Tucked inside the massive One Big Beautiful Bill Act (signed on July 4, 2025), the new “no tax on overtime,” rule gives many hourly workers a reason to pay closer attention to their pay stubs. Retroactive to January 2025, eligible employees can deduct a chunk of their overtime earnings from their federal taxable income. The idea is simple: work more, keep more.

- Retroactive from Jan 1, 2025, eligible nonexempt workers can deduct qualifying overtime premium from federal taxable income through 2028.

- Deduction limited to overtime premium; individuals up to $12,500, joint filers up to $25,000, and income cap of $160,000 applies.

- Employers must still withhold federal income, Social Security, and Medicare taxes; payroll processes and W-2s unchanged for 2025.

- Accurate overtime tracking and paystubs are essential for employees to claim the deduction; IRS will add reporting changes on 2026 W-2s.

Overtime pay, or time and a half, is currently taxed like regular wages. The “no tax on overtime” rule provides a federal income tax deduction equal to overtime wages reported in a year.

Sure, you’re not likely to hear employees complain about paying less in taxes. But what does this new tax law actually mean for how you handle overtime in payroll? Let’s break down the “no tax on overtime” rule and how it impacts your employees on payroll.

Skip Ahead

Overview of overtime pay and taxation

Under federal law, overtime is 1.5 times an employee’s regular hourly wage for each hour worked over 40 in a workweek. Nonexempt employees are entitled to overtime pay under the Fair Labor Standards Act. Only 12% of employees work FLSA-qualified overtime regularly, and an additional 5% work FLSA overtime occasionally.

Is overtime taxed differently than regular wages? No, overtime is subject to the same taxes as regular wages, including federal income, Social Security, and Medicare taxes.

When employees receive overtime wages, you calculate and withhold taxes the same way as you do for regular wages. You must remit all withheld taxes to the proper agencies and report income and taxes on Form 941 and each employee’s W-2 form.

The new overtime taxation law exempts employees’ overtime wages from federal income tax.

What is the new “no tax on overtime” law?

Like another popular provision, “no tax on tips,” the “no tax on overtime” is a key component of the One Big Beautiful Bill Act (OBBBA).

This legislation allows a federal income tax deduction specifically for overtime pay, aiming to provide financial relief to eligible workers through tax deductions on overtime wages.

How does the “no tax on overtime” law work?

Nonexempt employees who work time-and-a-half hours (i.e., hours beyond 40 in a workweek) can now claim a federal income tax deduction equal to the qualified overtime compensation they receive during the taxable year when filing their income taxes. The tax deduction for overtime wages is available for tax years 2025 through 2028.

The “no tax on overtime” only applies to nonexempt employees who work FLSA-qualified overtime. The tax deduction would not be available to highly compensated employees. Employees can only claim a tax deduction on overtime federal income taxes if they make up to $160,000 and have a Social Security number.

It’s important to point out, the tax deduction is only for the “premium wages” paid on overtime (the “extra half” of time-and-a-half pay) if the employee meets the IRS requirements.

And, the “no tax on overtime” only applies to federal income tax. Still, several states are also considering a no tax on tips and overtime law as well.

Do employers still withhold taxes on overtime?

Yes. If your employees work more than 40 hours in a week, you still need to track and tax the overtime wages like any other wages. You must continue withholding federal income tax, Social Security, and Medicare as well as any state or local taxes from overtime wages just as you would with regular wages. Overtime pay remains fully taxable.

What’s changed is that employees may now be eligible to deduct up to $12,500 for individuals and $25,000 for joint filers of their gross overtime wages when they file their federal tax return. This deduction could reduce their taxable income, potentially lowering what they owe or increasing their refund.

Be prepared for employees who may adjust their W-4 form to lower their tax withholding. The IRS updated the new 2026 Form W-4 Deductions Worksheet for step 4(b) to include fields for estimated tip income, the “and-a-half” portion of overtime, as well as other new fields. Either way, when an employee adjusts their federal income tax withholding, you must update your payroll.

Guidance for tracking overtime on 2025 employee W-2s

On August 7, 2025, the IRS confirmed* that for Tax Year 2025, Form W-2, Forms 1099, and 941, and the federal income tax withholding tables will remain unchanged during the phased rollout of the One Big Beautiful Bill Act. Updated guidance and new forms are planned for 2026.

While payroll reporting won’t change, accurate overtime tracking will be critical for employees who want to claim the federal overtime tax deduction on their 2025 returns. Even though overtime won’t appear separately on the W-2 this year, employees can still deduct the FLSA overtime premium if they meet the IRS requirements.

So where would you come in? This doesn’t change your payroll process, but it does mean your overtime tracking needs to be accurate. Employers should be aware that tracking may get more complex, especially in states or localities with stricter overtime rules than the FLSA. Those additional amounts will not qualify for the federal deduction.

Make sure FLSA overtime hours and premium pay are recorded clearly and accessible to employees. Using time and attendance software can help maintain accurate, digital records and make year-end reporting easier for everyone.

*The IRS has stated it will provide transition relief for tax year 2025 for taxpayers claiming the deduction and for employers and other payors subject to the new reporting requirements. Because of this, the IRS has provided general guidelines on how to determine the overtime tax deduction amount.

Employees who received overtime compensation in 2025 can use the overtime amounts shown on pay stubs, earning statements or similar documents to figure the FLSA overtime premium wages for the year.

One simple estimate example provided by the IRS was to use a pay statement that shows all the wages earned in 2025 and use the overtime total listed there. For example:

The employee’s end of year totals on a pay statement shows a total of $15,000 in “overtime” pay. That $15,000 includes both:

- The extra FLSA overtime premium, and

- The regular pay for the hours worked over 40 in a week.

For figuring out how much qualified overtime compensation they got in 2025, the employee can count $5,000 of that amount. That $5,000 is the FLSA overtime premium, which they get by taking the $15,000 total overtime and dividing it by 3.

Whatever is used, employees should be sure to keep copies of those pay stubs and records, since the IRS requires taxpayers to keep the documents relied on for your tax calculations.

Proposed 2026 Form W-2 overtime reporting changes

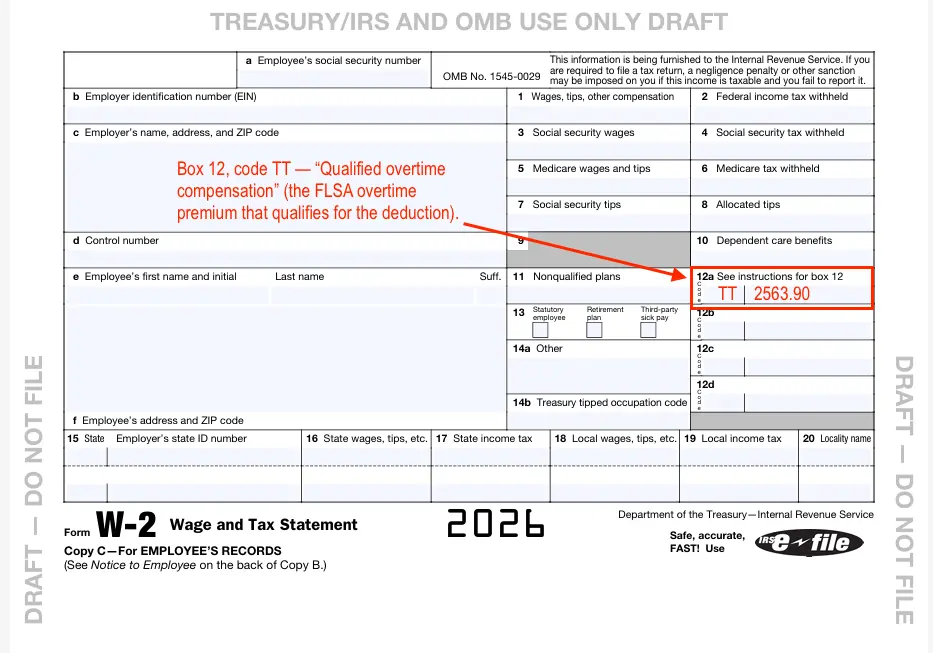

The IRS has released a draft of the 2026 Form W-2 introducing code TT for Box 12 for employers to report FLSA qualified overtime compensation, the half-time premium that employees may exclude from taxable income.

💡 District of Columbia employers shouldn’t be confused about the emergency bill passed on December 3, 2025 decoupling from the One Big Beautiful Bill. This won’t affect how you are tracking and reporting overtime (or tips) for federal compliance. This decoupling means qualified tip and overtime deductions generally will not apply at the D.C. income tax level.

“No tax overtime” FAQs

Yes, overtime hours are subject to taxation like regular wages. Employers will withhold as they normally will in payroll. Employees who qualify may be able to claim a tax deduction on overtime wages when filing their income taxes.

Not quite. The One Big Beautiful Act introduced a new tax break that lets employees deduct part of their overtime pay, up to $12,500 for individuals and $25,000 for joint filers, on their federal income tax return. But this doesn’t change how payroll is run. All regular payroll taxes still apply to overtime, and paychecks will look the same throughout the year. The deduction only kicks in when employees file their taxes at year-end.

The goal of the tax break for nonexempt employees who work overtime is to let them keep more of their wages.

For the 2025 tax year, nothing changes on employee W-2s. However, employers should be tracking overtime for employees separately until further guidance from the IRS is released for 2025. Visit Patriotsoftware.com for more updates as they become available from the IRS.

The provision is retroactively effective from January 1, 2025, and will remain in place through the end of 2028. This means overtime earnings from the beginning of 2025 are eligible for the deduction.

Employees won’t see immediate changes in their take-home pay on paychecks (unless they adjust their Form W-4 withholding). The benefit is realized when filing federal tax returns; an employee’s taxable income will be reduced by the amount of qualifying overtime, potentially resulting in a larger refund or lower tax liability.

No. Even though federal income tax is not applied to qualifying overtime, Social Security and Medicare taxes still are. Therefore, your social security tax contributions, (and future benefits) remain unaffected.

The “no tax on overtime” provision only applies to deductions on federal income taxes. It does not include state (or local) tax deductions. Although Alabama had an exception for overtime hours, it expired in June 2025. Other states are considering some type of overtime or tips laws in the future, but would need to be passed at the state level.

The IRS isn’t requiring overtime reporting other than what is standard on pay reports. Employers should use a “reasonable approximation” method to calculate overtime for the 2025 transition tax. See the IRS notice for more information.

This article has been updated from its original publication date of May 15, 2025.

This is not intended as legal advice; for more information, please click here.