One of the four main financial statements you have to keep track of as a business owner is your balance sheet. Your balance sheet gives you insight into where your business stands financially. But, you won’t get an accurate picture of your company’s finances if you don’t keep up with balance sheet reconciliation.

Read on to learn more about reconciling your balance sheet, including what steps you should take to reconcile your balance sheet and why it’s important to have a reconciliation process.

What is balance sheet reconciliation?

As a brief recap, your balance sheet keeps track of your company’s financial progress. It includes your assets (what you own), liabilities (what you owe), and equity (amount left over after you pay expenses).

On your balance sheet, your total assets must equal your total liabilities and equity. If they don’t balance, track down the discrepancy.

Balance sheet reconciliation is the process of ensuring your balance sheet information is accurate. The balance sheet reconciliation process includes cross-checking balances and entries with documentation (e.g., bank statements).

Reconciling your balance sheet lets you verify that all of your entries are recorded and classified correctly. If you don’t reconcile your balance sheet, you run the risk of having inaccurate balances on your sheet.

For most businesses, it’s best practice to reconcile your balance sheet every month. Having monthly balance sheet reconciliations keeps your balance sheet accurate and free of errors.

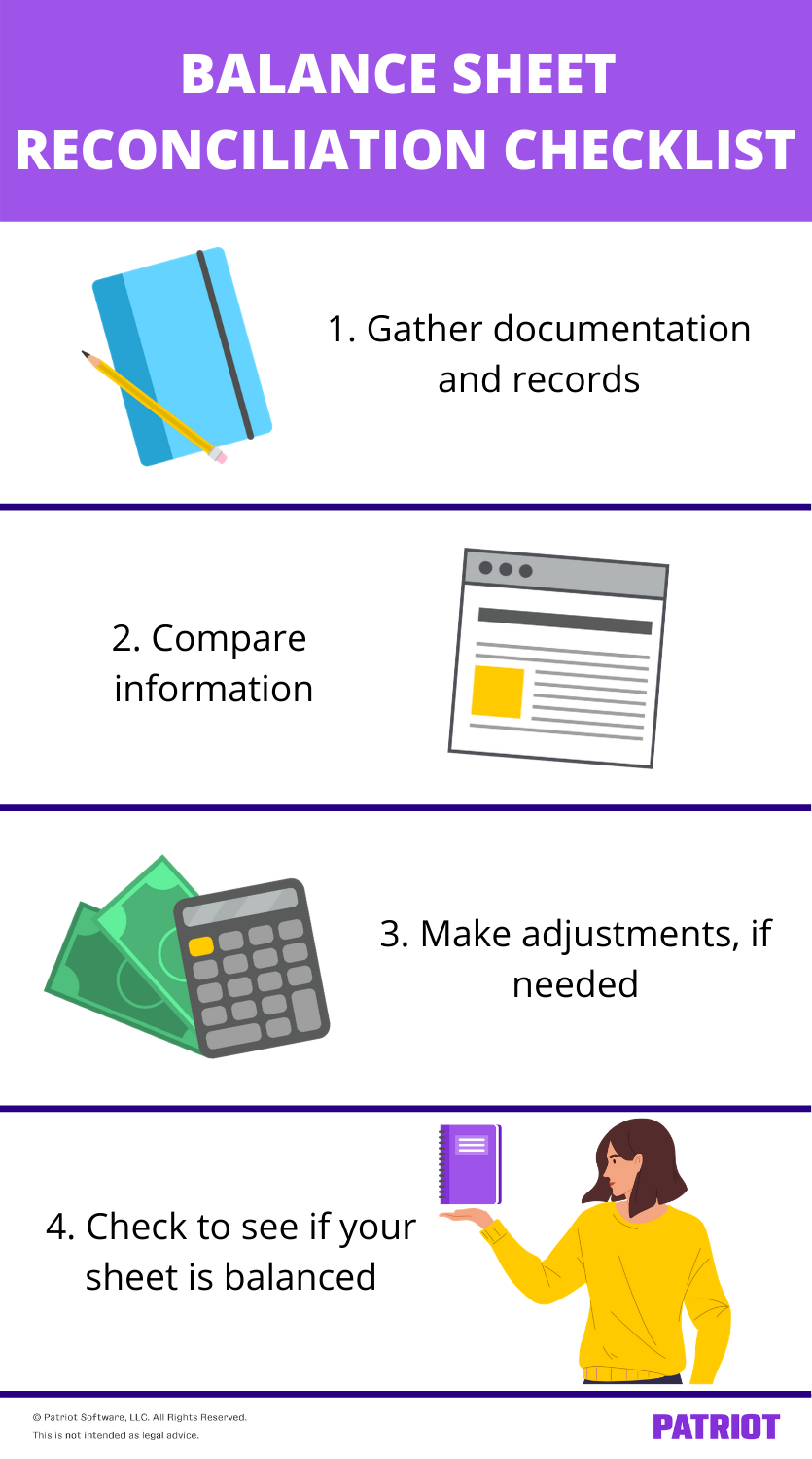

Balance sheet reconciliation checklist: 4 steps

When reconciling balance sheet accounts, look at things like your business’s current and fixed assets, current and noncurrent liabilities, and owner’s equity. And, you’ll have to gather information to make comparisons and catch errors.

Balance sheet account reconciliation is a pretty straightforward process. However, it may be confusing if it’s your first time around. To make sure your reconciliation process goes smoothly, follow the checklist below.

1. Gather documentation and records

Before you can look over your balance sheet and reconcile it, gather the proper documentation. Pull information for the current period (e.g., from the past month). This includes things like:

- Bank statements

- Receipts

- Current account balances

- Other accounting and financial records

After you have all of the records you need from the period, you can move on to the next step.

2. Compare information

When cross-checking information on your balance sheet with financial documentation, be on the lookout for discrepancies. This includes things like misclassified transactions (e.g., asset instead of liability), transposition errors, and missing information. If you catch an error on your balance sheet, take note of it.

In addition to making sure your documentation and balance sheet information line up, you want to make sure your ending balances match your general ledger. If your ledger and balance sheet totals don’t match up, track down the inconsistency using your records.

3. Make adjustments, if needed

If you wind up finding any discrepancies while comparing your documentation to your balance sheet, make the necessary adjustments.

Depending on the error(s), you may need to:

- Add a new transaction

- Adjust entries

- Change the transaction classification

After you make adjustments, consider comparing your records to your balance sheet a second (or even a third) time to ensure the mistakes were fixed and that your balance sheet is accurate.

4. Check to see if your sheet is balanced

As you know, your balance sheet consists of your business’s assets, liabilities, and equity. For your balance sheet to balance, your total assets must equal your total liabilities and total equity. This is also known as the accounting equation:

Assets = Liabilities + Equity

To make sure your balance sheet is free of any discrepancies, do a final check to verify that your total liabilities and equity equal your total assets. If they don’t, you know the drill (aka follow the previous steps to find errors).

Compare your ending balances to your general ledger one more time to make sure your balance sheet is completely reconciled.

Importance of balance sheet reconciliations

In general, reconciling your accounts is crucial to help avoid accounting mistakes and inaccurate account information. Balance sheet reconciliations can help you:

- Pinpoint fraudulent activity

- Prevent errors

- Highlight positive and negative financial activity

- Keep transactions in shipshape

- Catch discrepancies

To catch any balance sheet errors early on and prevent future blunders, reconcile your balance sheet monthly. Keep in mind that, depending on your business, you may need to reconcile weekly, semi-quarterly, or quarterly instead.

Looking for an easy way to track your business’s transactions? Patriot’s accounting software lets you streamline your books and get back to business. Try it for free today!

Like what you read? Let’s connect, friend! Like us on Facebook and let’s get talking.

This is not intended as legal advice; for more information, please click here.