When it comes to running payroll, you have a lot of things to mark off on your to-do list. From gathering timesheets to distributing pay stubs, there can be a lot of steps that go into paying your employees. But after you pay employees, your payroll checklist isn’t finished just yet. You also need to file payroll reports. Keep reading to find out what is a payroll report and which forms you’re responsible for filing.

What are payroll reports?

A payroll report is a document employers use to notify government agencies (e.g., IRS) about payroll and employment tax liabilities. Payroll reports summarize payroll data, such as:

- Wages paid to employees

- Federal income taxes withheld

- Medicare tax

- Social Security tax

- Reported tips

- Additional taxes withheld

- Unemployment taxes

The form you must use to report your business’s liabilities depends on the type of tax. Use payroll reports to report the taxes you contribute to as an employer and the payroll taxes you withhold from employee wages. For example, you need to report both the employee and employer portions of Social Security and Medicare taxes.

Your payroll reports can help you, lenders, and government agencies analyze your business’s payroll costs. And, they can help you out when applying for a business loan.

Types of payroll reports for businesses

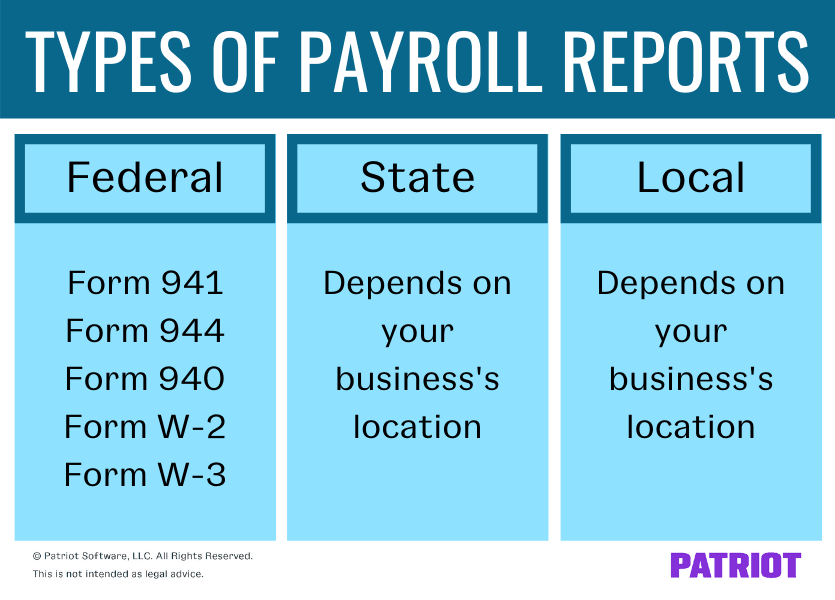

Some taxes have their own payroll reports while others are combined on different forms. Reports may be federal, state, or local, depending on the tax. And, some payroll report filings are due more frequently than others (e.g., quarterly and annually).

To ensure you’re filing the correct forms for your business, check out a rundown of the common payroll reports below.

Federal payroll reports

There are a number of federal payroll reports you need to file. You typically file federal payroll reports with the IRS. Depending on the type of report, you may need to file it more frequently (e.g., quarterly) or less frequently (e.g., annually). Let’s take a look at some federal payroll reports, shall we?

Quarterly payroll reports

One payroll report many business owners need to file quarterly is Form 941, Employer’s Quarterly Federal Tax Return.

Use Form 941 to report employee wages and payroll taxes each quarter. Include the following information on Form 941:

- Wages paid to employees

- Federal income taxes withheld

- FICA tax (both employee and employer contributions)

- Reported tips

- Additional taxes withheld

If you took advantage of coronavirus-related relief measures, such as paid sick or family leave wages, report this information on your 941, too.

Mail or e-File Form 941 each quarter. The form is due by the last day of the month following the end of a quarter. If a deadline falls on a weekend, the form is due by the next business day. Check out a full list of the Form 941 deadlines:

- April 30 for Quarter 1

- July 31 for Quarter 2

- October 31 for Quarter 3

- January 31 for Quarter 4

If you’re an employer and are not exempt from filing Form 941, be sure to learn how to fill out Form 941 correctly.

Annual payroll reports

There are a variety of annual reports you may need to file with the federal government. These include the following forms:

- 944

- 940

- W-2

- W-3

Form 944

Form 944, Employer’s Annual Federal Tax Return, is used for the same purpose as the quarterly 941: to report employee wages, withheld federal income, and FICA taxes. However, businesses file Form 944 annually instead of quarterly.

Employers cannot file both Form 944 and Form 941. In fact, only certain businesses can file Form 944. Form 944 was made specifically for small businesses with a lower tax liability. The IRS tells you if you need to file a 944 form. Generally, the IRS will tell you to file Form 944 if your annual liability for Social Security, Medicare, and federal income taxes is $1,000 or less for the year.

Again, you cannot file Form 944 if the IRS did not tell you to. If you suspect that you should file Form 944 instead of Form 941, contact the IRS.

If you’re required to file Form 944, mail or electronically file the form with the IRS by January 31 each year.

Form 940

Form 940, Employer’s Annual Federal Unemployment Tax Return, is an annual form employers file to report their federal unemployment tax (aka FUTA tax) liability.

FUTA tax is an employer-only tax. This means that you do not withhold federal unemployment tax from employee wages.

File Form 940 if you did one of the following:

- Paid at least $1,500 in wages to any employee during the standard calendar year

- Had an employee (temporary, part-time, or full-time) work anytime during 20 or more weeks

Although most employers have to pay into FUTA tax, some are exempt from it (e.g., tax-exempt organizations). If you are exempt from FUTA tax, you do not need to file Form 940 each year.

If you’re responsible for paying FUTA tax, file Form 940 annually to report FUTA tax payments. File Form 940 online or mail it to the IRS by January 31 each year.

Form W-2

Use IRS Form W-2, Wage and Tax Statement, to report information about employees’ annual wages. Do not use Form W-2 to report independent contractor compensation.

File Form W-2 for each employee that you had during the calendar year (including the employees who no longer work for you). You are also responsible for sending a copy of the form to the Social Security Administration (SSA). And in some cases, you may need to file a copy with the state or local tax departments.

On the form, report the employee’s annual wages, tips, and other compensation and withheld taxes from the year.

Forms W-2 are due to your employees, the SSA, and other agencies (e.g., state) by January 31 each year. Be sure to keep a copy of each W-2 for your payroll records, too.

Form W-3

Form W-3, Transmittal of Wage and Tax Statements, summarizes information from Forms W-2. The information on Form W-3 should match your Forms W-2.

Send Form W-3 to the SSA along with Forms W-2. Do not send Form W-3 to your employees.

Form W-3 is also due by January 31 each year. You can either electronically file or mail the form to the IRS.

State payroll reports

Depending on where your business is located, you state may require you to file state payroll reports each quarter or year. Typically, state payroll reports for things like state income and unemployment taxes are due quarterly.

Although most states require you to file quarterly, check with your state for specific requirements and deadlines.

Keep in mind that due dates can vary from state to state, too. For example, one state might require you to file a quarterly form by the end of the following month after quarter-end, like Form 941. On the other hand, another state might require you to file a similar form by the 15th day of the following month.

To be safe and ensure you’re following the correct state requirements, check with your state for more information about state payroll report rules.

Local payroll reports

Along with state payroll reports, you may also be responsible for filing local payroll reports.

Depending on your business’s location, you or your employees may be subject to local payroll taxes. Therefore, you may need to also file local payroll reports on a regular basis (e.g., quarterly).

To ensure you’re complying with local laws, consult your locality for more information on local payroll report requirements.

Keeping up with payroll reports

To ensure you stay on top of your payroll reporting responsibilities and don’t miss any due dates, you can:

- Set reminders for yourself

- Mark your calendar

- Prepare forms ahead of time (looking at you, procrastinators)

- Use payroll software

Using payroll software can make filing payroll reports a breeze. With many payroll providers, you can access certain forms (e.g., Form 941) directly in your software, fill them out, and submit the forms to the proper agencies. Some providers, like Patriot Software, may even pre-fill the forms for you.

Depending on the payroll provider you have, you may be able to opt for a full-service payroll software option that files your payroll reports on your behalf.

If you use payroll software (or plan on using it), check with your provider to find out which payroll reports you will be responsible for handling.

Like the idea of using online payroll software to streamline the way you file your payroll reports and handle taxes? Patriot’s Full Service Payroll software collects, files, and remits federal, state, and local payroll taxes for you. Say goodbye to stressing over forms and hello to more free time for your business. Try it for free today!

This article has been updated from its original publication date of December 6, 2017.

This is not intended as legal advice; for more information, please click here.