When you have employees, you are responsible for paying them—but not before taking out some money for payroll taxes. The IRS, Social Security Administration (SSA), and state and locality (if applicable) all require payroll tax withholding.

So, what is payroll tax withholding? What do you need to do to stay compliant?

What is payroll tax withholding?

Payroll tax withholding is when an employer withholds a portion of an employee’s gross wages for taxes. Payroll withholding is mandatory when you have employees. The amount you withhold is based on the employee’s income. Remit the withheld payroll taxes to the appropriate agencies (e.g., IRS).

You can either withhold taxes from employee wages manually or by using payroll tax withholding software. Withholding reduces the lump sum an employee may need to pay when they file their annual tax return. If the total amount you withhold for the year is more than what the employee owes, the employee receives a tax refund.

So, what all do you need to withhold? You must withhold the following for the employee portion of payroll taxes:

- Federal income tax

- Social Security tax

- Medicare tax

- State income tax (if applicable)

- Local income tax (if applicable)

Federal income tax withholding varies based on the employee’s marital status, dependents, and Form W-4 adjustments.

Social Security and Medicare taxes are known as FICA tax. Unlike federal income tax, FICA tax is a flat percentage of an employee’s wages. And, FICA is an employee and employer tax, meaning you must contribute the same amount you withhold from the employee’s wages.

Payroll withholdings exemptions

In some cases, an employee may be exempt from federal income tax withholding. How do you know if you have a tax-exempt employee?

Do not withhold federal income tax from an employee’s wages if they claim exemption on Form W-4.

Withholding payroll taxes

Now that you have a little background on what payroll tax withholding is, you may have some questions on how to do it.

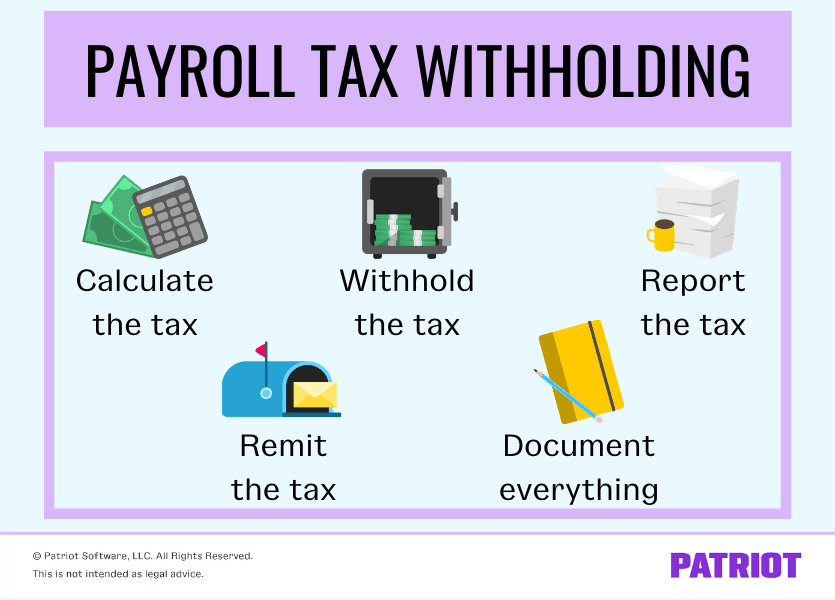

Here’s the lowdown on your responsibilities relating to payroll tax withholding:

- Calculate the tax

- Withhold the tax

- Report the withheld tax

- Remit the tax to agencies

- Document everything

1. Calculate the tax

The first step of payroll tax withholding is to calculate the tax.

Again, Social Security and Medicare taxes are standard percentages. Social Security tax is 6.2% of an employee’s wages—until they reach the Social Security wage base. Medicare tax is 1.45% of an employee’s wages. If the employee earns above the Medicare threshold, you must withhold an additional 0.9% of their wages for additional Medicare tax.

Federal income tax is based on the employee’s Form W-4. If applicable, state income tax is based on the employee’s state W-4 form. Local income taxes either use a flat rate or a progressive tax rate.

Manually calculating payroll taxes can be time consuming and leave room for errors, especially if the employee’s wages and hours change. To help calculate the tax, consider using payroll software.

Shopping for software? Know what to look for. Download our free guide, “9 Things to Consider When Choosing Your Payroll Software,” for the scoop!

2. Withhold the tax

After calculating the payroll tax, you have to hang onto withheld payroll taxes until the time comes to deposit it with the IRS and your state and locality.

When it comes to payroll tax withholding, you have a few options. You can:

- Deposit the payroll tax liability in your business bank account

- Deposit it in a separate payroll bank account

- Use a payroll service to handle the withheld payroll taxes

However you choose to handle the withheld tax, put it in safekeeping. Don’t spend the money. Remember, the withheld tax is a liability that you must remit to the agencies by the due dates.

3. Report the withheld tax

The next part of payroll tax withholding is to report your employees’ wages and how much you withheld. Report the withheld tax to the IRS, SSA, your state and/or locality (if applicable), and employees.

Take a look at the following documents you report payroll tax withholding on:

- Form 941 or 944 (IRS)

- Form W-2 (employee, SSA, state, and locality)

Consult your state and locality to learn how to report withheld payroll taxes throughout the year. Pay attention to your federal, state, and local reporting deadlines.

4. Remit the tax to agencies

In addition to reporting payroll tax withholding to the appropriate agencies, you must also deposit the tax.

Deposit withheld payroll taxes to the:

- IRS

- State

- Locality

Pay attention to federal, state, and local deposit deadlines to avoid penalties. Federal deadlines are based on whether you are a monthly or semiweekly depositor. Consult your state and locality for state- and local-specific deadlines.

5. Document everything

One of the most important parts of payroll withholdings is to document everything. Keep employee-related records such as:

- Pay rate

- Hours worked

- Gross wages

- Taxes withheld

- Net wages

Also, make copies of the following forms for your records, and keep them in a secure location:

- W-4

- W-2

- 941 or 944

- State-specific forms

- Local-specific forms

Confused about how much to withhold from an employee’s paycheck? Patriot’s payroll will do all the calculations for you. Put your calculators away and get free, U.S.-based payroll setup and support, free workers’ comp integration, and so much more. Start your free trial today!

This article has been updated from its original publication date of July 29, 2015.