Offering competitive benefits attracts, satisfies, and retains top talent. Benefits include everything from retirement plans to health insurance coverage. When you dive into different small business employee benefits, you might consider a section 125 plan.

But, what is a section 125 plan? Is it a cafeteria plan? Are section 125 plans pre-tax health insurance? Keep reading to find out the answers to these questions and more.

What is a section 125 plan?

So, what is section 125? Section 125 is a written plan that lets employees choose between two or more benefits, including qualified benefits (e.g., health insurance) and cash. Employees receive benefits as pre-tax deductions. Employees, their spouses, and their dependents can all benefit from section 125 plans.

What is a cafeteria plan? Well, think of a 125 plan like a cafeteria. In a cafeteria, individuals can pick the foods they want from the selection offered. Similarly, employees can pick the benefits they want in a section 125 plan. This is why a section 125 benefit plan is also called a cafeteria plan.

How do you calculate taxes with section 125 plans?

Again, a section 125 plan gives pre-tax benefits to employees. With pre-tax benefits, you deduct the employee’s contribution before withholding taxes, reducing their taxable income. Typically with pre-tax deductions, the employee pays less in federal income and FICA (Social Security and Medicare) taxes. Some states also allow a section 125 plan to reduce the amount an employee owes in state income taxes.

Because section 125 plans are pre-tax, they also come out before federal unemployment tax (FUTA), reducing your employer FUTA liability per paycheck. The tax remains 6% (or 0.6% if you receive the credit) on the first $7,000 of an employee’s wages. However, the pre-tax deduction reduces the taxability of each check. So, you pay less FUTA tax per check than you would without a section 125 plan.

In some states, you also calculate state unemployment tax (SUTA) after the section 125 plan, which reduces your employer SUTA tax liability per check.

Who can participate in a section 125 plan?

Now that you know what a cafeteria plan is, let’s look at who can participate in or purchase a section 125 plan.

Any employer with employees can sponsor a cafeteria plan, including:

- C corporations

- S corporations

- LLCs

- Partnerships

- Sole proprietorships

- Government entities

But, not everyone who performs work for the business can participate in the plan. Nonemployees cannot enroll in a section 125 plan, including:

- 1099 contractors

- Partners in the partnership

- Members of the LLC

- Individuals who own more than 2% of the S corporation

What are section 125 deductions?

You must follow section 125 guidelines when adding benefits to your cafeteria plan. The IRS has specific rules for which benefits you can include in a section 125 plan. IRS Publication 15-B details which benefits they do and do not allow in cafeteria plans.

Generally, you cannot include a benefit that defers an employee’s pay. However, you can include certain types of 401(k) plans and life insurance plans maintained by educational institutions.

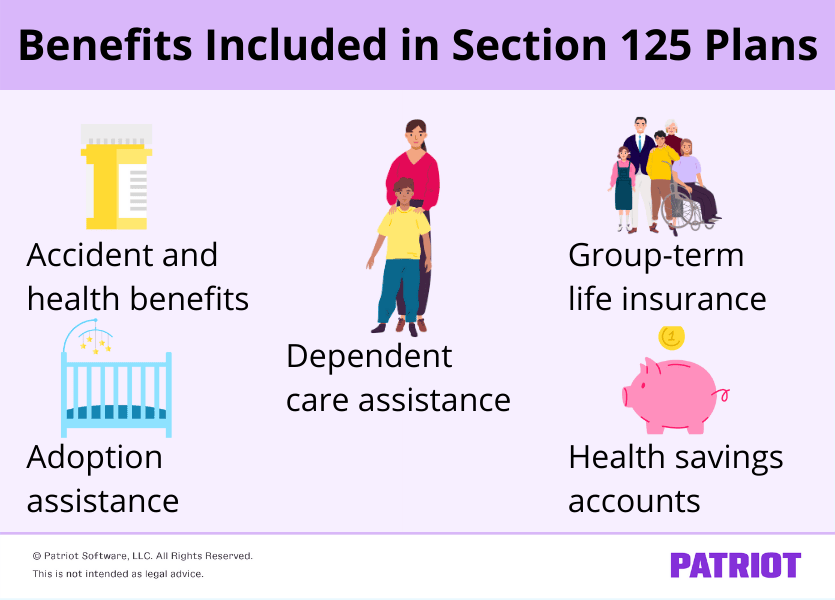

Benefits included in section 125

Here are the qualifying benefits you can include in your section 125 cafeteria plan document:

- Accident and health benefits (not including Archer medical savings accounts)

- Adoption assistance

- Dependent care assistance

- Group-term life insurance coverage

- Health savings accounts (HSAs)

Another benefit you can include in your cafeteria plan is a flexible spending account (FSA). However, there is a limit on these contributions. Employees can only contribute up to $3,850 to an FSA (2023), or it is not considered a cafeteria plan.

Benefits excluded from section 125

So, what benefits are not included in a cafeteria plan? These are the benefits you cannot include in your IRS section 125 plan:

- Archer MSAs

- Athletic facilities

- De minimis (minimal) benefits

- Educational assistance

- Employee discounts

- Employer-provided cell phones

- Lodging on your business premises

- Meals

- Moving expense reimbursements

- No-additional-cost services

- Retirement planning services

- Transportation (commuting) benefits

- Tuition reduction

- Working condition benefits

Benefits not included in a section 125 cafeteria plan typically do not reduce the tax liability for employees or employers. Instead, tax these deductions per the IRS instructions for the specific type of benefit you offer.

Plans favoring employees

If your plan favors highly compensated or key employees regarding their eligibility to participate, you must include the value of the benefits they could have selected in their wages.

A highly compensated employee is an officer or shareholder owning more than 5% of the voting power. If someone meets these descriptions, their spouse or dependents are also considered highly compensated.

A key employee is an officer who earns an annual pay of more than $220,000 (2024) or an employee who is either a 5% owner or a 1% owner who earns more than $150,000. If more than 25% of the nontaxable benefits you provide for all employees go toward key employees, it favors them.

Simple cafeteria plans

Some businesses can offer a simple cafeteria plan to their employees. With a simple cafeteria plan, you don’t need to worry about favoring highly compensated or key employees. Instead, you must contribute benefits on behalf of each employee.

To offer a simple cafeteria plan, you have to qualify. If you employed an average of 100 or fewer employees during either of the two previous years or if you expect to employ an average of 100 or fewer employees in the current year, you are eligible.

Employees who worked at least 1,000 hours in the previous plan year are eligible. If you want, you can exclude employees who:

- Are under the age of 21

- Have worked for you for less than one year

- Are covered under a collective bargaining agreement

- Are nonresident aliens who are paid outside the United States

For employees included under your simple cafeteria plan, you must make the same contributions for each worker. You can choose from providing:

- At least 2% of their compensation for the plan year OR

- At least 6% of their compensation for the plan year or twice the amount of salary reduction contributions, whichever is less

For more information on simple cafeteria plans, refer to Publication 15-B or contact the IRS.

Creating your section 125

You must have a written section 125 cafeteria plan document before taking out pre-tax deductions. Otherwise, the IRS may think you’re not withholding enough taxes.

Your written plan must list and describe all the benefits you offer. Also, detail the contribution limits for each benefit, participation rules, employer contributions, the plan year, and any other necessary information.

For help writing your cafeteria plan, turn to a professional, like a business lawyer. They can help ensure your section 125 plan is accurate, legal, and understandable.

This article has been updated from its original publication date of July 3, 2012.

This is not intended as legal advice; for more information, please click here.