Let’s face it: Your finances play a major role in your business’s success. You need to have accurate reporting to know where your business stands financially. Otherwise, you could end up overspending and running your business into the ground. To keep your small business finances in shipshape, learn how to improve financial reporting processes.

Financial reporting overview

Financial reporting includes collecting and documenting your finances to monitor your business’s financial health. Without accurate financial reporting, you may not know if you’re turning a profit, what costs you need to cut back on, and how your business is performing financially (big yikes).

Your financial reports tell you a lot about your business and what changes you need to make financially to stay on track to success. As a business owner, here are the main financial statements you should be tracking:

- Income statement

- Cash flow statement

- Balance sheet

- Statement of retained earnings

In addition to using these financial statements internally, you may need to provide reports to external parties to help grow your business (e.g., investors).

To ensure your business’s finances are in order, it’s oh-so-important to keep these financial reports up-to-date, accurate, and organized. Otherwise, you could wind up not accurately forecasting cash flow and ineffectively planning your budget.

A good financial reporting process can make it a breeze to track revenue, expenses, liabilities, profit, and more.

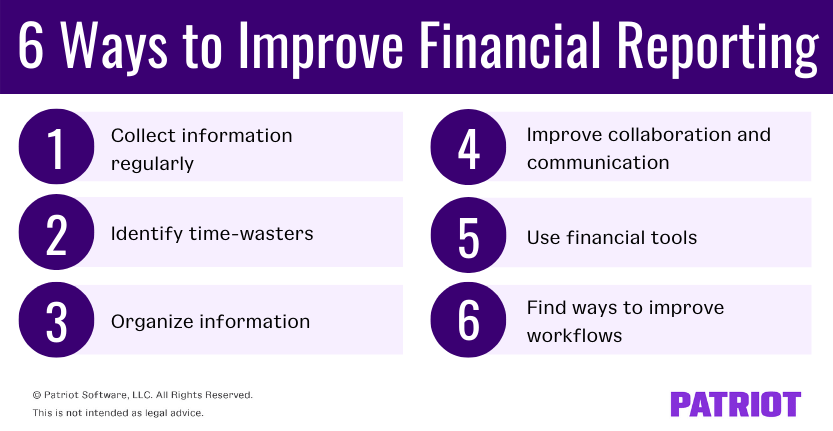

How to improve financial reporting processes: 6 Tips

Again, accurate financial reporting is a must in business. If you don’t have solid financial reporting in business, you could end up hurting your company in the long run. To ensure your reports and all-things finances are accurate, learn how to improve reporting process with these six tips.

1. Collect information regularly

When it comes to your finances, you should be looking at your income, expenses, cash flow, budget, etc. on a regular basis. Not just when you “have to” or “feel like it.” Collecting information regularly is a must if you want to improve your processes and keep your reports accurate.

To ensure your books and reports are up-to-date, collect financial information on a regular basis (e.g., weekly, biweekly, monthly). This may include spreadsheets, invoices, receipts, and more.

Routinely collecting information can create more accurate financial reports. Not to mention, the less you have to scramble to put everything together to see a snapshot of your finances.

2. Identify time-wasters

What kinds of tasks are wasting your time? Repetitive accounting tasks? Updating spreadsheets? Whatever they are, you need to identify them and kick them to the curb to help improve your processes.

There are plenty of tasks that are time sucks for your reporting process. Here are just a few examples:

- Manual data entry

- Spreadsheet formatting

- Multiple spreadsheets

- Unimportant or unrelated data

Pinpoint which tasks are taking you the most time. Determine if you can automate them or get rid of them altogether. This can help you speed up your financial reporting process and focus on important financial data.

3. Organize information

When it comes to running a business, organization can help increase accuracy. If you don’t have an organized process in place for collecting information, it’s time to get cracking.

To ensure your financial reporting process goes smoothly each and every time, make sure to have information like receipts, credit card statements, and bank statements.

Keep information organized by having it in a centralized location. For example, if you store paper documents, have a secure filing cabinet system with folders to break down what goes where. Or, you can store information electronically and put documents in digital folders.

Whatever organization route you decide to take, make sure you have one in place to make your reporting process a snap.

4. Improve collaboration and communication

Your financial reporting process can quickly fall flat if you fail to collaborate and communicate with your team.

To efficiently collaborate:

- Make sure everyone is on the same page

- Utilize a secure, shared, and centralized financial reporting system

- Use communication tools

- Meet regularly to go over processes and work on improvements

Communicate as much as possible throughout the process. Keep everyone in the loop and on schedule to ensure your financial reporting process goes off without a hitch.

5. Use financial tools

To help streamline your financial reporting process and automate tasks, there are a number of tools you can take advantage of. Here are just a few of them:

- Accounting software

- Collaboration tools

- Budgeting tools

- Inventory management system

- Expense tracking

- Payroll software

- Tax preparation software

- Business expense tracking

The more tools and automation you have up your sleeve, the better off your business’s finances will be. For example, using accounting software can help you not only organize your books, but also automate repetitive tasks, like sending recurring invoices. Instead of spending precious time manually completing tasks, you can spend more time focusing on your business and customers.

6. Find ways to improve workflows

The better your workflows are, the smoother your financial reporting process will be, right? Right.

To improve your financial reporting process, you need to improve workflows. Figure out exactly who is going to do what and when they are going to do it. To simplify things and ensure everyone is on the same page, consider writing down your workflow and processes.

Accounting isn’t the most glamorous aspect of running your business. But, it’s one of the most important. That’s where Patriot comes in. Our accounting software makes it a breeze to streamline your financial reporting process and keep your books organized and accurate. Start your free trial today!

This is not intended as legal advice; for more information, please click here.