Whether you’re a startup or have been in business for years, you may be considering applying for outside funding. This could include receiving small business loans, obtaining investors, or applying for grants. Small business grant funding can be the most complex, but most desirable, option. So, what are small business grants, and what should you […]

Read More Small Business Grants: What to Know Before ApplyingFunding Articles

Funding - Tips, Training, and News

The Ultimate Guide to Small Business Financing

Here’s a number that might surprise you: 29%. That’s how many startups fail because they run out of cash. To make sure you have enough capital to see your dream through, consider small business financing.

Read More The Ultimate Guide to Small Business Financing

What Is Crowdsourcing, and How Can You Use it to Grow Your Business?

Your business is your baby. You want to see it grow and prosper. But sometimes, you need to try new methods to get the word out about your company and raise funds for business growth. Thanks to the technological age, more options are out there now to assist you with funding and growing your business, […]

Read More What Is Crowdsourcing, and How Can You Use it to Grow Your Business?

Debt-to-equity Ratio: How the Math Works for Your Business

Sometimes, debt is a necessary evil when running a business. Taking on debt may be your best option when you don’t have enough equity to operate. But, how much debt is too much debt? And, when does debt become “bad”? The accounting debt-to-equity ratio can help you determine how much is too much and draws […]

Read More Debt-to-equity Ratio: How the Math Works for Your Business

How Does Accounting Information Help in Decision Making? The Employer’s Guide

Financial reports and accounting information may seem time-consuming or confusing. But, that data is an essential part of running a business—especially when you need to make big decisions. Do you need to take out a loan? Can you afford to give raises to your employees? What about buying new equipment? All of these questions can […]

Read More How Does Accounting Information Help in Decision Making? The Employer’s Guide

7 Steps on How to Apply for an SBA Loan

Whether you’re opening the doors to your business or 20 years into the swing of things, you may be considering a loan. One option is a loan through the Small Business Administration (SBA) if you have a small business. But, what is an SBA loan? And, how do you complete an SBA loan application? Let’s […]

Read More 7 Steps on How to Apply for an SBA Loan

What Is a DUNS Number?

Dun, dun, dun! If you’re unfamiliar with what is a DUNS number, now might be the time for a quick overview. Otherwise, you might not know if you need one for your business.

Read More What Is a DUNS Number?

An Overview of the Consumer Credit Protection Act

When you’re in business, you’re bound to deal with credit and loans. So, are you extending credit to customers, requesting credit, borrowing a loan from lenders, or doing all of the above? If so, you need to know about the Consumer Credit Protection Act.

Read More An Overview of the Consumer Credit Protection Act

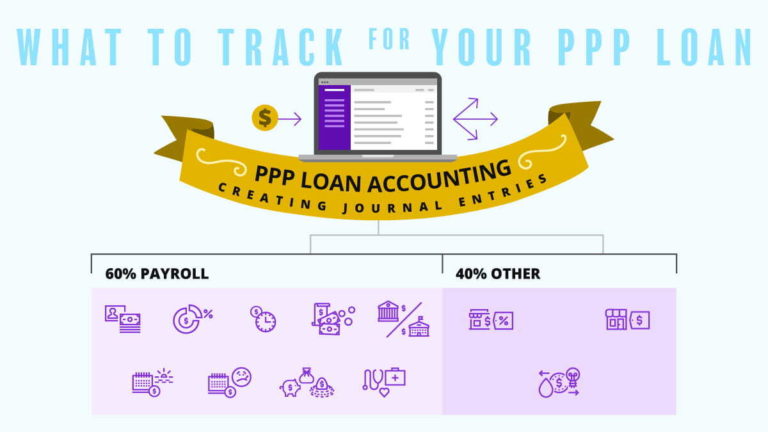

PPP Loan Accounting: Creating Journal Entries

Businesses could apply for a Paycheck Protection Program loan through May 31, 2021. As of June 1, 2021, the SBA is no longer accepting PPP loan applications. Congratulations on receiving a Paycheck Protection Program forgivable loan! But if you want to receive loan forgiveness, you need to use it for eligible expenses and keep detailed […]

Read More PPP Loan Accounting: Creating Journal Entries