The latest COVID package to come out of Washington D.C. (and the first of 2021) has been signed into law. Dubbed the American Rescue Plan, this legislation is jam-packed with relief measures aimed at individuals and businesses.

Read More What’s in the American Rescue Plan?Rachel Blakely-Gray and Maria Tanski-Phillips

IRS Announces Tax Filing Extension—and Many States Follow Suit

Have you heard the IRS’s latest announcement regarding the tax filing extension? Like last year, the IRS has extended the federal tax deadline to give taxpayers additional time to file and pay income taxes. But that’s not all—many states and localities are also updating their state and local income tax deadlines to match the IRS […]

Read More IRS Announces Tax Filing Extension—and Many States Follow Suit

Is a Stimulus Check En Route to You? FAQs About Economic Impact Payments

If you’ve been keeping up with the news, you know that the IRS began sending out Economic Impact Payments to qualifying recipients. These stimulus checks will go out in a few rounds, so don’t panic if you aren’t included in the first send-off.

Read More Is a Stimulus Check En Route to You? FAQs About Economic Impact Payments

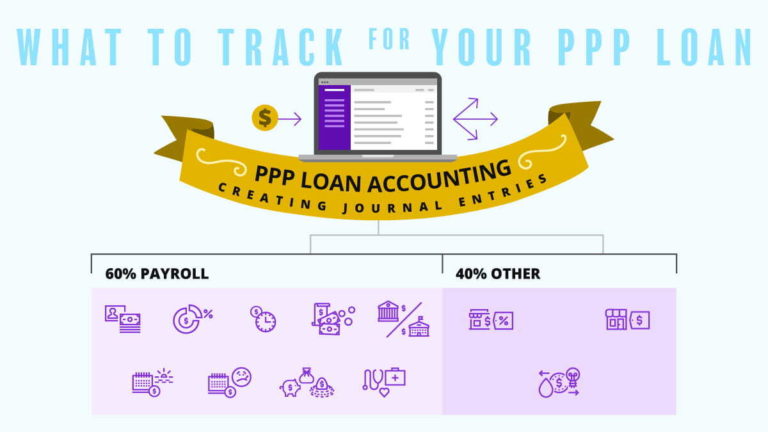

PPP Loan Accounting: Creating Journal Entries

Businesses could apply for a Paycheck Protection Program loan through May 31, 2021. As of June 1, 2021, the SBA is no longer accepting PPP loan applications. Congratulations on receiving a Paycheck Protection Program forgivable loan! But if you want to receive loan forgiveness, you need to use it for eligible expenses and keep detailed […]

Read More PPP Loan Accounting: Creating Journal Entries

Small Business Relief During Coronavirus Pandemic

Updates for Businesses & Employees The information in this article is current as of January 6, 2021, 10:25 a.m. EST. Updated information is in bold. Our entire nation has been impacted by the coronavirus. Due to the quick spread of the virus, the economy has taken a hit. Business operations nationwide, particularly in small businesses, […]

Read More Small Business Relief During Coronavirus Pandemic

Small Business Resources for Dealing With COVID-19

Updated 6/5/2020 to reflect the passage of the Paycheck Protection Program Flexibility Act. From state-mandated stay-at-home orders to stimulus packages, there’s a lot changing because of the coronavirus. We know you want answers fast. That’s why we’ve put together the following list of coronavirus facts and small business resources.

Read More Small Business Resources for Dealing With COVID-19