You’re driving late at night, exhausted. You can’t see anything, and you don’t know where you are. Before you run out of gas, you pull up your GPS, and ah! There’s the path. Now you know where the path is again. Likewise, you can get lost in business ownership if you don’t have a “roadmap” guiding you (aka a business plan). That’s why you need to know how to write a business plan.

Creating and updating a business plan helps you understand your market, obtain small business financing, and strategize your company’s future. But, writing a small business plan takes time and resources.

You might be wondering, How do I write a small business plan? What does a business plan look like? Let’s get started, shall we?

How to write a business plan

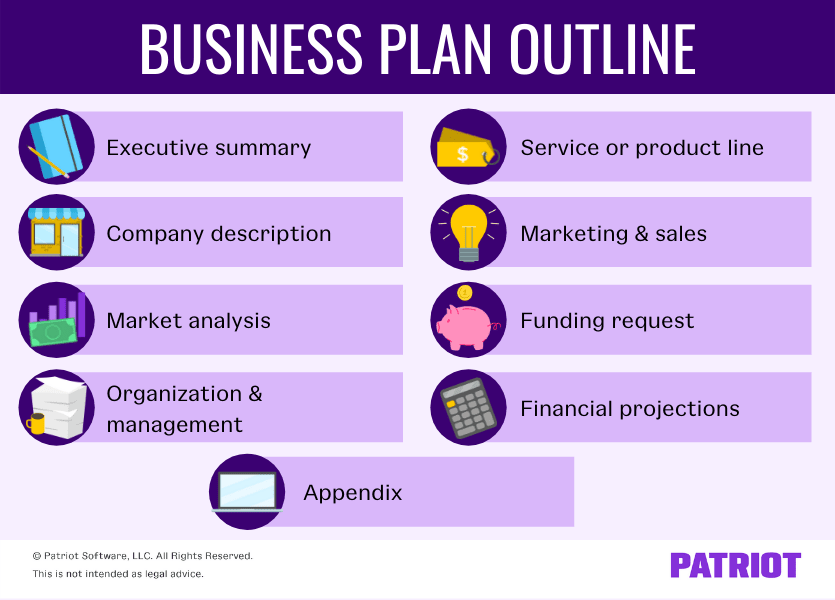

There are typically nine sections in a traditional business plan outline. But, the business plan template may vary between companies.

Take a look at how to draft a business plan with the following sections:

- Executive summary

- Company description

- Market analysis

- Organization and management

- Products and services

- Marketing and sales

- Funding request

- Financial projections

- Appendix

Learn more about how to write a business plan step-by-step by checking out the sections below.

1. Executive summary

Your executive summary should concisely explain the key points of your business. Keep your summary short and sweet. It should outline the rest of your business plan, not repeat it.

Use this first section of your small business plan to answer (briefly):

- What is your mission statement?

- What do you do?

- Who runs your business?

- How many employees do you have, need, or plan to have?

- What is your business location(s)?

- What do your finances look like?

- How much money do you need to run or grow your business?

Consider waiting until you’re done writing a business plan to craft your executive summary. For some, summarizing is easier than expanding.

2. Company description

Like the executive summary, the company description is a brief summary of the scope of your business.

When creating a business plan, use this section to go into detail about who runs your business, how it’s structured, and where it’s located. Include your mission statement and talk about how your company fills a marketplace need.

Your company description should answer:

- What does your business do?

- Who are your target customers?

- How is your business poised for success (aka what sets you apart)?

- What is your business structure (e.g., sole proprietorship, S Corp, etc.)?

- Where are you located?

- What is your mission statement?

Use the company description as an opportunity to make your business look good and grab any lenders’ and investors’ attention early on.

3. Market analysis

The market analysis portion of your plan details your market, target customers, and competition. To find this information, you need to do some research.

Find out your competitors’ strengths and weaknesses. Learn which demographics you plan to target. Analyze the size of the market you want to penetrate.

Questions you should answer in your market analysis include:

- Who is your target audience?

- What part of the market does your business exist in?

- Who are your competitors?

- How many competitors are in this part of the market?

- What do your competitors do right? Wrong?

Like the title of this section suggests, you need to do a bit of analyzing to fully understand the scope of your market, the current players in it, and how your business fits in (or how it stands out).

4. Organization and management

Now is the time to get into the nitty-gritty details of your business’s structure and leadership. So, what structure makes the most sense for your business?

You can structure your company as a:

- Sole proprietorship

- Partnership

- Limited liability company (LLC)

- Corporation

- S corporation

Compare the advantages and disadvantages of each business structure before choosing. Explain why you chose this structure in your business plan.

Next, list the names of the people running your business. Describe the strengths, skills, and experience of business leaders. Delegate roles and responsibilities to each leader. For example, if you form a partnership, explain each partner’s role.

Use your organization and management section to answer:

- What is the legal structure of your business?

- Why did you choose this business structure?

- Will you change your business entity in the future?

- Who runs your business?

- What skills do your key employees bring to the table?

- What kinds of positions do you need to fill to run your business?

5. Products and services

Now for the fun part of your business plan—what you’re going to sell. If you’re like most business owners, you’re likely more excited about running your company than structuring it.

This section of your business plan defines your offerings and explains how they benefit your customers. Also, discuss your offerings’ unique value proposition. Explain what sets your products or services apart from the rest of the market (hint: refer back to your findings from the market analysis!).

You products and services section should answer the following questions:

- What will you sell?

- What is your product life cycle?

- How do your offerings compare to what’s already out there?

- What problem does your product or service solve?

- Do you plan on seeking patents or copyrights?

6. Marketing and sales

You may have a great product or service, but it doesn’t matter if nobody knows about it. Cue marketing and sales.

This section of your business plan should explain how you plan to market to potential customers. Will you use online marketing strategies, such as social media and email campaigns? Or, do you plan to use offline strategies, like radio ads and direct mail? Lay out exactly what combination of marketing and sales strategies you plan to pursue.

Use this section to answer the following questions:

- What marketing strategies will you use?

- Which channels will you use to market to your target customers?

- How will you sell to customers (e.g., online or in-store)?

- What are your ideal profit margins?

7. Funding request

If you plan on using your business plan to obtain outside financing, here’s your chance. Define your funding needs in this section of your plan.

Knowing how to make a business plan to secure funding requires you to give the lowdown on your financing needs, plans for funding, and desired repayment terms.

Your funding request should answer questions like:

- How much funding do you need?

- How will you fund your business?

- What will the requested money go toward?

- How do you plan on paying back debt?

- Will you pursue debt financing vs. equity financing?

Use this section of your business plan to show investors or lenders exactly what you’re asking for and how you plan on protecting their money.

8. Financial projections

Use this section to lay out your business’s future finances to help you budget. Use historical data to estimate financial projections, if applicable.

When coming up with your financial projections, work within time periods. You want to be as specific as possible. And, avoid overestimating your small business revenue. Also, be prepared to answer what you’ll do if you don’t reach your financial projections.

Some financial questions to answer in this section include:

- How much do you have in expenses?

- What is your cost of goods sold (COGS)?

- How much is your projected income?

- What is your break-even point?

- What is your business exit strategy?

9. Appendix

The last part of knowing how to write a business plan is tying up any loose ends. Add any additional attachments to the appendix section of your plan.

Some documents you may need to provide include:

- Credit histories

- Prior financial statements (if applicable)

- Business licenses and permits

- Photos

3 Tips on writing a small business plan

Now that you know how to prepare a business plan with the basic sections, follow these tips to bring it home.

1. Do your research

Research might not be your favorite thing in the world. But before you start a business or write your plan, you need to make research your new best friend.

From conducting a thorough market analysis to deciding the best structure for your venture, research is a must.

Without researching your idea, you could set your business up for failure. Know what you’re getting into so you don’t wander blindly into an oversaturated market or dying industry.

Resources to use:

- U.S. Bureau of Labor

- Small Business Administration: Business data and trends

- IRS: Business structures

2. Prioritize presentation

After doing the necessary research and writing, make your plan stand out by prioritizing presentation. Here are some do’s and don’ts when it comes to putting together the components of a business plan:

Do:

- Check for grammar

- Use graphs and charts

- Go the extra mile to simplify navigation (e.g., binder dividers)

Don’t:

- Write it on loose-leaf paper

- Stick your business plan in an old folder

- Forget to format your business plan

How long should your presentation be? There is no set business plan length. According to the Small Business Administration, experts recommend keeping the business plan between 30 – 50 pages. Avoid writing just to write. Answer what you need to and keep your plan concise.

Resources to use:

- Grammar and spell-check tools (e.g., Grammarly)

- Tools to turn data into graphs and charts (e.g., Google Data Studio)

3. Update your business plan

Done writing your small business plan? Great! But, that doesn’t mean you can set it on your bookshelf to collect dust. You need to revisit your small business plan from time to time.

Businesses grow constantly. As your company develops and changes, you must also update your business plan with new:

- Financial data

- Products or services

- Business structure changes

Consider looking at your small business plan annually or whenever your venture changes.

Resources to use:

- Accounting software or another accounting system

This article has been updated from its original publication date of March 5, 2019.

This is not intended as legal advice; for more information, please click here.