If you’re an employer, you can’t just be on your merry way after paying your employees. You also need to account for payroll expenses in your books. This is where payroll accounting comes into play. To ensure your accounting books are accurate, learn how to record payroll transactions.

What is payroll accounting?

Payroll accounting is the recording of all payroll transactions in your books. As a business owner, you use payroll journal entries to record payroll expenses in your books.

Payroll journal entries fall under the payroll account and are part of your general ledger. Record the following expenses in your payroll account:

- Employee compensation: Salaries, wages, paid time off (PTO), bonuses, commissions, and other taxable income reported on Form W-2.

- Payroll taxes: Federal income, Social Security, Medicare, and applicable state or local income taxes withheld from employee wages.

- Employer taxes: Employer match of Social Security and Medicare taxes, as well as federal and state unemployment taxes

- Employer portion of fringe benefits: Health insurance, life insurance, education assistance, etc.

- Employee deductions for benefits: Health insurance, retirement plan, etc.

- Other deductions: Child support, spousal support, outstanding tax liabilities, etc.

Payroll accounting helps you keep track of employee compensation and other payroll costs. Accounting for payroll gives you an accurate snapshot of your expenses.

To get a clear picture of your company’s finances and stay compliant, keep your payroll accounting up-to-date.

Debits and credits: Recap

You need to record all payroll transactions in your accounting books. But before you can do that, understand the basics of using debits and credits in accounting. So, let’s go back to the basics.

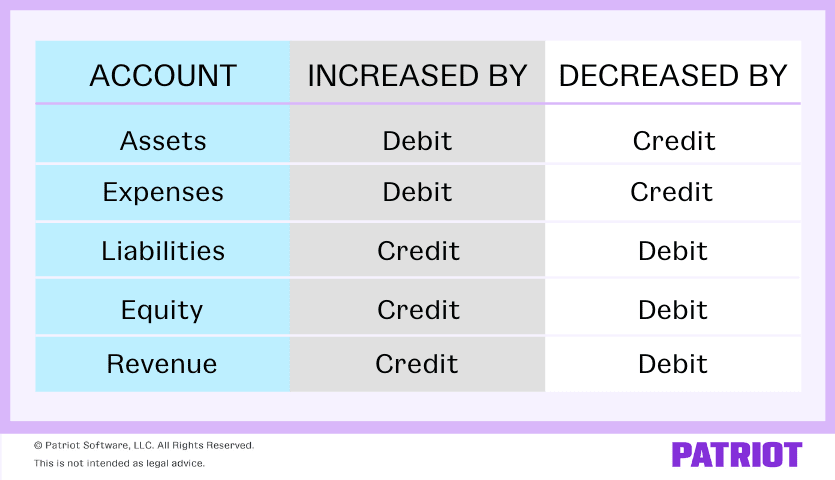

Debits and credits are equal but opposite entries. For example, if a credit increases an account, you will increase the opposite account with a debit.

Debits increase asset and expense accounts and decrease equity, liability, and revenue accounts. On the other hand, credits increase equity, liability, and revenue accounts and decrease asset and expense accounts. Take a look at how each account type is impacted by debits and credits:

When it comes to payroll accounting, you typically use expense, liability, and asset accounts. Here are a few examples of different types of accounts in payroll accounting:

- Gross Wages: Expense

- Checking: Asset

- FICA Tax Payable: Liability

Expenses are costs your business incurs during operation. When you pay an employee, you increase the expense account because you are paying them.

Liabilities are amounts you owe. Increase the liability account because, as employees earn wages, you owe more.

Assets are items of value your business owns. As you pay an employee, decrease your asset account to reflect the decrease in cash.

As you do your payroll accounting, record debits and credits in the ledger. Whether you debit or credit a payroll entry depends on the type of transaction made. The debits and credits in your books should always equal each other.

Types of payroll accounting entries

When recording payroll in your books, there are three types of journal entries for payroll accounting that you should know about:

- Initial recording

- Accrued wages

- Manual payments

You must handle each type of payroll accounting entry differently. Typically, you work with initial recording entries. Let’s take a look at how each payroll entry compares…

Initial recording

Initial recordings, also known as the originating entry, are the primary entries for payroll accounting. It’s the first entry you record to show a transaction.

For these entries, record the gross wages your employees earn and all withholdings. Also, include employment taxes you owe to the government.

Accrued wages

Record accrued wages at the end of each accounting period. These entries show the amount of wages you owe to employees that have not yet been paid. After you pay the wages, reverse the entries in your ledger to account for the payment.

Manual payments

Manual payments come up occasionally in payroll accounting. Use these entries when you have to adjust an employee’s pay or for employee terminations.

How to do payroll accounting: 7 steps

At first glance, payroll accounting can be scary. But if you follow these seven steps, you can learn how to account for payroll with ease.

1. Set up payroll accounts

If you haven’t already, set up your payroll accounts in your chart of accounts (COA). Payroll accounts include a mixture of expenses and liabilities. Here are a few examples of payroll accounts:

- Gross wage expense

- Employee FICA tax payable

- Federal income tax payable

- State income tax payable

- Wages payable

- Employee health insurance payable

- Vacation payable

Depending on your business and employees, you may have additional payroll accounts.

2. Calculate taxes and other deductions

Calculate taxes and deductions to find out how much you need to withhold from employee wages and contribute as an employer.

Taxes vary depending on the employee and where your business is located. Before you calculate any taxes, brush up on state and local payroll laws.

Hold it! Consider using payroll software to simplify the process of calculating taxes and deductions. Payroll software handles the tax calculations for you, giving you more time to get back to your business.

3. Gather payroll reports

If you decide to use software to run payroll, gather reports to get breakdowns of payroll transactions. You can gather the following reports and documents to make recording entries for payroll and payroll taxes easier:

- Payroll register: Includes all payroll transactions during a certain period of time, employee names, pay dates, payment amounts, etc.

- Payroll tax report: Shows a breakdown of the taxes you withheld from employee wages, plus taxes you owe as an employer.

You may also need to pull reports for deductions, contributions, and other benefits.

4. Record payroll expenses

After you get the information to record payroll entries in accounting, head on over to your books to get cracking.

First things first, record payroll expenses in your books. This includes anything that you paid during the accounting period (e.g., wages, salaries, etc.).

Because they are paid amounts, increase the expense account. As a reminder, expenses increase with debits. Debit the wages, salaries, and company payroll taxes you paid. This will increase your expenses for the period.

When you record payroll, you generally debit Gross Wage Expense and credit all of the liability accounts.

5. Record payables

Next, record entries for amounts you owe but have not yet paid. These amounts are liabilities, or payables.

Because you owe payroll amounts, you gain liabilities. Liabilities increase with credits. Credit the FICA tax payable, federal income withholding payable, state income withholding payable, and any other withholdings on employee paychecks. Doing so increases your payroll liabilities.

6. Double-check your records

After you finish entering your expenses and payables, double-check your records for accuracy.

Compare the amounts you entered to the information you have in your payroll reports. And, make sure that your debits equal your credits. If your books don’t balance, retrace your steps to find your accounting mistake and fix it.

7. Transition accounting periods

You eventually pay amounts you owe to employees and government agencies. Paid liabilities are no longer payables.

When you switch accounting periods, make additional journal entries to reduce the cash account and eliminate the liability account balance. Decrease the liability account by debiting the payable entries in your books.

As you pay off amounts you owe, your assets (e.g., cash) decrease. To show the decrease in assets, credit the appropriate asset account, such as your Cash account.

Payroll accounting example

Understanding payroll accounting can take time. But with a little bit of practice, you’ll become an allstar at recording payroll accounting journal entries. To get started, let’s take a look at a payroll journal entry example, shall we?

Journal entry #1

Say you have one employee on payroll. Your first entry shows your employee’s gross wages, payroll taxes withheld, deductions, and net pay. It includes the following:

- Gross wages

- Employee FICA tax payable

- Federal income tax payable

- State income tax payable

- Employee health insurance payable

- Payroll payable (aka the employee’s net wages)

Gross wages are an expense, which increases with a debit. The rest of the accounts are liabilities. Credit your liabilities. Here’s how your first journal entry would look:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Gross Wages | 1,000 | |

| Employee FICA Tax Payable | 76.50 | ||

| Federal Income Tax Payable | 70 | ||

| State Income Tax Payable | 30 | ||

| Employee Health Insurance Payable | 25 | ||

| Payroll Payable | 798.50 |

Keep in mind that your debits (left side) should equal your credits (right side). If they don’t balance, double-check your totals and look for accounting mistakes.

Journal entry #2

Make a second journal entry when you give your employee their paycheck. When you pay the employee, you no longer owe wages, so your liabilities decrease. And, your cash decreases because you paid the employee.

Because it’s a liability, decrease your Payroll Payable account with a debit. And, decrease your Cash account (an asset) with a credit.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Payroll Payable | 798.50 | |

| Cash | 798.50 |

Journal entry #3

Eventually, you need to pay employer taxes and remit withheld taxes. This is where a third accounting entry for payroll comes in.

Reverse the payable entries with a debit and decrease your Cash account with a credit.

The amount you credit your cash account is the total amount you must remit for federal and state taxes.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Employee FICA Tax Payable | 76.50 | |

| Employer FICA Tax Payable | 76.50 | ||

| Federal Income Tax Payable | 70 | ||

| State Income Tax Payable | 30 | ||

| Federal Unemployment Payable | 25 | ||

| State Unemployment Payable | 20 | ||

| Cash | 298 |

Payroll accounting doesn’t have to be complicated. Simplify the way you record payroll transactions, income, and expenses by streamlining your books with Patriot’s easy-to-use and affordable online accounting software. What are you waiting for? Try it for free today!

This article has been updated from its original publication date of June 1, 2017.

This is not intended as legal advice; for more information, please click here.