Incoming revenue is vital to business growth, but it doesn’t paint the most accurate financial picture of your business. You must know whether your company is profiting after deducting business expenses. You need to determine your business’s net income.

Calculating your business’s net income helps you determine your business’s profitability, decide whether to expand or reduce operations, plan budgets, and relay information to investors.

Learn what net income is, how to calculate net income, and which financial statement to record your company’s net income on.

What is net income?

Net income is your company’s total profits after deducting business expenses. You might hear net income referred to as net earnings, net profit, or your company’s bottom line.

Net income can be either positive or negative. If you have more revenues than expenses, you will have a positive net income. If your expenses outweigh your revenues, you will have a negative net income, which is known as a net loss.

Types of business expenses you might have include operating expenses, payroll costs, rent, utilities, taxes, interest, certain dividends, etc.

You can find yearly, quarterly, or monthly net income. Use a time frame that works for your business.

To find your company’s net income, you need to know your business’s gross income and expenses for the period.

Net income vs. gross income

So, what is gross income? Unlike net income, gross income (also called gross profit) is how much your business has before deducting expenses. Use gross income to find your net income.

To find gross income, you need to know your business’s total revenue and cost of goods sold. Your business’s gross income is the revenue you have after subtracting your cost of goods sold (COGS). COGS is how much it costs you to make a product or perform a service.

Gross income is how much money your business has after deducting the cost of goods sold from total revenue.

Net income is how much money your business has after deducting expenses from gross income.

How to calculate net income (net income equation):

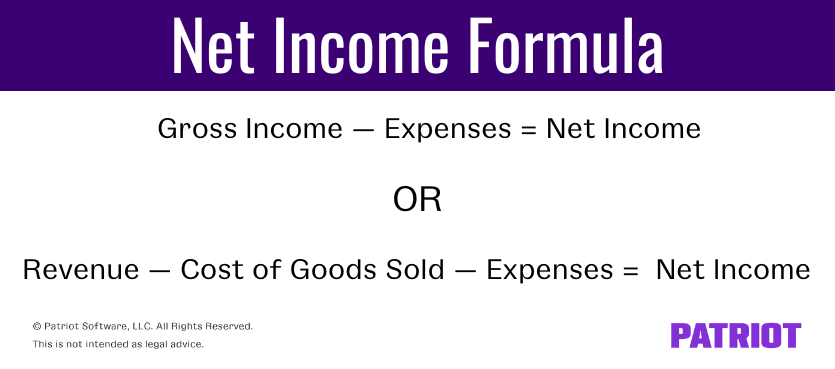

You can calculate net income by subtracting the cost of goods sold and expenses from your business’s total revenue.

Before calculating net income, you need to understand the gross income formula:

Gross Income = Revenue – Cost of Goods Sold

Now, take a look at the net income formula:

Net Income = Gross Income – Expenses

Or, you can use the following formula to calculate net income:

Net Income = Revenue – Cost of Goods Sold – Expenses

Net income formula example:

Let’s say you want to find your company’s net income for the month of March. Here are the facts:

- Total revenues: $30,000

- Cost of goods sold: $12,000

- Expenses:

- Rent: $2,000

- Utilities: $400

- Purchases: $1,000

- Payroll: $3,000

- Taxes: $800

First, you want to find your business’s gross income. Subtract the cost of goods sold from your total revenue.

Gross Income = $30,000 – $12,000

Gross Income = $18,000

Next, tally up your total expenses for the month (not including the cost of goods sold). After adding rent, utility, purchase, payroll, and tax expenses, your expenses total $7,200. Now, subtract your total expenses from your gross income to find your net income.

Net Income = $18,000 – $7,200

Net Income = $10,800

Your net income for the period is $10,800.

Where to record net income

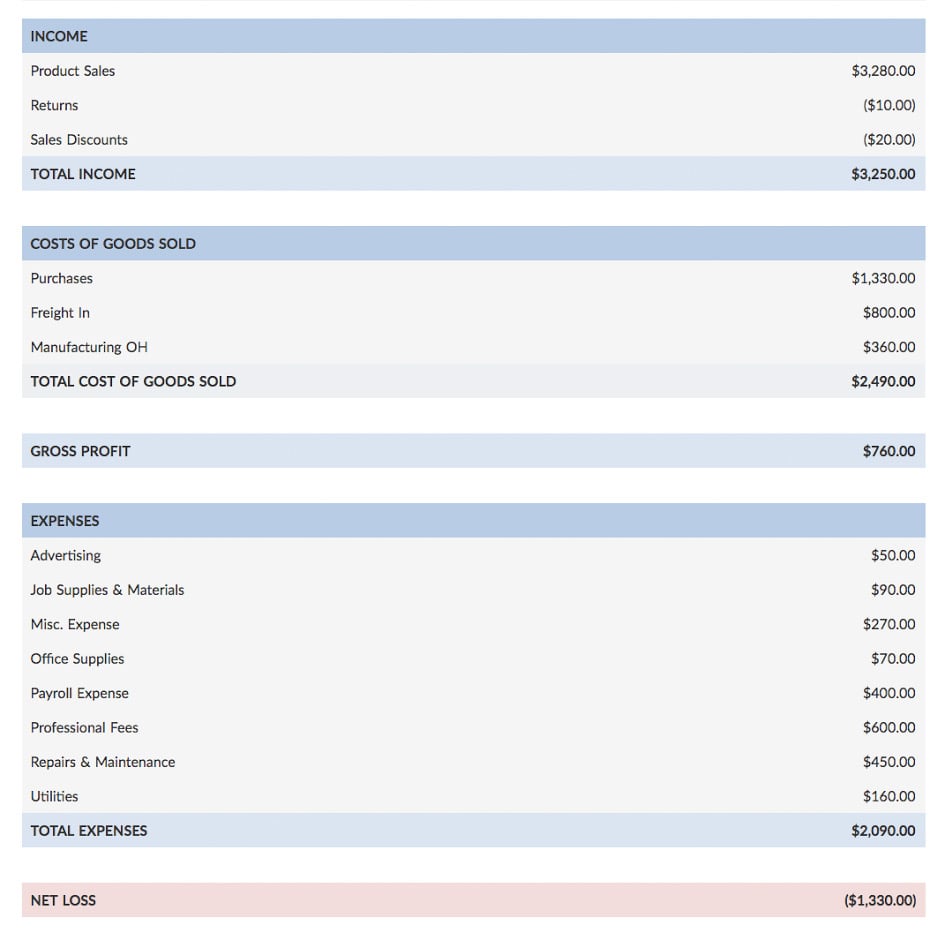

Record net income on your business’s income statement. The income statement is one of three main financial statements companies use.

An income statement shows you the profitability of your company. It reports your business’s profits and losses over a specific period. Income statements show the process of determining net income.

Total revenues, cost of goods sold, gross income, expenses, taxes, and net income are all line items on the income statement. Net income is the final line of the statement, which is why it is also called the bottom line.

Here is a sample income statement:

Ready to take control of your business’s finances? With Patriot’s online accounting software, you can easily track expenses and income. Plus, you can record payments, create invoices, and track unpaid invoices to help you better stay organized. Get your free trial today!

This article has been updated from its original publication date of February 6, 2015.

This is not intended as legal advice; for more information, please click here.