Maybe you started out running your business from your home or garage. Or, maybe you’re getting ready to launch a new business. Whatever the case may be, there might come a time when you need to rent an office, retail space, or warehouse. And if you do, you need to know the ins and outs of leasing a commercial space.

Read on to learn the requirements for leasing a commercial space, like what business financial records you need.

Leasing a commercial space 101

A commercial lease is an agreement that lets a business rent commercial property (e.g., building, vehicle, land, etc.) from a landlord for business purposes.

Keep the following in mind when starting your business rental property journey.

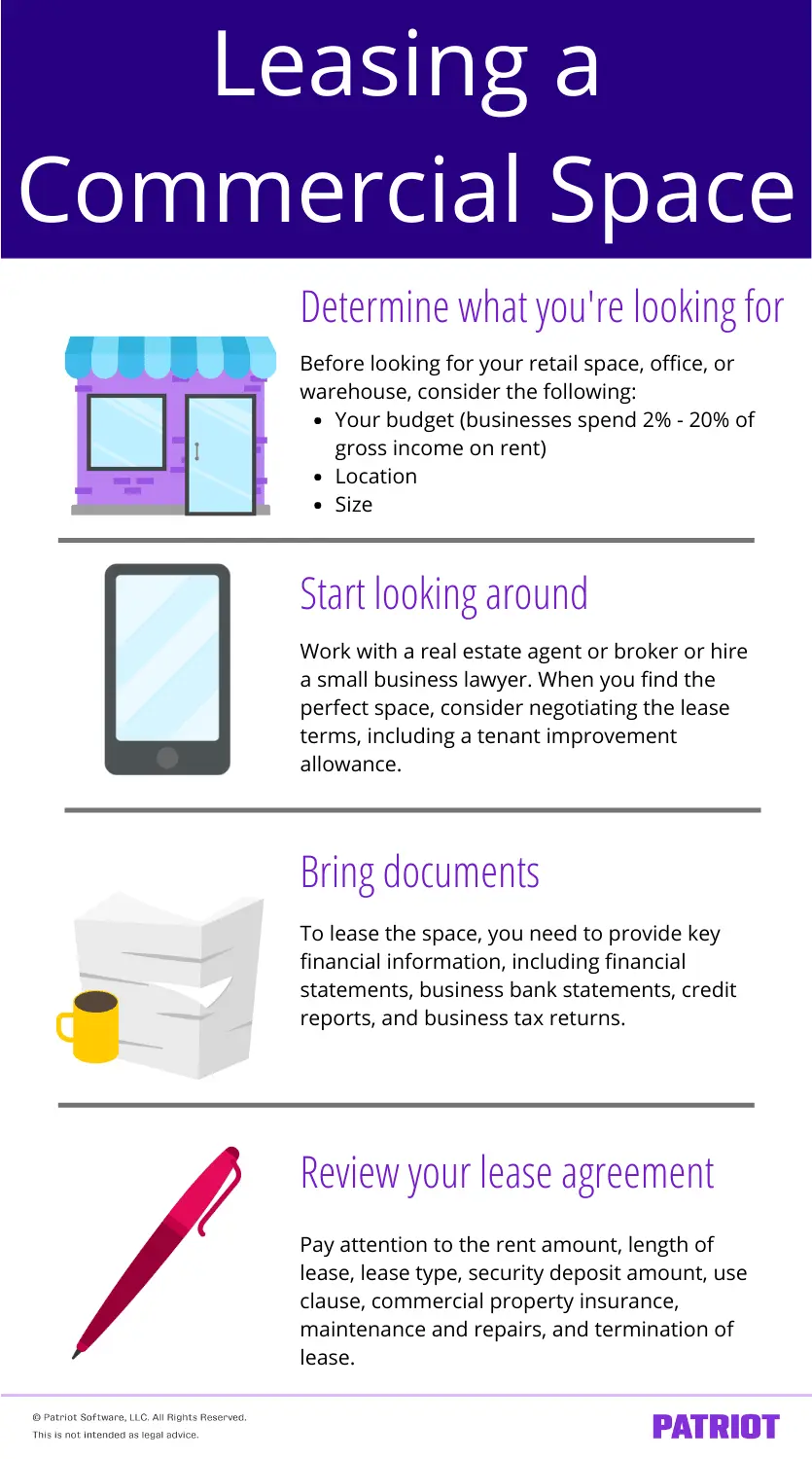

1. Determine what you’re looking for

First things first: Narrow down the details of what your business needs. Do you need a small retail space? An office? A warehouse? Jot down must-haves and nice-to-haves about what you’re looking for.

Before leasing a commercial space, consider the following:

- Your budget: How much can you afford to spend each month?

- Location: Is the area easily accessible for your employees and customers? How’s parking?

- Size: How much space do you need, especially if you plan on scaling quickly?

- Accessibility: Does the building follow ADA guidelines (Americans with Disabilities Act)? For example, are there wheelchair ramps?

- Lease type: There are several types of commercial lease agreements, such as full-service, net, and percentage leases.

- Full-service lease: The tenant pays a base rent while the landlord pays other expenses, like utilities, insurance, and taxes. Generally, the rent is higher.

- Net lease: The tenant pays a base rent, plus additional monthly expenses, like utilities, insurance, and taxes.

- Percentage lease: The tenant pays a base rent, plus a percentage of their retail sales.

If you’ve been in business long enough to have financial statements, take time to review them. Determine what percentage of your business’s income you’re willing to spend on rent. Depending on the industry, businesses spend anywhere from 2% – 20% of their gross income on rent.

2. Start looking around for business space for rent

Now, onto the fun part, looking for business space for rent. You might consider working with a real estate agent or broker whose expertise is in commercial property, especially if this is your first business rental. They can help you find the type of commercial space you’re looking for and handle the rental agreement details. Or, you may hire a small business lawyer to help secure the space and handle the lease agreement.

If you want to do some research for commercial spaces on your own, you can Google things like:

- “Retail space for rent near me”

- “Office space for rent near me”

- “Small office space for rent near me”

- “Storefronts for rent near me”

Once you’ve found a building for lease or small commercial space for rent, work it into your budget. If the landlord doesn’t pay for maintenance and repairs, make sure you have enough to cover unexpected expenses.

Are your negotiating skills up to snuff?

Consider negotiating the lease terms with the landlord (or ask your real estate broker or lawyer to negotiate for you). You might be able to negotiate the lease amount, length of the lease, security deposit, and who’s responsible for maintenance.

You may even be able to negotiate a tenant improvement allowance. Jonathan Prichard, founder and CEO of Mattress Insider, suggests always negotiating one, sharing:

“Your business won’t be ready to open its doors on the first day of your lease. You’ll need time to modify the space, decorate, bring in inventory if you’re a retailer, receive furniture, and so on.

Always negotiate a tenant improvement allowance, either through an upfront payment or a reduction in rent for the first few months at a minimum. This way, you’ll have time to get ready to open your doors for business without having to worry about cash flow during the critical first few months of operations.”

3. Know which documents to bring

Like any rental agreement, there are several record requirements for leasing a commercial space. Be ready to dig up your financial information to secure the lease.

The landlord of a commercial space for rent may require the following:

- Security deposit (e.g., one month’s rent or more)

- Financial statements

- Profit and loss statements

- Balance sheet

- Business bank statements

- Previous landlord information

- Credit reports

- Business tax returns

If you use accounting software, you can typically generate financial statements (e.g., profit and loss) in a few clicks.

If you’re a new business owner, you won’t have certain documents, like previous business tax returns and financial statements. Instead, the landlord may require documents like a copy of your business plan and personal tax returns.

You may need additional records depending on your business structure. Examples include:

- Articles of incorporation or organization

- Names of other partners, members, officers, etc.

- Certificate of filing

- Operating agreements

If you work with a commercial real estate agent or broker, they should give you a detailed list of documents to bring.

4. Carefully review your lease agreement

You’re about to secure your business property lease, congratulations! But before signing on the dotted line, carefully review your lease agreement to prevent surprises.

Ivan Novikov, CEO and founder of Wallarm, shared the following on the importance of reading the fine print:

“I have had first-hand experience with leasing commercial space. The most important thing to keep in mind when leasing is to do your research and know what you are signing up for. Make sure to read the fine print and ask lots of questions. Ensure you understand what the lease agreement covers, such as who is responsible for maintenance and repairs and what kind of access you are permitted.”

Pay attention to the following information in your lease agreement:

- Rent amount (your monthly payment)

- Length of lease (e.g., three years)

- Lease type (e.g., full-service lease)

- Security deposit amount

- Use clause (e.g., things you can’t do in the space)

- Commercial property insurance

- Maintenance and repairs (who’s responsible?)

- Termination, amendment, and modification of lease

Review your lease agreement with your real estate broker or small business lawyer. Ask any clarifying questions to the landlord before signing.

Don’t want a lease? 5 Reasons to buy instead

Leasing a commercial space isn’t for everyone. If you’re on the fence, you might consider buying property instead.

Although renting property has advantages like fewer upfront costs and greater flexibility, there are several pros of buying property instead.

Here are some reasons to buy commercial space:

- Tax breaks: You can receive tax breaks for interest, depreciation, and non-mortgage expenses.

- Appreciation: The value of the property may increase over time.

- Equity: When you buy property, your equity increases over time.

- Control: Want to take down a wall? When you buy instead of rent, you can generally make changes to the property.

- Fixed mortgage payments: You don’t have to worry about your landlord increasing your rent.

Keep in mind that there are several disadvantages of buying commercial property, such as higher liabilities and monthly costs. Weigh the pros and cons of buying vs. leasing commercial property before signing.

Need an easier way to manage your books and generate financial statements? Sign up for a free trial of Patriot’s online accounting today!

This is not intended as legal advice; for more information, please click here.