheet, or software to create the financial statement.

Accounting software makes generating a profit and loss statement fast, repeatable, and sustainable. It automatically creates the statement based on your transaction history and makes sharing the report with your accountant a breeze.

By automating the P&L statement creation process, you can keep a close eye on your financial health while saving precious time.

This is not intended as legal advice; for more information, please click here.