Did an employee leave your business? It’s time to whip out your employee termination checklist to see what you need to do. And one of the responsibilities on said checklist is giving terminated employees their final paycheck. But, how soon do you need to pay their final paycheck? Cue final paycheck laws by state.

Read on to learn about (and comply with) final paycheck laws.

General rules for a final paycheck for a terminated employee

Regardless of whether you fire an employee or they quit, you must give them their last paycheck.

The final paycheck should contain the employee’s regular wages from the most recent pay period, along with other types of compensation, such as accrued vacation, bonus, and commission pay.

You may be able to withhold money from the employee’s last paycheck if they owe your business and you have written authorization to do so. For example, an employee may still owe you money from a salary advance agreement. Be sure to check with your state before doing this.

You cannot withhold unpaid wages that the employee earned, even if you fired them. And, you cannot attach a condition of receipt to the final paycheck.

Although last paycheck laws vary by state, giving a terminated employee their final paycheck on their last day can simplify your responsibilities. That way, you don’t need to mail the paycheck or have the employee pick it up from your business at a later date.

Keep in mind that the employee’s final paycheck isn’t the same thing as severance pay. Severance pay is money you give to an employee for a certain length of time after they lose their job. Unlike a final paycheck, severance pay is negotiable. And, you may require employees to sign something saying they won’t sue your business if they accept severance pay.

Final paycheck laws by state

No federal final paycheck law requires employers to give employees their wages immediately.

However, some states require the employer to provide a terminated employee’s final paycheck immediately or within a certain time frame, such as the following payday.

And in some states, the final paycheck laws depend on whether the employee was fired or quit.

As an employer, you must follow your state’s final paycheck laws. Failing to do so can result in penalties or even a lawsuit. Beyond when the last paycheck is due, your state might set further regulations on things like paying out unused vacation pay.

Termination pay laws by state: Chart

Take a look at the following chart for last paycheck laws, for both employees who quit and employees you fire. Keep in mind that state laws can change, so check with your state for more information (using the handy links provided below!).

| State | Final Paycheck Deadline for Fired Employees | Final Paycheck Deadline for Employees Who Quit |

|---|---|---|

| Alabama | None | None |

| Alaska | 3 working days after the employee’s day of termination | Next payday that’s at least 3 working days after the employee’s last day |

| Arizona | 7 working days or the next regular payday (whichever comes first) | Next payday |

| Arkansas | Next payday (employers owe double the wages due if wages are not paid within 7 days of payday) | Next payday |

| California | Immediately at the time of termination (with exceptions for seasonal employees in certain industries) | Immediately if the employee gives at least 72 hours prior notice; 72 hours after quitting if the employee gives no notice |

| Colorado | Immediately (with some exceptions) | Next payday |

| Connecticut | Next business day | Next payday |

| D.C. | Next working day | Next payday or within 7 days of resignation date, whichever is earlier |

| Delaware | Next payday | Next payday |

| Florida | None | None |

| Georgia | None | None |

| Hawaii | Immediately, or next working day | Next payday, or immediately if the employee gave at least one pay period’s advance notice |

| Idaho | Next payday or 10 business days, whichever is earlier | Next payday or 10 business days, whichever is earlier |

| Illinois | Immediately if possible, but if not, next payday | Immediately if possible, but if not, next payday |

| Indiana | Next payday | Next payday |

| Iowa | Next payday | Next payday |

| Kansas | Next payday | Next payday |

| Kentucky | Next payday or 14 days, whichever is later | Next payday or 14 days, whichever is later |

| Louisiana | Next payday or 15 days after the discharge date, whichever is earlier | Next payday or 15 days after the discharge date, whichever is earlier |

| Maine | Next payday | Next payday |

| Maryland | Next payday | Next payday |

| Massachusetts | Immediately (in most circumstances) | Next payday |

| Michigan | Next payday (with exceptions for certain industries) | Next payday |

| Minnesota | Within 24 hours of a written demand for payment | Next payday. If the payday is within 5 days of the last day of work, employers have up to 20 days. |

| Mississippi | None | None |

| Missouri | Immediately | None |

| Montana | Immediately within 4 hours or end of the business day (whichever occurs first) | Next payday or 15 days, whichever is earlier |

| Nebraska | Next payday or within 2 weeks, whichever is earlier | Next payday or within 2 weeks, whichever is earlier |

| Nevada | Within 3 days | Next payday or within 7 days, whichever is earlier |

| New Hampshire | Within 72 hours | Next payday |

| New Jersey | Next payday | Next payday |

| New Mexico | Within 5 days; task, piece, and commission wages due within 10 days | Within 5 days; task, piece, and commission wages due within 10 days |

| New York | Next payday | Next payday |

| North Carolina | Next payday | Next payday |

| North Dakota | Next payday | Next payday |

| Ohio | Next payday or within 15 days, whichever is earlier | Next payday or within 15 days, whichever is earlier |

| Oklahoma | Next payday | Next payday |

| Oregon | Next business day | On the last day of employment if the employee gave 48 hours notice; within 5 working days or the next payday (whichever comes first) if employees did not give 48 hours notice |

| Pennsylvania | Next payday | Next payday |

| Rhode Island | Next payday | Next payday |

| South Carolina | Within 48 hours or next payday, not exceeding 30 days | Within 48 hours or next payday, not exceeding 30 days |

| South Dakota | Next payday | Next payday |

| Tennessee | Next payday or within 21 days, whichever occurs last | Next payday or within 21 days, whichever occurs last |

| Texas | Within 6 calendar days | Next payday |

| Utah | Within 24 hours | Next payday |

| Vermont | Within 72 hours | Next payday or the following Friday |

| Virginia | Next payday | Next payday |

| Washington | Next payday | Next payday |

| West Virginia | Next payday | Next payday |

| Wisconsin | Next payday | Next payday |

| Wyoming | Next payday | Next payday |

Make sure to consult your state government for more information. Your state might:

- Have more restrictive final paycheck laws for some circumstances

- Make exceptions if you have a written contract or agreement with an employee

- Let employees request earlier payment

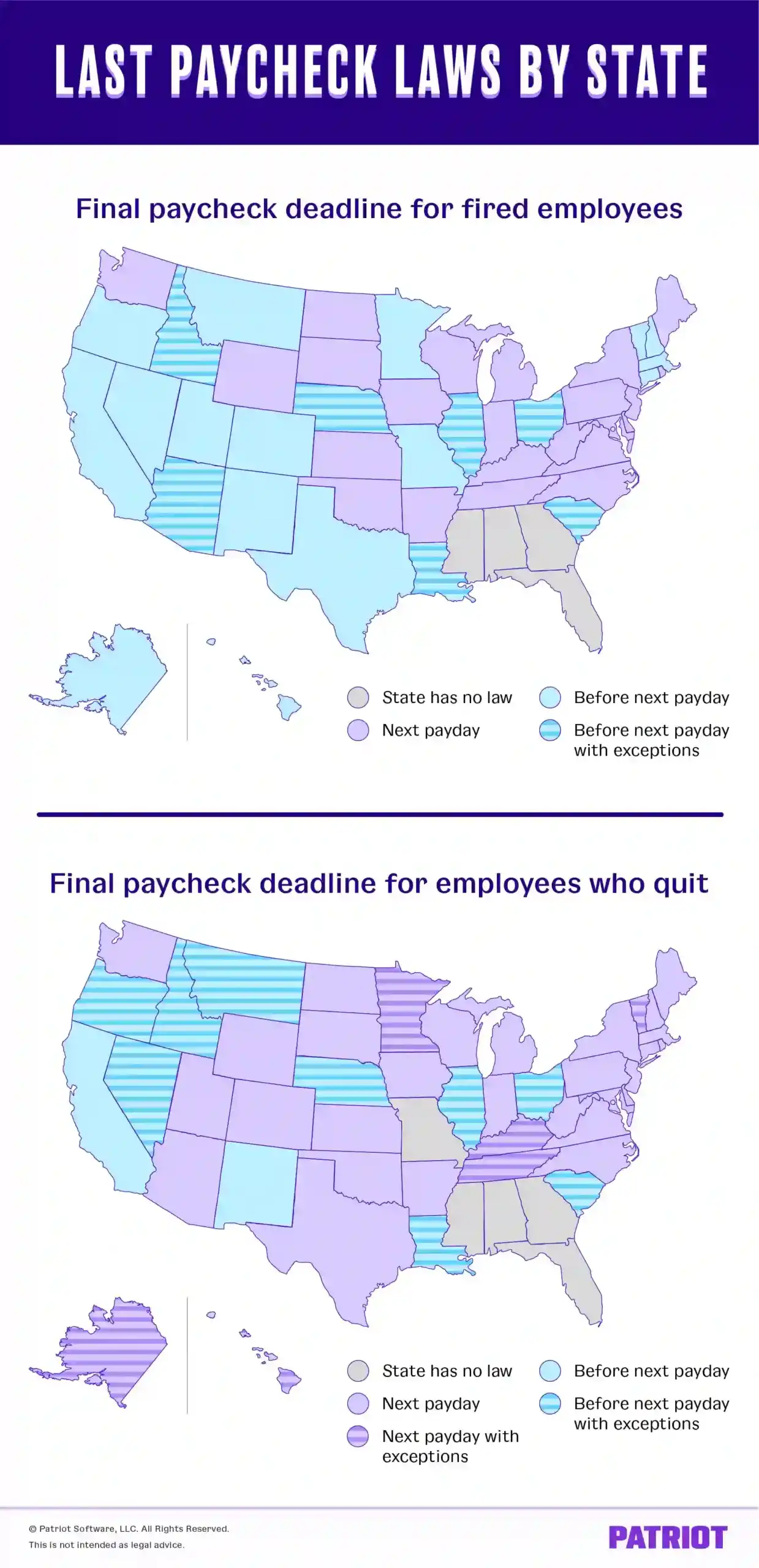

Final paycheck laws by state: Map

Use our quick-reference map to find your state’s final paycheck laws.

Looking for an easy way to run payroll? Patriot’s online payroll software lets you run payroll using a simple three-step process. And, we offer free setup and support. Get your free trial now!

This article has been updated from its original publication date of October 15, 2018.

This is not intended as legal advice; for more information, please click here.