Hired your first employee? Check. Set a start date? Check. Ready to process payroll? Not quite yet. Before you can start paying your employees, there are a few steps you need to know and some terms to learn. This handy payroll 101 guide explains how to set up payroll the right way so you can breathe easier and get back to business.

Before you run payroll

Before running your first payroll, you have some preparation to do. Luckily, most of the tasks are ones you only have to do once.

Gathering payroll information

You need to gather some payroll information and register for accounts before running payroll. Each of these accounts is required to run payroll and pay taxes. Here are some things you need to register for:

- Employer Identification Number (EIN)

- Electronic Federal Tax Payment System (EFTPS) account

- State tax accounts (e.g., state unemployment insurance)

- New hire reporting account from the state

- Workers’ compensation coverage

This is not an all-inclusive list. Your state may require you to register for additional payroll-related accounts. Contact your state for more information.

After you gather all your employer information, you also need to get paperwork and details from your employee to run payroll.

Each employee must fill out Form W-4, Employee’s Withholding Certificate. On the form, the employee enters information that affects how much federal income tax you withhold from their wages. Depending on where your business is located, your employee might also need to fill out a state withholding form.

If you offer small business employee benefits, you need the benefits election information for each employee. You need to know how much you must withhold for the benefits and whether the deductions are pre-tax vs. post-tax.

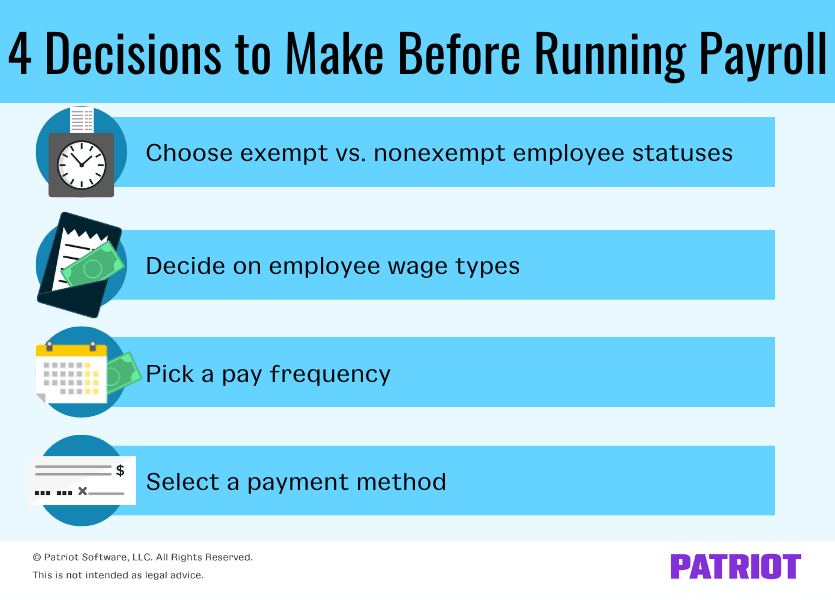

Making payroll decisions

Have all of your employer and employee information sorted out? Good. Now that you know your employer accounts and employee withholding details, it’s time to make a few other payroll decisions.

Exempt vs. nonexempt

First, determine if an employee is exempt vs. nonexempt from overtime wages. To be exempt under federal guidelines, an employee must fall under one of the following exemptions:

- Executive, administrative, or professional exemption

- Computer exemption

- Outside sales exemption

- Highly compensated employee exemption

If the employee does not meet one of the above exemption types, the employee is generally nonexempt, and you must pay the employee overtime wages for overtime hours worked. Some states require stricter criteria than the federal government. Check with your state for more information.

Employee wages

After determining if an employee is exempt or nonexempt, decide if you will pay an employee a salary vs. hourly wages. If your employee is exempt, you must pay the employee a salary. But if your employee is nonexempt, you can choose whether you pay a salary or an hourly wage.

Also, decide if your employee will earn other wages, such as tips or commissions.

Pay frequency

Pick a pay frequency. The pay frequency determines how often you pay your employee. Common frequencies include weekly, biweekly, semimonthly, and monthly.

Again, your state may have more information about how often you must pay employees. Learn the pay frequency by state rules or check with your state directly.

Payment method

Do you know how you will pay your employees and how often? Now it’s time to select how you will give the employee their paychecks.

You can pay your employee with a written or printed check, direct deposit, cash, or payroll card. If you use direct deposit, you will need extra information to complete your payroll, such as your business’s bank account number and routing number. If you decide to use direct deposit to pay your employees, collect their banking information, too.

Setting up a payroll system for small business

Once you get all the necessary information and make your payroll decisions, it’s time to start setting up payroll. When setting up payroll for small business, you can either hire an employee or accountant, do payroll by hand, or use online payroll software. Payroll software is less expensive than hiring someone and less time exhaustive than doing payroll by hand. When choosing a payroll system, make sure to compare costs, features, and support.

Add all your payroll information (e.g., employee withholding and payment info) to whatever system you use. That way, you are prepared the first time you need to run payroll.

After completing how to set up payroll for small business, you are ready to run payroll.

Running payroll 101

When you reach the end of a pay period, it’s time to run payroll. How you run payroll depends on what payroll method you use. Despite the differences, there are generally three steps of running payroll.

1. Gathering information, entering hours, and making calculations

First, gather and calculate employee hours and wages. You need to know how many hours your employee worked during the pay period. Consider using time and attendance software for small business to help with employee attendance management.

You also need to know your employee’s hourly wage or pay period salary. Using that information, calculate the employee’s earnings. Ensure you include overtime wages and any other earnings (e.g., commission).

After calculating the employee’s gross wages earned, subtract taxes and other deductions ( we’ll get to that later).

If you use payroll software, the software will automatically calculate your employee’s wages and withholdings.

2. Approving payroll

When the calculations are done, double-check the results for accuracy. This step is easy to skip over, but you shouldn’t.

If you do manual payroll calculations, make sure you did the math correctly. If you use payroll software, check to make sure you entered the numbers correctly (e.g., 40 hours instead of 400).

When you are approving payroll, look over the paycheck totals. The net pay and the withholdings should be the same or similar to previous paychecks.

Check to ensure that all withholdings are deducted from the employee’s paycheck before approving payroll.

3. Paying your employee

After you approve payroll, you need to get the wages to your employee. Use the payment method you chose earlier to distribute the wages (e.g., direct deposit).

Payroll taxes

As an employer, you must withhold and contribute to employment taxes. The main taxes you need to know about include:

- Social Security and Medicare taxes

- Federal, state, and local income taxes

- Federal and state unemployment taxes

Each tax has its own rate and rules. Check them out in the chart below:

| Tax | Tax Rate | Wage Cap | Who Pays? |

|---|---|---|---|

| Social Security Tax | 6.2% (Employee) 6.2% (Employer) | $168,600 (2024) | Employee Employer |

| Medicare Tax | 1.45% (Employee) 0.9% (Additional Medicare tax, employee only) 1.45% (Employer) | No wage cap Additional Medicare tax starts at: $250,000 if married filing jointly $125,000 if married filing separately $200,000 for everyone else | Employee Employer (Only the employee owes additional Medicare tax) |

| Federal Income Tax | Varies based on employee’s income and withholding adjustments | No wage cap | Employee |

| State and Local Income Tax | Varies by state and locality (Does not apply to all states and localities) | No wage cap | Employee |

| Federal Unemployment Tax (FUTA tax) | 6% (0.6% with tax credit) | $7,000 | Employer |

| State Unemployment Tax/Insurance (SUTA tax) | Varies by state | Varies | Employer In some states, both employee and employer |

After you withhold the taxes, you have to deposit them on a regular basis. There are also forms you need to fill out as an employer. Here is what you need to know about depositing and filing payroll taxes:

| Tax | Deposit Frequency | How to Deposit | Form to File | Filing deadline |

|---|---|---|---|---|

| Social Security, Medicare, and Federal Income Tax | Monthly or semiweekly (Depends on a lookback period) | Electronic funds transfer using EFTPS, a tax professional, or a payroll tax filing service | Form 941 (Quarterly) OR Form 944 (Annual), if applicable | Quarterly: April 30 July 31 October 31 January 31 Annually: January 31 |

| State and Local Income Tax | Varies | Varies | Varies | Varies |

| Federal Unemployment Tax (FUTA tax) | Quarterly, due on: April 30 July 31 October 31 January 31 | EFTPS, a tax professional, or a payroll service | Form 940 | January 31 |

| State Unemployment Tax/Insurance (SUTA tax) | Varies | Varies | Varies | Varies |

Check the IRS website and your state tax website for more information about employment taxes.

Form W-2

At the end of every year, you must send Form W-2, Wage and Tax Statement, to your employees and the federal and state governments. Form W-2 summarizes what you paid your employee during the year. The form also lists how much you withheld for each tax.

You must send Form W-2 to the employee, the Social Security Administration (SSA), and your state government (if required) by January 31 each year. Also, send Form W-3, Transmittal of Wage and Tax Statement, with the copy of Form W-2 you send to the SSA.

This article has been updated from its original publication date of March 13, 2017.

This is not intended as legal advice; for more information, please click here.