Did you make payments to independent contractors during the year? If so, you must use Form 1099-NEC. For accurate reporting of contractor payments, learn how to fill out a 1099-NEC.

First, a little background…

Just when you thought you had filling out Form 1099-MISC down to a science, the revived 1099-NEC swoops in.

Beginning with tax year 2020, businesses that make contractor payments must report them on Form 1099-NEC, Nonemployee Compensation.

Previously, businesses used Form 1099-MISC, Miscellaneous Information, to report nonemployee compensation and a number of miscellaneous payments to vendors (e.g., rent).

Depending on your business activities during the year, you may need to prepare both Form 1099-NEC and Form 1099-MISC.

Form 1099-NEC

Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren’t employees.

Report payments for:

- Services performed by a nonemployee (including parts and materials)

- Fish purchased (in cash) from someone engaged in the trade or business of catching fish

- Attorney fees for legal services in the course of your trade or business

If you make oil and gas payments for a working interest of $10 or more, report the payment on Form 1099-NEC.

You may pay your nonemployees compensation in the form of fees, commissions, prizes, awards, or other forms of compensation for services. Include all of these payments on Form 1099-NEC.

Form 1099-MISC

Use Form 1099-MISC to report all types of 1099 miscellaneous payments:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest

- At least $600 in:

- Rents

- Prizes and awards

- Other income payments

- Cash from a notional principal contract to an individual, partnership, or estate

- Any fishing boat proceeds

- Medical and health care payments

- Crop insurance proceeds

- Payments to an attorney related to legal services (NOT fees)

- Fish purchased for resale

- Section 409A deferrals

- Nonqualified deferred compensation

How to fill out a 1099-NEC

Form 1099-NEC is due to the contractor and IRSby January 31 each year.

That means you need to know how to fill out 1099 for contractor by the deadline. Thankfully, Form 1099-NEC is a short form.

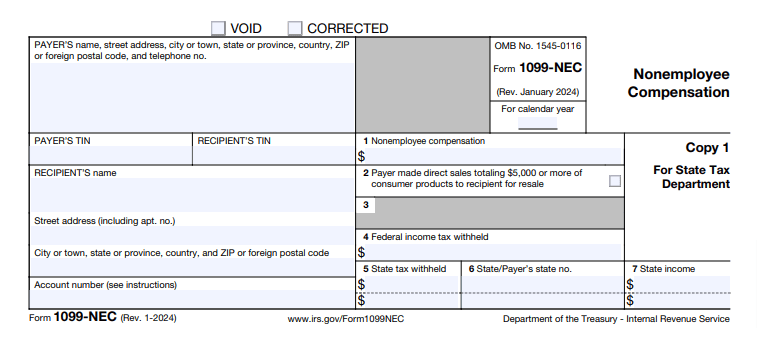

There are seven unnumbered boxes on the left side of the 1099. These boxes ask for information about the payer (that’s you) and recipient (that’s the contractor you paid during the year). There are also seven numbered boxes on the right where you enter amounts.

Here are the 1099-NEC instructions, broken down box-by-box:

Payer’s name, address, and phone number

The first unnumbered box asks for a bit of information about you, including your business:

- Name

- Street address

- City or town

- State or province

- Country

- ZIP or foreign postal code

- Telephone number

This information is not spread out between multiple boxes. Enter all of the above information about you and your business in the first box.

Payer’s TIN

Next, you must enter your taxpayer identification number (TIN) on Form 1099-NEC. Social Security numbers and Employer Identification Numbers (EIN) are both TINs.

Keep in mind that the formatting varies depending on whether you use an EIN or SSN:

- Social Security number: XXX-XX-XXXX

- Employer Identification Number: XX-XXXXXXX

Can’t remember your TIN? No worries. Simply find an information return or employer tax form from the past, like a 1099-MISC or Form 941.

Recipient’s TIN

Next, you need to enter the contractor’s TIN. Not sure where to find this? You should have this information from when the worker filled out Form W-9, Request for Taxpayer Identification Number and Certification.

When you hire contractors, they must fill out Form W-9. That way, you have the information you need—like their TIN, name, and address—to accurately fill out Form 1099-NEC.

Hopefully, you kept Form W-9 in your accounting records. Once you find it, scan for Part I: Taxpayer Identification Number (TIN). Then, enter the contractor’s Social Security number or Employer Identification Number, whichever they entered on the W-9.

Recipient’s name

The only thing you need to enter in this box? The contractor’s name. If you have questions about spelling, consult the Form W-9 you collected from the worker at the time of hire.

Street address

Enter the contractor’s street address. You should be able to pull this information from Form W-9. If you’re concerned that the address is no longer current, check with the contractor.

City, state, and ZIP

Enter the following contractor information in this box:

- City or town

- State or province

- Country

- ZIP or foreign postal code

Again, you should be able to pull this information from Form W-9 or verify it with the nonemployee.

Account number

Did you give the contractor a unique number for your records? If you did, enter the account number in this box. And if you didn’t, leave the box blank.

Box 1: Nonemployee compensation

Box 1 is where you enter the full amount of payments you gave to a nonemployee during the year.

Report all payments that you made:

- To someone who is not your employee

- For services in the course of your trade or business

- To an individual, partnership, estate, or, in some cases, a corporation AND

- To someone of at least $600 during the year

The worker uses the amount in Box 1 to file their income tax return. This amount is subject to self-employment tax. If any payment is not subject to self-employment tax and not reportable anywhere else on Form 1099-NEC, report the amount in Box 3 of Form 1099-MISC.

Box 2: Direct sales

If you made any direct sales of $5,000 or more of consumer products for resale, buy-sell, deposit-commission, or any other basis, enter an “X” in the checkbox. Or, you can enter an “X” in Box 7 on Form 1099-MISC.

Do not enter an amount in Box 2. It is simply a checkbox.

Box 3: (Empty)

Currently, Box 3 is empty. According to the IRS, it is “reserved for future use.” You may need to use this box in future tax years, but not yet.

Box 4: Federal income tax withheld

Did you withhold any federal income tax from the contractor’s wages? Typically, you don’t. However, if their wages are subject to backup withholding, you must withhold federal income tax.

A contractor’s wages are subject to backup withholding if the IRS notifies you that their TIN is incorrect OR you received an incorrect TIN on Form W-9. The backup withholding tax rate is 24% of their wages.

So if you had to withhold federal income tax from the contractor’s wages, report the amount in Box 4.

Box 5: State tax withheld

Did you withhold state income tax on contractor payments? Generally, you do not need to withhold taxes from nonemployee compensation payments. But if you did, report the withheld taxes on Box 5.

You can report withheld payments for up to two states.

Keep in mind that you do not need to fill out Boxes 5 – 7 on the copy you send to the IRS. These boxes are for the recipient and state only.

Box 6: State/Payer’s state no.

If you withheld state tax, enter the abbreviated name of the state, as well as your state identification number, in Box 6.

If you are reporting for more than two states, correctly match up the state and amounts so they are next to one another.

Box 7: State income

Last but not least, enter the amount of the state payment in Box 7.

This is not intended as legal advice; for more information, please click here.