All businesses have assets. Assets can be broken down into two categories: tangible and intangible. Understand the difference between tangible vs. intangible assets to keep your accounting books and financial statements accurate.

Tangible vs. intangible assets

Both tangible and intangible assets add value to your business. But, tangible assets are physical while intangible assets are non-physical property.

This difference between tangible and intangible assets affects how you create your small business balance sheet and journal entries.

Read on to learn the differences between tangible assets vs. intangible assets.

Tangible assets

Tangible assets are physical items that add value to your business. Tangible assets include cash, land, equipment, vehicles, and inventory.

Tangible assets are depreciated. Depreciation is the process of allocating a tangible asset’s cost over the course of its useful life. An asset’s useful life is the duration it adds value to your business. Generally, assets lose value after a year.

Tangible assets can be further broken down into two categories: current and fixed.

Current assets are liquid items that can easily be converted into cash within one year. These assets are more liquid than fixed assets. Cash, inventory, and accounts receivable are examples of current assets.

Fixed assets, on the other hand, are long-term assets that cannot be converted into cash within one year. Buildings, land, and equipment are examples of fixed assets.

Intangible assets

Unlike tangible assets, intangibles are non-physical items that add value to your business. Patents, trademarks, copyrights, and licenses are examples of intangible assets.

Intangible assets are not easy to convert into cash. They are less liquid than fixed assets.

The cost of intangible assets is difficult to determine because they are not physical items. For example, there isn’t a price tag on the value of your company’s logo.

Intangible assets are amortized. Amortization is the process of allocating an intangible asset’s cost over the course of its useful life.

List of tangible assets vs. intangible assets

Here is a more detailed look at tangible and intangible assets you might have at your business.

| Tangible Assets | Intangible Assets |

|---|---|

| Cash | Patents |

| Land | Trademarks |

| Equipment | Copyrights |

| Inventory | Goodwill |

| Machinery | Brand recognition |

| Furniture | Internet domain name |

| Stock | Customer lists |

| Bonds | Employment contracts |

Tangible vs. intangible assets on the balance sheet

A business balance sheet is a financial statement that lists your company’s assets, liabilities, and equity. Assets are broken up and clearly listed on the balance sheet.

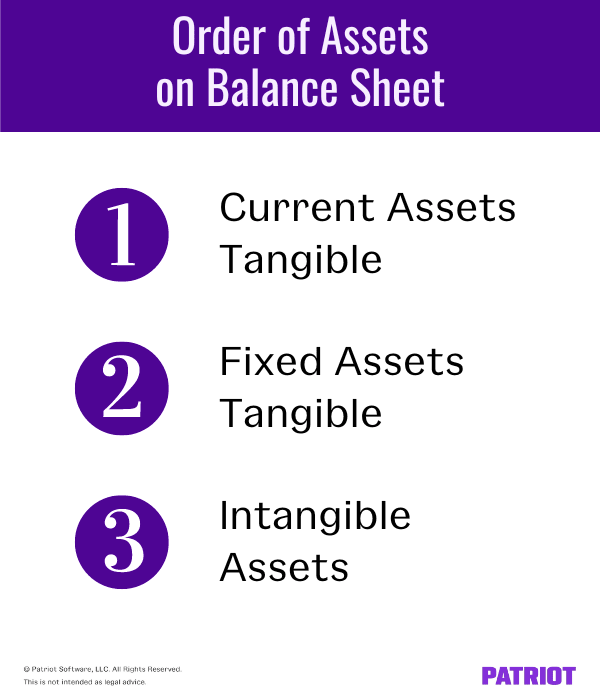

Record both tangible and intangible assets on your balance sheet, with tangible assets being first. Assets are listed from most to least liquid.

You must break down tangible assets when listing your property on this financial statement. List your current assets first, followed by your fixed assets. Then, list your intangible assets.

Generally, you can only record acquired intangible assets on your balance sheet, meaning assets you obtain from another business. You will not include intangible assets that your company internally generated (e.g., a patent you purchased).

Tangible assets and intangible assets in accounting

You must know how to record tangible and intangible assets in accounting. Keep in mind that assets are increased by debits and decreased by credits.

Let’s say you spend $5,000 on inventory, a tangible asset. You will need to debit your inventory account (because it is increasing) and credit your cash account (because it is decreasing). The same would be true if you spent $5,000 on a patent, an intangible asset.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 2/27/2018 | Inventory Cash | Supplies | 5,000 | 5,000 |

Depreciation and amortization

Depreciation and amortization paint a more accurate picture of your company’s finances. These processes spread out a big expense over the course of several years.

Accounting for intangible assets and tangible assets gets tricky when you factor in depreciation and amortization for long-term assets. Again, you depreciate tangible assets and amortize intangible assets.

List depreciation and amortization expenses on your income statement.

Like assets, depreciation and amortization expenses are increased by debits and decreased by credits.

Depreciation

The IRS lists two methods of depreciation you can use, which are straight-line and accelerated depreciation. Straight-line depreciation spreads out an asset’s cost evenly (by dividing the total cost by its useful life) while accelerated depreciation deducts a higher percentage in the first few years, then less later on.

To create journal entries for depreciation expenses, you must debit your depreciation expense account and credit your accumulated depreciation account.

Let’s say you purchase a vehicle for $20,000 with a useful life of five years. Using straight-line depreciation, divide the cost by the useful life. This gives you an annual depreciation expense of $4,000. Your journal entry would look like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 3/2/2018 | Depreciation Expense Accumulated Depreciation | Vehicle | 4,000 | 4,000 |

Amortization

Amortization works similarly to depreciation. You can find an amortization expense by dividing an intangible asset’s cost by its useful life.

Then, create journal entries that show how much your annual amortization expense is. Debit your amortization expense account and credit the intangible asset account.

Let’s say you purchase a patent with a useful life of 14 years for $14,000. After dividing the cost by the lifespan ($14,000 / 14), your annual amortization expense is $1,000. Your journal entry would look like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 3/2/2018 | Amortization Expense Patent | Patent on ABC | 1,000 | 1,000 |

Tangible vs. intangible assets and taxes

Tangible and intangible assets can benefit your business come tax time, too. You can reduce your tax liability through depreciation and amortization. Depreciation and amortization are tax deductions you can claim with the IRS.

Need a new system to manage your books? Patriot’s online accounting software is easy to use and made for the non-accountant. Get your free trial today!

This article is updated from its original publication date of April 19, 2018.

This is not intended as legal advice; for more information, please click here.