As an employer, you’re well aware of which payroll taxes are paid by employers. You know you’re responsible for contributing to things like FICA, SUTA, and FUTA taxes. But how familiar are you with employees’ payroll tax liabilities?

Read on to find out the answer to Which payroll taxes are the employee’s responsibility? and check out a handy chart that breaks down the different employee payroll taxes.

What are payroll taxes?

As a brief refresher, payroll taxes are taxes that both employees and employers pay. Some payroll taxes, like Social Security tax, have both an employee and employer portion. Other payroll taxes, like federal income tax, are an employee-only tax.

There are many types of payroll taxes, including:

- Federal income tax

- State income tax

- Local income tax

- Social Security tax

- Medicare tax

- Federal unemployment tax (FUTA tax)

- State unemployment tax (SUTA or SUI tax)

- State-specific taxes

Regardless of whether the tax is contributed by the employee, employer, or both, employers are responsible for withholding the applicable payroll taxes and remitting them to the correct parties.

Which payroll taxes are the employee’s responsibility?

Now that you know a little more background information on payroll taxes, it’s time to learn who pays what.

Payroll taxes paid by employers are Social Security, Medicare, FUTA, and SUTA taxes.

Employees have a little bit heavier of a load when it comes to payroll taxes. Depending on the individual and where they’re located, employees might need to pay the following taxes:

- Social Security tax

- Medicare tax

- Federal income tax

- State income tax

- Local income tax

- SUI tax

- State-specific taxes

Take a look at each type of payroll tax you might need to withhold from employee wages below. Keep in mind that some of these payroll taxes depend on your employee’s locality.

Social Security tax

Social Security tax is paid by both the employee and employer. It is one part of FICA tax.

Social Security is a total flat percentage of 12.4%. The employee and employer split this percentage (6.2% each). You must withhold 6.2% from employee wages for the employee’s portion. As an employer, you must also contribute 6.2% for Social Security tax.

Employers must follow a Social Security wage base. A wage base is the maximum amount of an employee’s income you can tax. Not all payroll taxes have a wage base.

The Social Security wage base for 2022 is $147,000. This means you must stop withholding Social Security tax if an employee earns above $147,000. Keep in mind that the Social Security wage base is subject to change each year.

Medicare tax

Medicare tax is another employee and employer payroll tax. It makes up the other portion of FICA tax (along with Social Security tax).

Medicare tax is 2.9% and is split by you and your employee. Withhold 1.45% from employee wages for Medicare tax. And, you need to contribute 1.45% for the employer portion.

Unlike Social Security tax, Medicare tax does not have a wage base. However, once an employee reaches a certain amount of wages, you must withhold additional Medicare tax from their pay. You do not pay anything toward additional Medicare tax.

The additional Medicare tax rate is 0.9%. When an employee reaches one of the following thresholds, begin withholding 2.35% from their wages for Medicare tax (1.45% + 0.9%):

- Single: $200,000

- Married filing jointly: $250,000

- Married filing separately: $125,000

Federal income tax

Federal income tax is an employee-only tax and is different for every employee.

The amount of federal income tax you must withhold depends on the employee’s pay frequency, information on Form W-4, earnings, and whether they’re filing single or married.

In rare cases, some employees might be exempt from federal income tax. If an employee is tax-exempt, do not withhold federal income tax from their wages.

You can calculate federal income tax withholding by hand using IRS Publication 15. Use the withholding tables in the publication along with your employee’s information (e.g., filing status) to calculate federal income tax. To make the federal income tax withholding process simpler, consider using payroll software that automatically calculates the taxes for you.

State income tax

The majority of states (41 states and Washington D.C.) have a state income tax. If you employ workers in a state with income tax, you must withhold state income tax from their wages.

State income tax rates vary. Some states have single-rate structures (e.g., one flat tax for all pay levels). Other states have graduated-rate tax structures (e.g., tax brackets with multiple income levels).

Like with federal income tax withholding, some states allow employees to claim withholding exemptions to reduce the amount of state income taxes withheld.

The following states do not have income tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

New Hampshire and Tennessee only have income tax on dividend and interest income. They do not have state income tax on employment income.

Local income tax

Local governments in a number of states impose a local income tax on employees. Generally, local income taxes apply to employees who live or work in a certain locality.

As an employer, it’s your responsibility to know whether or not an employee falls under a certain locality. If an employee does live or work in an area with local tax, withhold the local tax from their wages.

In most cases, local income tax is withheld from employee wages and deposited by the employer. However, in some locations, local income tax is paid solely by the employer.

Some localities charge a flat rate across all income levels (e.g., 2%), while others have progressive local income tax rates that increase when an individual’s income level increases.

There are 16 states that charge some type of local income tax. These states include:

- Alabama

- Arkansas

- Colorado

- Delaware

- Indiana

- Iowa

- Kentucky

- Maryland

- Michigan

- Missouri

- New Jersey

- New York

- Ohio

- Oregon

- Pennsylvania

- West Virginia

Local taxes vary across different jurisdictions. Check your local laws to understand which local taxes (if any) you must withhold from employee wages.

SUI tax

If you’re an employer, you’ve likely heard of SUTA tax (also called SUI, state unemployment insurance, or reemployment tax) before.

In most states, SUI is an employer-only tax. But, three states require employers to withhold SUI tax from employee wages. Employees in the following states must contribute to SUI tax:

- Alaska

- New Jersey

- Pennsylvania

If you have employees in one of the states above, withhold SUI tax from their wages until they meet the state’s wage base.

State-specific taxes

Some states impose state-specific taxes that only apply to employees and/or employers in that state.

For example, Oregon has an Oregon statewide transit tax that employers must withhold from employee wages.

If your state has a state-specific tax, withhold it from employee wages, as long as they aren’t exempt from it.

Check with your state for more information about state-specific taxes and whether you need to withhold them from employee wages.

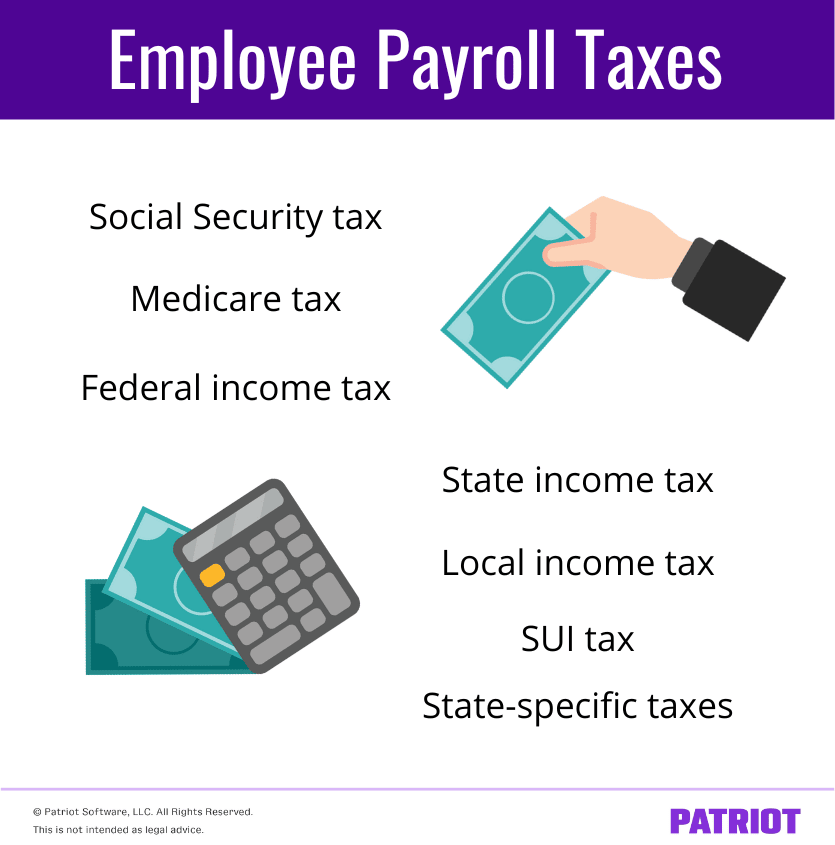

Breaking down employees’ payroll taxes

The above information can be a lot to soak up. To makes things a little easier to understand, check out a brief recap below of which payroll taxes are the employee’s responsibility.

| Payroll Tax | How much do you withhold from employee pay? |

|---|---|

| Social Security tax | 6.2% up to $147,000 in 2022 |

| Medicare tax | 1.45% and subject to an additional 0.9% rate after hitting a threshold |

| Federal income tax | Varies depending on filing status, pay rate, and pay frequency |

| State income tax | Rates vary and can either be a single-rate or graduated-rate tax structure |

| Local income tax | Varies depending on locality and can be a flat or progressive rate |

| SUI tax | Rates vary, and SUI applies to employees in Alaska, New Jersey, and Pennsylvania |

| State-specific tax | Varies state to state |

Searching for a simple way to run payroll and stay compliant with payroll taxes? You’ve come to the right place! Patriot’s Full Service payroll services calculate, collect, and remit your payroll taxes for you. Start your free trial today!

This article has been updated from its original publication date of February 12, 2020.

This is not intended as legal advice; for more information, please click here.