As a business owner, you’re used to wearing a million hats and doing things yourself. But sometimes, you need a helping hand. Some tasks, like accounting, can be time-consuming and downright stressful— especially if you’re not an expert. If you’re struggling to manage your own books, hiring an accountant may be a good fit for you. But before you pull the trigger and hire an accountant, you need to ask yourself, Do I need an accountant for my small business?

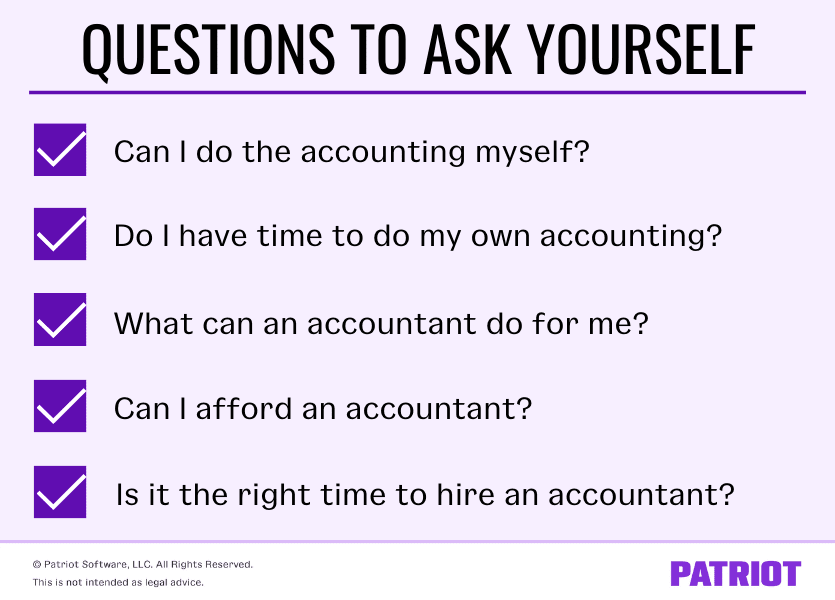

Do I need an accountant? 5 Questions to ask

So … when do you need an accountant? The truth? Every business is different. Some companies may need to hire an accountant sooner rather than later, especially if they are growing quickly. Other businesses, like startups, may be able to hold off for a few months or years.

Determining whether or not your business needs an accountant isn’t always an easy decision. To help you decide which route to take and if it’s time to find an accountant, ask yourself some questions.

1. Can I do the accounting myself?

When determining if you need an accountant, ask yourself if you can do the accounting yourself. If the answer is no, you may need to start hunting for an accountant.

Many business owners have little to no accounting experience—and that’s OK. According to one study, 60% of business owners feel they are not very knowledgeable when it comes to accounting and finance. Sure, you may have taken an accounting class or two back in high school or college. But even with that experience, you may not be comfortable taking on the task of accounting for your business.

So … where do you fall? Are you part of the 60%? Or, are you part of the 40% that is ready to tackle accounting tasks?

If you fall into the 60%, you may need to consider hiring an accountant. If you’re part of the 40%, you may be able to handle accounting on your own manually or by using accounting software (and of course passing your books on to an accountant as needed).

Not sure where you fit in? To figure out if you can do the accounting yourself, ask the following questions:

- How much accounting knowledge do I have?

- Am I willing to learn more about accounting?

- Am I tech-savvy? Can I use/learn accounting software?

- Can I keep up with tax laws and changes?

2. Do I have time to do my own accounting?

Next, ask yourself if you even have time to do accounting yourself. What does your schedule look like? How many tasks are you juggling at once?

If you don’t have time to take on accounting responsibilities and keep your books up-to-date, it may be time to seek help from an accountant.

The last thing you want to do is rush making entries in your books and wind up with accounting mistakes. Blunders will only lead to more issues down the road for your business, including tax problems and potential penalties.

3. What can an accountant do for me?

To decide if it’s worth it to hire an accountant, ask yourself, What can an accountant do for me?

There are a number of things an accountant can do for your business. Accountants can:

- Analyze your finances for you

- Prepare tax returns

- Manage your books

- Prepare financial statements

- Help you with payroll tasks (e.g., filing payroll taxes)

- Ensure your business is following the latest regulations

4. Can I afford an accountant?

Is an accountant in your small business budget? This is something you have to ask yourself before you invest in an accountant.

According to one source, accountants on average typically cost $50 per hour. And, that price can go up depending on what services your business needs.

It’s no secret that hiring an accountant is the most expensive accounting solution out there. So if you’re debating about whether you need an accountant full time or not, review your budget first to make sure it’s actually in the cards.

If you think you need an accountant but aren’t sure if you can afford one, you may consider:

- Getting accounting software

- Hiring an accountant part time for now

- Shopping around to find an accountant in your budget

5. Is it the right time for me to hire an accountant?

Last but not least, ask yourself if it’s the right time to hire an accountant for your business.

Is your business growing? Are you too swamped with your business to handle your books on your own? Did you make a big boo-boo and need help getting your books back in order? If you said “yes” to one (or more) of these questions, it might be time to hire an accountant.

By asking yourself a few questions, you can determine if it’s time to say “the heck with it” and start researching accountants to hire for your business.

Perks of having an accountant for your business

Hiring an accountant to help you with your books has plenty of advantages. Here are a few pros of hiring an accountant for your business:

- Increases the accuracy of your books

- Helps you avoid accounting mistakes

- Gives you more free time for other tasks

- Makes tax time a breeze for your business

- Gives you a go-to person for advice and questions

- Steers you in the right direction for important decisions

- Helps minimize business expenses

Of course, hiring an accountant comes with some cons, too. The biggest con of getting an accountant is the cost associated with one. Hiring an accountant is the most expensive accounting option out there.

If you’re looking for accuracy without breaking the bank, consider investing in accounting software instead. Accounting software crunches the numbers and streamlines accounting tasks for you. That way, you can record your day-to-day transactions easily and pass along detailed records to your accountant.

Steps for finding an accountant

Decided to go the accountant route? Congratulations! If you’re on the hunt for an accountant, follow the steps below, and ask yourself a few additional questions:

- Narrow down your business’s needs

- What kinds of accounting services do I need?

- Do I want the accountant to do all of the accounting?

- Do I need payroll services, too?

- Do your research on accountants

- What accounting firms are in my area?

- Who has good reviews?

- What is their pricing like?

- Are there any virtual accountants I can work with?

- Ask around for recommendations (e.g., friends, fellow business owners, family, etc.)

- Do you know any good accountants in the area?

- Can you refer me to a CPA?

- Interview accountants

- What services do you provide?

- What do you charge your clients?

- How do you communicate with clients? (e.g., email)

- What kinds of clients do you work with?

- What experience do you have with my industry?

- Which accounting programs do you use?

- Make sure you’re a good match

- Do we get along well?

- Are we compatible as business partners?

After you’ve narrowed down your search and found an accountant who’s a good match for your business, meet with them regularly to discuss your business’s books and financial decisions.

Want to take charge of your business’s books? Use Patriot’s online accounting software to streamline the way you manage accounting tasks and record transactions. Then, easily gather and pass along reports to your accountant. Try it for free today!

This article has been updated from its original publication date of September 11, 2014.

This is not intended as legal advice; for more information, please click here.