As an employer, you’re responsible for withholding certain taxes from employees’ wages. One of the taxes you may need to withhold is local income tax. Read on to get the scoop on this tax, and learn how to calculate local income tax.

What is local income tax?

Before you learn all about how to calculate local tax, you need to know exactly what local taxes are. Here’s a brief rundown of what local tax is.

Local governments in a number of states impose a local income tax in addition to federal and state income taxes. In most cases, local income taxes apply to individuals who work or live in a specific locality or area. Generally, local taxes fund local programs and communities (e.g., parks).

It’s the employer’s responsibility to know whether or not to withhold local income taxes from employee wages. Depending on the locality, you may need to withhold local taxes from employee wages (e.g., school district tax) and deposit them. Or, you may be required to pay local income taxes as an employer.

Local income taxes can either be permanent or temporary depending on what they are funding. And, local income tax rates can vary. A local income tax rate can be a flat rate across all income levels (e.g., 2% local tax on wages) or a progressive rate. A progressive local tax rate increases as an individual’s income increases. Some localities may also require workers to pay a flat dollar amount per paycheck, regardless of how much they make (e.g., $30 for local tax per pay period).

Keep in mind that local tax rates and rules vary by locality. Check with your local tax department to ensure you are compliant with local tax laws and requirements.

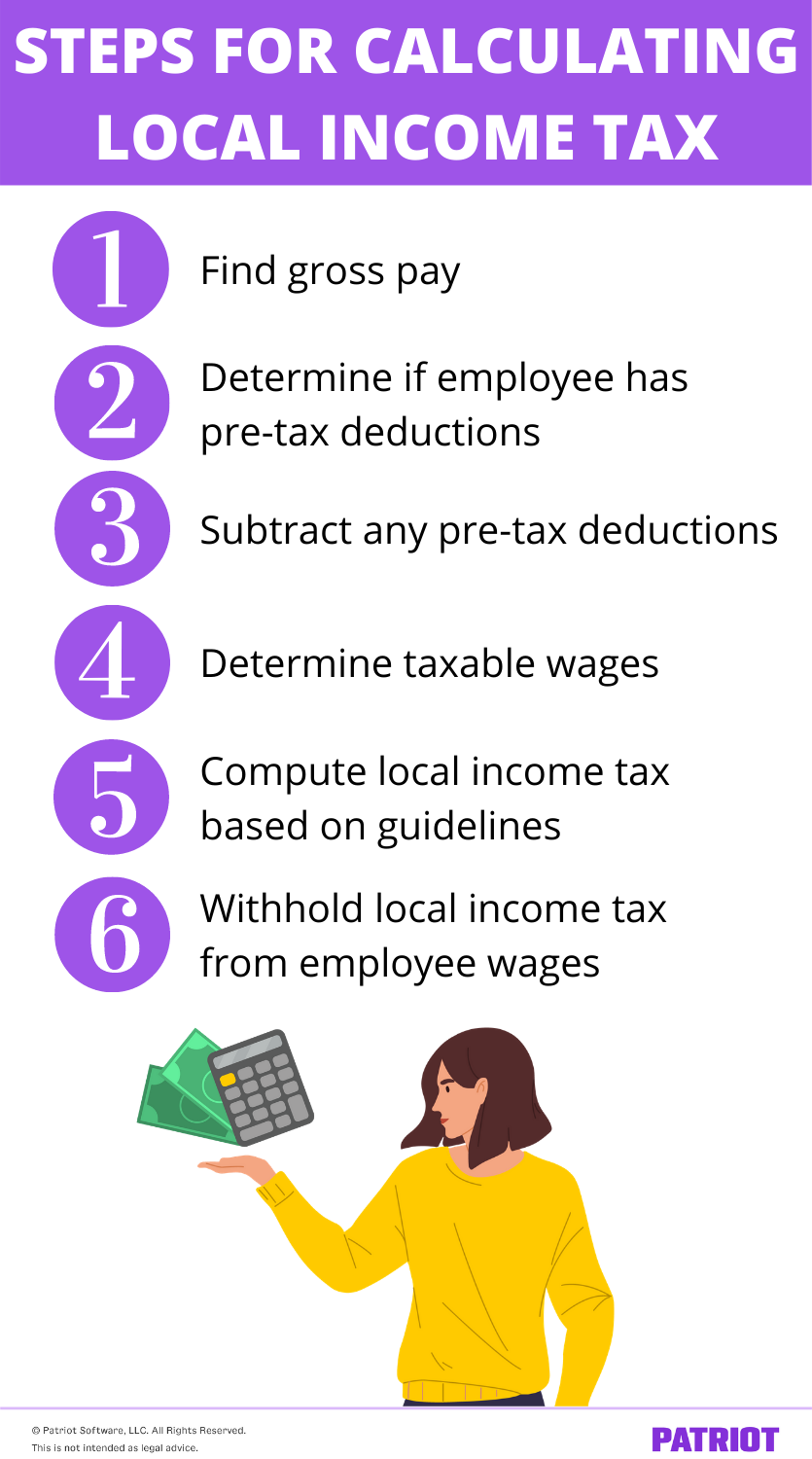

How to calculate local income tax: 6 steps

Calculating local income tax is a pretty straightforward process. Before you begin calculating any local taxes, confirm tax rates with your local tax office. That way, you can ensure your calculations and withholdings are accurate.

Here’s the part you’ve all been waiting for (drum roll, please). Use the six steps below to learn how to calculate local income taxes for withholding.

1. Find gross pay

First things first, calculate your employee’s gross wages. Gross pay is the total amount of money an employee earns before any deductions, taxes, or other withholdings.

How you calculate gross pay depends on whether the employee is hourly or salaried. To find gross income for hourly employees, use the following formula:

Hourly Gross Pay = Hourly Rate X # of Hours Worked During the Period

Include any overtime pay with the gross wages. If the hourly employee is eligible for overtime pay, multiply any overtime hours (hours over 40 for the week) by 1.5 (time-and-a-half).

Calculating a salaried worker’s gross wages depends on how frequently you pay them. For example, if you pay a salaried employee weekly, insert 52 for the “number of pay periods in the year” in the formula below.

Salaried Gross Pay = Annual Salary Amount / # of Pay Periods in the Year

To calculate for a salaried worker paid biweekly, divide by 26. Divide by 24 if you pay any salaried workers semimonthly. And, if you need to calculate a salaried employee’s gross wages who gets paid monthly, divide the employee’s annual salary by 12.

2. Determine if employee has pre-tax deductions

Does your employee have any pre-tax deductions? If the answer is yes, take those into consideration when calculating local income tax. Generally, pre-tax deductions can lower taxable wages.

Before you move on to the next step, determine whether or not the employee has pre-tax deductions. Pre-tax deductions can include:

- Health insurance

- HSAs and FSAs

- Life insurance

- Some retirement plans (e.g., 401(k) plan)

To learn if pre-tax deductions are taken before figuring local income tax, contact your local tax assessor or state revenue agency. In some cases, pre-tax deductions are not deducted before local income tax withholding.

3. Subtract any pre-tax deductions

Calculate any pre-tax deductions not subject to local income tax withholding from your employee’s gross pay before withholding local income tax. If pre-tax deductions are not subject to local taxes, subtract them from gross wages.

4. Determine taxable wages

Determine taxable wages if the employee has deductions that are subject to local income tax withholding.

For example, in Pennsylvania, you must include 401(k) contributions in state and local income tax withholding. Therefore, you would need to subtract local income tax withholding from the employee’s gross wages before you deduct the 401(k) contributions.

5. Compute local income tax based on guidelines

Calculate local income tax based on your local tax agency’s guidelines. Depending on the locality, you may need to withhold specific local taxes, like school district tax.

If you haven’t already, find out what the local tax rate is and whether it is a flat rate (2%), dollar amount ($2), or progressive rate.

Depending on how the local tax rate works (e.g., progressive), you may need the appropriate tax withholding table from the city, county, or locality to calculate the local income tax amount.

Take a look at how you would handle calculating local income tax based on the local tax rate methods:

- Flat rate (percentage): Multiply the flat rate by the employee’s taxable wages

- Dollar amount: Subtract the dollar amount from the employee’s taxable income

- Progressive rate: Use tax withholding tables to determine employee’s local withholding

In some cases, the employee may need to complete and submit a current local tax form showing their city of residence and other tax filing information.

When it comes to calculating local income tax, there is no universal formula. Every tax jurisdiction is different. Consult your local tax authority if you have any questions about calculating local taxes.

6. Withhold local income tax from employee wages

After you calculate the employee’s local income tax amount, withhold it from their wages along with other withholding and payroll taxes. Then, remit the local taxes to the correct tax authority.

If you’re responsible for paying any employer local taxes that aren’t withheld from employee wages, calculate and remit them to the proper tax agencies, too.

Other things to keep in mind about local income taxes…

To help simplify the local income tax process, you can:

- Use payroll software

- Have a separate bank account for taxes

- Keep detailed records of local taxes

Payroll software can help you streamline the process of withholding local income taxes by handling the calculations for you. And, full-service payroll software can even handle the filing and remitting of taxes for you.

To keep your local taxes neat and organized, consider opening a separate bank account specifically for taxes. That way, you don’t mix up your tax money with your other business funds.

Finally, all businesses need to keep detailed records of local taxes (and other business and payroll taxes) in case of an audit. You can keep your records organized in a filing cabinet or by using a digital storage system.

Do you need help figuring out your local tax obligations? Our Full Service payroll services will calculate how much to withhold from employee wages, and we will submit the taxes for you. Try it for free today!

This article is updated from its original publication date of March 2, 2015.

This is not intended as legal advice; for more information, please click here.