Deciding whether you want to provide paid time off (PTO) is something you need to do before you hire an employee. Offering PTO also requires you to craft a PTO policy that explains how your business treats accrued PTO. But, PTO payout laws by state may restrict whether you can establish a use-it-or-lose-it policy.

Sure, you don’t have to give your employees paid time off. But, over 75% of small business employees have access to PTO for sickness, vacations, and holidays. And if you do offer paid time off, you need to know your state’s PTO payout laws.

Read on to learn about accrued PTO, use-it-or-lose-it PTO policies, and what your state has to say about it.

Accrued PTO recap

When employees have paid time off, the number of days they receive typically accrue over time. Accrued time off is the time an employee has earned but not yet used.

An employee can do one of the following with their accrued PTO:

- Use it

- Cash it out

- Roll it over

- Forfeit it

Generally, employees must decide about their accrued time off at the end of the calendar year. Employee termination is another time when PTO accrual comes into play.

Your business’s policies—and your state’s laws—contribute to what an employee can do with their accrued PTO.

Some businesses set limitations to what employees can cash out or roll over. For example, you might only let employees cash out up to 40 hours and roll over up to 40 hours of PTO.

Include the ins and outs of your PTO accrual policy in your employee handbook. And, hold off on creating your policy until you know what states require employers to pay for unused vacation time.

What is a use-it-or-lose-it PTO policy?

A use-it-or-lose-it PTO policy states that employees must either use their PTO by a certain date or risk losing it. Use-it-or-lose-it PTO policies prohibit employees from cashing out or rolling over their earned time.

Employers who implement use-it-or-lose-it PTO policies must clearly convey it to their employees. Employees need to know when they must use their PTO before it expires.

Use-it-or-lose-it PTO policies limit an employer’s payout liability to employees who don’t use their vacation or sick time. But, dealing with limitations may be frustrating for some employees who want to save their PTO days for the next year or receive a year-end bonus.

Not to mention, use-it-or-lose-it PTO policies are illegal in some states.

Do states mandate how you calculate accruals?

When an employer voluntarily chooses to offer paid time off to employees, they typically determine how time is accrued.

Businesses can calculate PTO accruals based on the number of:

- Hours worked

- Days worked

- Weeks worked

- Pay periods worked

How you calculate accruals determines how you pay employees for earned but unused time off. To figure out how much you owe an employee, you must prorate their time off.

Be sure to explain how employees accrue time off in your handbook.

Keep in mind that states with mandatory paid sick leave laws decide how employers must calculate accruals.

PTO payout laws by state

Although states don’t require employers to provide paid vacation time to employees, some regulate PTO accruals.

What exactly do PTO payout laws by state mean? States might have unused vacation pay laws that require employers to:

- Provide accrued vacation payout or roll over unused days at the end of the year (aka, ban on use-it-or-lose-it policies)

- Include accrued vacation time as wages in an employee’s final paycheck

- Do both 1 and 2

Not all states have PTO payout laws. Many don’t address whether employers must pay employees for accrued time off.

Regardless of if your state requires accrued vacation payout or not, you must address it in your policies. You can choose to pay employees for accrued time. And if you say you will in your business’s policy, you must do it.

In most states, PTO payout laws only apply to earned vacation time.

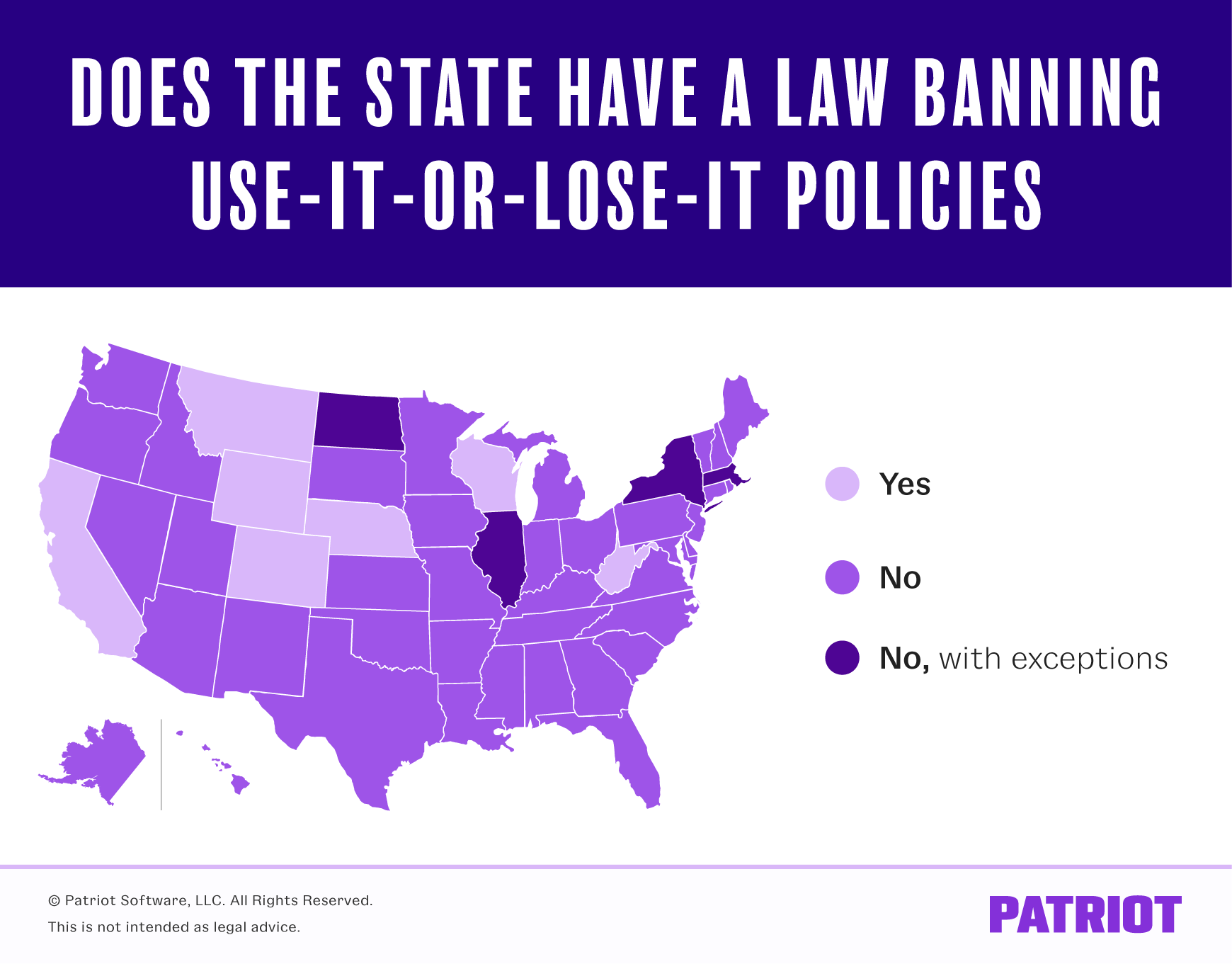

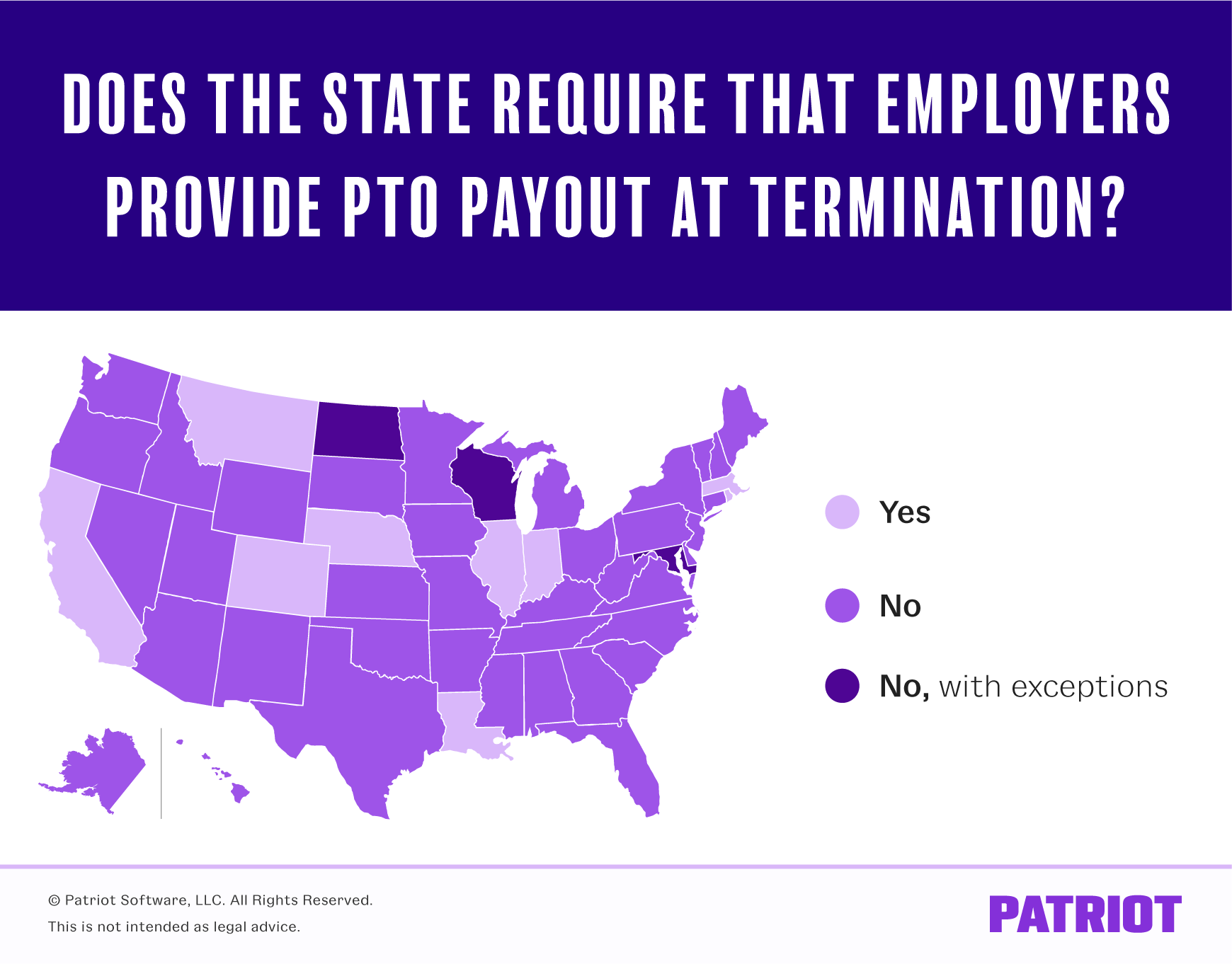

So, which states ban employers from implementing use-it-or-lose-it policies? What states require PTO payout at termination?

Learn more about the PTO payout laws by state below.

California PTO laws

Employers cannot implement a use-it-or-lose-it policy in their businesses. However, employers can place a cap on accruals.

California requires that employers pay terminated employees for accrued vacation time in their final paycheck. Under California law, vacation pay is considered a form of wages if an employer chooses to offer it to employees.

California’s accrued time law applies to vacation time or vacation time that is combined with sick time under a PTO policy.

For more information on California’s vacation pay payout laws, check out their state website.

Colorado PTO laws

Colorado requires that employers pay employees for accrued vacation time when they are terminated. And, Colorado generally prohibits use-it-or-lose-it policies under the Colorado Wage Act (“Wage Act”). Under Colorado law, vacation pay is considered a form of wages.

Colorado’s law only applies to vacation time, not sick time.

Check out Colorado’s state website for more information.

Illinois PTO laws

Illinois does not prohibit use-it-or-lose-it policies in the workplace. However, they do regulate it.

Employers can require employees to use vacation time by a certain date as long as they give them a reasonable amount of time.

Additionally, Illinois law requires that employers provide PTO payout to terminated employees.

You can review Illinois’ policies in more detail by visiting their state website.

Indiana PTO laws

According to Indiana’s state website, employers must pay employees for accrued vacation time when the employee is terminated.

However, Indiana does say that vacation policies are generally left up to employers. Employers can specify conditions that employees must meet to receive vacation accrual pay.

Louisiana PTO laws

Louisiana law requires employers who offer paid vacation to employees to pay out accrued time upon termination.

Maryland PTO laws

The state does not require employers to pay employees for accrued time off. However, Maryland requires employers to pay employees for unused vacation time if the employer does not have a forfeiture policy that says otherwise.

You can learn more about Maryland’s vacation pay payout rule by consulting their website.

Massachusetts PTO laws

Although employers cannot force employees to forfeit their earned time, they can set use-it-or-lose-it policies. Employers can set an expiration date on accrued vacation as long as it’s reasonable. And, employers can cap the amount of vacation time employees accrue or earn.

Massachusetts employers must provide accrued vacation pay to terminated employees.

For more information, check out Massachusetts’ advisory on vacation policies.

Montana PTO laws

Employers who offer paid vacation time cannot establish use-it-or-lose-it policies. However, they can set a cap that limits how much an employee can accrue.

Under Montana law, employers must pay employees for any accrued vacation time upon termination.

Check out Montana’s state website to learn more about their payout laws.

Nebraska PTO laws

If you are a Nebraska employer, you cannot establish a use-it-or-lose-it policy for your business.

When an employee is terminated, their employer must pay them for earned and unused vacation time.

To learn more about PTO payout laws, visit Nebraska’s website.

New York PTO laws

New York does not require employers to pay employees for accrued time off. However, employers must give employees advance notice of any implemented use-it-or-lose-it policy.

View New York’s website for more information on PTO payout.

North Carolina PTO laws

North Carolina does not require employers to pay employees for accrued time off. Employers must pay employees for accrued vacation at the time of termination if their policy doesn’t address what happens to it.

For more information on employee PTO payout rights in North Carolina, check out their website.

North Dakota PTO laws

Although North Dakota law says that employees are entitled to unused vacation pay when they are terminated, there are some exceptions.

Employers with employees who voluntarily leave can withhold accrued vacation pay if the:

- Employer provided the employee with a written notice about PTO payout conditions

- Employee has worked for the employer for less than one year

- Employee gave the employer less than five days notice

You can view more information about North Dakota’s laws on their website.

Oregon PTO laws

According to Oregon’s website, you may need to include accrued vacation time in an employee’s final wages depending on your policy.

Rhode Island PTO laws

Rhode Island does not address use-it-or-lose-it laws. However, the state says that employers must pay accrued vacation pay if the employee has worked there for at least one year.

Learn more on Rhode Island’s state website.

Wisconsin PTO laws

Employers can decide whether or not to provide accrued vacation pay upon termination. However, employers who do not include a written forfeit policy are generally on the hook for paying unpaid vacation.

View Wisconsin’s website for more information on PTO payout.

Wyoming PTO laws

Wyoming does not require employers to pay employees for accrued time off. Employers must pay terminated employees for accrued vacation time if they do not have a written forfeiture policy in place that has been acknowledged by the employee.

Check out Wyoming’s state website to learn more.

Use-it-or-lose-it PTO vacation policy by state chart

Check out our easy-to-read chart below to see whether you can implement a use-it-or-lose-it PTO vacation policy. And, find out if your state requires you to pay employees for unused vacation time when they leave your business.

Keep in mind that many states do not address accrued vacation payout. Generally, this means employers are free to implement use-it-or-lose-it policies or refuse to offer PTO payout at termination. However, you should consult your state to make sure you are compliant with restrictions and ever-changing policies.

And again, even if your state does not ban use-it-or-lose-it policies or require PTO payout, you must do so if you say you will in your policy.

| State | Does the State Have a Law Banning Use-it-or-lose-it Policies? | Does the State Require That Employers Provide PTO Payout at Termination? |

|---|---|---|

| Alabama | No | No |

| Alaska | No | No |

| Arizona | No | No |

| Arkansas | No | No |

| California | Yes | Yes |

| Colorado | Yes | Yes |

| Connecticut | No | No |

| Delaware | No | No |

| D.C. | No | No |

| Florida | No | No |

| Georgia | No | No |

| Hawaii | No | No |

| Idaho | No | No |

| Illinois | No* | Yes |

| Indiana | No | Yes |

| Iowa | No | No |

| Kansas | No | No |

| Kentucky | No | No |

| Louisiana | No | Yes |

| Maine | No | No |

| Maryland | No | No* |

| Massachusetts | No* | Yes |

| Michigan | No | No |

| Minnesota | No | No |

| Mississippi | No | No |

| Missouri | No | No |

| Montana | Yes | Yes |

| Nebraska | Yes | Yes |

| Nevada | No | No |

| New Hampshire | No | No |

| New Jersey | No | No |

| New Mexico | No | No |

| New York | No* | No |

| North Carolina | No | No |

| North Dakota | No* | No* |

| Ohio | No | No |

| Oklahoma | No | No |

| Oregon | No | No |

| Pennsylvania | No | No |

| Rhode Island | No | Yes |

| South Carolina | No | No |

| South Dakota | No | No |

| Tennessee | No | No |

| Texas | No | No |

| Utah | No | No |

| Vermont | No | No |

| Virginia | No | No |

| Washington | No | No |

| West Virginia | Yes | No |

| Wisconsin | Yes | No* |

| Wyoming | Yes | No |

*Please refer to the state sections above for specifics.

Quick tips for handling unused vacation pay

Here are a few steps you can take to comply with PTO payout laws by state and keep your employees happy:

- Understand your state’s PTO payout laws

- Consult your state for verification

- Create a written paid time off policy detailing how time is accrued and what employees can do with accrued time

- Include your time off accrual policy in your employee handbook

- Follow your business’s policy

- Calculate the employee’s accrued PTO and pay the employee for that time, if applicable

This article has been updated from its original publication date of August 28, 2019.

This is not intended as legal advice; for more information, please click here.