As a business owner, part of the job is managing a lot of different records. From tax records to accounting records, it can be quite a bit to keep up with. And when you hire employees and become an employer, it adds employee payroll records into the mix. Read on to learn all about payroll records, what they include, and how to keep payroll records.

What are payroll records?

So, what is a payroll record? Payroll records are documents that have anything to do with paying an employee. Employers must keep payroll documents and records for every employee.

Payroll records can be related to:

- Withholding forms

- Payroll taxes

- Benefits and deductions

- Hours worked

- Time off

- Gross wages

- Pay rate

Organizing your payroll records can make it easy to find information when you’re in a pinch. Instead of searching through a bunch of files to find payroll information for employees, you can easily access all of the documents you need in one place.

Keeping a payroll file for each employee not only helps you stay organized, but also compliant. According to the Fair Labor Standards Act (FLSA) and Equal Employment Opportunity Commission (EEOC), you must keep tidy wage records for both exempt and nonexempt employees.

Payroll recordkeeping also helps make sure your employees’ payroll processing records are secure. Payroll records contain a lot of sensitive and confidential information (e.g., Social Security numbers, addresses, etc.). So, it’s crucial to keep payroll documents separate from other employment information and limit who has access to them. And, you should keep separate files for each employee.

What do employee payroll records include?

So, what should be in an employee’s payroll file? Well, there’s a lot of documents that you should store for safekeeping. But here’s the general rule of thumb: If something helps you run payroll for an employee, put it in the payroll file.

Generally, here are the documents you should include in each employee’s payroll record:

- General information

- Employee name

- Address

- Social Security number (SSN)

- Birthdate

- Occupation

- Tax withholding forms

- Form W-4

- State W-4 form

- Other withholding forms, if applicable

- Time and attendance records

- Time cards

- Total hours worked each day and week

- Time and day when work week begins

- Time off history

- Remaining time off

- Payroll records

- Termination/separation documents, if applicable

- Final paycheck information

Where should you keep employee payroll information?

There are a couple of different ways you can store payroll documentation. Depending on your preferences, you may decide to:

- Keep paper copies (e.g., filing cabinet)

- Use electronic storage methods (e.g., store on computer)

If you decide to go the paper copy route, make sure to keep records in a secure location, such as a locked filing cabinet. Keep records organized by using folders and files. And, have backup records just in case something happens to the original files.

You can electronically store employee payroll documents on your computer, smartphone, or tablet or by using payroll or HR software. If you store information digitally, make sure to also have backup copies in case your device or software crashes. And, use a secure software or digital filing method to store your employee documents.

Regardless of which method you choose, only allow authorized people (e.g., managers) to have access to employee payroll records.

How long to keep payroll records

According to the FLSA, you must keep payroll records for at least three years (e.g., wages paid, benefits, etc.). And, store wage computation records (e.g., time cards, work schedules, etc.) for at least two years. Hold onto employment tax documents (e.g., Forms W-4) for at least four years. You can keep payroll records longer, if you’d like. However, you must maintain them for as long as the FLSA tells you to.

Keep in mind that your state might also have laws of payroll recordkeeping. Depending on your state, you may need to store employee records for longer than the FLSA’s requirements. Check with your state to find out how long you need to retain an employee payroll record.

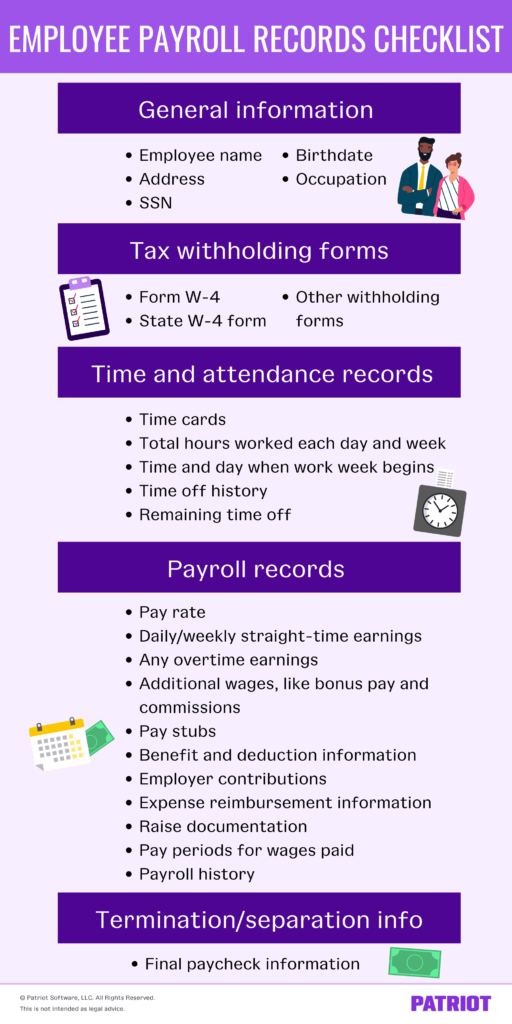

Employee payroll records checklist

Not sure what exactly to keep in your records? Use our employee payroll file checklist to keep your employees’ payroll documents neat and organized:

Need help organizing your employee payroll records? Patriot’s payroll software has you covered. Our online payroll allows you to easily view payroll history, employee information, and much more. And, our HR software add-on makes it a breeze to upload and store records and share them with employees. Try both for free today!

This article has been updated from its original publication date of April 19, 2017.

This is not intended as legal advice; for more information, please click here.