Here’s the scoop. You’re putting together or updating your list of small business accounting services. Nobody knows your expertise and strengths better than you. But … is that enough?

Not quite. You also need to know what services resonate with business owners (give the people what they want!). Read on for a list of accounting and tax services for small business—and beyond—you may consider offering.

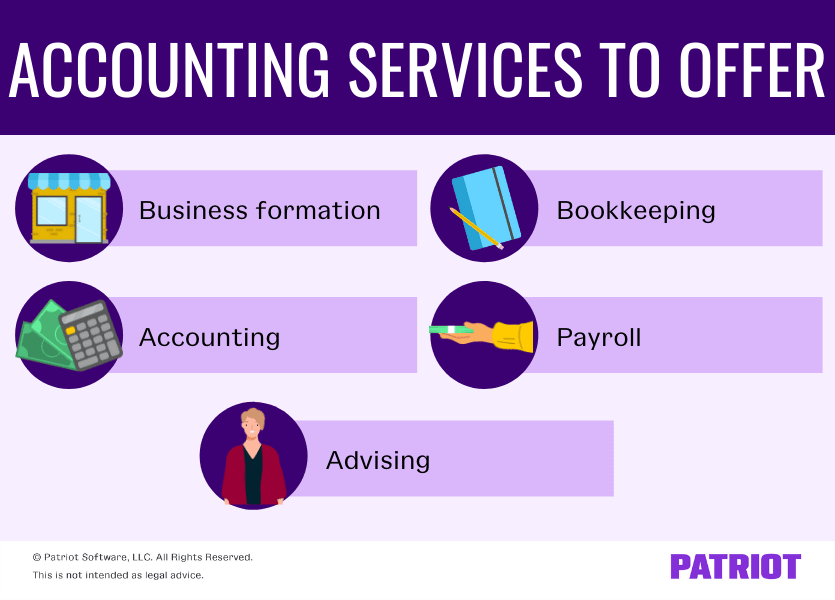

Small business accounting services to consider offering

Take a look at the following categories of accounting services clients look for, as well as the varying services nested under each:

- Business formation

- Accounting

- Bookkeeping

- Payroll

- Advising

1. Business formation

Do businesses turn to accountants or lawyers when forming their business? Chances are, the answer is yes to both. Many business owners work with both accountants and small business lawyers to help them with the intricacies of business formation.

Offering business formation services can help you attract long-term clients at the beginning of their business journey. You may offer services that help clients:

- Decide on a business structure

- Register their business with the proper agencies

- Budget their startup

- Get the appropriate licenses and permits

- Finance their new business

Starting a business is exciting, but also stressful and overwhelming. By offering services specifically for newbie entrepreneurs, you can poise yourself as a trusted adviser who’s there from the get-go.

2. Accounting

Clearly, clients expect you to offer accounting services for small business. After all, it’s in the name. Whereas bookkeeping services are more administrative and transactional, accounting is the art of using, analyzing, and interpreting that bookkeeping data.

There are a few types of services you can categorize as true “accounting” services, including:

- Tax planning and consulting

- Auditing

- Cash flow forecasting

- Financial statement analysis and interpretation

Sure, your clients may use accounting software to manage their transactions and generate financial statements. But, your accounting services help clients interpret their data, catch any data entry errors, identify cash flow issues, solidify decision making, and more.

3. Bookkeeping

Bookkeeping services for small business is another service clients want and expect from their accountants. Again, bookkeeping is the day-to-day task of recording transactions and maintaining up-to-date records.

You may offer must-have services like:

- Bank reconciliation

- Month-end close

- Transaction recording

- Recordkeeping

- Accounts payable

- Accounts receivable

- Financial statement creation

Not all small businesses use bookkeeping services from their accountant. Many small companies opt for handling bookkeeping themselves using spreadsheets or software to cut costs. Do some research on how much to charge for bookkeeping to set a fair price that appeals to cost-sensitive business owners.

Want to help your clients on a budget keep their books organized and up-to-date? Consider partnering with an accounting software provider to equip your clients with an easy way to track and organize their day-to-day transactions.

4. Payroll

In the pre-software days, many accounting professionals shied away from offering payroll services. It was time-consuming to manually run payroll for multiple clients and keep up with ever-changing tax laws. But now, thanks to online payroll, this is one accounting service for small business you don’t want to miss. Offering payroll services to your clients is not only quick and easy, it’s expected.

Clients expect accountants to provide payroll services. Not to mention, doing so can be a great way to source new clients and upsell other services.

If you decide to offer payroll services, you may completely handle payroll on your clients’ behalf. Or, you might offer a co-branded payroll solution (i.e., software) and let your clients run payroll themselves.

Whatever you decide, payroll-related services you may offer include:

- Employee time tracking

- Recordkeeping

- Running payroll and paying your clients’ employees

- Automatic payroll tax filings and deposits

- Preparing and distributing Forms W-2

- Employee benefits consulting

Make it easy on yourself: Partner with a cloud payroll software provider to streamline your responsibilities so you can focus on your clients, not the administrative hardships of payroll.

5. Advising

Last but not least, one of the many hats you wear as an accounting professional is that of a trusted advisor. So, it’s only fitting that you offer advising or consulting services.

You may help clients:

- Make business and management decisions

- Secure funding

- Choose software or services that can help their business

Advising is one of those services that comes naturally when your clients turn to you for help with their books. Or, clients may turn to you only for your expert advice. Whatever the case, becoming your clients’ trusted advisor is a key part of developing a strong client-accountant relationship and brand loyalty.

Services finalized? Check. Now what?

If you’re ready to roll with your list of small business accounting services, you may be wondering what’s next.

After developing or expounding on the services you offer, your next steps may include:

- Coming up with a fair and competitive pricing structure: “How much time will I be putting into this service? What do competitors in the area charge? How much are my clients willing to pay?”

- Upselling and cross-selling services: “I’m glad you’re enjoying our bookkeeping service. Have you heard about our new payroll service?”

- Gathering feedback from clients: “Thank you for trying out our new payroll service! How has it helped your business?”

To let clients know about any changes to your list of services, update your accounting website, post about it on your social profiles, and send out emails. You can also gather feedback from clients via email surveys.

This is not intended as legal advice; for more information, please click here.