Your alarm clock goes off, you roll over to get ready for work, but then … ugh. You just can’t do it because you’re too sick. Ever have one of those days? Your employees have, too.

Unfortunately, everyone gets sick. Between colds, the flu, and other medical issues, workers might have days where they’re not able to work. In these situations, some employers offer their employees sick pay. What is sick pay?

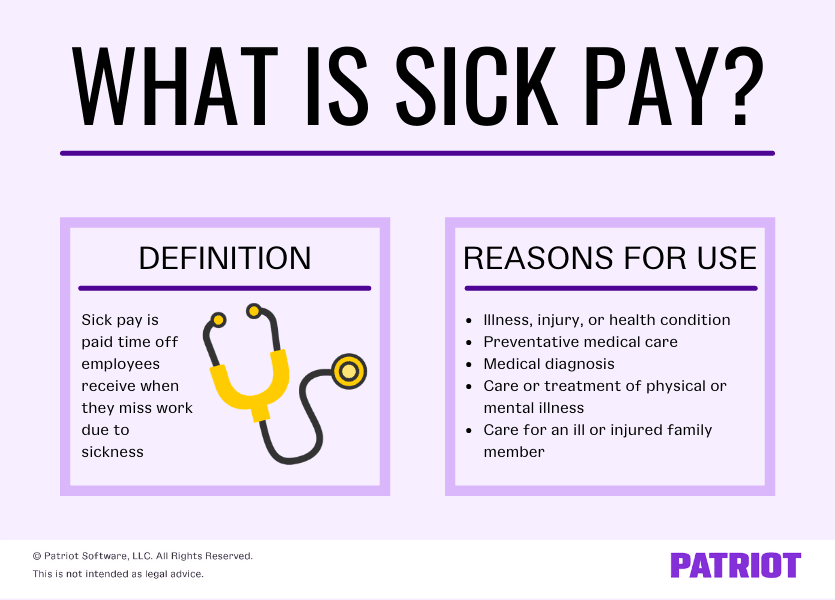

What is sick pay?

Sick pay (also called paid sick leave or paid sick days) is paid time off employees receive when they are absent from work due to illness, injury, or disability. Through paid sick leave, an employee receives their full wages or part of their wages when they are out sick.

So, what is considered sick time? State laws or employer guidelines vary, but qualifying reasons for sick pay may include:

- Illness, injury, or health condition

- Preventative medical care

- Medical diagnosis

- Care or treatment of physical or mental illness

- Care for a family member who is ill or injured

Some employers who offer employees sick leave do so under a paid time off (PTO) policy. PTO lets employees take paid time off for any reason, such as sick leave or vacation.

What is not considered sick pay?

There are some medical expenses that a business may make to an employee that are not considered sick pay.

These payments include:

- Workers’ compensation payments for any injury that occurred on the job or any illness the employee contracted due to the work environment

- Any disability retirement payment

- Medical expense payments made under a medical plan or for medical insurance

- Any payments that are not related to an employee’s attendance or absence (e.g., personal time off)

Is paid sick leave mandatory?

You might be wondering Is sick pay mandatory? There is no federal sick pay law requiring businesses to provide sick pay. However, a growing number of states have paid sick leave laws.

There is a growing number of states that require qualifying employers to provide sick pay to employees. Some states that require paid sick leave include Arizona, Maryland, Rhode Island, and Washington.

Unless your business is in a state with leave laws, you do not have to offer this employee benefit. However, you can opt to offer this popular benefit.

FFCRA leave

But wait! Wasn’t there a mandatory, federal paid sick leave rule? Yes, yes there was.

In 2020, the government passed the Families First Coronavirus Response Act, which was an emergency piece of legislation in response to COVID-19. Under this act, small business employers were required to offer employees paid leave for COVID-related reasons.

However, FFCRA sick pay did not apply to every type of illness or injury. And, it is not permanent. The requirement that small employers had to offer employees paid COVID sick leave expired at the end of 2020.

FMLA leave

The Family and Medical Leave Act (FMLA) is a federal law that requires certain businesses to offer employees unpaid time off. Businesses subject to the FMLA are those with at least 50 employees.

FMLA guidelines for employers require that employees get time off for qualifying reasons. Examples include dealing with a personal serious health condition or caring for someone with a serious health condition.

Advantages of offering employees sick leave

Not required to offer employees paid time off when they’re sick? Even so, there are a number of advantages to voluntarily offering the benefit.

Pros of sick leave include:

- Staying competitive with other businesses

- Improving employee retention

- Limiting the spread of sickness in the workplace

Staying competitive

According to the Bureau of Labor Statistics (BLS), a whopping 75% of private industry workers have access to paid sick leave benefits. If you choose not to offer paid sick leave, you could lose talent to an employer who does.

Worried about how much offering paid sick leave is going to cost you? The BLS reported that the average cost of offering paid sick time is $0.45 per employee hour of work.

Improving retention

Sick leave can also help you improve employee retention (which could pay for itself, depending on how much turnover you have without it).

According to one survey of restaurant industry practices, implementing top workplace practices like paid sick leave can help reduce turnover by 50%.

Limiting sickness

Employees who have to make a choice between going to work sick and missing out on wages might opt for going to work sick.

If you want to limit sickness in the workplace, offering paid sick leave could encourage sick employees to stay home.

Company sick pay: The details

Want to learn more about all things paid sick days? Check out this brief Q&A segment.

How much is sick pay?

Generally, sick pay is equivalent to an employee’s regular wages.

How does sick pay work?

You can make paid sick leave available to your employees at the beginning of the year in one lump sum. Or, you can require employees to accrue sick leave. For example, employees can earn one hour of sick leave for every 40 hours they work.

In most cases, employers pay for paid sick leave like regular wages. But, you can also opt for third-party sick pay. If you sign up for third-party sick pay, you pay a third party (e.g., insurance company), and they distribute sick leave wages to employees.

You may also be wondering about how sick pay works when it comes time to actually give the employee the wages. Include sick pay in the employee’s regular paycheck. Is sick pay taxable? Like regular wages and other types of paid time off wages you pay employees, sick pay is taxable.

What about leftover sick leave hours?

If employees don’t use up their accrued sick leave by the end of the year, what happens to the hours? When you establish your sick time policy, you may get to decide.

Depending on your policy, employees might:

- Forfeit earned, unused sick time

- Cashout earned, unused sick time

- Carryover earned, unused sick time

If you let employees cash out and/or carry over unused sick time, you can set limits. For example, you might let employees carry over up to 24 hours per year.

Keep in mind that some states have PTO payout laws that prevent employers from establishing use-it-or-lose it policies for accrued time off.

What if I’m in a state with paid sick leave laws?

States with paid sick leave laws have their own rules that employers must follow. If you’re subject to state leave laws, consult your state to find out:

- Sick leave usage

- Accrual rate and cap

- Waiting period guidelines

- Carryover rules

Want one less task to worry about? Patriot’s payroll software might be just what you’re looking for. Enter employee hours worked, other hours (e.g., sick time), and voila. The software crunches the numbers so you don’t have to. Get your free trial now!

This article has been updated from its original publication date of June 8, 2016.