Employer responsibilities are countless, and taxes are arguably the most important. You need to know which taxes to calculate and withhold from employees, how much to contribute as an employer, when to file, and more. And, you need to know what employment tax returns you need to file.

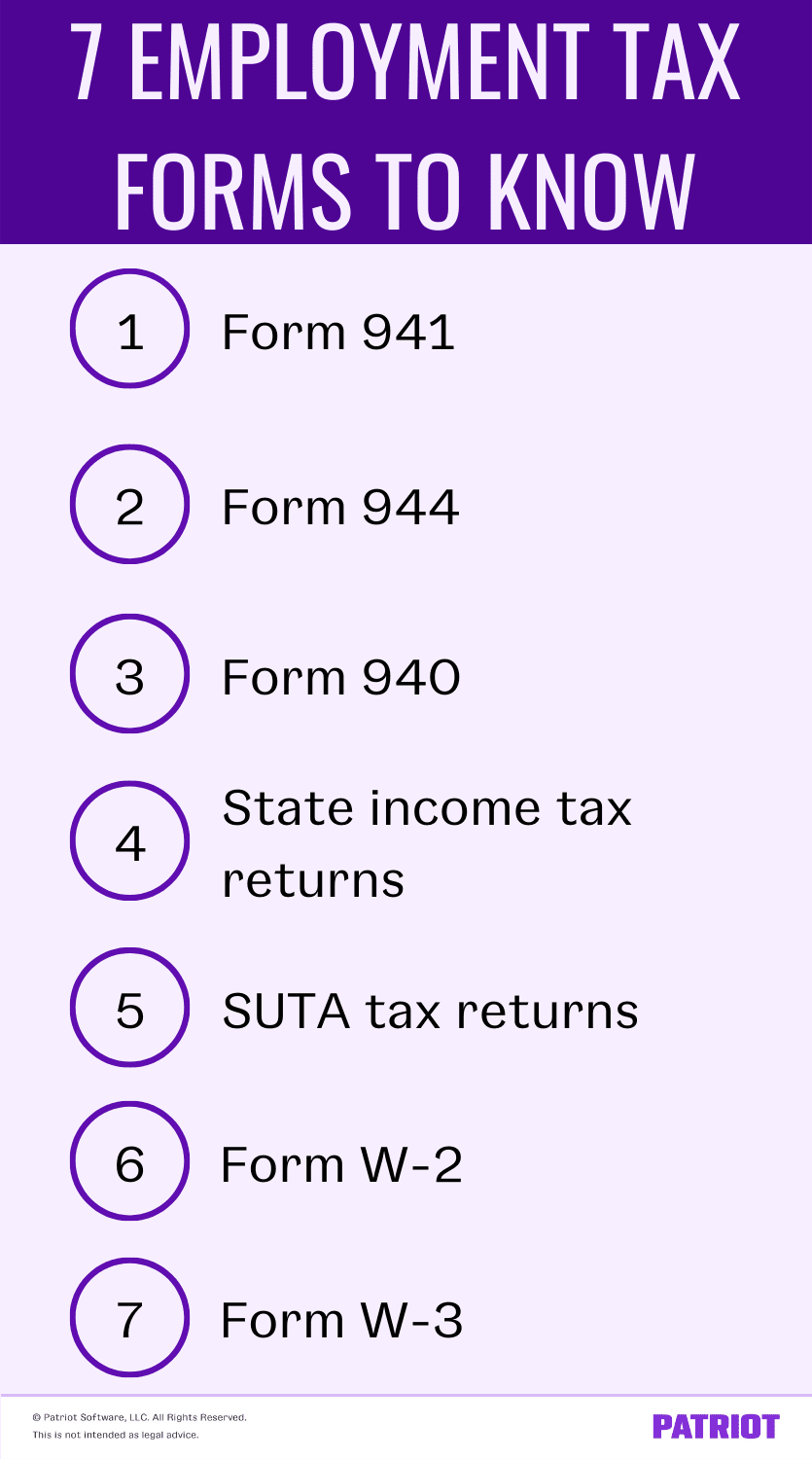

7 Employment tax returns to know

There are seven main employer tax returns you should know. These tax returns report your and your employees’ tax liabilities to the government. These tax returns include:

- Form 941

- Form 944

- Form 940

- State income tax returns

- SUTA (state unemployment) returns

- Form W-2

- Form W-3

Each tax filing also has its own employer tax return deadline (and we’ll get to those).

1. Form 941

IRS Form 941, Employer’s Quarterly Federal Tax Return, is an employment tax return employers use to report employee wages and federal payroll taxes. Form 941 is the quarterly tax return employers use to report payroll taxes and wages.

Most employers, but not all, use Form 941 for their payroll tax and wage reporting. Information on Form 941 includes:

- Employee wages

- Federal income taxes withheld

- Social Security taxes (employee and employer contributions)

- Medicare taxes (employee and employer contributions)

- Reported tips, if applicable

- Additional taxes withheld, if applicable

- Sick pay, if applicable

- Group-term life insurance, if applicable

Form 941 also includes a specific line asking how many employees were paid for the 12th day of a specific month each quarter (March 12, June 12, September 12, and December 12). Only include the number of employees who received wages, tips, or other compensation for the pay period that includes the 12th of the applicable month.

After you bring on employees and file your very first Form 941, you must continue to file the form every quarter. Select employers are exempt from filing Form 941, including:

- Those who have filed a final return

- Seasonal employers

- Household employers

- Farm employers

- Those who receive notification from the IRS to file Form 944

Forms 941 are due by the last day of the month following the end of the quarter. For example, the first quarter ends March 31, so Form 941 is due April 30. If the last day of the month following the end of a quarter falls on a weekend or banking holiday, submit the form by the next business day.

Form 941 is due quarterly, but that does not mean there are employer quarterly tax payments. Instead, the IRS informs you when you should deposit the tax payments (e.g., monthly). Check with the IRS for more information.

2. Form 944

The annual version of Form 941 is Form 944, Employer’s Annual Federal Tax Return. Form 944 reports all of the same information as the quarterly Form 941. So, you must include taxes paid by employer on behalf of employees and the employer contributions on Form 944.

Unlike Form 941, do not list the number of employees paid on the 12th day of a specific month. And, only file Form 944 if the IRS instructs you to do so.

Employers must meet certain criteria for the IRS to inform them of their Form 944 filing status. Only small businesses with $1,000 or less in annual payroll tax liabilities can file Form 944.

New employers may request to file Form 944 when applying for an Employer Identification Number (EIN). A line on the application form allows employers to indicate expected payroll tax liabilities of $1,000 or less.

File Form 944 by January 31 each year. If January 31 falls on a weekend or banking holiday, file the form by the next business day. Business owners who filed a final return should not submit Form 944.

3. Form 940

Most employers must pay federal unemployment tax (aka FUTA tax). Employers pay 6% on the first $7,000 in wages per employee for FUTA tax. However, most employers can receive a FUTA tax credit of 5.4% and only pay 0.6% (6% – 5.4%).

Without the tax credit, employers pay up to $420 for FUTA tax (6% X $7,000) per employee. With the tax credit, employers pay up to $42 per employee (0.6% X $7,000).

Employees do not pay FUTA tax. Therefore, do not deduct FUTA tax from employee wages. However, use the employee’s wages to determine how much money you owe for the tax.

Employers must file Form 940 if they:

- Paid wages of at least $1,500 to any employee during the standard calendar year

- Had an employee (full-time, part-time, or temporary) work anytime during 20 or more weeks (the weeks do not have to be consecutive)

If an employer typically has employees but did not pay employees during a specific calendar year, the employer must still file Form 940. Use the form to state that you did not make employee payments.

At the end of the tax year, use Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, to report your annual FUTA tax liability. File the employer tax return form by January 31 of the following tax year.

4. State income tax returns

Most states require employees to pay state income tax (SIT). If the state requires employees to pay income tax, the employer must withhold, deposit, and file the taxes with the state.

Individual state tax forms vary. And, employers must file state income tax forms with each state in which they have employees unless the employee lives in a state without an income tax.

Nine states do not have SIT:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Some states have tax reciprocity agreements. If your state has a reciprocity agreement with another state where you have employees, your employee may request an exemption. If the employee receives an exemption, withhold income taxes for the state where the employee lives, not for the state where the employee works.

Deadlines to file vary by state. Typically, employers must file state income tax returns by the end of the month following the end of the quarter. Check with your state for more information.

5. SUTA tax returns

State unemployment tax returns vary by state. And, some states have different names for the tax, including state unemployment insurance, SUI, and reemployment tax. Generally, SUTA is an employer-only tax. However, employees in Alaska, New Jersey, and Pennsylvania must also pay SUI tax.

Most employers must remit and file SUTA taxes. However, some businesses may be exempt from paying SUTA (e.g., nonprofits). The state notifies employers of their current SUTA tax rate and the wage base per employee. Typically, new businesses use the new employer SUTA tax rate for the state.

Tax filing deadlines may vary. Typically, SUTA tax returns are due by the end of the month following the end of the quarter. Check with your state’s unemployment division for more information.

6. Form W-2

Every employer must distribute Form W-2, Wage and Tax Statement, to every employee who worked for the business during the year. If an employee no longer works for your business, you must still send Form W-2 to the former employee. Form W-2 is the tax return for employed individuals.

Form W-2 reports information about employees’ annual wages, including the gross wages and taxes withheld. In addition, the form may include other information, such as tip income or health savings account contributions.

The form also lists:

- Employee’s Social Security number

- Employee’s personal information (e.g., name and address)

- Business’s name, address, zip code, and EIN

You may also need to complete additional fields on the form, such as allocated tips or nonqualified plans.

Form W-2 is due to employees no later than January 31. And, you must submit Form W-2 to the Social Security Administration (SSA) by January 31 each year.

7. Form W-3

In addition to Form W-2, employers must complete and submit Form W-3, Transmittal of Wage and Tax Statements. Form W-3 summarizes the Forms W-2. IRS Form W-3 compiles all employee information from all Forms W-2. It is not a standalone form, and employers must file it with copies of all Forms W-2.

Form W-3 shows the IRS the total amount you paid to all employees, as well as the total federal income, Social Security, and Medicare taxes withheld from all employees. The form also informs the IRS about the number of employees a business has and the total number of Forms W-2 you’re filing it with.

The IRS compares Forms W-2 and W-3 to the information on Forms 941 or 944 for the tax year.

Submit Form W-3 to the SSA by January 31. If January 31 falls on a weekend or banking holiday, submit by the next business day.

This is not intended as legal advice; for more information, please click here.