Do you know how your business is performing this year compared to last? No? Calculate year-over-year growth to find out.

Having the 411 on your business’s financial health puts you in a better position for decision making. Read on to learn what is year-over-year growth, why it matters, and how to calculate it (complete with easy-to-follow examples).

What is year-over-year growth (YoY meaning)?

Year-over-year (YOY) is the comparison of one period with the same period from the previous year(s). YOY growth compares how much you’ve grown in the recent period compared to the past period(s). The period is typically a month or quarter (e.g., fourth quarter of 2020 compared to fourth quarter of 2019).

Year-over-year measures your business’s performance—in any area you can measure. You can find your YOY growth for business performance indicators such as:

- Revenue

- Cost per acquisition

- Total employment

- Website traffic

The YOY growth rate is a percentage change. How much growth have you had during this year’s time period compared to last year’s? Did you have an increase or decrease in the performance area you’re analyzing?

Why does YOY growth matter?

There are a number of reasons to take YOY growth into account. Year-over-year calculations can:

- Show you what’s working and what’s not

- Help you get investments

- Put seasonality in the right context

- Help you spot errors

1. Show you what’s working and what’s not

Your year-over-year calculations can help you measure your business’s performance. You can see if your business is growing from year to year, not just month to month. You can easily see long-term trends and if your business is improving over time.

By measuring multiple business performance areas, you can see what’s working and what’s not. If something is not working, you may need to cut expenses or make other changes to improve.

For example, your cost per acquisition year-over-year might be better for Product A but not Product B.

2. Help you get investments

Investors usually want to see your year-over-year numbers before supplying you with business capital. Your YOY growth shows them whether or not your business is a good investment for them.

Whether the investor is a family member, friend, private investor for your small business, or another outside person, make sure your year-over-year analysis is available.

3. Put seasonality in the right context

YOY calculations are particularly good for businesses with seasonal peaks. For example, a greenhouse’s sales might peak in the spring and summer while a retail business might peak in November and December.

The YOY growth rate smooths out any monthly volatility. Instead of seeing large increases and decreases between seasonal months, you can compare your current business numbers to the same time last year.

You might find out:

- You’re doing better than last month but are actually down compared to last year

- You’re doing worse than last month but up from where you were at last year

4. Help you spot errors

Similar to using a comparative income statement, doing a year-over-year analysis might help you find errors and discrepancies in your books.

If there are big increases or decreases from last year, you might have incorrectly recorded something. Examining several time periods year-over-year can help you narrow down when you may have made the error.

How to calculate YOY growth

There are a few steps you need to take to calculate year-over-year growth for your business.

1. Determine what you’re finding YOY growth for

First things first: you have to decide what area of your business you want to find YOY growth for. Is it revenue? Number of employees? Marketing KPIs? When finding year-over-year growth, the world is your oyster…

…As long as you have the numbers for your calculations. Once you’ve decided what you’re calculating YOY growth for, gather the numbers for both time periods you are comparing. Which brings us to…

2. Choose your time period

Do you want to calculate YOY growth between two different months, quarters, or even years? The choice is yours. But by using smaller time periods, like months, you can help mitigate seasonality issues.

3. Use the year-over-year growth formula

Calculating year-over-year growth isn’t difficult. You can easily get results after pulling your information.

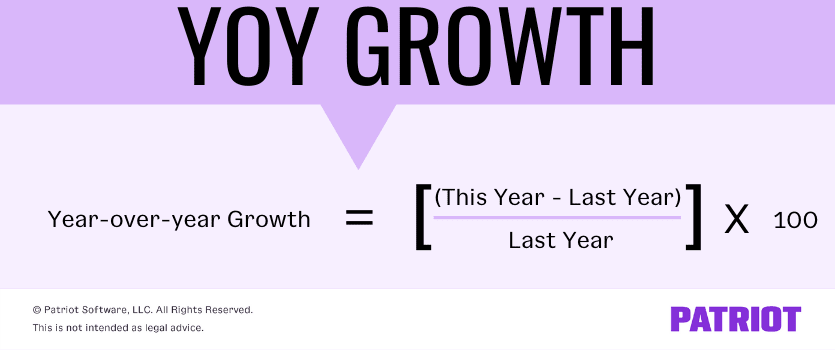

To start the equation, subtract last year’s number from this year’s number. This will give you the total difference for the year. If the number is positive, you had a gain. If the number is negative, you had a loss.

Next, divide the difference by last year’s number. This gives you the year-over-year growth rate.

Finally, multiply the number by 100 to turn your result into a percentage to get the year-over-year percentage change.

The YOY growth formula is:

Year-over-year Growth = [(This Year – Last Year) / Last Year] X 100

Examples

Ready to dive in? Check out these examples to see how you would calculate YOY for the following business performance indicators:

- Revenue

- Unique customers

- Website traffic

Revenue

Let’s say you want to compare your revenue from July this year to July last year. You made $40,000 this July and $25,000 last July.

Subtract last July’s revenue from this July’s revenue.

$40,000 – $25,000 = $15,000

Now, divide the difference by last July’s revenue to get the growth rate.

$15,000 / $25,000 = 0.6

Turn the growth rate into a percentage.

0.6 x 100 = 60%

You had a 60% year-over-year increase in revenue.

Unique customers

Let’s try another example. Pretend that you want to compare unique customers from this year’s Quarter 1 to last Quarter 1. This Quarter 1, you had 5,000 unique customers. Last Quarter 1, you had 7,500 unique customers.

Subtract last Quarter 1’s customers from this Quarter 1’s customers.

5,000 – 7,500 = -2,500

Now, divide the difference by last Quarter 1’s revenue to get the growth rate.

-2.500 / 7,500 = -0.33

Turn the growth rate into a percentage.

-0.33 x 100 = -33%

You had a 33% year-over-year decrease in customers.

Website traffic

Now, let’s say you had 100,000 website visitors in January, which was a big decrease from the 200,000 you had in December. Before panicking, you consider the fact that your peak season is December, which could contribute to the sudden drop. Instead, you decide to find your YOY growth to compare your website traffic in January with January of last year.

This January, you had 100,000 website visitors. Last January, you had 83,000. Use the YOY formula to determine your growth during this time period.

[(100,000 – 83,000) / 83,000] X 100 = 20.48%

You had a 20.48% YOY increase in website traffic.

This article has been updated from its original publication date of March 1, 2018.

This is not intended as legal advice; for more information, please click here.