Company ABC is now part of Company XYZ! Pop quiz … is this an example of a merger or acquisition? Understanding mergers vs. acquisitions may be a key part of your business’s exit, expense-cutting, or profit-boosting strategy.

Mergers vs. acquisitions

Both mergers and acquisitions are types of exit strategies, which are plans outlining how a business owner will sell their investment. An exit strategy is a key part of your business plan.

A business merging with another business is not the same thing as one being acquired by another company. Knowing the difference between acquisition vs. merger can help you come up with this all-important exit strategy. Not to mention, if another business wants to merge with or acquire your business, you need to know what you’re getting yourself into.

So, how does a merger differ from an acquisition?

Mergers

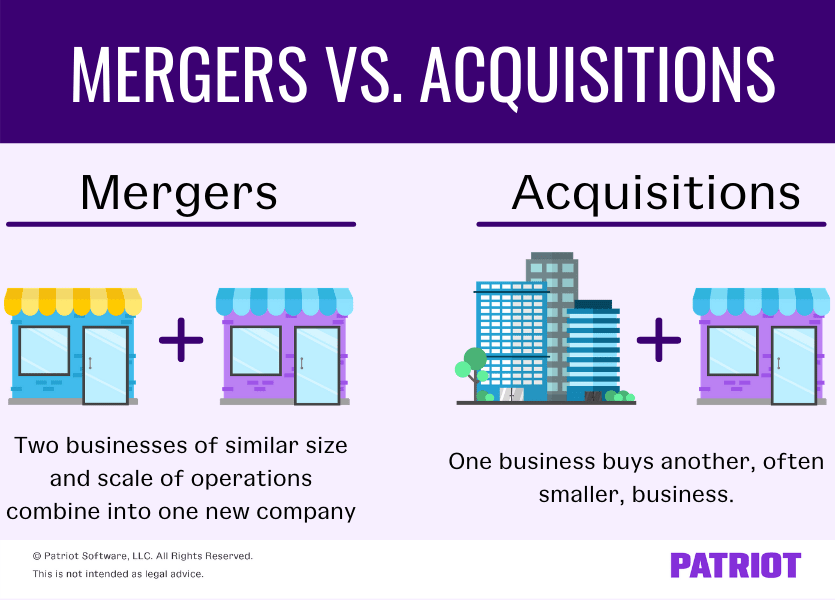

A merger is where two businesses of similar size and scale of operations combine into one new company. Like a new business, the newly merged companies must form a new entity, name, ownership, and management structures.

Mergers require both businesses to negotiate. Current owners and employees of both businesses may stay on board, either in their same or newly developed roles. Because it is a “new business,” the company issues new shares to its investors.

Unlike acquisitions, a merger is a mutual decision between businesses. If you merge with another company, you retain ownership—just with a new structure and name.

There are five main types of mergers:

- Horizontal: In a horizontal merger, both businesses come from the same industry. The two businesses are competitors that offer the same products or services to the same target audience.

- Vertical: Vertical mergers are where two businesses in different stages of the same supply chain join forces to reduce costs and improve efficiency. Because the businesses do not offer the same products or services, they are not direct competitors.

- Conglomerate: In a conglomerate merger, the two businesses come from different industries or locations, increasing their mission and scope. The businesses are not direct competitors.

- Market extension: Market-extension mergers occur when two businesses that sell similar products but compete in different markets come together. A market-extension merger can help the companies access a larger client base.

- Product extension: In a product-extension merger, the businesses’ products complement one another. Generally, the businesses compete in the same market, but they are indirect competitors.

Through a merger, you can expand your business, cut through the competition, and diversify your offerings.

Acquisitions

An acquisition, or takeover, is where one business buys another, often smaller, business. Acquisitions tend to have a negative connotation because one company absorbs the other company.

Unlike mergers, acquisitions do not result in a new company. The company acquiring the other business remains. If you are the business owner of the acquired company, you give up ownership of your business.

In an acquisition, the only negotiation is typically price—you can determine your selling price if a company is attempting to acquire your business. The business that is acquiring the other business does so by purchasing its stock or paying in cash.

There are two types of acquisitions:

- Friendly: In a friendly acquisition, the business being acquired agrees to it.

- Hostile: Hostile acquisitions are where the business being purchased does not want to be bought out.

Similarities between merger and acquisition

Although you need to be able to differentiate between merger and acquisition, there are also some similarities between the two. Mergers and acquisitions are known as M&A.

Both mergers and acquisitions are organization termination types that can:

- Act as exit strategies

- Increase company value

- Offer competitive advantages

1. Act as exit strategies

Whether you plan on leaving your business or not, you need an exit strategy. Again, both mergers and acquisitions are types of exit strategies, along with:

- Selling the business to a friend

- Taking it public

- Liquidating the business

Your exit strategy lets investors and lenders know how you plan on protecting their money if your business fails. An exit strategy also lets you prepare for life after your business (i.e., retirement).

If your exit strategy is a merger, you may attempt to find a business that is a good fit with yours before merging the two. And if your exit strategy is an acquisition, you may put in some footwork to find a business you want to sell yours to.

2. Increase company value

During mergers and acquisitions, the business’s customer (and employee) count generally increases. And depending on the success of marketing efforts and workplace productivity, mergers and acquisitions may both see boosted revenue.

Not to mention, many businesses see costs decrease (e.g., rent, utilities, etc.), which could also increase business profits.

With the increase in customers and potential revenue, many businesses that undergo M&A see a boost in company value, which makes investors happy.

3. Offer competitive advantages

Mergers and acquisitions have the potential to offer competitive advantages, which can boost long-term growth and overall company value.

If the businesses were competitors, mergers and acquisitions eliminate that competition by combining the companies. Plus, the quick increase in size can help the new business beat its other competitors.

Whatever stage your business is in, you know how important up-to-date financial records are. Patriot’s accounting software makes it easy to record payments, track income, and so much more. Why not start your free trial today?

This is not intended as legal advice; for more information, please click here.