As a business owner, you must track the money going in and out of your company to keep your finances on track. One way you can do this is by monitoring your profit and loss statement for small business.

Read on to learn how a profit and loss statement can benefit your business and how to create one of your own.

What is a profit and loss statement for small business?

A profit and loss, P&L, or income statement shows your business’s revenue, expenses, costs, and net income over a specific period of time. You can generate a statement for any time period, but the most common time frames include monthly, quarterly, or annually.

Business owners can use P&L statements to determine whether they need to improve their bottom line by increasing revenue or cutting costs.

To make your profit and loss statement, you must gather some information. You will need your business’s:

- Total income

- Cost of goods sold (COGS)

- Total expenses

How to create a profit and loss statement

A typical profit and loss statement has four core sections:

- Income

- Expenses

- Cost of goods sold

- Net income

The above sections should be lines on your profit and loss statement.

When you create your statement, start with your income/revenue. Then, work your way down and subtract expenses.

Income

Income, or revenue, includes your business’s total sales. It also includes money you receive from selling things like equipment or receiving a tax refund.

Income is the first item you must list on your P&L statement. It should be a positive number and include any money you earned from sales.

Cost of goods sold

Your COGS is how much it costs to produce your goods or services. Your cost of goods sold includes direct material and direct labor expenses. To calculate your COGS, add your beginning inventory and purchases during the accounting period together. Then, subtract your ending inventory from your total.

Subtract your cost of goods sold from your revenue when you create your P&L statement to get your gross profit.

Expenses

Business expenses are costs you incur during day-to-day business operations, like insurance, marketing costs, and equipment.

Your expenses likely include operating expenses (OPEX). Operating expenses include things like salaries, rent, and utilities. These expenses keep your business going, but do not produce sales.

Subtract your expenses from your income to build your profit and loss statement.

Net income

Net income, or net profit, is the bottom line of your profit and loss statement. Net income is what is left after you subtract all of your expenses from your income.

Hopefully, you’ll see a net profit at the bottom of your profit and loss statement. If you have a net profit, your business is earning more than it spends. If your expenses outweigh your revenue, you will have a net loss.

Other items on your profit and loss statement

In addition to the five main sections above, your business might also need to report other items on your P&L statement. Depending on your industry, you might need to include other items like:

- Depreciation

- Financial costs/gains

- Extraordinary costs/gains

- EBIT/EBITDA

Keep in mind that the items reported on a profit and loss statement vary from business to business.

Depreciation

When you buy certain items, like equipment or a vehicle, the asset loses its value (depreciates) over time. Depreciation can be a significant number that impacts your business’ worth.

Depreciation is typically lumped together with COGS on your profit and loss statement.

Financial costs/gains

Financial costs and gains represent changes in your debts or investments. This line can either be positive or negative and shows you either have accrued interest in money you owe or have earned interest from your investments.

Extraordinary costs/gains

Extraordinary costs and gains generally refer to one-time impacts on your business. For example, say you sold a large, depreciated asset. That transaction is considered to be an extraordinary gain. Or, say you make a large, one-time purchase. That large purchase is an extraordinary cost.

EBIT/EBITDA

EBIT (Earnings Before Interest and Taxes) measures how profitable your business is over time. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) shows your company’s operating performance.

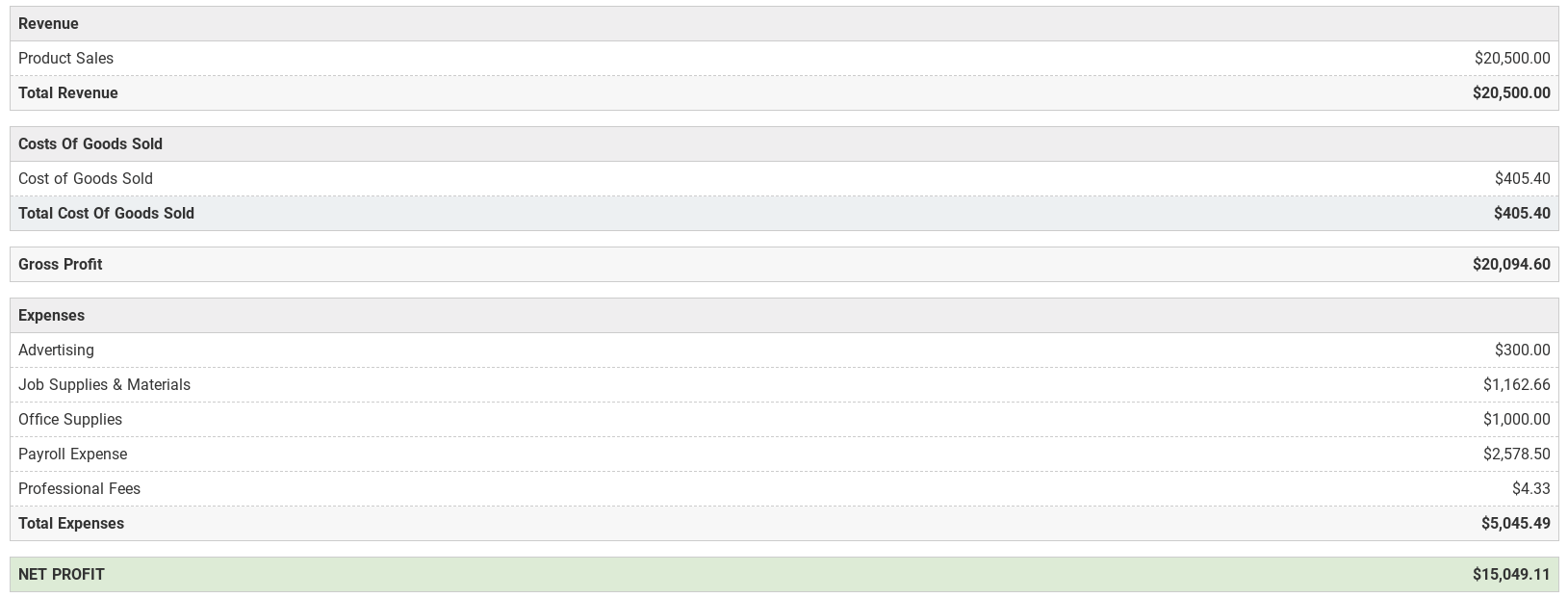

Profit and loss statement example

Again, profit and loss statements vary depending on the business. Check out what your profit and loss statement might look like below:

What’s not included on a profit and loss statement?

There are a plethora of things you can include on your profit and loss statement. However, there are also some that you can’t include on your statement.

So, what don’t you include in your profit and loss statement?

Your profit and loss statement only shows your income, expenses, and costs. You don’t report your business’s assets, liabilities, and equity on your profit and loss sheet. As a brief recap, let’s go over what assets, liabilities, and equity include.

Assets include the physical and non-physical properties that add value to your business, such as inventory or trademarks.

Liabilities are existing debts that you owe to another business, organization, vendor, employee, or agency (e.g., loans).

Equity shows how much your business is worth and is the difference between your assets and liabilities.

Updating your profit and loss statement

At this point, you might be wondering, How frequently should I update my profit and loss statement? Great question.

How frequently you update your profit and loss statement ultimately comes down to your preference. However, certain factors can impact how often you update your P&L statement. For example, factors like your business’s sales, expenses, or working capital can affect when you update your statement.

You know your business inside and out. And, you know what factors impact your profit and loss statement. Determine how frequently you’re going to update your statement. If something at your company changes, make adjustments to your frequency (e.g., monthly to quarterly).

When you review your P&L statement, be on the lookout for signs that your business is on the right track. And, watch out for warnings that you might need to make some changes.

Importance of profit and loss statement for small business

Profit and loss statements play an important role in your business. They give you the opportunity to review your net income and can help you make important financial decisions.

Profit and loss statements can help you:

- Create other business financial statements

- Show shareholders where your business stands financially

- Give you insight into your business’s net earnings (e.g., positive or negative)

You can compare and contrast your recent and past profit and loss statements to get a clear picture of your company’s financial standings. Regularly referencing your statements can help you stay on top of your finances and ensure you are on the right path for the future.

Searching for an easy way to track your business’s finances? Patriot’s accounting software lets you streamline your books and get back to your business. Try it for free today!

Have questions, comments, or concerns about this post? Like us on Facebook, and let’s get talking!

This article has been updated from its original publication date of July 16, 2014.

This is not intended as legal advice; for more information, please click here.