Pay frequency, or how often you pay your team, is one of the first decisions you must make when you hire your first employee.

If you haven’t thought about payroll frequency, now’s the time to start. Employee satisfaction, legal compliance, and cash flow may depend on it.

This guide explains each option (weekly, biweekly, semimonthly, monthly), shows how to estimate per-paycheck amounts, and outlines how to choose and change your schedule while staying compliant.

- Pay frequency determines how often employees are paid and how often you must run payroll, affecting workload and cash flow.

- Options: weekly (52), biweekly (26), semimonthly (24), monthly (12); each has tradeoffs for overtime, deductions, and admin.

- Choose based on state laws, employee types (hourly vs salaried), industry norms, and payroll process capabilities.

- When changing frequency, follow state notice rules, avoid delaying wages, prorate/pay accurately, and communicate to employees.

Skip Ahead

What is pay frequency?

Pay frequency, or payroll frequency, is how often you pay employees (aka the number of pay periods in a year). Your pay frequency also determines how often you must run payroll.

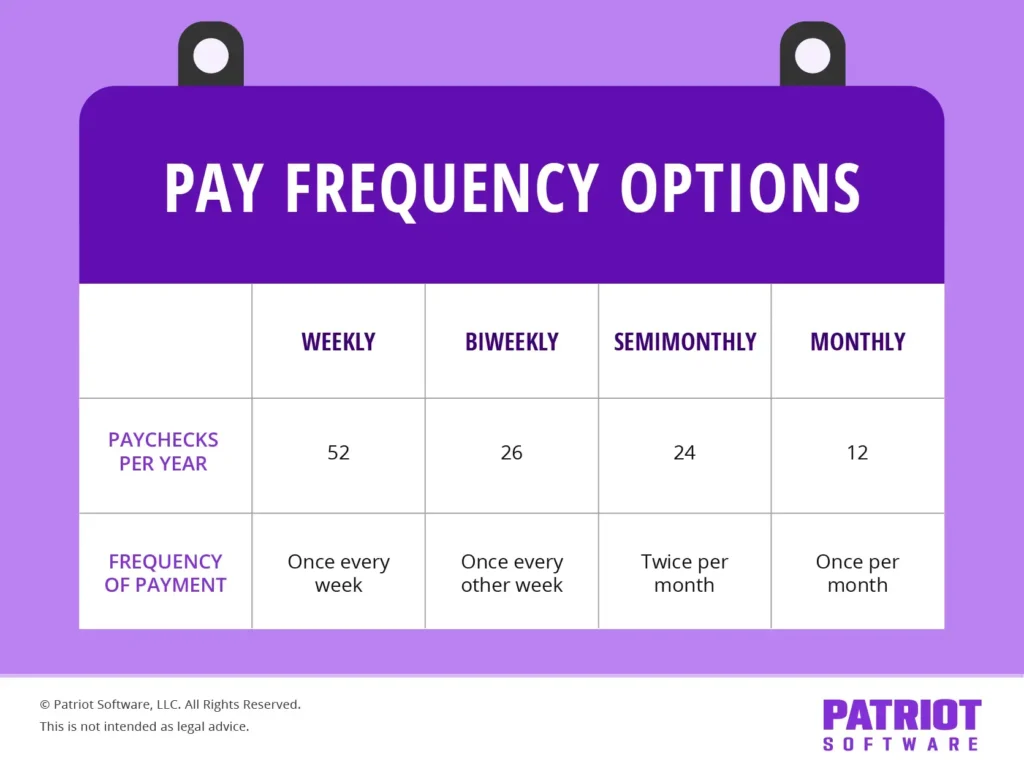

There are four popular pay frequencies to choose from: Weekly, biweekly, semimonthly, and monthly. Your frequency determines the number of paychecks an employee receives in a year.

Pay frequency influences each paycheck’s wage and tax amounts. However, it doesn’t impact an employee’s annual tax liability or net pay (over time, it all equals out).

It can affect per-paycheck withholding and benefit deduction amounts due to rounding and timing, but the annual totals should reconcile.

At-a-glance: Pay periods per year and typical tradeoffs:

- Weekly (52): Highest payroll workload; supports hourly teams’ cash flow

- Biweekly (26): Common balance of admin cost and employee cash flow; two “three-paycheck” months

- Semimonthly (24): Fixed calendar dates aid benefit deductions; can complicate hourly overtime calculations

- Monthly (12): Lowest payroll workload; can strain employee budgeting and may be restricted by state law for non-exempt workers

Pay frequency option #1: Weekly

Under a weekly pay frequency, employees receive their wages each week. An employee paid weekly receives 52 paychecks per year.

Each paycheck is less money and more frequent than other frequency options. You must run payroll more often than with any of the other frequencies.

- Best for: Hourly teams, construction/trades, and roles where faster cash flow helps retention.

- Pros: Predictable weekly overtime periods; easier budgeting for hourly workers; improved recruiting in some industries.

- Cons: Highest processing time; potential higher provider fees if charged per run.

- Weekly payrolls in Patriot Software: Run unlimited weekly payrolls with Patriot at no extra cost per run.

Pay frequency option #2: Biweekly

With a biweekly pay frequency, you pay employees every other week. Employees who get biweekly wages receive 26 paychecks per year.

Employees receive their wages the same day of the week each pay period, like on a Friday. Typically, employees receive two paychecks each month. However, there are two months in the year when employees receive three paychecks instead of two (so plan your budget accordingly!).

- Best for: Mixed hourly/salary teams seeking balance between admin effort and employee cash flow.

- Pros: Aligns cleanly with weekly overtime periods; widely accepted by employees; most common among U.S. employers.

- Cons: Budgeting must account for two “three-paycheck” months; benefits deductions may need prorating in those months.

- Biweekly payrolls in Patriot Software: Automate recurring payrolls and handle “three-paycheck” months without extra run fees.

Pay frequency option #3: Semimonthly

Under semimonthly pay, employees receive 24 paychecks per year.

It can be easy to confuse semimonthly pay with biweekly schedules. Under both frequencies, employees typically receive wages twice per month. But, there are a few key differences between biweekly vs. semimonthly pay.

With a semimonthly frequency, you pay employees on specific dates, but the days might differ. For example, you can pay an employee on the 15th and 30th of each month. These dates can fall on any day of the week.

A semimonthly pay frequency can be difficult for employers and employees to track. Employees can receive their wages on a Tuesday or a Friday, all depending on the day the date falls.

- Best for: Salaried teams where fixed calendar dates make benefits and salary allocations straightforward.

- Pros: No “three-paycheck” months; aligns with monthly benefit premiums.

- Cons: Weekly overtime periods split across pay dates; can be tricky for hourly workers and time tracking.

- Semimonthly payrolls in Patriot Software: Set fixed pay dates and automate benefit deductions to align with calendar-based schedules.

Pay frequency option #4: Monthly

If you pay employees monthly, they receive one paycheck per month. An employee paid monthly receives 12 paychecks per year.

Monthly paychecks are for larger amounts of money but are less frequent than other frequencies. Monthly paychecks can make financial planning difficult for some employees.

- Best for: Salaried, exempt roles in states/industries where monthly is permitted.

- Pros: Lowest processing workload; simple to align with monthly benefits and accounting cycles.

- Cons: May be restricted by state law for non-exempt employees; can hurt employee cash flow and retention.

- Monthly payrolls in Patriot Software: Support monthly runs while maintaining accurate deductions.

What is the best pay frequency?

There isn’t a “best” and “worst” frequency. But how often you pay employees does impact your:

- Time commitment: Running payroll by hand takes time. The more frequently you pay employees, the more time you spend running payroll.

- Money: Want to save time running payroll by using software? Great! But, some payroll software companies charge you based on the number of payrolls you run each month.

- Payroll cutoff: Your frequency determines your payroll cutoff, which is the date and time you must run payroll for it to process by payday.

In practice, many employers choose biweekly to balance admin effort and employee cash flow. Weekly is common in fields like construction for hourly workers. Semimonthly can work well for salaried teams and benefits alignment. Monthly is leastcommon and may be limited by state rules for non-exempt employees.

What is the most common pay frequency?

Every business is different. The pay frequency that works best for your industry, business size, and employee type (i.e., hourly vs. salary) may not work for the company next door.

With that being said, some frequencies are more popular than others.

According to the U.S. Bureau of Labor Statistics, biweekly payroll is the most common pay frequency, followed by weekly payroll.

Here’s the breakdown of how many businesses use each pay period in the United States:

| Pay Period | How Many Businesses Use It? |

|---|---|

| Weekly | 27% |

| Biweekly | 43% |

| Semimonthly | 19.8% |

| Monthly | 10.3% |

How much would an employee earn each pay period? Example

Let’s say an employee earns $60,000 annually. Take a look at how much their gross wages would be by pay period:

- Weekly: $1,153.85 ($60,000 / 52)

- Biweekly: $2,307.69 ($60,000 / 26)

- Semimonthly: $2,500 ($60,000 / 24)

- Monthly: $5,000 ($60,000 / 12)

Formula: Per-paycheck gross for salaried employees = Annual salary / number of pay periods.

Hourly example: If an employee earns $20/hour and works 40 hours weekly, weekly gross is 20 × 40 = $800. Biweekly (two 40-hour weeks) is $1,600. Overtime, premiums, and unpaid time will change these amounts.

Note: Withholding and benefits are calculated each run, so net pay per check will vary by frequency even though annual totals reconcile.

How to choose a payment frequency

Every business is different. Before you create a pay frequency schedule, consider the following four factors:

- Pay frequency laws

- Your employees

- Your industry

- How you run payroll

Quick decision checklist:

- Confirm state minimum frequency by employee type (exempt vs. non-exempt)

- Match to workforce composition (hourly vs. salary) and overtime cadence

- Consider recruiting/retention and employee cash-flow needs

- Model cash flow and benefits deduction timing

- Choose software and pricing that support your cadence without extra fees

1. Pay frequency laws

Are there pay frequency laws you have to follow?

There is no federal law that says what frequency you must choose. However, you must keep a consistent frequency. You cannot change up an employee’s frequency when you feel like it.

Pay frequency requirements by state determine what pay frequencies you can and can’t use. Most states set a minimum frequency you must follow. For example, Arizona requires that employers pay employees two or more days per month, not more than 16 days apart.

Before deciding on frequency, check with your state laws.

Examples (check specifics for your situation):

- D.C.: At least twice per month

- Idaho: At least monthly

- New York: Manual workers weekly; most others at least semimonthly

- Arizona: Two or more days per month, not more than 16 days apart

If you change frequency, many states require advance written notice and prohibit any delay of earned wages.

2. Your employees

How many employees do you have? Are your employees salaried or hourly? These employee-related factors may impact the frequency you go with.

Number of employees: According to the BLS, employer size can determine pay frequency. For example, 66.6% of businesses with 1,000+ employees use biweekly, compared to 39% for businesses with one to nine employees.

Hourly vs. salary: The type of workers you employ can also affect your business’s payroll frequency. You can establish different pay periods for salary vs. hourly employees (although this might get confusing if you run payroll by hand).

Also consider:

- Employee cash-flow preferences and financial wellness

- Tips/commissions cadence

- Overtime alignment (weekly overtime tracking is simpler with weekly/biweekly)

3. Your industry

What industry is your business in? For some companies, industry determines your frequency. Certain industries tend to pay weekly, while others tend to pay monthly.

According to the BLS, 65.4% of construction employers pay employees using a weekly schedule. But, only 14% of employers in the financial activities industry run weekly payroll.

4. How you run payroll

How do you run payroll? By hand? Using software?

If you run payroll by hand, shorter pay frequencies (i.e., weekly) require more payroll runs, which takes up more time and energy.

Payroll software, especially a system with payroll automation, can significantly cut back the time you spend running payroll. But again, some companies have additional fees and charge per payroll run. You could end up paying more to run weekly payrolls than running biweekly, semimonthly, or monthly payrolls.

Look for features like time import, automated tax filing, deduction scheduling, and multiple concurrent pay schedules. With Patriot, you pay per employee, not per payroll, so you can run weekly or biweekly without extra run fees.

Need a way to keep your payroll under control? With Patriot’s online payroll, you pay per employee, not per paycheck. So go ahead and run unlimited payrolls. We won’t charge more! Get your free trial today.

At-a-glance pros and cons by frequency

- Weekly:

- Pros: Fast cash flow, clean overtime weeks.

- Cons: Most admin effort; may cost more with per-run pricing.

- Biweekly:

- Pros: Common, balances admin and cash flow, clean overtime.

- Cons: Two months with three checks; deduction timing considerations.

- Semimonthly:

- Pros: Fixed calendar dates; aligns with monthly benefits.

- Cons: Overtime spanning dates; variable weekdays.

- Monthly:

- Pros: Lowest admin effort; simple benefit alignment.

- Cons: Employee budgeting strain; often not allowed for non-exempt.

Changing pay frequency

If you need to change your schedule, plan carefully to avoid compliance issues and missed expectations.

Step-by-step:

- Confirm state rules and any notice requirements (some states require written notice before changes).

- Choose an effective date that avoids delaying earned wages.

- Communicate in writing to employees (what’s changing, first/last check dates, impact on deductions).

- Prorate as needed (partial periods for salary; ensure overtime is correctly allocated).

- Update payroll system settings (pay schedule, cutoff, accruals, deductions).

- Coordinate benefits and garnishments (adjust per-pay amounts and collection dates).

- Audit the first run(s) for accuracy and address employee questions promptly.

FAQs

Biweekly is the most common in the U.S. (about 43% of employers), followed by weekly.

Confirm your state’s minimum, match to your team (hourly vs. salary), align with overtime and benefits timing, and pick software that supports it.

Often yes (e.g., weekly for hourly, semimonthly for salaried), but ensure state law permits it and your system can manage multiple schedules.

Yes, if compliant: provide required notice, don’t delay earned wages, and adjust deductions. Document the change and audit the first cycles.

No. Overtime is determined by federal/state law (e.g., weekly for FLSA non-exempt). Your frequency affects when you pay overtime, not whether it’s owed.

Twenty-six pay periods don’t divide evenly into 12 months; expect two “three-paycheck” months each year.

No. It changes per-paycheck withholding and timing, but annual tax liability reconciles based on total wages and withholding.

This article has been updated from its original publication date of October 30, 2014.

This is not intended as legal advice; for more information, please click here.